The interest difference between different banks deposits the dollar is 9 times!The lowest is China Merchants Bank, with an annual interest rate of only 0.35%

Author:Daily Economic News Time:2022.07.02

After the Federal Reserve ’s maximum interest rate hike in 28 years, does the domestic bank's US dollar deposit raise interest rates? How to choose the US dollar deposit of individual investors to maintain value?

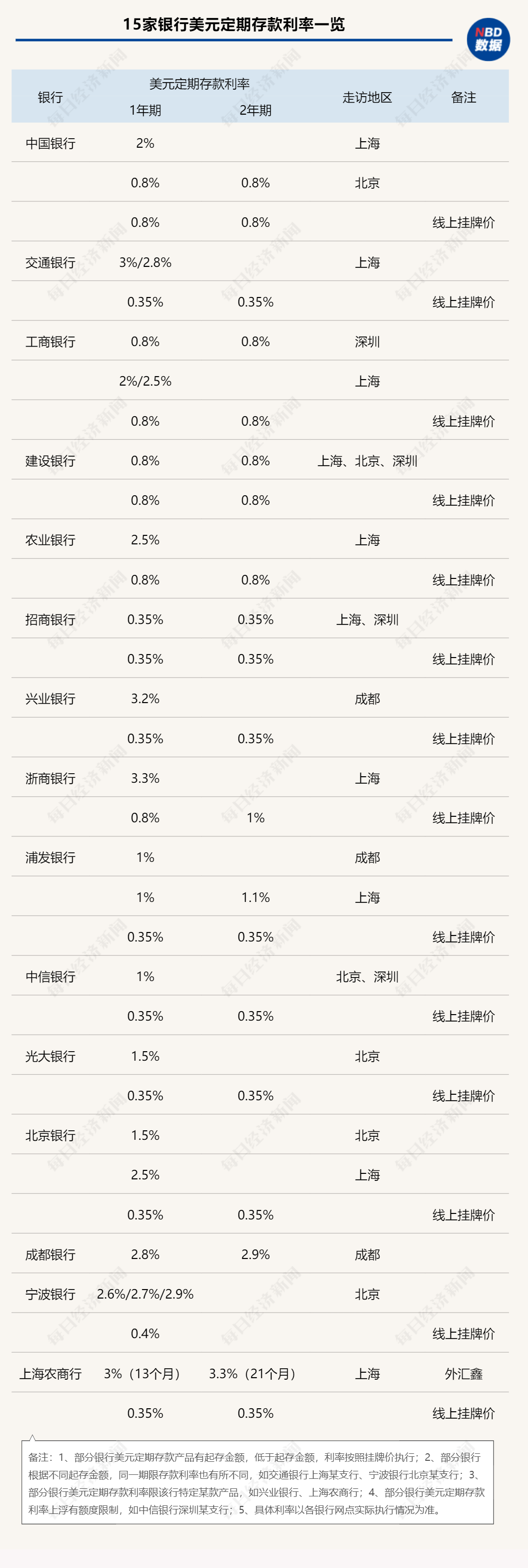

Recently, a reporter from "Daily Economic News" visited the outlets of Shanghai, Chengdu, Shenzhen, and Beijing's four -place bank outlets and found that among the 15 banks visited, the lowest per year of US dollar fixed deposit interest rates were China Merchants Bank, only 0.35%. The policies of various banks are also very different: First of all, most banks choose to raise interest rates sharply, but some banks have not raised interest rates; second The deposit interest rate given by different branches is also largely different; in addition, whether it is new funds and whether to go to the counter to handle it, it will also be treated by banks, giving high and low interest rates.

Multiple banks have greatly raised the US dollar regular deposit interest rate

Recently, each reporter visited many banks four banks in Beijing, Shanghai, Shenzhen, and Chengdu. Interviews and learned about the changes in the fifteen bank US dollar deposit interest rates including Da Bank, shareholders, urban commercial banks, and rural commercial banks.

Bank of China

When visiting the Washington Sub -branch of Chengdu Tianfu New District in mid -June, the lobby manager said that the bank's US dollar deposit was 0.35%, "but the counter processing will rise." The period is 1.2%and 0.85%in 6 months; if 10,000 US dollars start, the one -year period is 0.85%, and the 6 months will be 0.45%. The manager emphasized that the above products "need to add a white list at the counter to save."

On June 22, each reporter called the bank, the staff said that "the US dollar deposit interest rate has risen", with a one -year interest rate of 1.4%and 2%of the products. The difference is that the former has a large amount, and the quota of the latter is compared to the quota of the latter. few. The starting amount is $ 2,000.

On July 1, the reporter learned from a certain branch of Bank of China that there is a one -year interest rate of 2%of deposit products, with a starting amount of $ 2,000, and currently there is still a quota. The staff said that this interest rate "has risen", that is, from 0.8%of the 1 -year interest rate to 2%. At the same time, it is reminded that this product needs to be handled at the counter, because it is necessary to add a whitelist to get the quota.

At the same time, every reporter consulted on the outlets of the Beijing area of China, the business manager said that the one -year and two -year period of the US dollar deposit interest rate was 0.8%. As for whether it can float on the listing price, the business manager said that there is no rise.

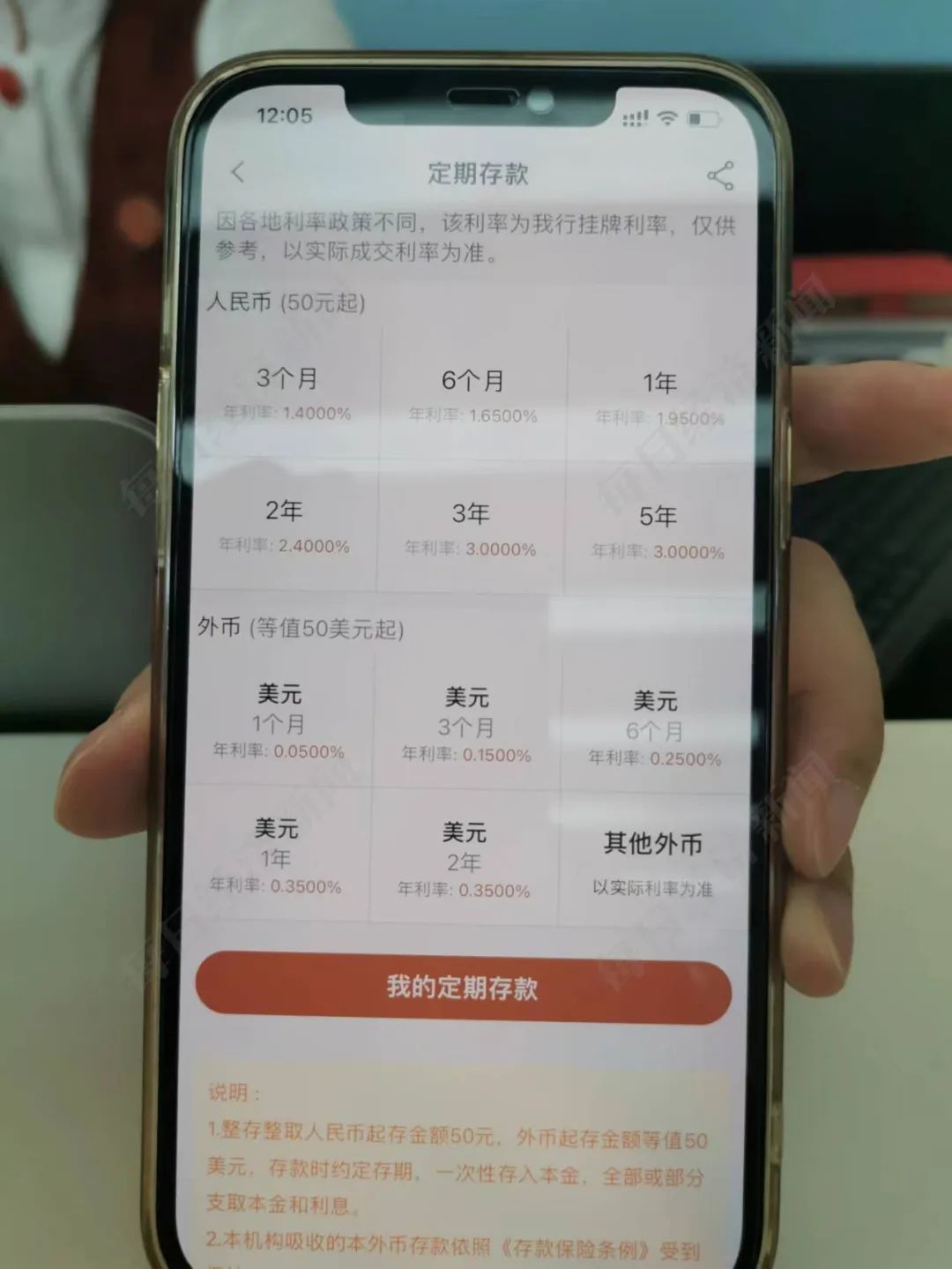

Photo source: Every reporter Zhang Shoulin

Bank of Communications

On July 1, the reporter learned from a certain branch of the Bank of Communications that the starting interest rate of US $ 2,000 can be 3%(1 year), and the deposit interest rate of less than US $ 2,000 does not float, which is the listing interest rate of 0.35%(1 year). The reporter further learned that 3%of interest rates need to be stored outside the bank. If the funds were originally on the Bank of China, the current interest rate is 2.8%.

In the process of visiting the Bank of China Bank of Bank of China, each reporter learned that the 1 -year fixed deposit rate of the Bank of Communications in the US dollar was 2.5%to 2.6%. As the foreign currency continued to raise interest rates, the interest rate was adjusted to 3%.

ICBC

"The income of regular deposits of US dollars is very low." On June 24th, the staff of a branch of the ICBC in Shenzhen told reporters that compared with the regular deposit of the US dollar, it is more recommended to have high interest and low -risk structural deposits. "It is on the product manual. The capital is promised, the product risk factor is lower, and it is relatively stable. " The manager stated that the bank's one -year and 2 -year fixed deposit rate was only 0.35%. The reporter noticed that the minimum structural deposit interest rate issued by the bank was 1.15%.

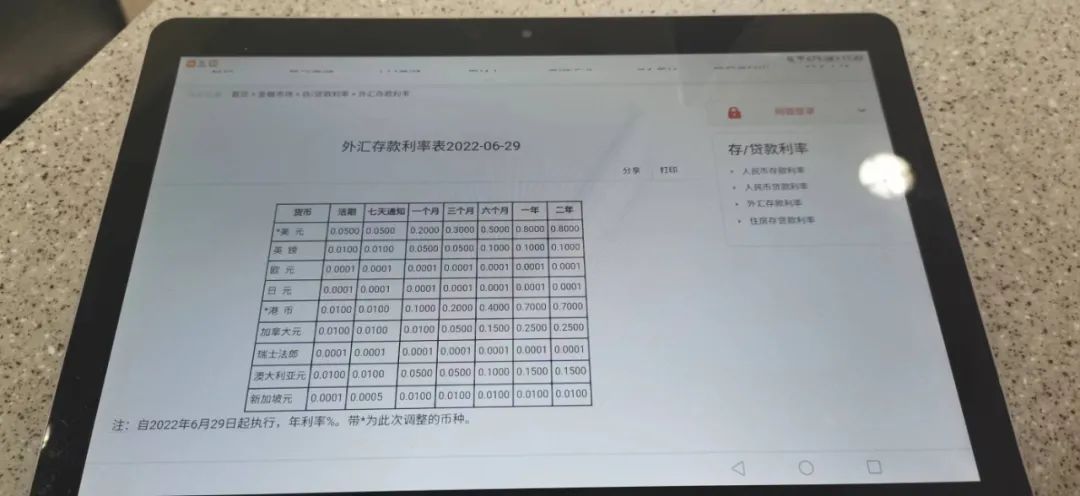

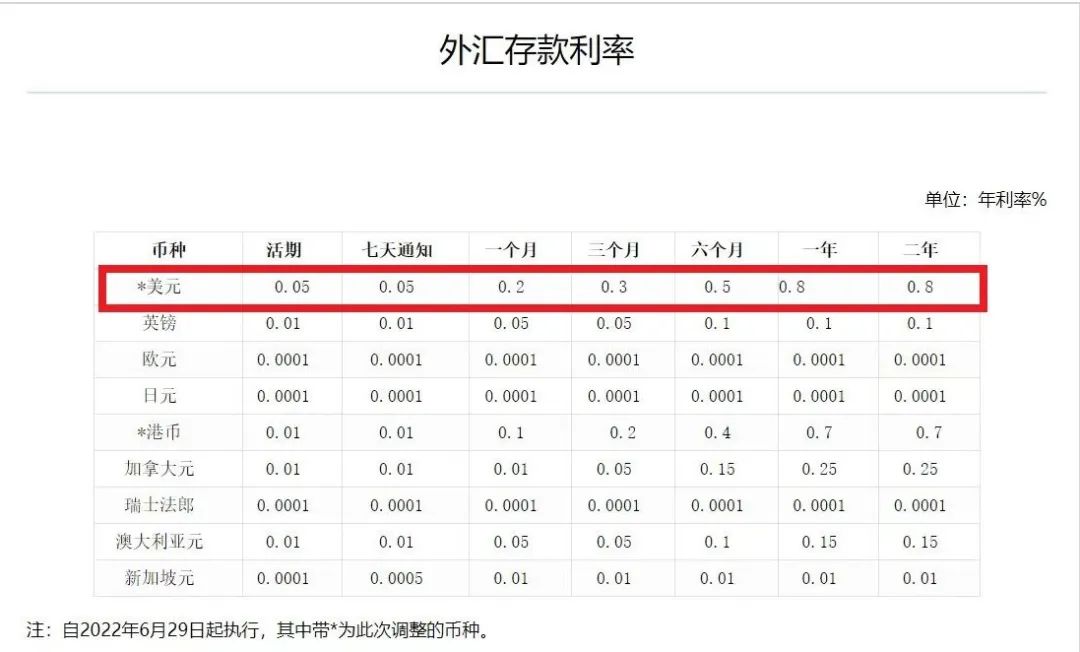

On June 29, every reporter found that the official website of the ICBC was adjusted on the US dollar deposit interest rate (annualization). At present, the bank's one -month USD fixed deposit rate has risen from 0.05%to 0.2%, from 0.15%to 0.3%in 3 months, from 0.25%to 0.5%, one -year and 2 -year interest rate From 0.35%to 0.8%, this is also the first time that the bank has adjusted the US dollar fixed deposit rate since September 2020.

On July 1, the reporter asked the customer manager of a certain branch of the ICBC Shenzhen again and found that the interest rate was consistent with the official website.

On the same day, the reporter learned from several sub-sub-sub-branch of the Industrial and Commercial Bank of China that a one-year US dollar deposit, $ 5,000 to $ 30,000, the maximum interest rate can reach 2%; more than 30,000 US dollars, the highest interest rate can reach 2.5%. This interest rate is implemented from June 22.

The staff said that floating interest rates need to be handled at the counter. Generally, they can help customers apply in advance. After approval, customers can come to the counter to handle it.

Construction Bank

On July 1, each reporter learned from a certain branch of the construction bank that the bank's one -year and two -year interest rate of the US dollar deposit was 0.8%, that is, the listing interest rate, which was not floating on this basis. The staff said that the interest rate level of CCB in Shanghai was the same.

Construction Bank's Shenzhen Sub -branch told reporters on June 25 that the bank's regular deposit interest rate (annualization) of the bank's US dollar was 0.05%, 0.15%of 3 months, 0.25%6 months, 0.35%in 1 year, 2 years in 2 years 0.35%. "The four major banks are basically the same," said the financial manager.

The reporter noticed that Construction Bank also adjusted the US dollar deposit interest rate on June 29. The staff also expressed a new policy to each reporter. The official website interest rate was the latest. According to the official website of Construction Bank, the bank's one -month US dollar deposit interest rate is 0.2%, the three -month US dollar fixed deposit interest rate is 0.3%, the 6 -month USD fixed deposit interest rate is 0.5%, the one -year and 2 -year fixed deposit interest rate All 0.8%. At the Beijing area of Construction Bank, each reporter learned that the current interest rate of the US dollar deposit is 0.05%, and the one -year and 2 -year fixed deposit interest rate is 0.8%.

ABC

On July 1, the reporter learned from a certain branch of Agricultural Bank of China that a one -year interest rate of 5,000 US dollars was 2.5%. The staff said that "just up today," the interest rate was about 1.6%a few days ago, and said that interest rates are still cost -effective. Every reporter learned that the mobile app and counter can be handled, and the interest rate level is the same.

The official website of the Agricultural Bank of China shows that the bank's current US dollar deposit interest rate is 0.2%, the three -month US dollar fixed deposit rate is 0.3%, the 6 -month USD fixed deposit interest rate is 0.5%, and the one -year and 2 -year fixed deposit interest rate is both all all It is 0.8%.

Picture source: Agricultural Bank of China official website

However, every reporter found that the mobile banking bank of the Agricultural Bank of China has not been adjusted simultaneously. The fixed deposit interest rate of 1 month, 3 months, and 6 months is displayed at 0.05%, 0.15%, and 0.25%. It is 0.35%.

Picture source: Agricultural Bank of China Mobile Banking APP

In response, the staff of the agricultural bank in Shenzhen stated that the interest rate was based on the official website standard, and "the system will definitely be adjusted."

China Merchants Bank

On July 1, every reporter learned from a certain branch of China Merchants Bank that the one -year and 2 -year interest rate of the US dollar deposits was 0.35%, and it was not floating on the basis of the listing interest rate. The reporter asked whether the China Merchants Bank outlets were all the level of interest rates. The staff said that the foreign currency of the China Merchants Bank was like this (not floating).

A sub -branch of Shenzhen China Merchants Bank showed reporters the bank's US dollar deposit interest rate. The monthly interest rate was 0.05%, 0.15%in 3 months, 0.25%in 6 months, and 0.35%in one and two years. For, for 0.35%. Whether the recent interest rate hike in the US dollar has led to an increase in income, and the staff said that the recent US dollar deposit interest rate has not increased.

Industrial Bank

The reporter learned from a certain outlet of Chengdu on June 22 that the US dollar deposit interest rate was "10 times higher than before." At present, the fixed deposit rate of US dollars is 1.75%, 6 months are 2.38%, 9 months are 2.8%, and the one -year period is 3.18%. The starting amount is $ 8,000.

Every reporter immediately inquired about the mobile banking of Industrial Bank, from the "deposit product" - "normal regular" - "US dollar" to the entrance to the entrance of the US dollar. The annual interest rates are 0.05%, 0.15%, 0.25%, 0.35%, and 0.35%, respectively. According to the staff referred to "up to 10 times" or referring to the regular 1 -year interest rate of 0.35%, the interest rate at that time had floated to 3.18%. However, the staff also reminded, "At present, this interest rate cannot be found on a mobile banking, and it needs to be operated at the counter."

On July 1, every reporter again learned from a certain outlet of Chengdu by the Bank of Industrial Bank, "For the US dollar deposit interest rate, if you go to the counter to handle, the 1 -year interest rate can float to 3.2%, and there is a little change every day, but it is relatively high. "He repeatedly emphasized.

It is worth noting that at this time, from mobile banking to check the US dollar ordinary fixed deposit, the one -year interest rate is still only 0.35%.

However, entering from different entrances can get another product: "deposit product" - "etiquette deposit list" - "universal gold" (US dollar deposit collection), one -year interest rate level will be much higher. The $ 10 (inclusive) starts from $ 10,000, with an annual interest rate of 2.5%; 10,000 US dollars (inclusive) to $ 50,000 starts, with an annual interest rate of 2.6%; the start of more than $ 50,000 (inclusive), an annual interest rate of 3.1%.

Picture source: Industrial Bank Mobile Banking APP

In other words, from different entrances from the bank's mobile banking, the US dollar regular deposit interest rate is several times different from the "Universal Gold" (US dollar deposit) interest rate. Its entire deposit products have strict regulations on the range of the storage amount, while the ordinary regular page does not require the starting amount.

For the difference in interest rates of ordinary regular periods and rectification, each reporter called the Chengdu Xinhua Avenue Branch of Xingye Bank on July 1, and the staff said that ordinary regular interest rates are universal in the country, and "Universal Gold" is the own bank of the Industrial Bank. Deposit (product) is a type of deposit.

Zhejiang Business Bank

The financial manager of Shanghai Branch said that the recent US dollar deposit interest rate has also risen with foreign currency interest rate hikes. "We will make adjustments every Thursday." The reporter learned on June 23 3.3%, an increase of 0.1 percentage points compared to last week.

Shanghai Pudong Development Bank

When a reporter visited the Chengdu Washington Avenue Sub -branch in mid -June, the wealth management manager informed that the bank's regular deposit interest rate of the US dollar was 0.8%and 1%of 1%. About 2 years lasted. "On June 22, the reporter called the bank again. The staff said that the US dollar deposit interest rate was 1.01%and the 2 -year period was 1.1%.

On July 1, the reporter learned from the Chengdu Jindu Sub -branch of Pudong Development Bank that the bank's one -year US dollar deposit interest rate was 1%, and the interest rate level through mobile banking and the counter to the counter. In the Shanghai area, each reporter consulted the three sub -sub -sub -branch of SPDB that the US dollar deposits are currently 1%of 1%and 1.1%in 2 years. No changes have been changed in the near future. Mobile apps and counters have consistent interest rates.

CITIC Bank

A branch manager in Shenzhen said that the current US dollar deposit interest rate has not changed, and the deposit interest rate (annualization) of 1 month, 3 months, 6 months, 1 -year, and 2 -year period is 0.05%, 0.15%, 0.25%, and,,,,,,,,,,,,,,,, ,an, respectively 0.35%and 0.35%.

Photo source: Every reporter Zhao Jingzhi

However, the manager said that the bank will have interest rates to enjoy the interest rate every other time. The period of one -year US dollars can rise to 1%.

The financial manager of a certain branch of Beijing told reporters that the bank's US dollar's regular product of $ 100 at a period of $ 100 is 1%. This price is mainly based on bank costs.

Everbright Bank

On June 22, the customer manager of a certain branch of the Beijing Everbright Bank said that the US dollar deposit can apply for interest rates. "Starting from 5,000 US dollars, we can give you a certain interest rate according to the internal capital transfer pricing (FTP) provided by the asset -liability management department. In the near future, we can float to about 1.5%." He then then In addition, 1.5%is a reference. The specific proportion should be decided according to the FTP table provided by the branch on the day.

The business manager said that if there is no up floating, the US dollar deposit interest rate is 0.35%. "See if you have new funds, etc.". He said that this floating event was only available this year. There was no floating event last year, and it could only be done at the outlets. It was necessary to give the customer an approval order and then transfer to the branch to sign.

Bank of Beijing

The staff of a Beijing branch showed to each reporter that the "Beijing Huijie's US dollar was regulated for three months", with sufficient remaining quota, $ 10,000 in deposits, and 1.5%interest rates. When the US dollar deposit interest rate is updated, the staff said, "This interest rate has to be notified."

A staff member of Shanghai Sub -branch told reporters on June 22 that the bank raised the US dollar deposit interest rate on June 21, which started at 30,000 US dollars, with a one -year interest rate of 2.1%. The 1 -year interest rate is 2.5%, while the interest rate increases, the starting threshold has also decreased.

Bank of Chengdu

The reporter called the head office in mid -June to learn that the bank's US dollar savings business was only deposited and collected, with a one -year 2.3%period and 2.325%in 2 years. In addition, 6 months, 3 months, and 1 month US dollar deposit interest rates were 1.1%, 0.6%, and 0.2%, respectively.

On June 22, the reporter once again called the Banking Department of the Bank of Chengdu to learn that the bank's US dollar deposit interest rate was also raised. The 6 -month -old fixed deposit rate is 1.6%, the 1 -year interest rate is 2.8%, and the 2 -year interest rate is 2.9%, which is about 0.5 percentage points from the interest rate level on June 14.

Bank of Ningbo

The reporter consulted the Dipping of the Beijing area of Ningbo. The staff said that the regular interest rate below 10,000 US dollars was 2.6%, $ 10,000 to $ 50,000 is 2.7%, and $ 50,000 and above were 2.9%. The staff further stated that this is the offer this week, by July 3. "We have new offers every week, may be adjusted, or it may remain unchanged."

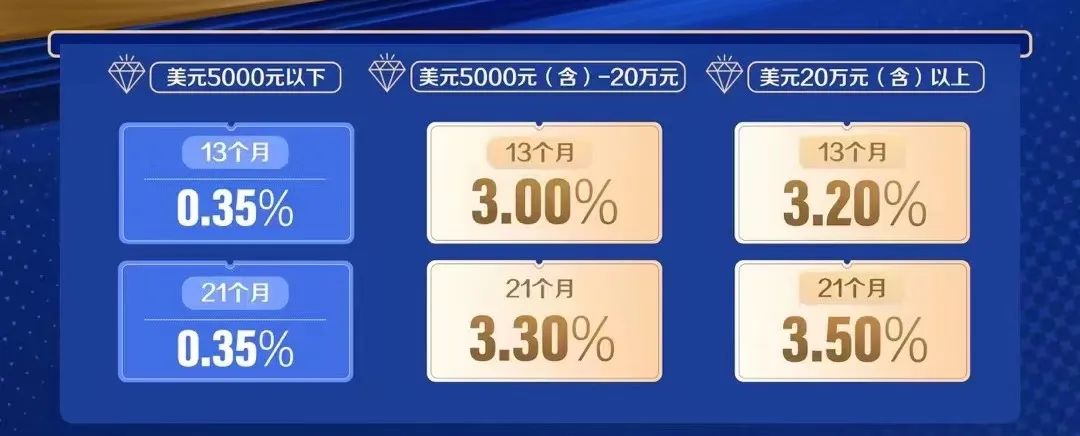

Shanghai Rural Commercial Bank

The reporter called several Shanghai regional branches to understand that the Shanghai Rural Commercial Bank adjusted the US dollar deposit interest rate on June 23. It is now $ 50,000 to 200,000, the interest rate of 13%, and a 21-month interest rate of 3.3%. Some staff members told reporters that the interest rate level of the 13 -month deposit period was 1.3%, "1.3%have been a long time, about a year, just adjusted this year (from 1.3%to 3%)."

The reporter also saw from the official website of Shanghai Rural Commercial Bank that the "foreign exchange Xin deposit" interest rate implemented by the bank from June 23, in addition to the above 50,000 to 200,000 US dollars, the US dollar rate of more than 200,000 (inclusive) 3.2%of the US dollar is 3.2%. 21 months 3.5%.

Shanghai Rural Commercial Bank "Forex Xin" product interest rate status

Summary: The bank's US dollar interest rate hike presents four major characteristics

From the results of the reporter's on -site survey, although most banks have raised the US dollar deposit interest rate, the interest rate hikes between banks and different branches of the same bank between banks and different branches of the same bank can reach 9 times. In addition, whether you can go to the bank counter and whether it is new funds will affect the interest rate.

Features 1: The interest rate hike is different, and the difference can reach 9 times

The reporter found that the interest rates of the US dollar deposits were several times different.

From the perspective of several state -owned banks visited, the interest rate range of the 1 -year US dollar deposit is roughly 0.8%to 3%; from the perspective of the six joint -stock banks of Xingye, Zhejiang Shang, China Merchants, Pudong Development, CITIC, and Everbright, the interest rate interval In 0.35%to 3.3%, it should be noted that the interest rates of the China Merchants Bank have not been adjusted; as far as the situation of the city commercial banks such as Bank of Beijing and Chengdu, the interest rate level is 0.4%to 2.8%; , Shanghai Rural Commercial Bank's 13 -month deposit interest rate is 3%.

It can be seen that there are large differences in the level of one -year US dollar deposit interest rates of different types of banks. State -owned banks are nearly three times. From the visits, the interest rates given by the Bank , And many local China Merchants Bank outlets have not raised interest rates, only 0.35%in one year. Feature 2: Different branches of the same bank different interest rate differences

From the perspective of different banks, their respective interest rates are different. So does the same bank may also occur? Judging from the reporter's on -site visits, this phenomenon does exist.

For example, when the reporter asked a certain outlet in Beijing, he learned that the 1 -year deposit interest rate was 0.8%, but when he asked the Shanghai outlets, he learned that the 1 -year interest rate could float to 2%.

Feature three: different deposit interest rates on the Internet and counters

The reporter found in a field visit that some institutions prompts that although the interest rates announced on the APP are relatively low, if they can go to the counter to handle it, they can get higher interest rates. Some banks also mentioned that if you apply for US dollars, you can apply for high interest rates.

For example, the staff of the Chengdu Tianfu New District Sub -branch of Industrial Bank told reporters that the US dollar deposit interest rate is "10 times higher than before", with a one -year fixed deposit rate of 3.18%and a starting amount of 8,000 US dollars. However, the interest rate is currently not found on a mobile banking and needs to be handled at the counter.

When the reporter called the Chengdu Xinhua Avenue Sub -branch of Xingye Bank on July 1, the staff once again emphasized that "it is very low on the mobile phone (bank)". 1 year -on -year deposit).

The customer manager of an Everbright Bank Beijing Sub -branch stated that the one -year US dollar deposit can apply for a floating interest rate to about 1.5%, but it can only be done at the outlet.

Feature 4: New funds signing interest rates higher

In addition to personally in the counter, if it is a new fund storage, it may also get higher interest rates.

For example, a certain outlets in the Shanghai Bank of China said that the maximum interest rate of US $ 2,000 can be reached 3%(1 year), but the depositors of foreign banks can be achieved. If the funds are originally on the Bank of China, the current interest rate is 2.8%.

Another example is an outlet in Beijing in China, and the 1 -year US dollar deposit interest rate can float to about 1.5%(starting 5,000 US dollars), but you need to apply to the branch. "Whether it is a new fund" is one of the application conditions.

Professionals: Market -oriented pricing of interest rates, storage households need to open their eyes

In response to the aforementioned industry phenomenon, the reporter interviewed a number of legal professionals. The practicing lawyer who has worked in Da Bank told reporters that the price that mobile banks saw can be regarded as invitation to contract dealership, and it is also necessary to sign to confirm offline. It is a customer commitment.

Another lawyer in Beijing told reporters that as long as it does not violate the banking supervision rules.

"The high return rate of new customers is a common means of various industries. It should not be regarded as discriminatory clauses. The threshold stipulated in the current regulations on discrimination clauses is relatively high." For different interest rates obtained by new and old customers, Shanghai A lawyer of a law firm told reporters that no cases of discriminatory clauses in the transaction relationship between banks and stores have not yet been found.

Regarding the problem of large differences in online and offline interest rates, the person believes that if the interest rate level is launched through normal processes, indicating that the regulatory agency should also recognize the scope of its floating interest rate. There are no protection, there is no fraud and concealment. The storage households can choose to go online or offline, and even choose not to go to this bank.

A personnel of a judicial department told reporters that after the marketization of interest rates, banks can independently formulate interest rates according to market conditions. In order to rush the performance, inconsistent interest rates can be used to buy online, and there are price differences in online and offline. "In the final analysis, financial goods are also commodities in a broad sense," he believes.

"The amplitude, timing, rhythm, etc. of interest rates have no unified requirements. One is market behavior, and the other is influenced by the inter -bank market market." People close to the regulatory authorities analyzed.

Bleak

Throughout the actual exploration, different types of banks may have several times the interest rate of US dollar deposits, and the interest rate hike is also different.

In this regard, the person believes that "banks with sufficient liquidity, such as large -scale state -owned banks, do not worry about funds, generally do not raise interest rates. Unlike some small and medium -sized banks, interbank business accounts for relatively high, and it is affected by the market. "

Bleak

Every reporter found that the level of US dollar deposit interest rates in different regions of the same bank is also different.

The person explained that this is related to the market. The tasks of all banks distributed to the provinces (branches) are different, and the liquidity of each region is different.

"For example, for example, in some areas, joint -stock banks and local provincial party agencies have business cooperation. If the source of funds can guarantee, and the market is less affected by the market, the interest rate hike is also small. Buying or selling the bond market nationwide, if this channel accounts for a lot, the interest rate hike will be larger. "

In the process of exploring, the reporter noticed that the interest rate level of some banks through mobile banking was inconsistent with the interest rate levels to the counter, and even the levels of online and offline interest rates were several times.

In this regard, the person analyzed that the regulatory authorities did not interfere with the online interest rate offer of various banks. "Different channels of absorbing deposits are different. Compared with the Internet, the counter has a task volume. When dividing the task, the number of tasks on the Internet usually has a small amount of tasks. It is higher than the Internet, otherwise customers are unwilling to go to business outlet deposits. "He added that there was another situation. With reference to the public opinion of Henan Village Bank some time ago, the online interest rate was significantly higher than the offline interest rate. "Because the Internet is facing the national absorption of deposits, the more absorbs, the smaller the cost of funds, and there is no labor cost." He said that the interest rate level and the regional conditions, the marketing methods of different outlets of the bank, and the amount of tasks are all related.

From the perspective of some banks, if the US dollar savings deposit funds come from the bank, the interest rate is higher, and the interest rates in the bank will be low, which will be differentiated to new customers and old customers.

In this regard, the person believes that this is a differentiated marketing strategy in order to expand the customer group. "After the marketization of interest rates, it is calculated according to the daily interest rate. The supervision and interference in the deposit interest rate are less and there are no compulsory requirements. For example, a bank, the quarterly deposit task has been completed, the interest rate will be reduced, the interest rate will be increased next quarter, and the deposit will be absorbed. "He added that the current market is generally scarce, and many banks have a decline in deposits.

It is worth noting that during the interview, the person revealed to the reporter that the current (where it is located) is currently investigating that small and medium -sized bank deposits, loans in different places, investment in different places, and other interbank industries. In the future Different places may be restricted, and the scale of business in different places must be compressed.

"According to the current policy, the Rural Commercial Bank's loan is required not to go out of the county or the funds." The person said.

Reporter's notes | US dollar deposit interest rates "up to the wind", but the exchange rate risk cannot be ignored

Recently, the US dollar index has risen strongly. The promoters behind this have not only the turmoil of the global financial market, and some investors have risen in risk aversion, and the Federal Reserve has boosted 75 basis points on June 15.

The strength of the US dollar is transmitted to the rise in the US dollar deposit interest rate. We visited banks from all over the country. The general feeling is that the level of fixed deposit interest rates of different types of banks is very different. From 0.35%to 3.3%, various banks or factors such as product strategies and tasks have different considerations and rhythm, but the fixed deposit interest rate is indeed a general trend.

The interest rate of US dollar deposits between banks is very different. When investors are deposited, they may wish to "get more than three" and go to the bank to learn more. In addition, due to the continued strong rise in the US dollar index, pay attention to the exchange rate risk when choosing a long -term US dollar deposit.

Reporter | Li Yuwen Liu Jiakui Zhang Shoulin Zhao Jingzhi

Edit | Liao Dan

Coordinating Edit | Yi Qijiang

Vision | Liu Qingyan

Video editor | Zhang Han

Capture | Liao Dan

Daily Economic News

- END -

The improvement of the financing environment of housing enterprises is expected to increase the scale of credit bond financing in the second half of the year

6JulWen | Wu XiaoluSince the beginning of this year, the financing environment of ...

Total investment 18.1 billion yuan!Chengdu Eastern New District Signing 8 major industrialization projects

On June 28, the Eastern New Area of Chengdu held the Signing Ceremony of the E...