There are three industries such as coal, steel, and basic chemical industry!The semi -annual newspaper pre -hospitality section collectively rose collectively

Author:Securities daily Time:2022.07.06

Text | Zhang Ying Ren Shi Bi

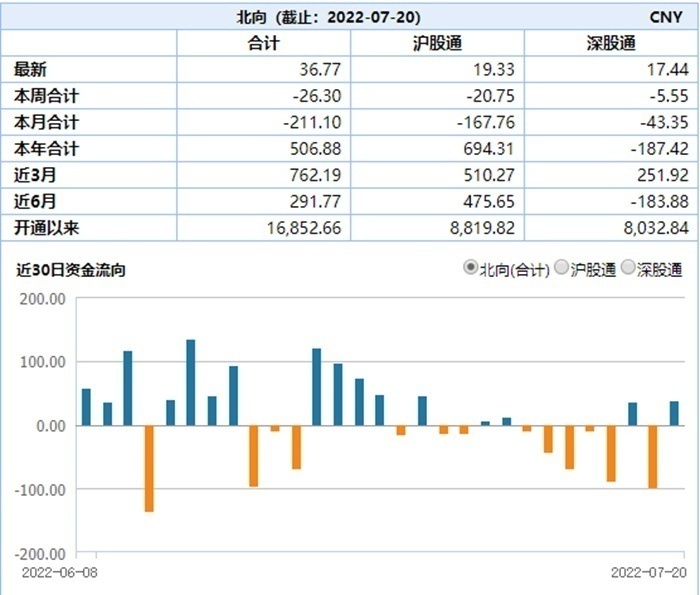

On Tuesday (July 5), the three major A -share index shocked and picked up, and the turnover of the 9 consecutive trading day exceeded trillion yuan in consecutive trading days. In terms of hotspots, there are many industries such as coal, steel, and basic chemical industry. Eight basic chemical stocks have daily limit, and two stocks have daily limit in the steel industry. Recently, the Shanghai Index has repeatedly shaken around 3,400 points. How will the A -share market market be performed? On July 5th, the three major indexes rose in the afternoon, and the Shanghai Stock Exchange Index shook around 3400 points. As of the close, the Shanghai Stock Exchange Index fell 0.04%to 3404.03 points, the Shenzhen Stock Exchange Index fell 0.41%to 12973.11 points, the GEM index fell 0.34%to 2825.13 points; Yuan; Northern Wells sold 1.348 billion yuan. Generally speaking, individual stocks of the two cities have fallen more. From the perspective of the Shenlian industry, 13 industries have achieved rising. Among them, the coal industry has risen to the top of 3.65%, followed by steel and basic chemicals, and the increase has reached 1.81%and 1.06%, respectively. In addition, the building materials industry led a decline, a decline of 2.96%. In terms of daily limit board, on July 5, 48 stocks rose daily limit. Among them, there were 21 daily limit stocks, and the stock price had risen more than 3 consecutive trading days. From the perspective of the industry, the basic chemical industry has the largest limit, reaching 8, followed by the power equipment industry, and the number of daily limit shares is 6. Table: Rising on the 3rd consecutive day and today's daily limit Stocks S conditioning: Ren Shibi said today, Hu Po, manager of Rongzhi Investment Fund, said that the market has experienced a relatively large rebound in this round. At present, the market began to differentiate. In addition, the recent market hotspot has the phenomenon of spreading from the high prosperity track with new energy vehicles and photovoltaic as its core to military industry, consumption and other sectors. This kind of benign interaction is expected to drive the market to continue to rebound. However, considering that there are still certain uncertainty in July, the risks such as overseas and domestic listed companies may not have time to report the risks in semi -annual reports may form a certain suppression of the short -term market. Therefore, in this case big. Jufeng Investment Consultant said that the 3400 -point area was hindered after the short -term market continued, and the index ushered in a high vibration. However, the pre -increased stocks have risen, and the interim reporting may have kicked off, and continue to seize the rotation opportunity in the structural market. Regarding the market outlook, Yuan Huaming, general manager of Huahui Chuangfu Investment, believes that with the gradual effectiveness of the impact of the epidemic influence and the stable growth policy, the opportunity to stabilize the rebound in the third quarter of the Chinese economy is very large. In addition, market adjustments in the previous period are sufficient in time and space. Loose liquidity and continuous steady growth policies are favorable, and the downward space for the A -share market is limited. Zhejiang Business Securities believes that market sentiment is auxiliary indicators for strategic research and judgment. Combined with our emotional monitoring system, it has a short period of rest after the rising, but the mid- and long -term emotions are still in the early stages of restoration. Further combining the fundamental aspect, we believe that after the market experience rose sharply, it will gradually differentiate in the shock. In terms of operating strategy, Lang Yicheng, the general manager of the Fund Fund Research Department, believes that the market will gradually switch with the low -level sector with the logic of the economic recovery in the short term. It is recommended that the company with a relatively balanced configuration and grasping the semi -annual report performance exceeded expectations. CICC stated that during the performance trailer and express report, the proposal focuses on: 1. Economic restoration and policy support, and are relatively sensitive to policies; Fields; 3. Facing the inflection point and gradually bottoming out. The basic chemical industry rose more than 1%on July 5th. In the basic chemical industry, the titanium pink, phosphorus chemical, chemical raw materials and other segmented tracks rose together, and the basic chemical industry rose 1.06%of the third place. Among them, eight basic chemical stocks including Zhenhua Co., Ltd., Jinpu Titanium, Shinyangfeng, Six Kingdoms, Fengyuan Co., Ltd., Huashu, Shandong Haichu, and*ST Youfu gain daily limit. BOC Securities stated that in July, it is recommended to pay attention to the main line of domestic demand steady growth policies. Foreign demand pays attention to the increase in chemical exports brought about by the expansion of domestic and foreign prices, as well as the central report of high -growth companies, especially high -declined growth stocks in the early stage. The selection of the sub -industry focuses on integrated leading company and high prosperity. From the perspective of the sub -industry's prosperity, upstream petrochemical refining, agricultural products related to agricultural products, phosphorus chemicals, infrastructure -related chemicals, semiconductor materials, new energy materials, etc. are expected to remain high. The scenery. The semi -annual pre -increase sector rose by 1.54%of the fellow flowers. As of July 5, a total of 104 listed companies in A shares released the performance forecast of the first half of 2022. The performance of 86 companies was pre -joy, accounting for more than 80%. In this context, on July 5th, the pre -happy sector performed well in the semi -annual report, and its overall rose 1.54%. Among them, four pre -happy stocks such as Yongtai Energy, Dalian Heavy Industry, United Precision, and Demommi were daily. CICC stated that the energy and raw material industries are supported by overseas supply risks, and their profitability is generally maintained. The reporting profit in industries such as coal, petroleum and natural gas, and agricultural chemical industries in chemical industry has maintained high growth. The price is optimistic. The interim reporting is expected to exceed the expected fields of coal, the power coal in coal, and coal companies with overseas assets, lithium, rare earth materials and cobalt nickels in non -ferrous metals, pesticides, chemical fertilizers, and soda in chemicals.

Recommended reading

Coal mining and processing rose nearly 3% of Li Daxiao: Seven reasons to support A shares to continue

my country's per capita life expectancy has increased to 77.93 years, and the proportion of people often participating in physical exercise has reached 37.2%. Healthy Chinese actions have also brought these changes ... Picture | Site Cool Hallo Bao Map.com Final Trial | Dong Shaopeng

- END -

Guarantee the smooth flow of supply chain of the steel industry

Putian.com Recently, the Far -See Sea from Brazil's 393,000 tons of iron ore sand was successfully completed the inspection and release after the Luoyu Operation Zone in Putian Port, Putian Port, wa...

Military industry prosperity is fulfilled, medicine continues to rise, and breeding is adjusted as scheduled

On July 20th, the three major indexes performed strongly. The Shanghai Composite I...