The price of silicon material will enter 300,000/ton Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Guan Gu

Author:Daily Economic News Time:2022.07.06

When the price of silicon materials entered 300,000/ton, TCL Technology and GCL Technology held hands to cooperate with the granular silicon project.

On July 6, TCL Technology stated that the company and partners have carried out investment cooperation of relevant projects in the polycrystalline silicon and single crystal pull rods. Through the Inner Mongolia Xinhuan project, it will further consolidate cooperation relationships, strengthen upstream and downstream resources coordination, and new and downstream resources. The capacity of energy photovoltaic products climb and laid a good foundation for expanding the market share of the product.

In fact, the tension of silicon materials has become the focus of recent market attention. TCL Technology and GCL Science and Technology have attracted attention, and there are also factors in this regard. "The added value of the investment threshold and technology of the silicon material is too high, and the silicon material cannot keep up with the middle and lower reaches." A photovoltaic industry is unwilling to be famous. Silicon material. However, some research reports stated that the new production capacity was flat in the second half of the year.

TCL Technology Cut in Granules Silicon

On July 6, TCL Technology (SZ000100, a stock price of 4.6 yuan, and a market value of 64.54 billion yuan) issued an announcement. Previously, with GCL Group Co., Ltd. and GCL Technology (HK03800, HK $ 3.83, a market value of HK $ 103.8 billion) signed the "Cooperation Framework Framework framework) On the basis of the Agreement, the parties have signed a joint venture agreement recently.

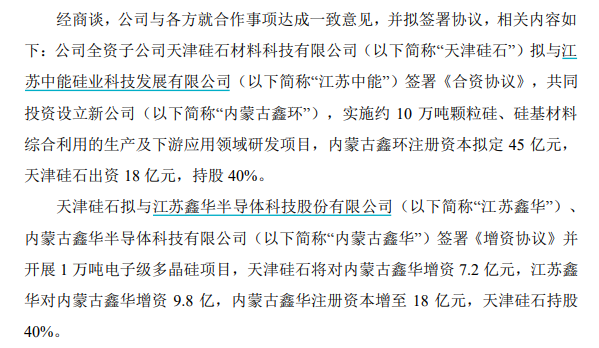

According to the TCL Technology Announcement, the company's wholly -owned subsidiary Tianjin Silicon is planned to sign the "joint venture agreement" with Jiangsu China to jointly invest and set up a new company Inner Mongolia Xinhuan to implement the comprehensive use of about 100,000 tons of granules silicon and silicon -based materials for production and downstream applications. In the field of research and development projects, Inner Mongolia's Xinhuan registered capital will formulate 4.5 billion yuan; on the same day, Tianjin Silicon is planned to sign the "Capital Increase Agreement" with Jiangsu Xinhua and Inner Mongolia Xinhua and carry out 10,000 tons of electronic -grade polysilicon projects. 1.8 billion yuan. The company and Xinxin semiconductor signed the "Capital Increase Agreement" to subscribe for 1.79 billion yuan in registered capital for Xinxin Semiconductor, accounting for 23.08%of the total capital increase after capital increase.

TCL Technology stated that the company and partners have carried out investment cooperation of projects in the poly crystal silicon and single crystal pull rods. Through the Inner Mongolia Xinhuan project, it will further consolidate cooperative relationships, strengthen upstream and downstream resources coordination, and serve the production capacity of new energy photovoltaic products in the future. Climbing up and expanding the market share of the product laid a good foundation.

Image source: Announcement Screenshot

In April of this year, GCL Technology and TCL Technology all issued announcements. All parties will build 100,000 tons of granular silicon, silicon -based materials in Hohhot, the comprehensive use of silicon -based materials and downstream application research and development projects, as well as 10,000 tons of electronic polysilicon silicon projects.

Relevant persons in GCL Technology told reporters that GCL Technology has been completed and put into production 60,000 tons of granular silicon production capacity in Xuzhou, Jiangsu; all construction tasks of the 100,000 -ton granular silicon project in Sichuan Leshan are entering the final sprint of the countdown; Inner Mongolia Baotou 100,000 tons of granular silicon project is being advanced at full speed, and it is expected to be officially put into production in the second half of the year. The substantial advancement of cooperation with TCL technology this means that GCL Technology's 100,000 -ton granular silicon project in Hohhot also enters the substantive preparation stage, marking that GCL Technology ’s currently planned 600,000 tons of granular silicon production capacity will all will all will all will be all. Enter the state of production or construction.

It should be noted that TCL Technology Group (Tianjin) Co., Ltd. is the controlling shareholder of TCL Central. TCL Central is one of the leaders of domestic silicon wafers, while TCL technology enters its upstream link. TCL Central and Longji Green Energy are two kinds of silicon wafers in different directions. The former focuses on large size. From the perspective of the layout of the industrial chain, the granular silicon of the controlling shareholder of the TCL Central in Central has the coupling of the industrial chain with the listed company.

Especially at the current air outlet node of silicon materials, the cooperation between TCL technology and GCL is easier to attract attention.

Reasons for price increases: upstream expansion momentum is slower than the middle and lower reaches

The price of silicon material enters 300,000/ton!

According to Antai's data today, the price range of the domestic single -crystal rewing this week is from 288,000 yuan/ton to 300,000 yuan/ton, and the average transaction price is 291,600 yuan/ton, and the period ratio increases by 1.85%; the single crystal is tightly tightly material. The price range is 286,000 yuan/ton to 298,000 yuan/ton, the average transaction price is 289,600 yuan/ton, and the period ratio increases by 1.90%.

Andaco said that the silicon material market is still in the situation of extreme shortage of supply this week, and the orders of various silicon companies have been required to sign a new order lock before the order is completed.

The situation of being urged for the delivery only increases, mainly due to the accidental suspension of a Xinjiang company, and other silicon material factories within Xinjiang are affected to varying degrees. , Make the shortage of silicon material markets that are in short supply; second, due to the influence of the sudden maintenance of silicon materials companies, there are a large number of supply gaps in individual silicon wafers. At the same time The situation of over -signing of silicon materials on the market has increased significantly; third, the increase in the price of silicon wafers is still surplus on the basis of covering the increase in the cost of raw materials, so Acceptance.

According to Antaiko data, in addition to the failure to restore production and maintenance of Oriental, four domestic silicon companies in China will gradually enter the maintenance status.

According to the latest production planning plans of each enterprise, the domestic polysilicon output in China is expected to be about 58,000 tons in July, a net decrease of about 3,200 tons month -on -month, a decrease of about 5%.

Enterprises with reduced production include Xinjiang GCL, Oriental Hope, Tianhong Ruike, etc., with a total reduction of about 6,700 tons. During the same period, four domestic companies expanded production capacity to release a small amount, including GCL Technology (03800.HK), Baotou Xinte, Yunnan Tongwei, and Asian Silicon Industry. In addition, the output of individual enterprises had a normal fluctuations, and the increase in an increase of about 3,500 tons.

Antai mentioned that, including imports, it is expected that the supply of silicon materials in the domestic market in July is about 65,000 tons, which can only meet the output of about 24.5GW. Compared with, there is still a large gap, so the price of polysilicon in July is expected to continue to rise.

The downstream companies have predicted the tension of silicon materials. Prior to this, Tongwei (SH600438, a stock price of 65.38 yuan, and a market value of 294.3 billion yuan) signed 200 billion yuan in two months, which is considered as a measure for downstream locking supply.

"The added value of the investment threshold and technology of the silicon material is too high, and the silicon material cannot keep up with the middle and lower reaches." The above -mentioned photovoltaic industry is unwilling to be famous. Silicon material, "it will rise."

However, some people think that the new production capacity of silicon materials will be released in the second half of the year.

According to the Research Report of CITIC Construction Investment Securities, the production capacity of silicon materials in the fourth quarter of this year is about to be released from last year. At that time, the supply of silicon materials will be more abundant. Although it is still difficult to make accurate predictions on the price of the industry, it can be determined at least at least It will appear in a stable price to magnify the transaction volume.

(Cover picture source: Daily Economic News

Daily Economic News

- END -

After 17 years, my country ’s largest nuclear power base was fully put into production at the largest nuclear power base!

June 23China Guang Nuclear Liaoning River River Nuclear Power Unit 6Formally have ...

Gaming Factory Mihayou "Stepping on Thunder" Minmetals Trust Dingxing Series?Some investors call the sales page of the same series of products have shown "Fund" products

A few days ago, the People's Court of the Chengzhong District of Xining City relea...