The one -time anniversary of the reduction of the two giants will pay the work Alipay: the money collection code will continue for two years for free

Author:Huaxia Times Time:2022.08.20

Huaxia Times (chinatimes.net.cn) reporter Fu Bixiao Beijing report

On the occasion of the implementation of the "Notice on Reducing the Payment Fee of Small and Micro -Enterprises and Individual Industry and Commerce" (hereinafter referred to as the "Notice"), on August 16th and 17th, Alipay and WeChat Pay announced the relevant data: Alipay For more than 22 million small and micro -merchants, the cost is reduced by nearly 8 billion yuan; WeChat payment has accumulated a total of about 3 billion yuan in payment service fees, benefiting more than 20 million small and micro merchants.

A number of payment industry interviewed by the "Huaxia Times" reporter revealed that since this year, payment institutions have generally strengthened their service efforts to small and micro enterprises, and helped the digital transformation of small and micro enterprises to reduce the adverse effects of the epidemic. Analysts pointed out that cost reduction and fee reduction can help strengthen the stickiness of the payment institution and help diversify business ecological expansion.

Significantly reduced the results of the profit

The above -mentioned "Notice" was released in June last year. It was jointly issued by the Central Bank, the Banking Commission, the Development and Reform Commission, and the General Administration of Market Supervision, and will be implemented on September 30, 2021.

On August 17, Tencent Holdings (00700.HK) released a second quarterly report, and the transcript of WeChat payment services was also disclosed.

According to the data released by the "WeChat Payment Smart Life" public account, from September 2021 to June 2022, WeChat Pay has accumulated about 3 billion yuan in payment service fees and benefited more than 20 million small and micro merchants. WeChat payment reduction cycle will last until 2024, and it is expected that the overall goal of 10 billion yuan in fee reductions for 3 years.

Another payment giant Alipay disclosed the results of the small service on August 16. The official public account of Alipay shows that in the past year, Alipay has reduced fees for more than 22 million small and micro merchants for nearly 8 billion yuan.

Beginning in March of this year, more WeChat and Alipay personal collection codes can be upgraded to personal operating revenue codes in individual operations. "Huaxia Times" reporter learned from the Ant Group people that for all Alipay's money collection codes (including personal business revenue codes), the withdrawal codes continue to be free until September 30, 2024. The withdrawal of the withdrawal is free of charge. And a single -day limit. For small and micro enterprises that meet the standards, individual industrial and commercial households registered in the market supervision department, and individuals with operating behaviors, continue to do a good job of reducing fees in accordance with the current policies. 10% off.

In addition, according to Alipay related plans, user funds are stolen to get compensation. If the merchant's collection code is maliciously replaced and packed, the loss of money can receive up to 2 million yuan in compensation through insurance companies. The user scanned the suspicious QR code, and the virus or Trojan caused the Alipay account to be stolen, and they could get compensation. Throughout 2021, the Alipay guarantee plan claimed more than 2 million yuan.

In addition to WeChat and Alipay, payment institutions generally have launched a small and micro -reduction policy. For example, La Kara's offline consumer transactions for all standard merchants debit cards, implementing card service fees and 10 % discounts such as issuing card service fees and transfer liquidation costs, merchants use digital RMB payment business to exempt merchant fees during the pilot period.

Su Xiaorui, a senior analyst of the financial industry, told the reporter of the Huaxia Times that in recent years, third -party payment institutions have responded to the supervision call, and have effectively implemented the related measures to reduce fees and benefit. It brings positive influence and gives full play to the role of support for the real economy. It can also bring corresponding improvements to its own business. Promotional charges can further stabilize the small and micro customer base of payment institutions.

Help small and micro digital transformation

Su Xiaorui also pointed out that the fee reduction has affected the fee income of the institution, but it also brings an opportunity to promote the payment institution to increase customer stickiness, and expand income other than the payment fee through diversified business and ecology, so as to thus Enhance your own market competitiveness

In terms of diversified business, the third -party payment platform has launched related services through output technology capabilities to help small and micro digital transformation, helping Xiaowei reduce operating costs.

Most of the more than 2,000 digital tools opened by the Alipay Merchant Service Channel to Xiaowei Merchants are free. The "Ant Group's 2021 Sustainable Development Report" released on June 1st this year shows that Alipay security risk control technology has reduced the damage rate to less than 0.098 ‰. The goal of Ant Group's digital inclusive is to help 100 million small and micro enterprises.

Tencent Financial Technology connects industrial platforms, enterprise business systems and banking systems to help SMEs improve efficiency through online digital management methods. On July 7, Tencent signed an agreement with the Bank of China. Tencent Fintech will connect to the open bank of the Bank of China to provide services for small and medium -sized enterprises to solve the degree of digitalization of traditional SMEs and breakpoints in financial management. problem.

In the first half of this year, the epidemic was repeated, and offline small and micro -merchants were greatly impacted, and the demand for digital transformation was particularly urgent.

Insiders insiders told the reporter of the Huaxia Times that during the epidemic, they actively cooperated with banks, governments and other cooperation to help merchants re -production and re -production, and meet their digital transformation needs. With the rise of the "non -contact" service model and the rise of the new retail economy, the accompanying payment analyzes the various business data of the merchant, and uses the self -proclaimed algorithm model to provide merchants with selection, replenishment, dynamic real -time inventory, user marketing, etc. Inside digital intelligent decision -making services, increase user retention and repurchase rates. Payment institutions help small and micro, such as moving the card through its local living business platform "Thousands of Hui" to help catering merchants and consumers under the epidemic. "Huaxia Times" reporter learned from the card -moving company that during the Beijing epidemic, Qianqianhui contacted Beijing local food merchants with pre -production dishes and distribution capabilities to meet consumers' home supplies procurement needs, and provide merchants with free lines for free lines. Sales channels. Qianqianhui also provides free online promotion services to many types of merchants such as catering and wine travel to reduce customer acquisition costs.

Su Xiaorui told the reporter of "Huaxia Times" that the payment platform deepen the service to the small and micro merchants, and can also play a role in the following aspects: First, use technical advantages to help small and micro merchants carry out digital upgrades to provide more convenient and efficient and efficient The receipt function; the second is to use the operating advantages to help small and micro merchants consolidate the flow of passenger flow and enhance the passenger flow. A wider one -stop service, such as cutting into the B -end field to help merchants connect with external supply suppliers, warehousing distribution, financing institutions, etc.

Editor -in -chief: Meng Junlian Editor: Zhang Zhiwei

- END -

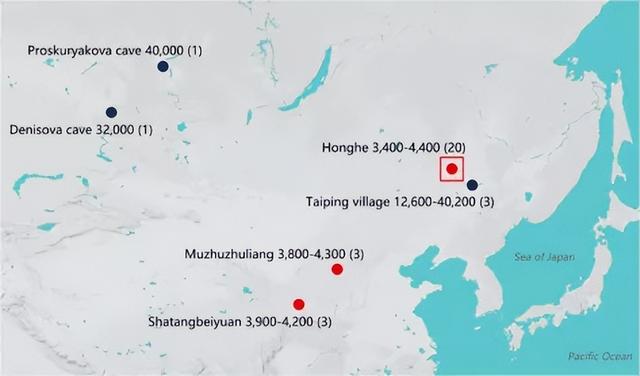

Ancient DNA research and reconstruction of the history of animal evolution

Cai Dawei, School of Archeology, Jilin University, and his team and Jiang Yu and h...

B -side visual trend analysis

Edit Introduction: Affected by the major environment, lifestyle changes, and many ...