Don't you change your mobile phone?How to "survive" domestic mobile phones

Author:China News Weekly Time:2022.09.01

Now the domestic mobile phone market

Too need a "explosive product" to boost sales

People are still waiting in the high -end machine market

Handling domestic brands

When the news that Huawei Mate 50 will be released on September 6th, the release time of the iPhone14 will make the outside world smell a trace of gunpowder.

As a representative high -end flagship machine in Huawei, Huawei Mate50, which was supposed to be released last year, was finalized as September 6 this year. Just after Huawei official announcement, Apple's annual autumn conference time was finalized. Obviously, this year's press conference has come earlier than previous years. At 1 am on September 8, Beijing time, iPhone14 will debut for the first time.

The release time of the two "machine emperors" products is only one day. The industry described that this is a duel like "Mars hit the earth" in the high -end mobile phone market. Huawei and Apple have been divided into autumn in the Chinese high -end machine market. IDC data shows that in the first half of 2020, Huawei, which had encountered sanctions, still surpassed 44 % of Apple with a market share of 44.1 %, ranking first in the domestic high -end machine market. However, with the exhaustion of chip inventory, Huawei's share in the domestic high -end machine market has been almost eaten by Apple. At present, the market share of Apple's mobile phone market is close to 50 %.

Illustration/Wang Bai

However, when communicating with Huawei dealers, they will still find that they are used to call Ren Zhengfei "Ren President". They have experienced the peak period of Huawei's mobile phone business. Even if Huawei could no longer launch 5G mobile phones last year, many people still choose to adhere to. "Take survival as the main program. The edge business shrinks and close, and the cold air is passed to everyone." Before Ren Zhengfei's internal speech spread to society, Huawei's dealers have felt "cold" in advance.

Not only Huawei's dealers, the entire mobile phone industry feels the arrival of "cold winter". This year, the mobile phone industry chain really felt the power of the "cycle". After experiencing the rapid growth of the past, accompanied by the impact of the epidemic and the slowdown of innovation, the industry felt the chill collectively for the first time.

The new Mate series of new products that have been returning again for two years have surpassed the level of Huawei company, and it has also aroused a hint of waves in the domestic mobile phone market. At present, the domestic mobile phone market needs a "explosive product" to boost sales.

The store can't sell anymore

On August 19, Xiaomi announced the second quarterly report. After a clean profit of 2.081 billion yuan, the fourth consecutive quarter declined. Compared with the high point of 6.322 billion yuan in the same period last year, it fell 67.1 %.

Just 8 days ago, Lei Jun shared his perception through the trough of life in his annual lecture. Xiaomi was crossing another trough again, mainly because of the decline in mobile phone business with a revenue of more than 60 %. In the second quarter, Xiaomi's mobile phone shipments were 39.1 million units. In the same period last year, this number was 52.9 million units. Xiaomi would attribute it to the influence of the global macroeconomic and mainland China epidemic.

On December 29, 2021, people experience Xiaomi mobile phone 12 series in a Xiaomi Mi House in Shanghai. Photo/Visual China

Xiaomi's financial report reflects the collective dilemma of Chinese smartphone manufacturers.

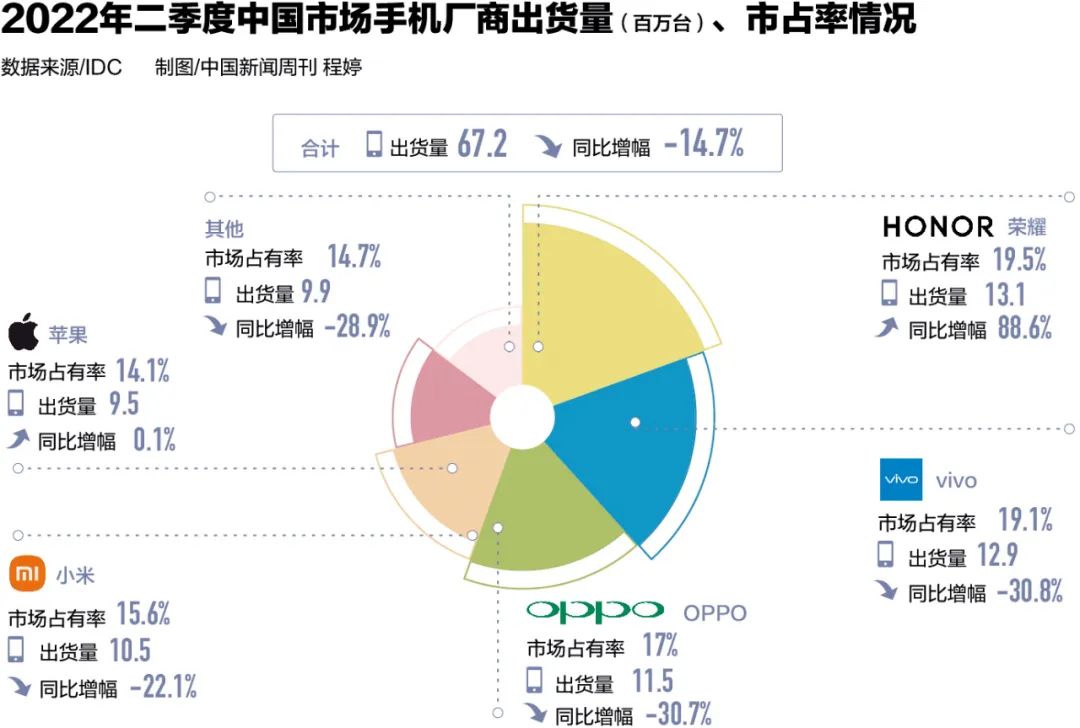

According to data released by the third -party market research agency IDC, in the first half of 2022, in addition to glory, domestic shipments in mobile phone manufacturers such as OPPO, VIVO, Xiaomi, and other domestic shipments declined to varying degrees. OPPO and Vivo declined exceeded 30 %, down from 371 million units and 391 million units to 252 million units and 262 million units. Honor's shipments rose from 104 million to 266 million units. More due to chip supply in the first half of last year, the shipment base was low.

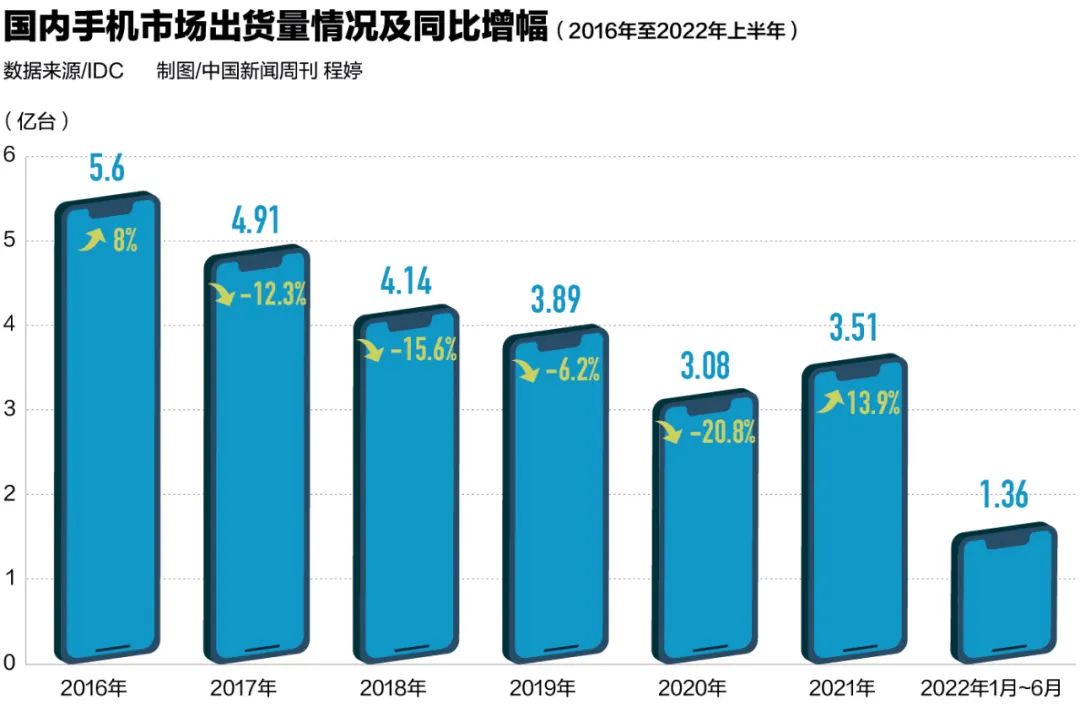

According to statistics from the China Institute of Xinong, in the first half of this year, the overall shipments of mobile phones in the domestic market were 136 million units, a year -on -year decrease of more than 20 %. In an interview with "China News Weekly", China Xintong Academy has not released data on mobile phone shipments in the domestic market in July. Wang Changying, Chairman of Changbai Consulting, believes that data in July will not be optimistic. He predicts that the domestic market's smartphone shipments will not exceed 280 million units, compared with 350 million units last year.

In fact, compared to the shipping data released by manufacturers and third -party institutions, stores have a more real feeling for the decline in mobile phone sales. The shipments refer to the number of distributors with a higher level of dealers. The secondary distribution will be sold to consumers. It is a store that really faces consumers offline.

"Traditional offline sales channels are facing the" double decline "predicament. On the one hand, sales have declined, and on the other hand, single -machine gross profit has declined, that is, the gross profit of the sales of a mobile phone has fallen." Wang Changcong told reporters.

On July 27, 2022, a press conference of Huawei Harmonyos 3 system was broadcast in a Huawei physical store in Shaoxing, Zhejiang. Photo/Visual China

In the online channel landscape of mobile phones, first -tier cities such as Beijing, Guangzhou and Shenzhen, and high -quality prefecture -level markets such as provincial capitals, and high -quality prefecture -level markets have been included in the first- and third -level markets, and ordinary prefecture -level cities, county -district -level, township -level markets belong to the 4th and 6th level. market. Some veterans of mobile phone manufacturers told China News Weekly that the current proportion of sales in the first and third -level markets accounted for slightly strong, reaching 50 % to 60 %.

According to his understanding, the sales volume of the fourth and sixth levels declined by about 20 % to 30 % year -on -year, and as the market level increased, the decline was greater. Go to half to sell.

Why is the decline in the first and third market decline? Wang Changzhan analyzed that the demand for middle and low -level markets for the 4th and sixth markets is relatively rigid. In contrast, the demand for high -end machines in the first and third markets has declined. However, the layout of the first and third markets is precisely the direction of domestic mobile phone manufacturers in recent years. At the end of November last year, in an interview with "China News Weekly", Honor CEO Zhao Ming revealed that as of the end of October of that year, Honor in the core business district or landmark business district of first -tier cities, the number of "positions" and experience stores increased by more than the year -on -year increase of more than more 80 %, over 30,000 in the national layout counters, zones, and experience stores.

But this strategy may be more injured now. In particular, those retailers with large scale and large -scale retailers, that is, the "big business" considers the industry, losses more seriously. Because these "big merchants" often face high labor costs, rent costs, and decoration costs. For example, with the continuous upgrading of offline channels in mobile phone manufacturers in recent years, the store needs to be renovated and upgraded in one year and a half to two years. It may be that the fixed assets of the previous round of decoration have not yet been shared, and the new round of decoration has arrived.

In addition to sales, there is also a single -machine gross profit. Wang Changying told reporters that, in fact, the decline in sales in the domestic mobile phone market is already a long -term trend, but in recent years, the offline channel experience is not obvious, especially at the profit end. Beginning at the end of 2018, the supply of Huawei chip was restricted. Until September 2020, the supply was completely disconnected, which led to Huawei's sources of tight sources. Offline channels harvested the "Huawei dividends", more of the original price and even premium sales. However, after September last year, Huawei's 5G chip inventory was exhausted, and the market share fell from 35 % at the peak period to the bottom. It impacted the offline channels and directly lowered the single -machine gross profit of some retailers.

"Huawei retailers are usually the heads of various levels of retailers. With the withdrawal of Huawei high -end machines withdraw from the market. Now the single -machine gross profit has fallen from about 500 yuan to 200 yuan to 300 yuan." Some Huawei retailers told China News Weekly.

Wang Changying will be regarded as the watershed of offline channels for the mobile phone market this year. "The market will no longer need so many offline stores. It turns out that the market is still a blue ocean. Anyone can easily make money when entering this industry. Stores and closed stores, it is estimated that 30 % of the stores will disappear during the year. "

"Destover" pressure increases

Inventory is becoming a "sensitive word" in the current mobile phone industry.

Judging from the second quarter report, although Xiaomi's total inventory increased by 3.61 % year -on -year to 60.15 billion yuan, the finished product rose from 21.597 billion yuan in the same period last year to 32.49 billion yuan on June 30 this year, an increase of more than 50 % This means that Xiaomi's inventory is rising significantly, and finished products are facing large sales pressure.

Wang Xiang, president of Xiaomi Group, said at the telephone meeting that "the changes in the international economic situation exceeded everyone's expectations, and semiconductors also from shortage to supply. The supply chain was lagging behind in the process of reducing demand. Therefore, rising inventory rising is normal."

"Xiaomi has always belonged to a benign manufacturer with inventory." Senior mobile phone manufacturers told reporters that manufacturers are still accustomed to designing inventory according to previous sales volume, and the decline in sales will inevitably generate bad inventory, especially brands like Honor who want to compete for market share. There may be a gap between the order volume and the actual sales progress.

In mid -July, in an interview with media such as "China News Weekly", Honor CEO Zhao Ming once said that there is no inventory pressure on Honor. But he admits that he is indeed very vigilant about the glory of inventory. "In the current environment, how to better balance the timely of supply and the risk of possible inventory are critical."

However, some insiders told China News Weekly that the reason why the glory was less inventory pressure than Xiaomi, OPPO, and vivo was because its "crushing" was relatively large. "After the Honor 50 hot sale, its expectations of the market share increased, which leads to a certain extent, which has caused strengthen distribution, that is, there are various channels for paving, but some products may be premium. "".

On June 16, 2021, the Honor 50 series of new mobile phones held a press conference in Shanghai. Photo/Visual China

"In comparison, there are relatively few brands such as OPPO, vivo and other brands." This industry insider revealed to reporters that the trading and layout of the Honor offline channel products basically re -engraved Huawei's play. In recent years The most serious pressure on the lower channel is Huawei.

How much inventory is there in the current mobile phone industry? The Whei think tank has announced the inventory of the mobile phone industry as of the end of the first quarter of this year. Domestic mobile phone manufacturers have a total of 30 million mobile phone inventory. Sun Yanzhi, chairman of the Worker Think Tank, told China News Weekly that 20 million of the 30 million inventory at that time was the finished product and 10 million were semi -finished products, but the situation changed in the second quarter.

"First of all, mobile phone manufacturers are relatively tight in inventory. During this year's '618', they increased their promotional efforts and consumed inventory. From the statistics of the China Institute of Xinong, the domestic mobile phone market shipments increased by 9 % year -on -year. With further upgrading of US chip sanctions risks, mobile phone manufacturers have changed their attitude towards inventory to a certain extent, and inventory becomes good information in a sense. "Sun Yanzan said.

This year's "618" is a "blood" for mobile phone manufacturers, and price reductions and pushing new have become the means of cleaning inventory. When offline channels are constrained by factors such as the epidemic, the manufacturer must strive to break through the online channels. Driven by the "618" this year, the proportion of online sales in June is significantly enlarged, even more than 45 %, which has attracted a batch of batches Originally consumers who were not purchased on online channels. Taking Xiaomi as an example, its price reduction on the Jingdong platform is significantly reduced. For example, Xiaomi 12, the daily price is 3699 yuan, and the starting price after consumer coupons during the promotion period is 2699 yuan.

From the Q5 to 3000 ~ 4000 yuan price segment of the price segment of 1000 ~ 1500 yuan, all the models of Realme have almost reduced the price during the "618" period, ranging from 200 yuan to 500 yuan, and also provided the whole process of the whole process. Insured service. At the same time, consumers have also joined the gameplay of mobile phones in different periods of time in the live room.

Publishing new machines is also usually an important means for manufacturers to stimulate demand. Senior mobile phone manufacturers told reporters that domestic manufacturers are normal for the main models to insist on twice a year. A mobile phone is considered to be updated after 6 months of release. The long tail period, I hope to use a new product to stimulate consumers, while driving the old models to sell. In order to compete for the "618" time window, Honor released the Honor 70 series on May 30 in half a month in advance. Zhao Ming admits that this is to launch new products to seize the share at a very good time.

Not just online channels, some people in the industry admitted to reporters that the current price of the mobile phone market is relatively chaotic. Several domestic manufacturers hope to compete for 20 % of the market share. More channels to sell their own products, this is the easiest way to increase shipments. Therefore, the phenomenon of "string goods" between different channels is frequent, and prices are prone to confusion.

"The difference between theoretical gross profit and actual gross profit has increased. In order to survive, everyone will sell prices. String goods and bargaining are common choices in the market where sales are declining." The aforementioned person revealed.

The result of price reduction and cleaning inventory directly reflects the level of mobile phone manufacturers, that is, the average price and gross profit margin decline. Xiaomi's second quarterly report shows that although the sales in the second quarter increased slightly by 600,000 units from the first quarter, the average selling price was reduced from 1188.5 yuan in the first quarter to 1081.7 yuan in the second quarter. %, Falling to 8.7 % in the second quarter. Wang Xiang, president of Xiaomi Group, explained to this that "Due to the weak consumer market globally, the Chinese market epidemic situation has also been repeated. The overall demand is not strong. We will definitely use more means to clean up our inventory, so it will cause profits Decline."

However, Zhao Ming judged in an interview with the media before that many brands did not achieve the goal of cleaning up inventory. Minsheng Securities Research Report even believes that mobile phone manufacturers have sold more new machines in the fourth quarter of 2021, but the sales of the quarter and the first quarter of 2022 are not ideal, resulting in the backlog of inventory. Until the second quarter of this year, the channels of major mobile phone manufacturers still exist still existing Desting pressure.

No matter how much the mobile phone manufacturer uses the "618" to complete the goal of cleaning up inventory, Sun Yanxuan believes that "618" does boost sales in the short term, but to some extent, it has also overdrawn the third quarter consumption, the market in the second half of the year in the second half of the year It's still hard to speak.

The misjudgment under the impact of the epidemic situation

In the eyes of many interviewees, this year's domestic mobile phone market is naturally affected by short -term factors such as epidemics, but from a long -term trend, its downturn is not unexpected.

Sun Yanzhi believes that the epidemic in first -tier cities such as Beishang, Guangzhou and Shenzhen has successively promoted the secondary market around the Beijing -Tianjin -Hebei, the Yangtze River Delta, and the Pearl River Delta. about.

Wang Changying believes that the market decline is first affected by the overall economic situation, and consumers are more rational. "In 2020 at the beginning of the outbreak, retaliated consumption has occurred after the epidemic was controlled, but the epidemic was affected by the overall economic situation, and consumers were more rational. The significant decrease in passenger flow has led to some active types or fewer and fewer random purchases. The epidemic will still bring great uncertainty. It is estimated that from the second half of this year to next year, the market is difficult to improve. "

In fact, the impact of short -term factors has only enlarged the long -term decline this year. Counterpoint summarized the trend of domestic mobile phone shipments since the fourth quarter of 2012 to the present. In the fourth quarter of 2012, the iPhone 5 was released. Since then, China's mobile phone shipments have gradually risen every quarter. Taiwan has since settle down. In the second quarter of this year, the shipment was only half of the fourth quarter of 2016, less than 70 million units, which was almost the same as the second quarter of 2013.

"The shipping volume fell back ten years ago." In fact, it was in line with the downward trend of shipments since 2016. "From 2016 to a peak of about 550 million units, it fell at a rate of about 15 % each year. It was only two and a half years from 2019 to September 2021. The most profitable time. "Wang Changcong believes that the decline in sales in the domestic mobile phone market is a long -term trend. "Such a situation will not change by 2025. From 2021 to 2025, the global smartphone market sales will stabilize at 1 billion units. This year may fall to 900 million units. China will stabilize at about 300 million units. The Chinese smartphone market accounts for 35 % of the global market, and it has shrunk to about 30 %. "Sun Yanzheng believes that 5G and folding screens have not stimulated consumers' willingness to replace the opportunity.

5G has been described by mobile phone manufacturers. Sun Yanxuan believes that the amount of 5G mobile phones supports the need for replacement in 2021, but after Huawei no longer has 5G chips, Yu Chengdong said that 4G+WIFI is equal to 5G mobile phones. Differences have further reduced the urgency of users to replace 5G mobile phones.

When the 4G withdraws from the rivers and lakes, there is no such sign. Senior mobile phone manufacturers told "China News Weekly" that in 2021, some manufacturers were subject to chip shortage and still launching 4G mobile phones. It is difficult for consumers to fully experience the advantages of 5G. I simply use this part of 5G costs to improve the performance of mobile phones such as batteries and photos to better meet consumer needs. Therefore, 4G mobile phones were launched when the entire industry was doing 5G mobile phones last year. Although the strategies that had to be adopted because of the chip supply at the time, the good efficiency prompted more manufacturers to follow up with this strategy and launch 4G mobile phones. "

Wang Changying also believes that it is difficult to stimulate consumers to change technology and network iteration. The experience of 5G mobile phones and 4G mobile phones is not much different, and the layout of 5G base stations is relatively slow. At present The high investment of 5G in the county -level and township -level market layout, coupled with the impact of the epidemic, has also slowed down the base station layout speed.

In addition, he also believes that the quality of smartphones is getting better and better, and hardware is homogeneous, even if the mobile phone model configuration launched two or three years ago was not low, key indicators such as screens, cameras, and memory were enough to meet the needs of ordinary consumers. With the decrease of the willingness to change the machine, the changing cycle is stretched. "The average period of changing the domestic mobile phone market in 2016 and 2017 is 18 months, and it has been more than 30 months."

Regarding the replacement cycle, Vivo Executive Vice President and COO Hu Baishan publicly stated that the earliest mobile phone replacement cycle was 16 to 18 months, and later became 20 to 24 months, and recently reached 36 months.

"The decline in sales of domestic mobile phone markets is already the consensus of mobile phone manufacturers, but it has made mistakes in prediction in the first quarter of this year." Sun Yanzan believes that mobile phone manufacturers generally follow the fourth quarter of the first quarter of the next year in the first quarter of the next year. The market predicts. "When predicting the market shipment in the first quarter of this year, it may only be 20 % off and 10 % off, but did not expect the epidemic factors. After the inventory of the Huawei 5G chip is exhausted, the iPhone 13's hot -selling cycle far exceeded expectations. As a result, there are more deviations in prediction. "

But it is this misjudgment that the upstream and downstream of the domestic mobile phone industry chain "steadily".

Injured chip supply chain

Speaking of the decline in demand for the mobile phone industry this year, the wake (pseudonym) of the deputy general manager of a plastic machinery supplier only told China News Weekly, "a lot".

This is a Taiwanese -funded enterprise that supplies production equipment for parts and component manufacturers such as mobile phone, protective cover, and lens. The wake -ups are quite concerned about the rivers of customer factories, that is, the actual production of a machine and equipment to the ratio of possible production quantity. "The population rate of most customer factories is about 50 %, and some even only 30 % to 50 %.

If the demand for the mobile phone industry this year compared with 2020 and 2021, the market in the past two years can be called "crazy", an increase of more than 560 %. They are all expanding capacity. Wake up telling reporters that since this year, it is not just mobile phones. "Some consumer electronics, such as smart speakers, TWS headphones and other production lines, are also declining."

"Although the company's shipments this year still increased by 20 % compared with last year, the amount of new orders fell significantly, especially during the Shanghai epidemic, and it improved in July and August. There is no signs of rebound at present. "Wake up.

The shrinking of the industry's capacity has led to the upper and lower reaches of the mobile phone industry chain. Among them, the most obvious fluctuation may be the chip industry.

On February 25, OPPO officially released a new generation of flagship Find X5 series in Shanghai, of which the Find X5 Pro was first equipped with OPPO's self -developed NPU chip -Marianilicon X. Figure/IC

The report issued by Boston Consultation and the US Semiconductor Association showed that the sales of smartphones using chips ranked first with 26 %. The decline in mobile phone sales is bound to drag the chip industry. A domestic OLED shows that the relevant person in charge of the driver chip supplier told China News Weekly that the downstream terminal manufacturers did face certain inventory pressure, which caused the sales of upstream chip manufacturers to be affected. The price is not greatly affected, but he is unwilling to talk too much about the degree of demand decline. Senior mobile phone manufacturers revealed to reporters that for the core SOC chip, the annual chip supply is locked in the fourth quarter of the supply volume in the next year. The misjudgment of mobile phone manufacturers for this year's market situation makes it difficult for some chip manufacturers to turn the bow in time, and the inventory pressure has risen sharply. Zhao Ming admitted that the chip changed from supply shortage to the backlog of inventory in July. In fact, there was only one or two months of response time. Natural reaction no longer could deal with this situation.

Cinno Research data shows that in the second quarter of 2022, the domestic smartphone SOC chip shipment decreased by about 20 % year -on -year, and the decrease was 6 percentage points compared to the first quarter. This directly drags the inventory of SOC chip suppliers like Qualcomm. In the first half of this year, the number of Qualcomm inventory weeks increased to 85 days, an increase of about 11 days year -on -year.

"This year's demand from the smartphone side has been reduced by 30 %. Last year, mobile phone manufacturers planned to prepare an additional 20 % inventory. This year's demand reduced 50 %, which is equivalent to the chip manufacturer's more normal inventory in one year. Wait at least until the second quarter of next year. "Yang Yang (pseudonym), the head of a domestic mobile phone chip supplier in China, told China News Weekly that due to the high inventory of upstream chip manufacturers, the current price war is basically fierce, and they have basically begun to ship loss.

The decline in consumer electronics, including mobile phones, directly enable the upstream semiconductor industry to enter a new round of cycle. Data from the US Semiconductor Association show that the growth rate of semiconductor sales began to slow. The total global sales in the second quarter were US $ 152.5 billion, which was basically the same as the first quarter. The entire industry was entering the eighth round of cycle since 1976. It's just a sudden change this time.

"Taking mobile phones as an example, manufacturers may have had higher goals in 2022. In recent months, when the sales are not good and the inventory is more, it will reduce the purchase in the market. When it is transmitted to a foundry manufacturer, there will be a particularly large magnification when it is transmitted to the foundry manufacturer. "Zhao Haijun, a chief executive officer of SMIC, said so after the company's second quarterly report was released. In the second quarter, SMIC's revenue from smartphones decreased by 7 % month -on -month.

Wang Xiang admits that due to the changes in the global economic situation and the political environment, this year's global semiconductor supply situation is greatly reversed, and many chips and products are surplus.

Just in 2021, the shortcomings of the mobile phone industry were still the problem of anxiety in the entire industry. Xiaomi management has talked about the topic of core lack on multiple occasions. “芯片缺货的周期不会太短,今年肯定不可能缓解,乐观的话明年上半年会缓解,但我觉得也有一定的难度,也可能明年会出现整体缺货的状况。”去年4月底,小米Lu Weibing, a group partner and senior vice president, made such predictions.

Last year, Yang Yang was also pleased to have a strong demand for downstream mobile phone manufacturers. In 2021, a certain chip shipment of the company's mobile phone increased by 50 % to 60 million, of which the purchase volume from mobile phone manufacturers was about 55 million.

On May 21, Jiujiang, Jiangxi, a technology company's mobile phone (straight chip in the board) production workshop. Figure/IC

"50 % of the increase indeed exceeds previous years." Yang Yang believed that on the one hand, it was awarded the pronunciation of pronunciation mainly facing the Asian African mobile phone market. The mobile phone users in Africa and South Asia switched from functional machines to smart phones, especially South Asia,, especially South Asia,, especially South Asia,, especially South Asia,, especially South Asia. The 4G network has basically been popular in the past two years. India, Pakistan, and Bangladesh have a population of about 2 billion. This part of this increase is obvious. In addition, another reason is that various manufacturers increase their stock preparation in order to grab Huawei's empty market.

But the rapid transformation of the style of painting exceeds the imagination of most people in the industry. In November last year, Zhao Ming told China News Weekly that for the mobile phone industry, unless special circumstances were "starved to death", they were "dead". The mobile phone is like seafood products. The old and new products are replaced quickly. The characteristics of the cycle are obvious. A new model is sold quickly when it was launched. The market share is very high, and then it will decline all the way. "Any mobile phone manufacturer is overly estimated that the popularity of their products will have a huge crisis and challenges, but this is exactly that the industry is very easy to make mistakes."

At that time, when he believed that when mobile phone manufacturers split the Huawei and Honor market, they might increase the tension of chip supply. Therefore, in order to compete for Huawei's vacant market, various mobile phone manufacturers have increased the number of orders for upstream chip manufacturers, but the "sweetness" felt by the chip industry at that time turned into "bitterness" today.

Find a way out

The new machine is slow, but the volume of the recycling business of the two mobile phones has increased. "In the case of consumption regression rationality, young people accept two mobile phones. It is expected that the market transaction volume will exceed 80 million units this year." Wang Changcong told reporters that the offline stores need to change.

"For offline stores that only rely on mobile phones as profit points, it will be greatly impacted, but if the store is sold on mobile phones, there are also several profit points such as operators, accessories, insurance, and two mobile phones. A better profit level. "Wang Changcong believes," In the next two to three years, this environment will continue. Retaisers need to improve the profitability of other surrounding products other than mobile phones. It attaches great importance to the diversified operations of offline channels, especially in the second half of this year to next year, first of all, it is necessary to find breakthroughs in cooperation with operators. "Wang Changcao noticed that some Huawei's head retailers will also try low -cost spanning low cost spans Borders sell cars because head retailers often occupy a relatively good commercial complex. The original 4S store input cost cost tens of millions of yuan, but the Huawei system could achieve low -cost cross -border.

Finding the profit points outside the mobile phone, in other words, diversification is not just a breakthrough direction for offline sales channels for mobile phones.

After Lei Jun shared how to cross the lecture of the trough of life, Xiaomi not only released MIX FOLD2 of the folding screen mobile phone, but also announced its progress in autonomous driving and human bionic robots. Just one day before, OPPO released a number of new IoT (Internet of Things) such as Watch 3, and released the layout of the IoT ecosystem, revealing that IoT business increased at least 120 % of the goal within 3 years. At the new product conference in July, Honor also launched a number of products such as tablets and smart screens outside the mobile phone.

"In the future, the way out is the non -mobile phone business. Each manufacturer is speeding up the development of its own non -mobile phone business, which is relatively conservative in the past.

OPPO and vivo are also working on new products such as wearing, not only mobile phone manufacturers, but also the adjustment direction of the entire industry chain. "Sun Yanzhi told reporters.

On February 23, 2021, at the 2021 World Mobile Communication Conference with the theme "Common Life", OPPO's scroll screen mobile phone attracted visitors to watch. Photography/Reporter Zhang Hengwei

The IoT layout of mobile phone manufacturers seems to become more complicated. In November last year, Zhao Ming told reporters that Honor will definitely be strictly controlled in what areas of entering. "We have our own core logic that will not make refrigerators, air conditioners, and washing machines. Instead, considering consumers, the collaboration of mobile phones and equipment can provide consumers with a better experience."

Although it means that the smart screen is not completely based on profit -based considerations, mobile phone manufacturers undoubtedly want to create more profit points outside the mobile phone.

In addition to diversification, the trend of high -end has long been a consensus in the industry. Wang Changying believes that only Apple will get better sales growth in the Chinese market. After all, in the original high -end market, Apple and Huawei each account for 40 % of the market. Apple has become the "receiver" of Huawei's high -end market share, occupying 70 % of the domestic high -end market On the right, other domestic manufacturers are also attacking the high -end market, but after all, the accumulation of two generations and three generations is required. Even if the hardware configuration is good, the brand power is not enough.

Sun Yanzhi believes that Xiaomi, Honor, OPPO, and vivo will gradually gain a foothold in a market with $ 600 ~ 800.

Senior mobile phone manufacturers talk to reporters about the "ceiling" of the Chinese mobile phone market. The key is how to define "ceiling". If it is from the perspective of sales, it may be stable in about 300 million in the future. However, from the perspective of meeting consumers' needs for mobile phones, the total amount of Chinese mobile phone markets is continuously increasing. "For example, mobile phones with a price of less than 1,000 yuan, only 7.9 % of the Chinese market, and the value of the entire mobile phone industry is going up. On the contrary, it is a high -end challenge for mobile phone manufacturers."

However, after Huawei, although vivo has gradually established a foothold in the high -end machine market, such as the X series, it has not yet appeared to fight against the apple trial. In the second quarter of 2022, Apple still occupied the top domestic high -end machine market with a market share of 46 %, while the second -ranked Vivo market share was only 13 %. Essence

Send 2022.9.5 Total Issue 1059 "China News Weekly" magazine

Magazine title: How to "survive" domestic mobile phones

Reporter: Chen Weishan ([email protected])

Edit: Min Jie

Operation editor: Xiao Ran

- END -

Interview with the party secretary of the Beijing Science and Technology Association: "City of Science and Technology Museum" opened the science and technology museum to the door of the people's house

On June 27, the 13th Congress of the Communist Party of China opened. The report of the Party Congress stated that the goal of struggle in the next five years includes the four centers cities' strat...

Fortunately to witness the light from 13 billion years ago, deputy editor of Frontiers told the story behind the scenes

Follow us01After delayed 14 years and more than 20 times the budget, the Weber tel...