Isn't it stealing or buying? Is Xiaopeng Automobile a assembly factory?

Author:Yu Bin Time:2022.09.07

Edit | Yu Bin

Produced | Chaoqi.com "Yu See Column"

Among the three new vehicles, Xiaopeng Automobile has always appeared a little special.

Different from the ideal car and Weilai Automobile, which always wants to make a name in the mid -to -high -end, Xiaopeng Automobile revealed from the inside to the outside is a relatively cheaper and more affordable temperament. This is now "Xiaopeng". It seems that the brand names that are slightly random can be seen.

What's more special is that as several brands continue to attack the city in the new energy vehicle market, Xiaopeng Automobile's sense of existence at the vehicle sales level is getting stronger and stronger. Because the main model is cheaper than competing products, it means that Xiaopeng Automobile can cover more ordinary consumers, which helps it achieve very dazzling sales data.

In the first half of this year, Xiaopeng Automobile had delivered a total of nearly 69,000 new cars. This number allowed it to steadily sell the first place in the three major car manufacturing forces. At the same time, in the current new energy vehicle market environment, Xiaopeng Automobile still has a lot of growth potential at the product sales level in the future.

However, under the scenery, Xiaopeng Automobile showed more and more crisis at the same time at the same time in financial performance and future expectations. This makes people wonder why it is more and more dug under its prosperous appearance. Class hidden dangers.

At the product level, Xiaopeng Automobile has faced questions that lack core technologies for a long time. Under the brand crisis of "assembly factory", it is constantly being involved in the news of "stealing patents"; at the performance level, lower hairy hair The more the interest rate performance and selling and the more losing the status quo, the more the investors no longer sought out its long -term value. Recently, the company's stock price has fallen as the main theme.

Why is this?

Lack of core technology, Xiaopeng is deeply involved in the "assembly factory" question

After ZTE and Huawei broke out, one of the biggest experience learned by domestic large Internet technology companies in China is that only by holding core technologies in their own hands can they be "stuck neck" one day in the future.

In this context, the independent technical capabilities of new energy vehicle companies have become an important factor to measure whether it has an advantage in the industry.

But at the level of autonomous technical ability, Xiaopeng Automobile has always faced more questions than other new forces of other cars. A relatively simple and rude look is that the core technologies of Xiaopeng Automobile are basically relying on buying, buying, buying or external cooperation. Even some of its technologies have been involved in long -term plagiarism disputes.

In 2019, Tesla prosecuted Xiaopeng Automobile to the court and sued Cao Guangzhi and Xiaopeng Automobile's plagiarism in Tesla who worked in Tesla and later changed jobs to Xiaopeng Automobile. This case once caused a stir at the time. Although there was no final result, Tesla always seemed to believe that Xiaopeng Automobile was the one that was plagiarized. Until recently, Tesla has reported from time to time. Mocure.

It is worth noting that the Tesla plagiarism incident involves Xiaopeng Automobile's autonomous driving technology. This technology has always been one of the technical territories of new energy vehicle companies as the core. It has a great negative impact on Xiaopeng's brand reputation.

In addition, on the three major pieces of electric vehicle batteries, motors, and electrical control, Xiaopeng Automobile also faces criticism of lack of independent technical content.

Needless to say, battery manufacturing and battery solutions rely on Ningde Times and other battery suppliers, and many new energy vehicle companies do so. However, brands such as Tesla will get involved in the fields of battery design, research and development, and Xiaopeng is indeed more like a car company that uses batteries to assemble and use it.

It does not have the ability of motor research and development and depends on external purchases. The electrical control system also depends on external procurement ... It can be seen that at the level of key technology research and development of new energy vehicles, Xiaopeng Automobile is either suspected of "stealing" or buying it, so it is a "assembly factory "It didn't grieve it.

So the question is. If you have not had his own core technical ability, what exactly is Xiaopeng Automobile's competitive advantage and barriers in the industry? Can a good -looking appearance and more cost -effective price really help car companies to achieve long -term development?

Interestingly, in order to reverse the current loss, Xiaopeng Automobile has begun to launch high -end products such as G9. However, considering the lack of core technical capabilities in Xiaopeng Automobile, everyone may still be cheap and ignore these shortcomings in the low -end market. Facing a very disadvantaged situation in the competition, such stories have happened on Xiaomi mobile phones.

The profitability is worrying, and the future will continue to be pessimistic

Regarding the profitability of Xiaopeng Automobile, everyone knows that it shows a trend that sells more and more losses. This performance makes it a burden on its good sales results, which makes it more and more difficult for people I believe it will really make money one day in the future.

From the perspective of gross profit margin, Xiaopeng Automobile is the lowest in the new forces of three cars. Relevant financial report data shows that in the past 2021, the three overall gross margins of Weilai, ideal, and Xiaopeng were 18.9%, 21.3%, and 12.5%, respectively, and the gross profit margin of the vehicle was 20.1%, 20.6%, and 11.5%. Xiaopeng can be described as the only gear.

From the perspective of losses, Xiaopeng Automobile lost 4.863 billion in 2021. According to the latest quarterly financial report of 2022, Xiaopeng's total revenue in this quarter was 7.45 billion yuan, a decrease of 12.9%month -on -month, and the gross profit margin was only 12.2%. Essence In addition, Xiaopeng's net loss in the first quarter was 1.70 billion yuan, a significant increase of 53.5%year -on -year. It is no wonder that the media, which once had good things, calculated Xiaopeng Auto, thinking that every car sells a car, it will lose nearly 50,000 yuan, and every shop will lose more than 46 million. Isn't a small Peng more than more than you buy?

Poor performance naturally also affects Xiaopeng Automobile's stock price performance. Recently, Xiaopeng Automobile's stock price has entered a downward channel. Considering that new energy vehicle companies can only stop Lost and profitable, Xiaopeng still has a long way to go.

According to analysis, if you refer to Tesla, then Xiaopeng has to mention his sales at least 500,000 yuan in profit. Can Xiaopeng Automobile do it? How long does it take to do it? Even if it does, will this profit "access" threshold to improve the "access" threshold for low gross profit margins?

Time does not wait for people to leave the development window of Xiaopeng Automobile in the new energy vehicle market of the competitors "grinding the knife".

- END -

Weibo anime starts the "Super Yuanxing Plan" to witness the birth and growth of new virtual idols

Cover news reporter Meng MeiOn August 3, Weibo Animation announced the launch of t...

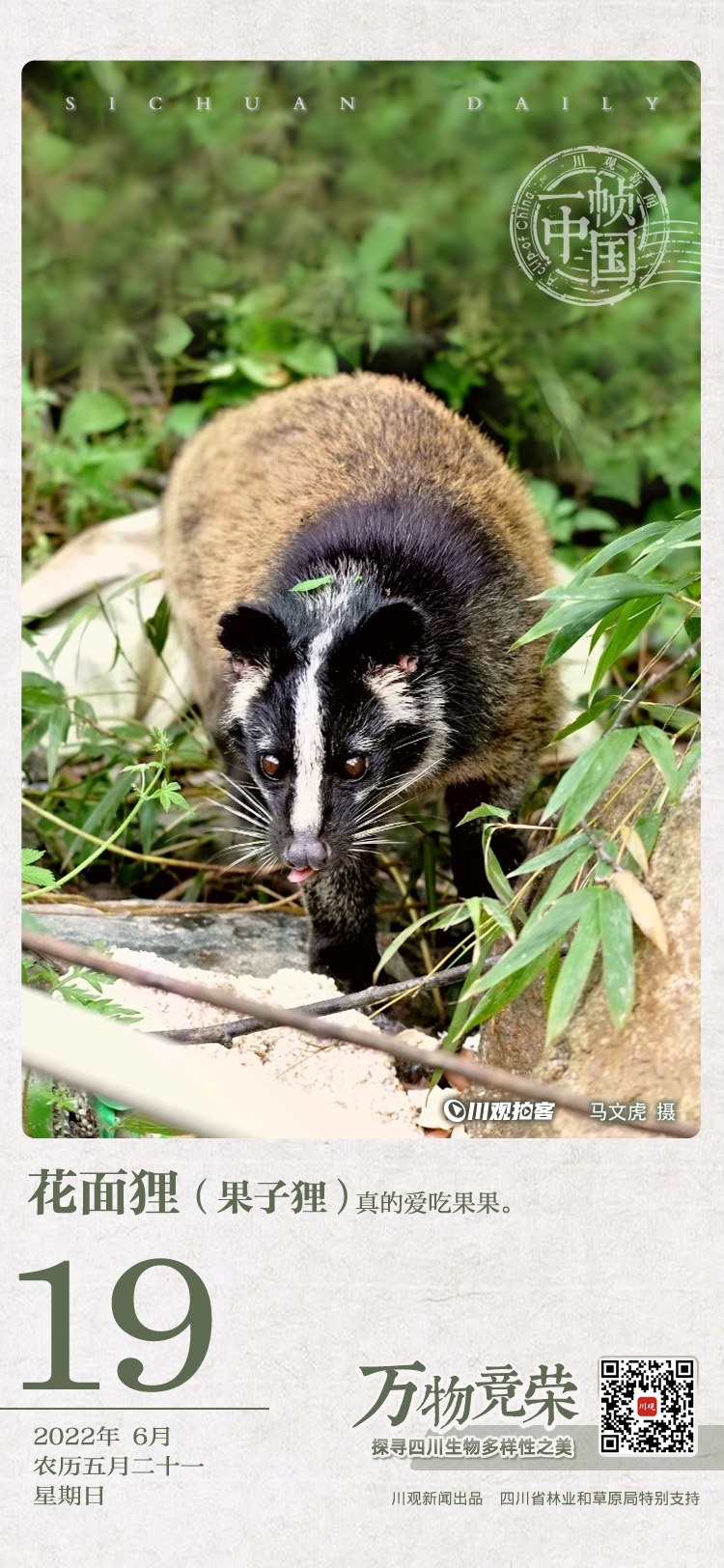

Tianfu's natural calendar 丨 "Night Walkman" who loves fruits (June 19, 2022)

Speaking of flower noodles, you may not be familiar with; but when you mention the...