Increase income!The market value is reduced by 70 billion, and the scanning Mao Shitou technology is not fragrant?

Author:Sword finger Time:2022.09.17

Text/Yang Jianyong

In the first half of 2022, the revenue of stone technology was 2.923 billion yuan, an increase of 24.49%year -on -year; net profit was 616.5 billion yuan, a year -on -year decrease of 5.4%, showing a situation of increasing increasing income. The main reason for the reduction of net profit is to further expand the increase in sales expenses at home and abroad, including advertising and market promotion costs, and increased salary costs for sales departments; and the decrease in profit or loss generated by long -term locks. In response to the high market costs, in my opinion, the industry's competition is becoming increasingly fierce. For C -end consumers, brands are core competitiveness. To this end, advertising investment has been continuously increased to obtain the C -side user group.

The smart home track in Stone Technology is the main product of the floor -to -family sweeping robot. It not only has to face the leading company Cobos competition, but also large home appliance manufacturers such as Haier and Midea have also launched sweeping robots, as well as mobile phone manufacturers such as Xiaomi. Competitors in different fields are pouring in, and then the market competition pressure gradually increases. From the perspective of shipments, in the first half of 2022, Stone Technology achieved 1.1 million floor -to -floor robots, and in the first half of 2021, a total of 1.23 million floor -of -floor sweeping robots were sold. Show a downward trend.

Of course, the overall sweeping robot market has declined. According to the report released by Aowei Cloud, the growth of the scanning robot industry in the first half of this year began to slow down. In the first half of 2022, the retail volume of scanning robots was 200,000 units, a year -on -year decrease of 28.3%. It is worth mentioning that, under the decline in sales of screen sweeping robots, sales increased by 9%year -on -year to 5.73 billion yuan. It was mainly driven by product prices, showing that mid -to -high -end products were driving significantly.

At the same time, the domestic landscape of the domestic sweeping robot is still stable. According to the data of Ovi Cloud Network, in the first half of 2022, the proportion of brand sales on the ground sweeping robotic online, the share of the two manufacturers of Cobos and Stone Technology exceeded 60%, and the market share was 39.8%and 22.9%, respectively. There are also manufacturers such as cloud whales, Xiaomi, pursuit, beauty, Haier, etc. on the domestic sweeping robot track. The competition between head manufacturers is still fierce.

For players on the track, while enriching the type of product, while continuously increasing the publicity and promotion of their own brands. Stone Technology uses celebrity endorsements and continues to cooperate with various e -commerce platforms in terms of marketing, so that sales costs have increased. In the first half of 2022, the sales expenses of Stone Technology increased by 91.22%year -on -year to 500 million yuan, accounting for 17%of operating income. The core growth of sales costs is that the advertising costs have soared significantly.

Specifically, in the first half of 2022, Stone Technology's cost of advertising and marketing was as high as 310 million yuan, an increase of 190 million yuan compared to the same period last year, and advertising expenses increased by 158%year -on -year. In fact, for a long time, the sales costs of Stone Technology have remained high. In 2021, sales costs were 938 million yuan, an increase of 67.74%year -on -year, accounting for 16%of operating income. Among them, the cost of advertising and marketing was as high as 640 million yuan, an increase of 101%year -on -year.

In the face of investor surveys in June this year, Stone Technology stated that in 2021, it continued to increase its own brand promotion and promotion, and continued to launch new products to continue to expand market influence. The total sales costs were 938 million. There are major e -commerce platforms such as Tmall, JD.com, and Youpin, as well as advertising publicity such as celebrity endorsement, star live broadcast, Douyin, Xiaohongshu, Bilibili and other online celebrities.

Of course, under the investment of huge advertising, the stone technology brand has shown strong competitiveness in the market and has led to the growth of overall operating income. In the first half of this year, revenue increased by 24.29%year -on -year. However, while continuously increasing marketing, promoting the stable growth of performance, while eating net profit to a certain extent, leading to an embarrassing situation of increasing income and increasing benefits. Behind it also reflects the extremely fierce competition in the industry, it is necessary to invest a lot of advertising fees to enhance brand competitiveness.

It should be pointed out that Stone Technology is a representative enterprise of Xiaomi ecological chain, and it has achieved high -speed development with the help of Xiaomi. It was just that Lei Jun continued to reduce his holdings and made the outside world speculate that Lei Jun was abandoning stone technology. Tianjin Jinmi Investment Partnership (Limited Partnership) Actually controller Lei Jun, from March 16, 2021 to June 10, 2021, reduced holdings of 1.333 million shares of stone technology, and the cash withdrawal amount was 1.65 billion yuan. QM27 LIMITED is cash more than 1 billion yuan. There are also large -scale reductions such as Banyan Consulting Limited, Dingdi, and Stone Technology employee holding platforms.

As a stone technology employee holding platform, it is also constantly reducing its holdings, which has cash more than 2 billion yuan in less than two years. From March 2021 to July 23, 2021, 1.74 billion yuan was cash, and 352 million yuan was cash out from March 24, 2022 to June 17, 2022. Under the pressure of important shareholders, the capital market is weak for a long time. The market value of stone technology has reached up to 99.7 billion yuan, and the current market value is 27.35 billion yuan. Compared with the high level, the market value decreases by 72.35 billion yuan, and it shrinks by 72.5%.

Behind this has both the pressure to reduce holdings, as well as industry competition, and the performance is weak. At present, the sweeping robot competition is more about advertising marketing. From the perspective of R & D investment and advertising marketing investment, Stone Technology is more like a technology company that redeem lightly develops and develops. In the first half of 2022, the R & D investment of Stone Technology invested 226 million yuan, an increase of 13.74%year -on -year, which was in sharp contrast to the increased growth of advertising expenditures. Finally, in the past two years, consumers have a strong demand for scanning robots, making the market grow rapidly. However, this year's industry has grown up. Ovi Cloud's network is expected to retail the number of flip -saving robots throughout the year, a year -on -year decrease of 20.2%. However, the retail sales of the floor -to -floor robot industry throughout the year were 13.4 billion yuan, an increase of 11.8%year -on -year. The main is the average price of the product further increased, which once again increased the gap between the amount. On the whole, the industry is still under pressure in the second half of the year, and the pressure is heavy. Only through prices, reaching new groups, and winning new users can break the deadlock and stimulate the further release of purchase demand.

Yang Jianyong, a Forbes Chinese writer, is committed to in -depth interpretation of cutting -edge technologies such as the Internet of Things, cloud services and artificial intelligence.

- END -

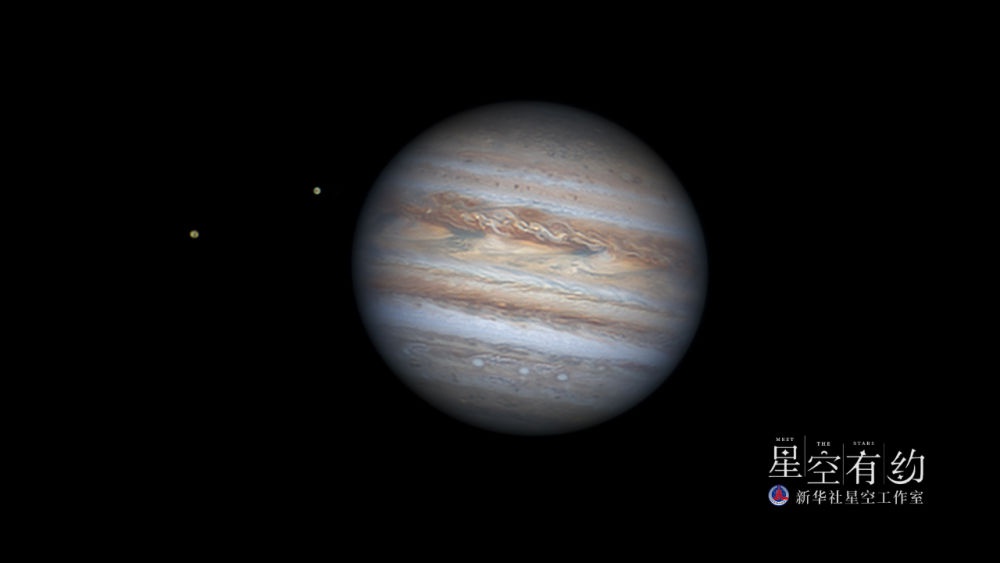

Don't miss it: On the evening of the 11th, the round moon "chase" super bright Jupiter

Poster production: Feng JuanAstronomical popular science experts introduced that a...

100 billion yuan cosmic market, soul and Yingke’s new driving force

The picture comes from Canva.In the second half of 2022, the enthusiasm of capital...