"Fengkou Research Report · Company" has a gross profit margin of nearly 60%of the new material leader. Equipment+material integration creates core competitiveness, and is about to open up optical, automotive electronics, medical equipment and other new fields.

Author:Federation Time:2022.09.19

① The new material leader with a gross profit margin of nearly 60%, equipment+materials integration to create core competitiveness, will soon develop optical, automotive electronics, medical devices and other new field applications; ② population aging+logistics cost reduction and efficiency Pushing the ventilation, the company's software and hardware eats new energy, aerospace, e -commerce and other industries, and the new signing of new orders has reached a new high.

"Fengkou Research Report" Today Introduction

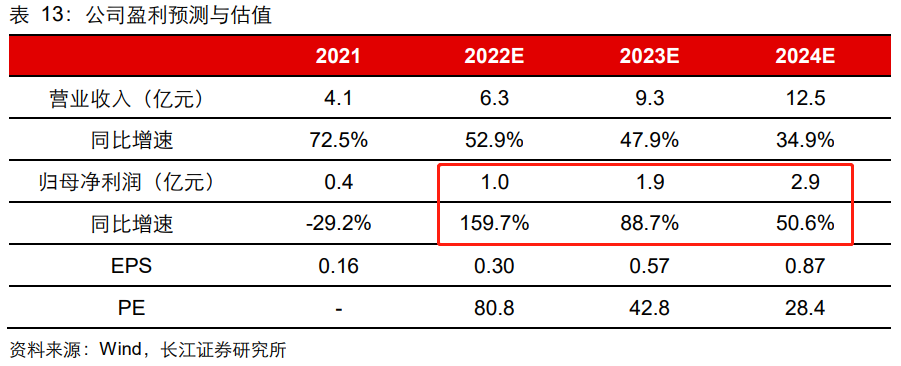

1. Company 1: ① nano -coating can achieve hydrophobic, oil sparse, dustproof and other functions on different substrate materials. Currently mainly applied to electronic consumer goods such as mobile phones, electronic readers, wearable electronic equipment, instead of the original three anti -lacquer paint The market of Parrein coating; ② The company broke through foreign technology monopoly and realized the integration of the entire coating process, with a comprehensive gross profit margin of 58.1%. At present, a series of head technology companies such as Huawei, Xiaomi, Apple, vivo, Amazon, etc. Reaching in -depth cooperation; ③ The company is still continuously strengthening and enriching the function of nano -film, and has achieved a lot of breakthroughs in technical fields with special functions such as super -proof water, ultra -hydrophobic or wear -resistant scratch resistance, and further expand the application scope of products to optical instruments and automotive electronics. , Medical Devices and other industries; ④ Changjiang Securities Yang Yang estimates that the company achieved net profit of 1.9 million yuan in net profit from 2022-2024, a year-on-year increase of 159.7%, 88.7%, and 50.6%. ; ⑤ Risk reminder: The new product is less than expected.

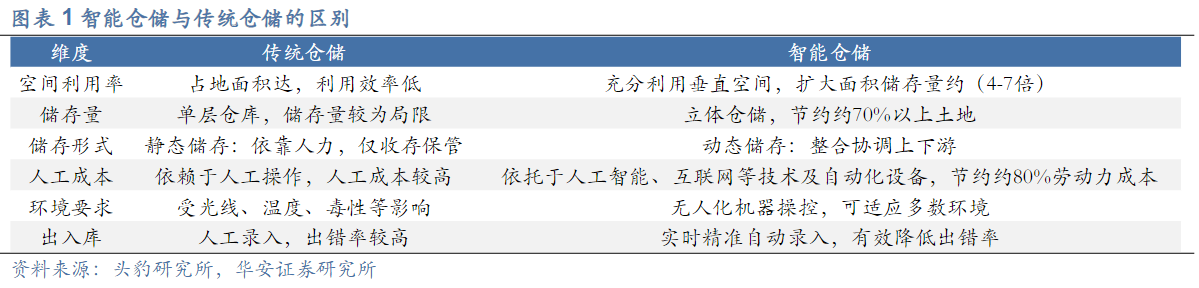

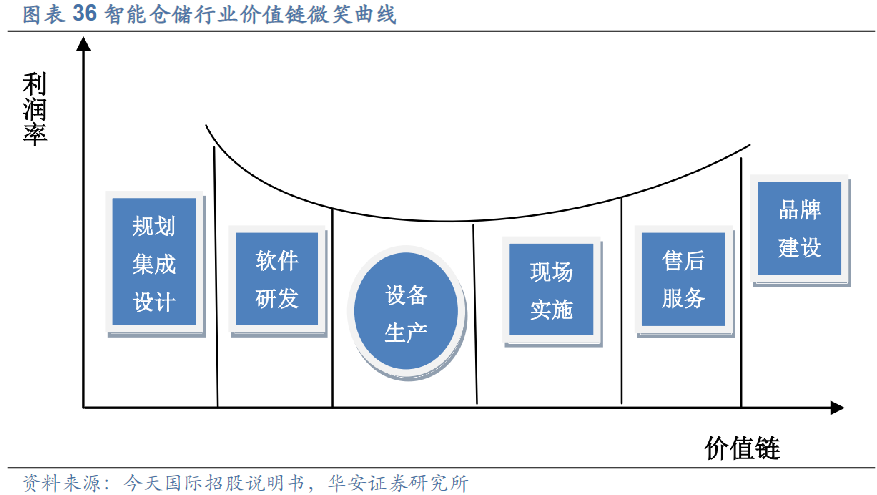

2. Company 2: ① The manufacturing cost reduction and efficiency increase the demand for intelligent warehousing. Intelligent warehousing saves about 80%of the labor costs, and through the three -dimensional warehousing model, it saves more than 70%of land. Xiaoxiao has not formed an absolute leader, and it is expected to benefit from the accelerated expansion of the industry's high β effects; The growth point of growth lies in the continuous extension of the upstream of the value chain (planning integration design, software development, etc.) and downstream (after -sales service, brand building, etc.) on the value chain; ③ Super future factories of companies in the production capacity field will be put into use in 2022 , Can support the order of 2 billion yuan, which is doubled from the current; ④ Huaan Securities Zhang Fan expects the company to achieve net profit at a net profit of 1.01/1.29/1.69 billion yuan from 2022-2024, a year-on-year increase of 26%/27%/31%. , Give "Buy" rating; ⑤ Risk reminder: technical research and development breakthroughs are not as good as expected.

Theme one

The new material faucet with a gross profit margin of nearly 60%, the equipment+material integration creates the core competitiveness, is about to open up optical, automotive electronics, medical equipment and other new field applications

There are few competitors and high barriers for nano -coating track. The downstream applications are currently electronics.

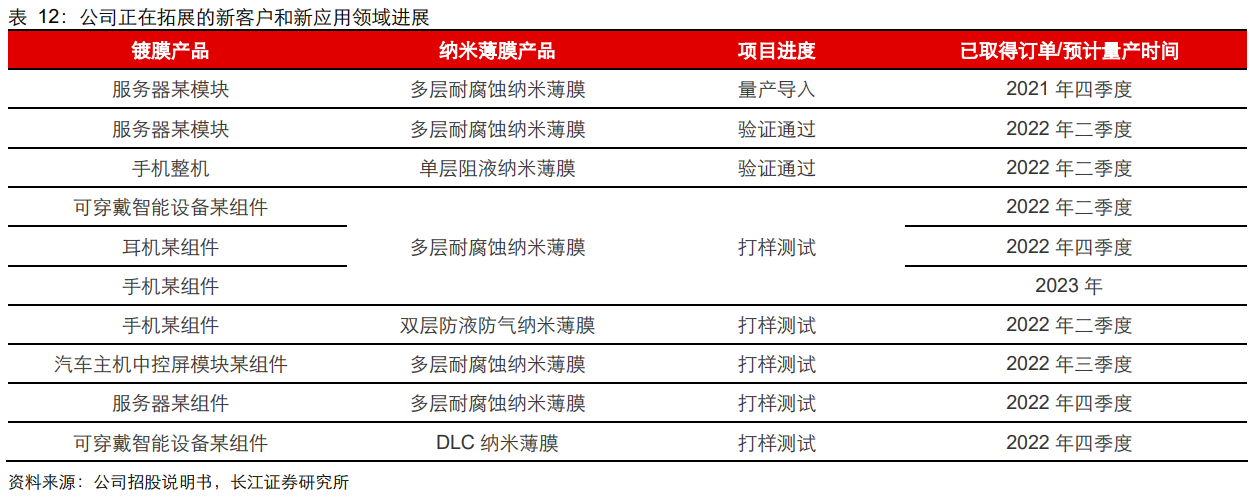

Yangtze Securities Yang Yang's latest coverage breaks through foreign technology monopoly, adopts independent research and development equipment, materials formula and preparation of the domestic industry nano -coating leader Philivy Thai (688371). Nano coating is currently mainly used in mobile phones, electronic readers, wearable electronic equipment For electronic consumer products, the company currently has made a lot of breakthroughs in technical fields in special functions such as super -proof water, hydrophobic or wear -resistant scratch resistance. The application scope of subsequent industries is expected to expand to security equipment, automotive electronics, medical equipment, etc.

Yang Yang expects that the company will achieve net profit of 1,19,290 million yuan in net profit from 2022-2024, an increase of 159.7%, 88.7%, and 50.6%year-on-year. For the first time, the "buy" rating is given.

Nano coating: obvious technical advantages, broad application scope

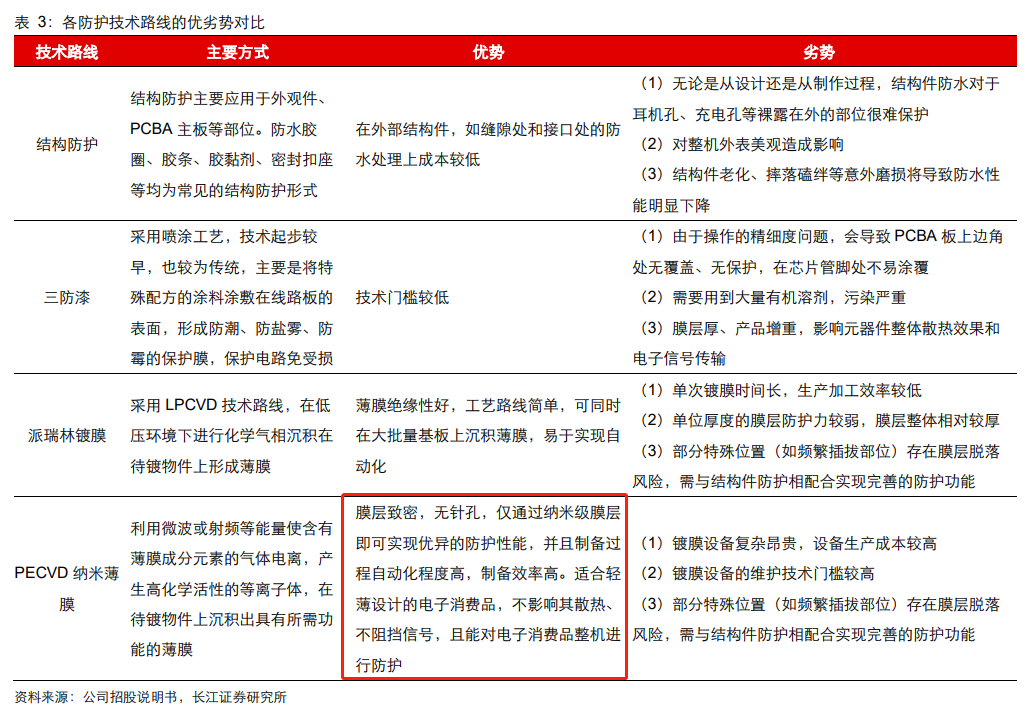

The protection of electronic products is usually divided into two types: structural protection and coating protection. From the perspective of development trends, PECVD nano -coating with better control of the membrane layer, better membrane layer performance, better plating performance, and wider applicability is gradually occupying the original three anti -paint, Perryin, Pai Ruilin The coating market.

Platform layout to create a leader

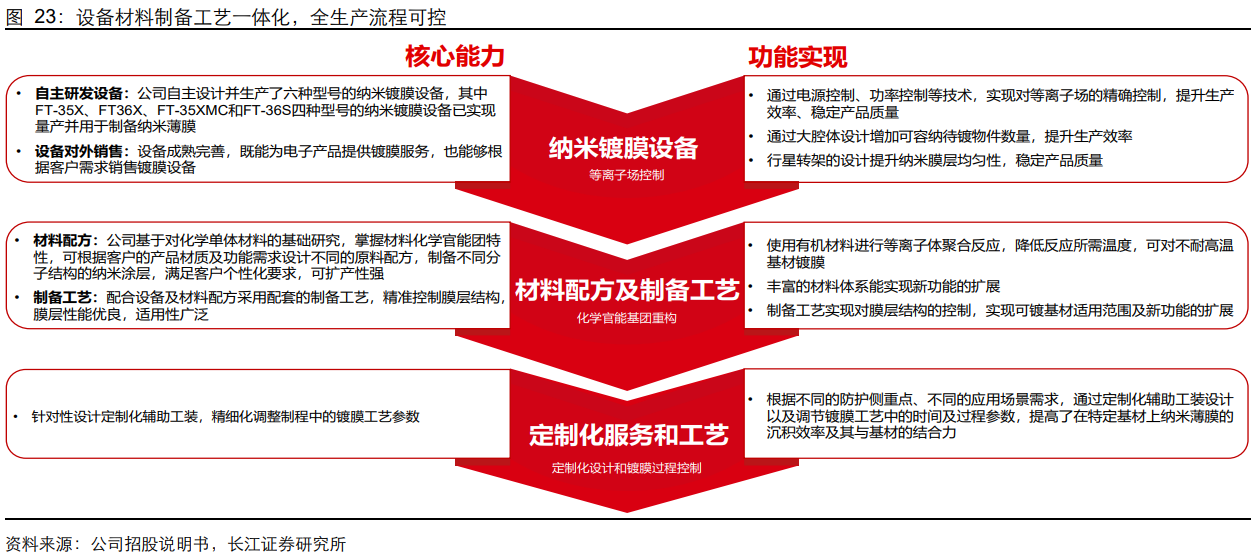

Filoya was established in August 2016. Since its establishment, it has been engaged in the research and development and preparation of high -performance and multifunctional nano -film. The company adopts independent research and development equipment. The material formula and preparation process are independent innovation, breaking through foreign technology monopoly, and realizing the integration of the full process of coating, which can also take into account the quality and efficiency of coating. Compared with competitors, the overall technical strength and product performance have a leading advantage. The company's comprehensive gross profit margin in 2021 was 58.1%.

Equipment: The company has independently designed and produced six types of nano -coating equipment. The self -developed equipment can better control the precise control of the ion field during the coating process, and has technical advantages in production efficiency and product quality.

Material recipe: Proper chemical materials can be selected for different scenarios to process them. It can flexibly expand the application scope of nano -thin film. For example, the current DLC nano -thin film has high hardness, high resistance and good optical properties. It can be used for folding. The abrasion resistance of mobile phone screen and optical devices.

The company's nano -thin film is currently mainly used in the fields of electronic consumer goods such as mobile phones, headphones, electronic readers, wearable devices, and reached in -depth cooperation with a series of head technology companies such as Huawei, Xiaomi, Apple, vivo, Amazon.

In 2021, the company's revenue in the field of consumer electronics accounted for 98.7%, of which mobile phones, headphones, and electronic readers accounted for the top three.

Assuming that the penetration rate of PECVD nano -coating technology reaches 100%, it is expected that the market size of the company that the company has expanded in 2022 will reach 5.672 billion yuan, and there is still much room for the company's income volume at this stage. In addition, the company is still continuously strengthening and enriching the function of nano -film, and has achieved a lot of breakthroughs in technical fields such as super -proof water, hydrophobic or abrasion -resistant and anti -scratch -resistant and anti -scratch -resistant scratch resistance, which can further expand the application scope of the product. The company's nano -thin film is optical Instruments, automotive electronics, medical equipment and other industries also have broad application prospects. At the same time, they also tried to push new products such as DLC nano -thin film to the market, providing more potential motivation for the continuous growth of future product sales revenue.

Theme two

Population aging+logistics cost reduction and efficiency push this industry to the air. This company's software and hardware eats new energy, aerospace, e -commerce and other industries. New signing creates a new high

The current market has entered the stock economy, and the cost reduction and efficiency of the manufacturing industry stimulate the demand for intelligent storage. The market size is expected to double by 2025.

Hua'an Securities Zhang Fan's latest coverage of Lan Jian Smart (688557), which focuses on the automatic system of the field of warehousing and logistics, has covered the entire process of the industry chain, the products focus on high -end markets, and the number of business orders has reached a record high. The super factory in the field of capacity and investment projects has been completed, supporting the scale of 2 billion yuan, which has doubled compared with the current capacity.

The company's customers cover the high -end fields of the "Fourteenth Five -Year Plan" development of tobacco, aviation, and new energy, and penetrate the entire industry through head companies. Zhang Fan expects the company to achieve a net profit of 1.01/1.29/169 million yuan in net profit from 2022-2024, a year-on-year increase of 26%/27%/31%.

Turnive reduction and efficiency stimulate the demand for intelligent storage, domestic manufacturers are expected to enjoy the industry's high β

In recent years, the logistics and warehouse industry has continued to prosper. In the context of the double increase of labor costs and land costs, the effective way to reduce logistics costs is intelligent warehousing.

The essence of intelligent warehousing is to reduce costs and increase efficiency, which not only saves about 80%of labor costs, but also saves more than 70%of the land through a three -dimensional warehousing model. At present, my country's warehousing logistics automation system industry is in the stage of integrated automation to intelligent automation.

The current industry -driven factors include: the efficiency of the existing logistics system needs to be improved, the labor cost and land cost of the demographic dividend are increasing, and the overall solution capacity of domestic manufacturers is an inevitable trend.

According to the statistics of the Toutao Research Institute, the size of my country's intelligent warehousing market in 2021 is 114.6 billion yuan, and the size of my country's intelligent warehousing market is expected to reach 266.5 billion yuan in 2026.

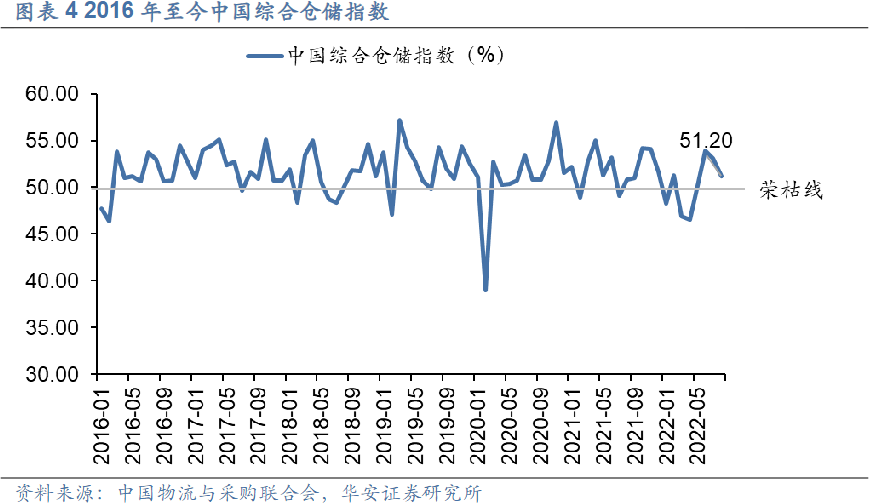

In August 2022, the Chinese warehousing index was 51.2%, a decrease of 1.9%from July, but it was still higher than the same period last year (50.8%) and the average level (50.0%) in the first 7 months.

From the perspective of the competitive pattern, the size of domestic industry manufacturers is small, and the downstream deep cultivation fields are different. The absolute leading leader has not formed. Therefore, domestic manufacturers are expected to benefit from the accelerated expansion of the industry's high β effects.

The entire process of business coverage of the industrial chain, the three major support points are expected to leverage the high -quality development of future performance

The company has focused on the automation system in the field of warehousing and logistics for many years, and has formed a business system covering the "front, middle and back" period of the industrial chain.

In the first half of 2022, the company's revenue reached 430 million yuan, an increase of 131%, mainly due to the continued growth of downstream customers' orders; net profit of home mother reached 31 million yuan, an increase of 88%year -on -year.

The company attaches great importance to the strength of R & D and establishes the Lanjian Research Institute to set up a segment research and development department. The company's executives are the leaders of the research institute. In the first half of 2022, the company's R & D investment continued to rise, reaching 41 million yuan, a year -on -year increase of 57%.

The company's future growth highlight lies in the continuous extension of the upstream of the value chain (planning integration design, software development, etc.) and the downstream of the value chain (after -sales service, brand building, etc.), the company's profit margin is expected to gradually rise:

① Digital twin+intelligent algorithm accumulation. The company currently has more than 40 core technologies of independent research and development, and has been applied to the company's main system -level products, including tray -level dense storage allocation systems, ingredient box -level dense storage allocation systems, tray and material box composite systems;

② The super factory has been put into production one after another, greatly broadening production capacity boundaries. The company's super -future factories will be put into use in 2022. After all the projects are expected to be put into production, it can support the scale of 2 billion yuan in order, which will be turned over compared with the current production capacity.

③ The product focuses on the high -end market, and the number of business orders has reached a record high. The tobacco industry company has created a number of benchmark projects such as Weifang tobacco; the company in the field of e -commerce first developed three squirrels, which further expanded multi -header companies such as Vipshop and JD.com. It has maintained good cooperation and expanded the overseas Japanese Procter & Gamble market through the domestic market.

The national key support industries such as agriculture and animal husbandry, aerospace and other countries have cooperated with well -known leaders such as Ningde Times and Muyuan shares.

As of the end of 2021, the company's handling orders reached 984 million yuan, and the total number of new sales orders also hit a record high. In the first half of 2022, the new order amount reached 631 million yuan. Among them, the aerospace industry orders made major breakthroughs, with an order value of 154 million yuan. Recent high -end manufacturing series in this column:

On September 19th, "The domestic machine tool industry welcomes ETF fund support, this" scarce leader "has achieved the core parts of the high -end CNC systems, or the opening of large -scale localization replacement, competing for the domestic 100 billion -level parent machine market" September 18 " The new VR new product will be released next week or catalyzed a new round of product cycle. This technology can reduce the device's thickness by 50%to become the first choice of new products of major manufacturers. This company is Oculus and Apple MR core suppliers. On the 18th, the "dark horse" growth stocks in the unpopular industry, downstream covering folding screens, drones, automobiles, medical devices, etc., the main business depends on the increase in capacity and utilization of capacity+the second growth curve gradually formed. Space on September 16 "The main supplier of the domestic security chip+car regulatory MCU chip" black horse ". The new generation of this company has won over 2 million orders. Analysts expect their performance to increase 5 times this year and next year. 60%valuation repair space "

- END -

JD.com and Tencent's strategic cooperation continues WeChat to provide Jingdong with first and secondary entrances

Economic Observation Network reporter Zhou Yingmei on June 29, JD.com announced a ...

This person is known as Holmes in the mountains

Wen | Jing HuaiqiaoChina Science News reporter Li YunIt is definitely a very intere...