DJI Movement Camera and GOPRO confront each other, and the starting market is still lower than the evening market.

Author:Blue Whale Finance Time:2022.09.23

Picture source: Oriental IC

Recently, DJI innovation released the new generation of sports camera OSMO Action 3. It is worth noting that the American sports camera brand GoPro also released a new Hero11 Black at the same time.

DJI, as a consumer drone giant, was foreseen the ceiling in the field as early as 2016. In recent years, the size of the scale of consumer drones has continued to decline, and the growth rate of DJI's revenue has declined before 2017. In this case, DJI urgently needs to develop new business and products.

In recent years, DJI has successively launched new products such as sports cameras, vehicles, industrial drones. However, DJI does not have the first advantage in these fields. At this stage, its market share cannot be resisted with giants in various fields.

The field of enrollment is relatively late, and the market share is far less than that of industry giants

Before the above two cameras were released, there were media revealed that the release time of the new product of DJI and GOPRO may collide. Earlier, Huawei Mate 50 and Apple iPhone 14 series mobile phones have also been exposed to release time or hedging, but in the end they were released.

Judging from the content released by GoPro on the official website, its new product release time has been determined as early as August 31, but the OSMO Action 3 in DJI was announced on September 6.

DJI has a relatively rich technical accumulation in the field of intelligent imaging. The layout movement camera field is not a cross -border, but in this field, DJI started a little later. It was not until 2019 that DJI launched OSMO Action Sports Camera for outdoor sports and video shooting enthusiasts.

In contrast, the GOPRO, which released sports cameras at the same time as DJI, was founded in 2004. It is the pioneer of the sports camera. It was listed in Nasdaq in the United States in 2014. According to Frost & Sullivan's data, the shipments of global cameras in 2019 were 20.3 million units. GOPRO's 2019 sports camera sales were 4.26 million units, which estimated that its global sports camera market share was 20.99%.

In the prospectus of Yingshi Innovation, Gopro is evaluated: At present, the leaders of the sports camera market are GOPRO in the United States. As an old sports camera manufacturer, Gopro has stabilized its sales. In addition to GOPRO, other major manufacturers and brands of sports cameras include Yi Tech, SJCAM, etc. The overall market is relatively scattered, and DJI has not mentioned in major manufacturers.

It can be seen that DJI chooses and releases sports cameras at the same time as GOPRO, highlighting its courage to confront the giant.

Qyresearch survey shows that the size of the global camera market in 2021 was about 13.2 billion yuan, and it is expected to reach 201 million yuan in 2028. The annual compound growth rate of 6.1%during the 2022-2028 period was 6.1%. In the next few years, the industry has great uncertainty. The main producers of the global sports camera market include GoPro, Sony, SJCAM and other companies. The top three companies account for about 60%of the world's market share. North America and Europe are the main markets, accounting for about 65%of the global market.

In the panoramic camera market, the market share of DJI is also far away from Yingshi Innovation, Japanese Ricoh, and GOPRO. According to Greenlight Insights data, the top three global panoramic camera market share in 2020 are Shogoshiko Innovation, Japanese Ricoh, and GOPRO, respectively. The market share is 35%, 28%, and 23%, respectively. And DJI is still in the "other".

Many people in the industry told reporters that although DJI's technology has been affirmed by many domestic users, its hardware products have a certain user base in the domestic market, but in the European and American markets, it is necessary to fight against the old sports cameras and panoramic cameras. A certain time.

The consumer -level drone market is topped, and the industrial -grade drone will continue to live

UAV can be divided into two categories: military drones and civilian drones. Among them, civil drones are generally divided into consumer -level drones and industrial -grade drones. DJI is the largest consumer -level drone manufacturer in the world. According to data from the Foresight Industry Research Institute, as of the third quarter of 2020, DJI products accounted for 80%of the world's market share, and domestic in China also exceeded 70%.

Previously, the sales of DJI consumer drones accounted for more than 80%. According to data from the Foresight Industry Research Institute, the sales of consumer drones in DJI in 2016 accounted for 80%of the sales of the year, and the industrial drone accounted for 20%; in 2017, its consumer drone sales accounted for further proportion Raise to 85%.

However, the consumer -grade drone that once used DJI products has begun to fall into a period of weak growth in recent years. The growth rate of industrial drones is expected to exceed the consumer drone and gradually become the main part of the civil drone market. According to FROST & SULLIVAN forecast, with the continuous expansion of application scenarios, industrial drones will achieve rapid development, and it is estimated that by 2021, the size of the Chinese industrial drone market will exceed the consumer -level drone for the first time, becoming a civilian drone segment The main market.

By 2024, my country's industrial drone market size will increase to 150.785 billion yuan, accounting for the proportion of the Chinese civilian drone market in 2015 to about 73%, and the average annual compound growth rate from 2015-2024 reached a reaching growth rate of reaching a compound growth rate from 2015-2024. 54.52%. Screenshot of AVIC UAV prospectus

Wang Tao, the founder of DJI, also said as early as 2016 that the drone market is about to be close to saturation, and DJI's revenue reaches 20 billion yuan.

According to the data of the "2018-2023 China Drone Industry Market Demand Planning and Investment Strategic Planning Analysis Report", from 2013 to 2017, DJI sales continued to increase, from 820 million yuan to 17.57 billion yuan, The annual growth rate is nearly 300%; the sales growth rate of DJI in 2015-2017 has slowed down significantly.

At this time, DJI urgently needs to find the second growth point outside the consumer -level drone. In the same year, DJI began to deploy industrial -grade drones. With the continuous expansion of the application scenario of industrial drones, it is currently mainly concentrated in the fields of emergency industries, surveying and mapping and geographical information, agricultural and forestry plant protection, security monitoring and other fields. In 2017, DJI released the plant protection drone, and then launched a number of industrial -grade drone products.

However, according to people familiar with the matter, compared with industrial -grade drones, DJI consumer drone sales are still relatively large.

It is worth noting that the growth rate of the civil drone market has continued to slow. In this regard, many people in the industry told reporters that behind this, on the one hand, under the influence of the factors of consumer drones, it is difficult to maintain the market renewal and growth rate like smartphones such as smartphones; In terms of consumer -level drones, although the application prospects for industrial drones are considerable, their development and operations have higher requirements for enterprises, services, technology and other aspects. Talent gap.

Diverse layout but not "multi -faceted flowering"

Founded in DJI in 2006, it has rushed all the way since the drone market ushered in the outbreak in 2013. The information of Tianyancha shows that since its establishment, DJI has obtained a total of 8 rounds of financing, and in 2013, it received tens of millions of dollars in Series A financing of Sequoia China. In 2015, it has obtained four rounds of financing from multiple investors. Shan China followed in round B's financing.

However, for nearly four and a half years after receiving a strategic financing of $ 1 billion in April 2018, DJI's innovation has not disclosed financing progress. As for its performance and listing plan, DJI has never disclosed it. Only investors' concerns about their performance growth and listing are far away.

In recent years, in order to cope with the slowdown of the growth rate of the consumer drone market, DJI has begun to have a diversified layout. In addition to adding industrial drones, DJI also launched smart hardware and shooting accessories such as sports cameras, and launched related products in smart driving.

Driven by multi -dimensional factors such as policy and social needs, the service demand for autonomous driving continues to increase. IIMEDIA Research (Ai Media Consultation) data shows that in 2021, the market size of the driverless industry reached 9.37 billion yuan, and the market size of the unmanned industry in 2022 will reach 10.04 billion yuan.

At that time, for the field of intelligent driving in DJI, Cui Dongshu, Secretary -General of the Federation of Federation, analyzed the Blue Whale TMT reporter that one was because the drone market slowed down; the other was that smart driving was currently a wind port; Third, DJI has certain technical accumulation in autonomous driving and control.

At present, the smart driving system in DJI has landed. On September 15, SAIC -GM Wuling held a new car conference in Hangzhou and officially released 2023 Kiwi EVs. Among them, the version of the DJI Lottery Intelligent Driving System is priced at 102,800 yuan.

Although DJI's products have landed in intelligent driving, the industry generally believes that unmanned driving is a technical fund -intensive track, with high technical thresholds and very "burning money". Not only are heavyweights such as Baidu, Huawei, and Xiaoma Zhixing's deep layout, but also the participation of innovative enterprises, and competition can be described as fierce.

Earlier, the car analyst Ren Wanfa had analyzed reporters that DJI's strategy can avoid the field of vehicle manufacturing that is not good at and avoid heavy asset investment, but the key is to depend on how much core technology can be opened to car companies to convince the car company to convince the car company to convince the car company to convince The cooperation of car companies depends on how willing to cooperate in car companies.

It can be said that in new areas except drones, DJI has not yet appeared in a track to match its main products.

According to the Fortune 500 non -state -owned enterprises listed in the past three years listed in "Hurun China Fortune 500", DJI's valuation of 100 billion yuan for three consecutive years is 100 billion yuan. Although the valuation has not changed, the ranking has been declining. The 63rd place dropped to the 100th place in 2020, and in 2021, the top 100 fell to 143. The latest release of "2022 · Hurun Global Unicorn List" shows that DJI is valued at 120 billion yuan.

Where is the new business growth point of DJI with a market valuation of 120 billion yuan?

- END -

After a lapse of 7 months, Maoming reproduced wild Chinese pangolins!Poke video →

7 monthsMaoming reproduces the national first -level protection wildlife--pangolin...

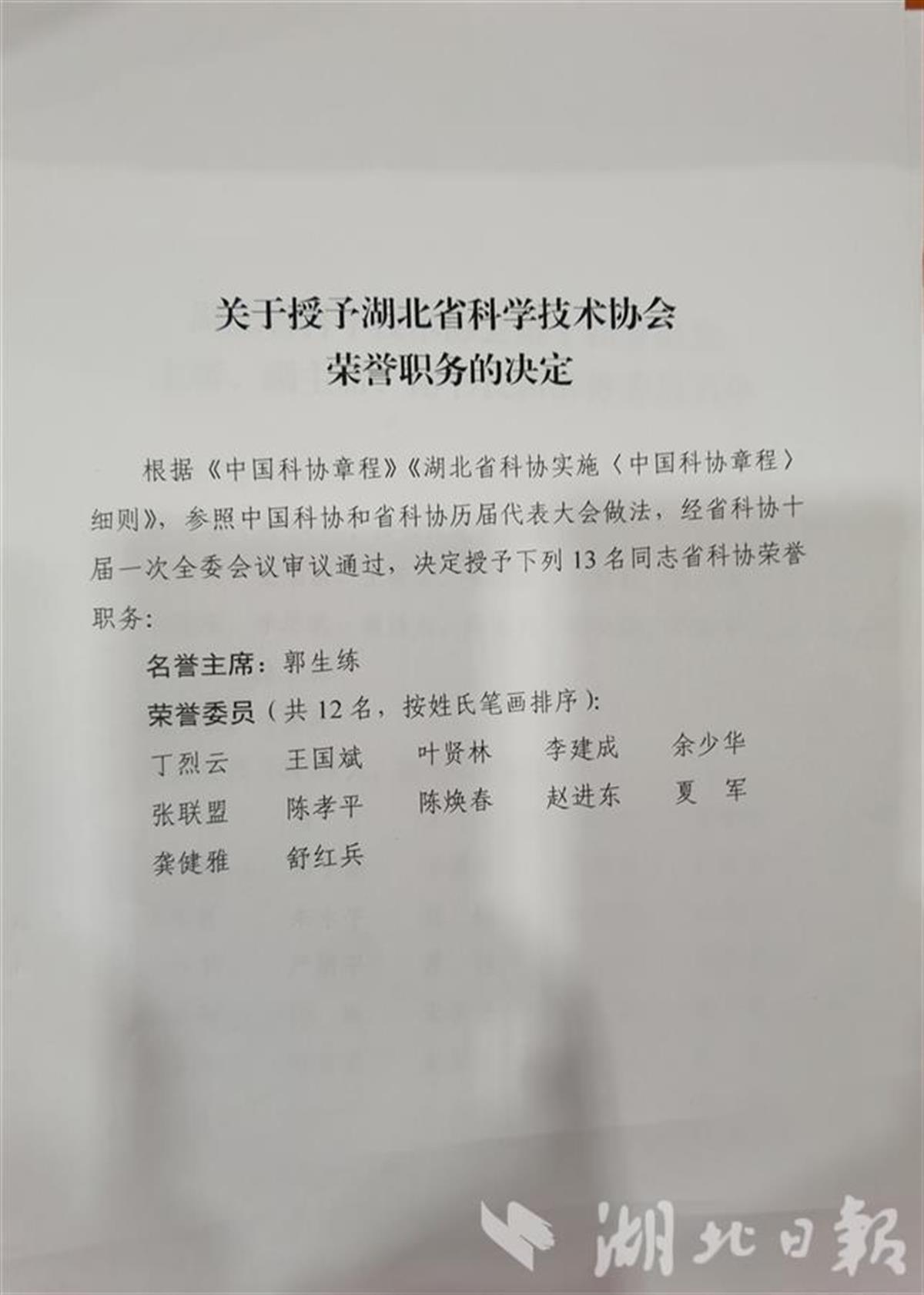

The list of the new committee of the Hubei Provincial Association for Science and Technology is released!Dou Xiankang was elected chairman of the 10th Committee of the Provincial Science and Technology Association

Jimu Journalist Li BansongOn August 31, the Tenth Congress of the Hubei Provincial...