The demand for bidding for high power components has increased greatly!150 billion global components leading 6 billion investment construction related projects, but major shareholders reduced their holdings at a high level

Author:Federation Time:2022.09.25

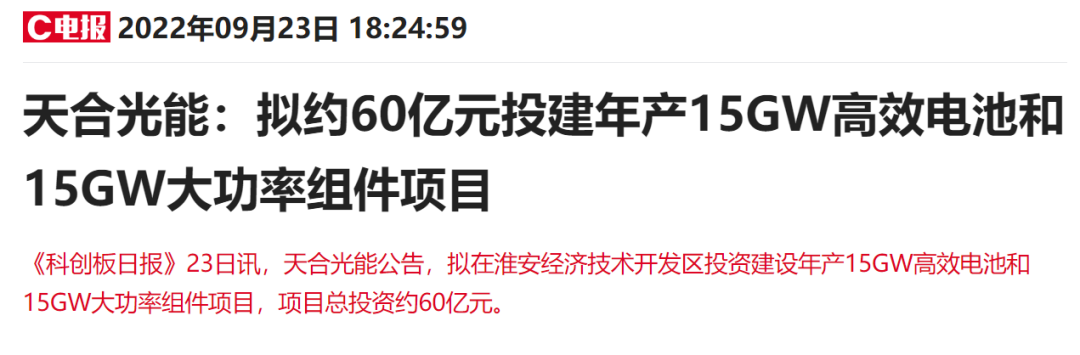

Tiantuang Energy, with a total market value of close to 150 billion yuan, announced on Friday after the announcement. It is intended to invest in the construction of a 15GW high -efficiency battery and 15GW high -power component project in the Huai'an Economic and Technological Development Zone. The total investment of the project is about 6 billion yuan.

The announcement shows that the plan is implemented in two phases, including the first phase of the 5GW battery+10GW component, and the second phase of the 10GW battery+5GW component. The signing of an investment agreement will help the company use Huai'an's local policy and industrial supporting advantages to further strengthen the company's leading advantages in high -efficiency battery and high -power components and enhance profitability.

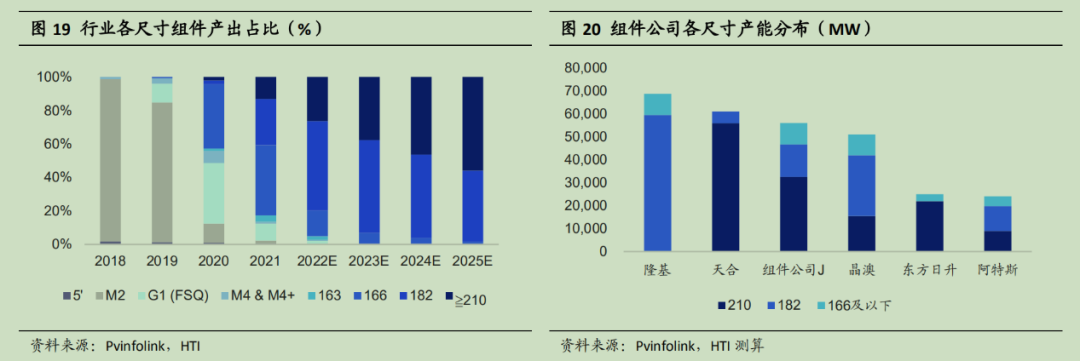

In the research report released by East Asia Qianhai Securities Analyst Duan Xiaohu, according to the research report released on August 17, according to photovoltaic information statistics, the proportion of bidding demand for 2022H1 high -power components accounted for 94.81%, an increase of about 21PCT from 2021. The demand for 540W+components accounts for 87.0%, becoming the mainstream demand of the terminal. In terms of 600W+components, it is a new choice for oversized ground power stations, and the market share has gradually increased. It is expected that with the large number of concentrated power stations in 2022H2, the market share of high -power components will be further increased.

In addition, under the main melody of the industry that reduces cost and increase efficiency, large -sized+N -type batteries+high power have become mainstream components. Large -sized component products can dilute the non -silicon costs of components and BOS costs, and improve the economy of photovoltaic power generation. According to the calculation of Central Co., Ltd., in the case of battery films the same efficiency and component arrangement is 72 half -sheet models, 210mm components can save 0.105 yuan/W in cost compared with 166mm components, a year -on -year decrease of 14.46%, and efficiency can increase 0.6 0.6 %about.

Tianheguang can be in the field of 210 size. In 2021, the company's 210 component shipments reached 16GW, leading the world. In 22 years, the company's 210 component market share reached 50%. As of Q3 of 2022, the capacity of Tianhe 210 large -sized module will exceed 50GW, ranking first in the industry. According to Pvinfolink's forecast, the penetration rate of 210 components in 2021 was 13.3%, and in 2022/2023, it is expected to increase to 26.4%/37.7%, respectively, and by 2025, products are expected to occupy half of the industry.

Tiansheng Energy is the earliest number of companies in the industry to lay out N-type TOPCON technology. As early as January 2020, the N-type I-TOPCON component was launched and large-scale mass production was achieved. The company's N -type ITOPCON battery technology mass production line experimental battery average battery efficiency reached 24.7%, up to 25%. The company's Suqian 8GWTOPCON battery project was launched in April 2022, and it is expected to gradually be put into production in the second half of the year. The Vertex Extreme N product power launched in August is as high as 690W+, leading the industry.

Public information shows that Tianghe Light Energy is the leader of photovoltaic components. The business layout includes the three major sections of photovoltaic batteries and components, photovoltaic systems and smart energy, and overseas revenue accounts for 61%. As of April 2022, the company's components had a cumulative shipment of 100GW, and the shipments in 2021 were 24.8GW, ranking second in the world. In 22 years of H1, the company's component market share reached 15%, and the annual component shipment target was 43GW, an increase of 73%year -on -year. By the end of 2022, the company's planned battery/component production capacity will reach 50/65GW, respectively, and 210/210R production capacity will account for more than 90%.

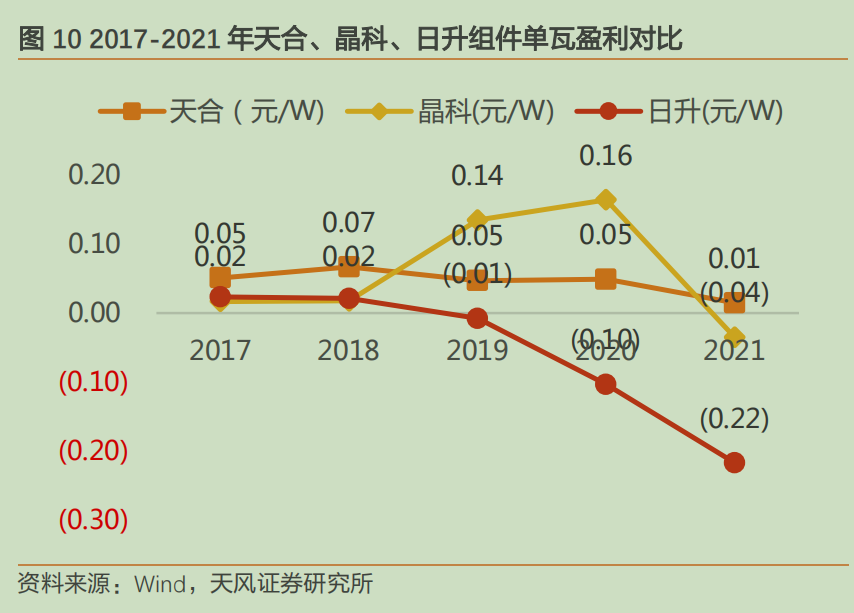

Tianfeng Securities analyst Sun Xiaoya pointed out in the research report released on August 2 that in 2021, the company's component business single -wal cost was 1.62 yuan/W, which was 0.11 yuan/W and 0.23 yuan lower than that of Crystal Energy and Oriental Energy. /W. The proportion of large -sized shipments has increased, the proportion of batteries increases, and the cost of diluting production has enabled the company to perform a strong profitability when the price of raw materials rises sharply.

In addition, under the current demand for distributed photovoltaic installations at home and abroad, the company's 210R component products are tailored, which can increase the power of 20-30W components, and the investment cost is lower, the shape is more beautiful, the premium is higher, it is expected to further further further. Open overseas high -end distributed photovoltaic market.

Tianheguang Energy issued an announcement in June that it is necessary to establish an integrated production capacity from silicon, silicon wafers, battery pieces to components in Xining, including 300,000 tons of industrial silicon, annual output of 150,000 tons of high -pure silicon, annual annual, and annual production. 35GW single crystal silicon, annual output 10GW section, annual output of 10GW battery, annual output of 10GW component, and 15GW component auxiliary material production line. This new production capacity layout is a new generation of N -type technology routes, and based on 210/210R products. The project is the company's first direct investment in the upstream polysilicon. After the project is completed, the company will enter the ranks of complete integrated enterprises from the "component+battery" layout.

In addition to components and battery business, the Tianhe Optical Energy System Products (brackets, distributed systems) have also increased. In the first half of 2022, the company's system products realized operating income of 5.362 billion yuan, an increase of 209.64%year -on -year. Among them, the company's photovoltaic bracket shipments are nearly 2GW, and the distributed photovoltaic system shipments exceed 2.2GW. The tracking support series products have obtained standard certifications for the issuance of renewable energy certification machines in Europe.

According to profit forecasts and valuations, Zhang Lei and other people from Zhejiang Business Securities and other people in the research report on September 10 commented. The company's strategic layout is integrated production capacity. It is expected that the net profit of the mother is 36.26, 64.09, and 8.026 billion yuan (3589, 49.45, and 6.06 billion yuan before the increase, respectively, and the company's net profit in 2022 increased by 100.96%year -on -year. However, in 2021, the sales revenue of Tianhe components was 34.4 billion yuan, accounting for only 77.3%of the revenue. Compared with Longji, Jing'ao, and Jingke, it accounted for relatively low. Some insiders said, "Tianghe is a company with a diversified layout, but in turn, this leads to limited organizational capabilities and business effects cannot meet expectations."

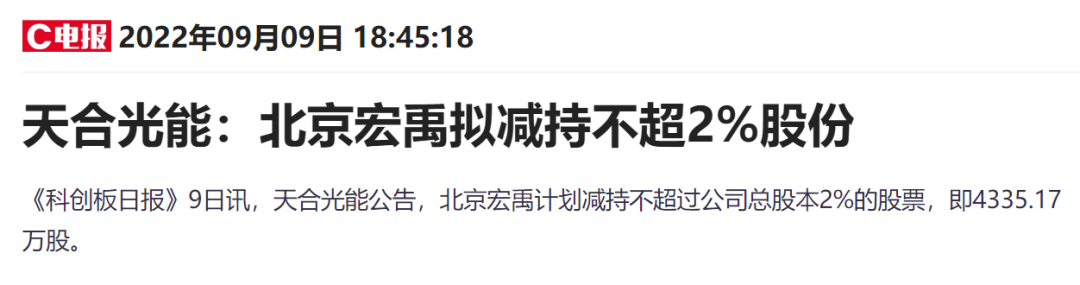

A few days ago, the company disclosed the announcement of shareholders' holdings, and Beijing Hongyu, the second largest shareholder, intends to reduce its holdings of not over 2%of the company's shares.

Click "watching

"Stocks make a lot of money

- END -

Tencent invested in Guangzhou Semiconductor

Financial Association News on August 10th, recently, the Guangbo Guide System Prov...

NWU2022 Grade Meng New Big Data is here!Men and women ratio 1: 1.13

The cute new people who have not completed the online predictionPlease follow the ...