Where is the next place to go to the sea?

Author:Everyone is a product manager Time:2022.09.27

With the top domestic traffic dividend and the difficulty of obtaining customers, Internet factories have gradually turned their attention overseas, and tried to find new incremental space in overseas markets. So in terms of the current situation, where is the place where the big factory is going to sea? What new opportunities are the current overseas market? The author of this article made a detailed interpretation and looked at it together.

To go to sea, it has changed from the "icing flower" from the large factory's financial report to an inevitable choice for the current reality.

The epidemic is repeated, the domestic Internet traffic is topped, the salary reduction and layoffs have frequently emerged. The large factory has already turned its attention to the new fertile soil full of infinite possibilities abroad.

Unconsciously, the road to the sea to the sea has reached the midfielder, and the overseas market has shown a completely different pattern.

Many large factories have followed the North American market with "big plates". On September 1, Temu, a cross -border e -commerce platform, chose to go online in North America, known as "American version of Pinduoduo". Earlier, in mid -June this year, the JD B2B platform "Jingdong Global Trade" was also officially opened, and the main market was also placed in Southeast Asia and North America.

Large factories on game tracks such as Tencent and Netease have aimed at the European market to be developed. At the beginning of September this year, Tencent became the shareholder of Ubisoft, a major French game manufacturer. Almost during the same period, Netease announced the acquisition of French game studio Quantic Dream, and NetEase Games has the first European studio.

In addition, Southeast Asia, Latin America, the Middle East, Africa and other seemingly marginal overseas markets have also increased by the attention and mentioned by domestic manufacturers. According to the "Entrepreneur 2022 Chinese Enterprise Ecological Development Report", 74%of going to sea companies have a business layout in Southeast Asia, 65%have deployed Europe, 62%have deployed North America. These three regions have become the "gathering positions" of Chinese companies going to sea. Among them, as a business and financial center in Southeast Asia, Singapore has become the primary destination for many companies to choose to go to sea.

China's Internet forces have expanded rapidly worldwide. Where is the next place where the big factory goes out of the sea?

This article will start from the latest overseas pattern of Southeast Asian models, the European and American battlefields, and Latin American new positions. The market will be combed one by one to explore the changes and futures of domestic Internet manufacturers.

1. Southeast Asian Mode: "Time Machine Theory" is endangered?

In mid -September this year, Zhang Mingfan (a pseudonym) engaged in business research in the sea made a special research on several Southeast Asian countries such as Singapore, Vietnam, Indonesia, the Philippines, and Thailand. She found that Southeast Asia is still a very hot market.

Especially in Singapore, which is highly developed in the Internet, a large number of Chinese people can be encountered on the street, and a large number of activities can also be exposed to many domestic companies in China. At the end of September this year, Singapore has the world's largest investor conference, and it has attracted many domestic entrepreneurs.

The organizers and business tourists attending various summits were crowded with the "garden city" in Southeast Asia.

During the meeting season in September this year, air tickets and hotels must be booked in advance, and business hotels with good conditions even rely on "grabbing". Many colleagues said that if the itinerary is full, the fare of the machine wine and the voucher of the conference will be more than 100,000. But most of the investors who came from thousands of miles still seemed interest and happy.

Another Southeast Asian city that made Zhang Mingfan feel "impressive" was Indonesia -even at 12 o'clock in the evening, the export of international flights at Indonesian airports was still overcrowded, and the G20 signs were placed in the halls. More than half of the people wearing masks are young people, and smartphones and the Internet have also developed rapidly.

"Before landing in Indonesia, you can see the urban lights on the ground from the plane portholes. The prosperity is visible to the naked eye." Zhang Mingfan told Xia Guang Society.

At the same time, the excessive gathering of "retirees" and business people also means that the Southeast Asian market has been quickly "ripened" in the replication of domestic manufacturers and entrepreneurs in the country.

"Southeast Asia immediately becomes a mature market, and there is no chance to go to the sea." Zhang Mingfan said, "Southeast Asia, which is more feasible in the future, is more likely to bias a model that combines the combination of 'Internet+Industry". "

The "time machine" theory of Sun Zhengyi, who was once regarded as the "ultimate logic of going out of the sea", replicated the developed Internet experience in China to the market that has not been developed in Southeast Asia, and achieved dimension reduction strikes like time shuttle. However, the so -called "time machine" theory is slowly losing its huge magic under the rapid changes in the Southeast Asian market.

In the past, many large manufacturers selected Southeast Asia in the first stop of the big factories. On the one hand, they considers the geographical advantages and familiar cultural contexts. Therefore, the domestic limelight tracks such as e -commerce, games, and long -term videos were all moved to Southeast Asia. On the other hand, it is also because the cost of Southeast Asia in the sea is relatively low, and the acquisition of blood is good.

Six years ago, Ali hit Lazada, which was over $ 2 billion, trying to copy the "Taobao model" to the Southeast Asian market. In the early days, Lazada had faced a period of helplessness because of the mutation of corporate cultural guidance, and even caused a group of native executives such as co -founder Charles Debonneuil and the chief market officer Tristan de Bellay.

This also made Shopee, which has Tencent's genes behind Tencent, once rose against the trend. Lazada led by Ali in the Southeast Asian market, in the TMO Group's 2021 report, ranked first. It's almost one. However, on September 19th, according to the interface news report, Shopee announced the "team adjustment" and plans to reduce some positions at the full conference.

In fact, since the end of August this year, "people are in Singapore, just got off the plane, took their wives with dogs, and unemployed on the spot." With the closure of many international sites such as SHOPEE France, India, Spain, etc. since this year, SHOPEEFOOD and ShopeePay teams in Southeast Asia are also "optimized".

Not only did he lose the "shrimp factory" overseas work, the little brother was lamented by netizens as "real", and a series of non -decent contraction moves also hit the Southeast Asian e -commerce giant Shopee.

But what cannot be ignored is that both Lazada and Shopee, GMV is growing. Xu Hong, the chief financial officer of Alibaba Group, said that GMV promoted Lazada's income to grow, and its competitors Shopee's financial report shows that the GMV in the first half of this year reached 36.4 billion US dollars. $ 80 billion.

Although the two major Southeast Asian e -commerce companies have their own advantages and can also see the shadow of domestic Internet giants behind them, Ali has completely different influence on Lazada and Tencent on Shopee.

An insider of Shopee told Xiaguang Society that different from Ali's comprehensive control over Lazada, Tencent's Shopee was completely "self -current". "Tencent's operation and operation of Shopee has nothing to do with it. Tencent is just one of the investors of SHOPEE's parent company SEA. It is different from Lazada's acquisition of Ali." The insider of Shopee said.

The two giants are deep in "fighting", coupled with Ali's international e -commerce, Shein independent station, surrounded by local e -commerce companies in Southeast Asia, such as TOKOPEDIA and TIKI. "New Market".

Whether Lazada is keen to copy domestic "festivals" or Shopee habitually smashing money to buy traffic, it has long been assimilated by the local e -commerce environment of Southeast Asia. From the early snatching market, the self -built logistics has been improved to the current level of "refined operation".

In addition, another factors that make the Southeast Asian market more complicated is that there are many Southeast Asian countries. Although they are close to each other, the differences in the overseas market are very obvious. This is also displayed in the content of the large domestic video manufacturers.

In the past two years, domestic dramas have begun to "reverse output" in Southeast Asia.

At the beginning, around 2019, iQiyi launched an international version of Iqiyi, while Tencent launched the video streaming service WETV. The market landed in the early days was also the Philippines, Indonesia, Malaysia and other places in Southeast Asia. The success of "Chen Qingling" also made Tencent Wetv top the top of Thailand's Google Play entertainment list in March, starring Xiao Zhan and others have become superstars that swept Thailand.

However, over time, the demand for the specific national market in Southeast Asia has also begun to differentiate.

Today's Southeast Asian TV drama market is not as long as the era of dubbing subtitles can open up territory. So iQiyi and Tencent have begun to cooperate with local media brands to produce original episodes that are more in line with local audiences of various Southeast Asian countries.

For example, iQiyi has produced local original dramas such as "Saying Goodbye" and "Hello, Heart" in cooperation with the Philippines ABS-CBN, which uses local languages. At the same time, iQiyi also relied on the big IP of "Soul Ferry" to launch "Soul Ferry · Nanyang Legend" for the Southeast Asian market, and combined with Singapore as a background to enter a lot of local elements.

The most typical case of long video localization is the second quarter of this year, the popularity of "The Gang Master Fall in Love with Me" produced by iQiyi. The Thai drama has always relying on the dog blood plot to attract the attention of the audience. The plot of "The Master of the Gangs in Love with Me" just in line with the appetite of the local audience. Coupled with the popularity such as "The Seven Days 3" in love with me, Iqiyi attracted a large number of users and advertisers in the Thai and Malaysian markets.

"Master of the Gangsters Fall in Love with Me" adapts the local online novels of the same name

Similarly, the original Thai drama produced by Tencent WETV is "Love in 711" and "White Gear", or "The Mystery of the Dead", which is suspense on the surface, and the inside selling rot. Tencent has also reached a cooperation with Indonesia's film and television company MD PICTURES and Malaysia Media Prima to launch a local style and try to follow the people's popular routes online.

"Southeast Asia is a very fragmented market." A brand founder who engaged in the Internet industry in Southeast Asia told Xiaguang Society.

Although domestic entrepreneurs are accustomed to collectively referring to the market of this region as "Southeast Asia", in the eyes of the founders of the above brand, "it is difficult to copy domestic experience directly to Southeast Asia, and each country must seriously be the local market. "Singapore, Vietnam, Indonesia, and Malays' maturity and the depth of Internet penetration are completely different. There is a significant difference in language, culture, religion, and even the behavior and thinking of users in each country. This has undoubtedly made the so -called simple model replication model in Southeast Asia fail.

Second, European and American big battlefields: plates do not mean to eat fragrant

Different from the early days of e -commerce in large manufacturers to test water in the marginal markets such as Southeast Asia, the leap of Pinduoduo TEMU jumped to the North American market in the "center of the pool".

In fact, in addition to the large factories in the field of social operations, the Tiktok really played a bustling world in Europe and the United States, and took this opportunity to start piloting live broadcast and cargo. Entering the European and American e -commerce markets. Other domestic Internet companies do not have this in developed countries in Europe and the United States. Audit flow pool.

The European and American Battlefield Pond is large in water. The possibility of Tiktok Shop and byte beating TIKTOK Shop are very unlikely that they are not easy to "save power".

At the end of 2021, TIKTOK began to pilot the goods in the UK and launched an event called "On Trend". At that time, the British pilot carried the hopes of byte beating for the European and American e -commerce market. Byte beating believes that the British pilot is just the beginning. When the business expands to European countries such as Germany and France, it will inevitably form a trend of Liaoyuan to spread to the North American market.

However, the reality is cruel, and Tiktok's live broadcast business in the UK failed to achieve the expected results. The "On Trend" activity has not attracted many users to place orders, and even the platform's cargo anchor has basically withdrawn. This time, the halberd can also be simply attributed to the relief of the soil and water, but the reasons for cultural, shopping habits, and early anchor reserves behind them must not be ignored.

On the one hand, the high -cost performance of high -cost performance in the "low price of the entire network", shopping vouchers, and large discounts in China has been tested in the European market. Local consumers cannot obtain a good shopping experience from the quality of product quality in the live broadcast room.

On the other hand, in the process of localization, it is inevitable to encounter local employee management problems, and it has also become the boss of the Tiktok overseas team. Tiktok, especially Tiktok Shop, brought the domestic "996" workplace culture into the United Kingdom, triggering unexpected conflicts.

On June 9 this year, according to the "Financial Times", the Chinese management team of Douyin International Tiktok, the conflict with local employees in London, triggers the "British Tiktok wave". The fuse of the "wave of departure" throughout the game was due to Tiktok European e -commerce head Joshua MA mentioned at a meeting that "as a capitalist, not thinking that enterprises should provide maternity leave", which caused dissatisfaction with local British employees.

Tiktok London employees said they were often asked to work for more than 12 hours a day, so they conflicted with the company. More than 20 people chose to leave around June alone. Internal management is out of control, the sales market is chaotic, and Tiktok, who is far away from the countryside, has not found e -commerce business models that are truly suitable for European and American countries.

However, Tiktok Shop initially had two major markets for testing water. Although it was "lying flat" in the UK, Indonesia in Southeast Asia responded well. Data show that in the first half of 2022, TIKTOK e -commerce Indonesia's monthly average GMV had broken $ 200 million, which was almost ten times that of the United Kingdom. This also confirms that the domestic manufacturers have matured rapidly in the Southeast Asian market, and in the European and American markets are still exploring.

However, Tiktok's folding halberd in the UK does not mean that there are no soils where e -commerce has gone to sea in developed markets in Europe and the United States. Pinduoduo's ambition to "end the end as the starting point" in North America proves that it must be a must -see for the big Internet manufacturers in the United States and the United States. Fight.

On September 1, Pinduoduo's TEMU website and APP launched in the United States.

When introducing the cross -border e -commerce platform TEMU, Pinduoduo is described that it aims to create a full category shopping platform and use the advantages of Pinduoduo supply chain to help the supply chain multi -dimensional reduction cost to provide rich and diverse products. According to rumors, TEMU has also dug a lot of core talents from the SHEIN team that has successfully verified in the North American market with a salary of 2-3 times the salary of 2-3 times to form its own overseas business team.

As far as the business model is concerned, TEMU's start in the North American market is not a simple copy of the domestic model.

Although TEMU has previously issued a great efforts to China sellers, such as full category and 0 yuan to settle in. However, some cross -border e -commerce sellers revealed that in fact, after the merchant's autonomous on -shelf goods were launched in the early stage, they need to pass the platform's goods review. The goods facing overseas will be issued by Pinduoduo domestic warehouse. Pind a lot of hands.

Although many businesses have taken away the worries that the North American market operations and logistics are not familiar with, it is a way to simplify the process of going out to the sea, but for the concerns of traffic and the sale model, and whether it can ensure the profit margin, it makes it so that it can make the profit margin, so that it makes the concerns of profit margin, so that it makes the concerns of profit margins, so that it can make the profit margin, so that it makes the concerns of profit margins, so that it can make the profit margin, so that so that it can ensure the profit margin, so that it makes the concerns of profit margins, so that it can make the profit margin, so that so that it can ensure the profit margin, so that it can make the concerns of profit margins, so that it makes the concerns of profit margins, so that it can make the profit margin. People and many domestic sellers are still watching. Some people in the industry believe that although Temu has dug a lot of original Shein teams to start the initial startup, it is more like SHEIN's independent operating websites, and from the perspective of supply logic, TEMU is more like comprehensive e -commerce such as Amazon. But whether it is SHEIN, or Amazon, you can see that Pinduoduo is ambitious to fight in North America.

In addition to e -commerce platforms, Tencent and Netease's acquisition of local game studios have also made Europe a new battlefield for large manufacturers to go to sea.

Recently, Tencent purchased a French company Guillemot Brothers Limited with a consideration of about 300 million euros. As a family company of Ubisoft founder Guillemot, Guillemot Brothers Limited is the major shareholder of Ubisoft. Through this acquisition, Tencent's Ubisoft equity rose from 4.5%to 9.99%.

On the same day when Tencent announced its second largest shareholder of FROM Software, NetEase also announced that its game department has acquired French game developer QUANTIC DREAM. Compared with the deep cultivation and efforts in the Southeast Asian market, whether it is Tencent or NetEase, they all choose to "invest in money and ask", and entrust the hope of Kaijiang's territory on the acquisition and cooperation of European and American companies.

"Of course, the European and American markets are more mature and wider." Entrepreneurs who engaged in overseas warehouses in the North American market told Xiaguang Society that "Southeast Asia is good to go to North America. The North American plate is large enough and the consumption level is higher."

However, the plate does not mean that it is fragrant. To a certain extent, mature markets in Europe and the United States will only be "more rolled" as a place for large factories to go to sea.

Third, Latin America's new position: invisible big blue ocean

Latin America, which was "selectively ignored" by many large factories in the past, is now increasing.

In the eyes of many people who go to the sea, Latin America has replaced Southeast Asia a few years ago, becoming a new battlefield of the sea. Especially driven by many entrepreneurial retail investors, Brazil, Mexico, Argentina, Chile and other Latin American regions have become a new position in sea.

The most obvious reflection of this point is the e -commerce maritime track. Many e -commerce giants who have gone out of Southeast Asia to find the New World have begun to focus more and more in Latin America. Shein, Shopee, and Ali Sales are all the way from Asia to Brazil and Mexico in Latin America. Especially under the catalysis of the Latin American epidemic, the development of online e -commerce is like sitting on a rocket.

E -commerce entrepreneurs in the Latin American region told Xiaguang Society that many cross -border sellers chose Brazil as the first stop for e -commerce to go out of the United States Latin America. The basic market of Brazil's entrance is large. Although the development of the e -commerce market has not yet started, it has also left room for growth for small businesses and new platforms.

Faced with the vast Latin American market, the SHEIN, who once "conquered the young people in the United States", and the SHOPEE of "conquered the young people in Southeast Asia", have already started the Latin American market layout.

Shein has deployed the Brazilian market since 2019. According to the local media Neofed, SHEIN founder Xu Yangtian personally inspected the Brazilian market. While establishing a branch in the local area, he frequently contacted local clothing suppliers to try to deploy the local supply chain.

According to BTG Pactual estimates, SHEIN downloaded 23.8 million times in Brazil in 2021, which is the most downloaded fashion app, and sales also reached 2 billion Leiy (close to 400 million US dollars).

Shopee has also accelerated the footsteps in Latin America. Shopee also entered the Brazil market for the first time in 2019, but according to the local media Valor, SHOPEE opened 5 new distribution centers in Brazil in the first half of this year. These five distribution centers are located in Sao Joao (Sao Joao Do Meriti, Campinas, Ribeirao Preto, Contagem, and Santana Do Parnaiba.

Obviously, Shopee has turned to Latin America from the funds that exit from India and the European market. This is to improve the transportation process in the future and shorten the delivery time. On the other hand, whether it is the Brazilian market with a "blue ocean" or investing in logistics and distribution, it is not easy to confirm that it is not easy to really want to open the "Latin American new position".

Not long ago, according to news from Reuters on September 8, the e -commerce department of Donghai Group informed employees that they would close the local business of Chile, Colombia and Mexico, continue to retain cross -border business, and completely withdraw from the Argentina market. However, the SHOPEE Brazil market team is not affected, and the business will continue to operate.

Why did Shopee choose Brazil and let the local business in Chile, Colombia and Mexico?

In fact, compared to Brazil, Chile, Mexico, and Argentina, Latin American countries have a higher level of living, and there are also local e -commerce platforms occupying the territory. For example, Chile's Falabella and Cencosud and other local traditional retailers are increasing the investment and marketing of online platforms. The "Cyberday 2022" of Chilean e -commerce is a local e -commerce festival under the San Diego Chamber of Commerce (CSS). Like Internet giants familiar with domestic consumers, the Chilean e -commerce platform will also launch "the lowest preferential price of a hundred brands throughout the year". These products include men's, women's shoe hats, wallet carpets, etc., as well as large electrical appliances such as grilled racks, freezers, audio, and "special discounts" of PS5, iPhone 11 and iPhone 13 mobile phones.

Although the Latin American e -commerce market generally belongs to the state to be developed, in fact, Latin American e -commerce companies are not too late.

It is considered to be "the eighth largest e -commerce platform in the world" Latin American e -commerce platform Mercado Libre. It was founded as early as 1999. It was "awakened" earlier than Taobao, which was officially launched in China in 2003, earlier. Some. Mercadolibre is now able to cover 18 countries and regions such as Latin America, Bolivia, Brazil, Chile, Colombia, Costa Rica.

These platforms all support domestic sellers from overseas warehouses to ship, and they also have comprehensive payment and logistics facilities. The platforms receive the commissions received by sites such as Mexico, Brazil and other sites. Essence

Small merchants and sellers in China can choose to open a store on Mercado Libre, which also causes more obstacles to the e -commerce platform with large domestic manufacturers to go out of Haradier.

In addition to the field of e -commerce, Latin America is also the focus of the attention of social entertainment track players.

Although TIKTOK is an absolute leading advantage in the global market as a domestic short video APP in China, in the Latin American market, the current performance of Kuaishou is also very eye -catching. Brazil is considered to be the most mature market for fast -handed operations. After KWAI's "three -in -one" merger last year, Kuaishou's overseas strategy was transitioning to refined operations.

Since the third quarter of last year, Kuaishou launched the advertising release system "KWAI for Business" in Brazil and other places. First, he started trying to sell advertisements in Brazil and tried commercialization.

4. Where is the next place?

Although going to sea has become an inevitable choice under the new situation in the big factory, it has been counted, and the "dispute" for different business priments to go to sea almost falls into the world.

In addition to these major markets, the African and Middle East markets are also popular destinations to go to sea. The success of Chuanyin Holdings in the African mainland mobile phone market has long been a classic case of going to sea. According to GSMA 2021 data, African mobile phone users have reached 495 million, of which more than 200 million smartphone users have been. Even the local residents have several cheap mobile phones, which are used to use it to prevent power stopping. The foundation of the Internet has existed.

However, the current African track is still focused on infrastructure, electricity, manufacturing, and some financial products. The domestic Internet manufacturers' investment in the African market is also limited to the level of "Ali passed training, incubation Nigeria e -commerce platform". To do the Internet in the African market, it is also necessary to solve the problems of payment systems and logistics overseas warehouses to open up the local market. It is difficult for large manufacturers to intervene in a large scale in the short term.

In Southeast Asia, Europe, North America and other markets, the focus of domestic Internet factories in different regional markets is also very different.

If Southeast Asia is a must -have place for a large factory, it is just a heavy bomb. Compared with the "next stop" that coexist with potential and opportunities, Southeast Asia is actually more like a "last stop" for large plants to go to sea.

E -commerce, logistics, and payment platforms in many countries in Southeast Asia have long been penetrated by domestic Internet capital. In addition to the Lazada mentioned above, there are e -commerce platform TOKOPEDIA, logistics platform Flash Express, and payment platform TureMoney. Ali has Ali as the shadow of shareholders' investment acquisition.

Photo source: Flash Express

The head of the head factories has come to an end, and the competition for e -commerce giants has been heated. Even if the cultural representatives of the Chinese drama go out to the sea, under the promotion of domestic Internet companies such as iQiyi and Tencent, it has localized to a very "volume" level.

In the future, the focus of large factories in Southeast Asia may be due to the further penetration of the latest e -commerce model. For example, the localization of domestic live broadcast and cargo, the incubation and training of the local MCN in Southeast Asia, and even the highly developed countries such as Singapore to jump directly to the field of Web3 investment.

Unlike the high enthusiasm of the Southeast Asian market, the sphere of influence of domestic large manufacturers in Europe and the United States is very limited. North America's Internet manufacturers can almost do not exist. Even the newly entered "North American Pinduoduo" TEMU. In detail, the gameplay with Shein is completely two systems.

Although TIKTOK has a very good user and traffic foundation in North America, due to the refused to accept Tiktok Shop's soil and water in the British market, the opening of the North American market is still in maintenance and preparation.

From this point of view, the United States, as the world's second largest e -commerce market, in 2021 e -commerce sales is 870 billion US dollars (about 6 trillion yuan), while online sales penetration rate is only 19.2%. cake. The United Kingdom is the third largest e -commerce market after China and the United States. In 2021, 60%of consumers shopping online on e -commerce platforms. Local mainstream e -commerce platforms such as Amazon, Etsy, EBAY, FRUUGO, etc. Essence Although the market online consumption competition in the market in Europe and North America is huge, it is obviously a "place of contention" in large factories. This is why the first stop of Pinduoduo chose to enter North America, dig a corner SHEIN, and benchmark Amazon.

Whether Lazada and Shopee enter the deep water area in Southeast Asia, or choose a lot of "one step in place" to enter the North American market, Tencent and Netease acquired European game studios. overseas market. The Southeast Asia and Latin America markets that seem "golden everywhere" also hidden the risk of competition risks of international capital, local forces and other powerful opponents.

At the same time, Chinese brands are rapidly expanding globally. New overseas markets means the investment of real gold and silver. Naturally, it is not necessary to take a brief copy of "Chinese -style success".

Local deep cultivation and sewing for life, and fully investigating the local market and user habits is the most secure choice for most domestic large manufacturers to land in the new market.

Author: Guo Zhachuan; Editor: Song Han Guan 作

Source public account: Xiaguang Society (ID: globalinsights); see the new economy Xia Guangguang.

This article is authorized by everyone in the cooperation media of product managers @本 本 本. Reprinting is prohibited without permission.

The title map is from Unsplash, based on the CC0 protocol

The point of view of this article only represents the author himself, and everyone is the product manager platform that only provides information storage space services.

- END -

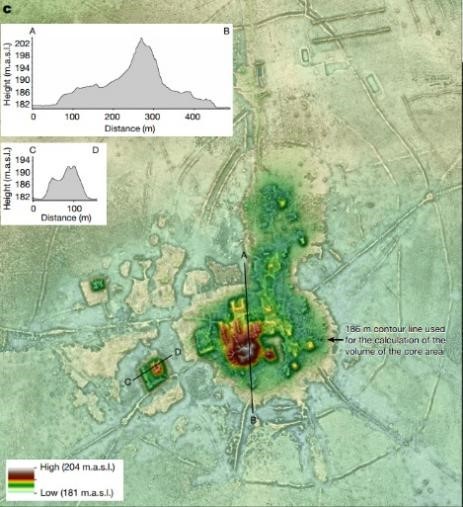

The strongest assistance of dense archeology -laser radar

Humans are small and stubborn on the earth. On this vast earth, how does our ances...

Ramen said that you can't sell anymore

Zhang Chen remembered that for the first time, he bought the ramen and said it was...