Thirty years of deep cultivation in the Chinese market, Microsoft brought innovation opportunities to the Chinese venture capital market

Author:36 氪 Time:2022.09.27

Do not use short -term returns, corporate strategic investment (CVC) to ensure long -term innovation of enterprises. This is also the thinking and timing of Microsoft's strategic incubator.

In China, the incubator had a wave of air. At that time, the Shuangchuang boom swept the country, and various "spaces" and "accelerators" were seen everywhere, but there were still a few who really understood the connotation of the incubator. Most of them were real estate business, which eventually became "second landlord".

However, the incubator is not a new thing. As early as 1959, the world's first incubator "Betivia Industrial Center" was born. Big help.

Time has come now. Facing the big change of a century: digital transformation, global web3.0 and Yuan universe wave, on September 26, at the "Microsoft China 30 -year Innovation and Future Summit", Zhang Siyuan, general manager of Microsoft Greater China Strategic Incubator announced Microsoft announced Microsoft The Microsoft China Strategic Incubator (CSI ") will be newly opened. CSI will be committed to becoming a catalyst in the field of science and technology entrepreneurship in China, bringing Microsoft's diversified high -quality resources to the ecology of the entire venture capital circle. Among them, it has become a resource platform that helps Chinese startups to radiate global. CSI mainly focuses on the six major areas -games/yuan universe, web3.0, corporate services, chips/communication, medical industry, and the automotive industry with promising startups to provide support to technology drive healthy and interconnected global Sex business growth.

It is reported that CSI will assist in the qualified incubation companies to obtain incubation resources such as technical support, entrepreneurial guidance, business recommendations, ecological connectivity, and PR from Microsoft, such as Microsoft Azure, Microsoft 365, Power Platform 365, etc. CSI also cooperates closely with Microsoft Asia -Pacific R & D Group, Microsoft (Asia) Internet Engineering Academy, and various business departments of Microsoft to help providing technical support, but also assisted entrepreneurs with Microsoft's global customers and partner ecosystems to help them win the market Marketing, sales and financing opportunities.

Thirty years of deep cultivation in China, Microsoft is a senior witness and companion of Chinese companies

In 1992, Microsoft settled in China and opened the first office in Beijing. At the same time, the Chinese equity market also sprouted and started at this time. In the next 30 years, Microsoft and Chinese companies have taken high -speed trains for China's economic and technological development. To face to face, a symbiotic relationship has been established with many local Chinese companies. Since 2014, Microsoft Azure, Microsoft Office 365, Microsoft Dynamics 365 and Power Platform, which are operated by Century Interconnect, have officially commercialized in the Chinese market, all of which have achieved localized operations. In March 2022, the overall service capabilities of the Microsoft smart cloud matrix facing the Chinese market doubled again, which also provided support for more companies at home and abroad.

At present, in the face of the opportunity of China's digital economy development, on the basis of providing technology, Microsoft mobilizes Microsoft's ability and China with China's industry, university -research capabilities to promote the implementation of the latest scientific research results with the cutting -edge exploration of basic research, engineering and product transformation capabilities, and promote the implementation of the latest scientific research results Application has quickly transformed scientific research innovation into a driving force for the digital economy. Including local enterprises including Carlsberg, GM, L'Oreal, Johnson & Johnson, and native companies including Xiaomi, Sanqi Games, Great Wall Motors, Junsheng Electronics, and Luoyang molybdenum, with the support of Microsoft Smart Cloud, the business transformation has been realized Upgrade, localized innovation and global business expansion.

While Microsoft helped mature companies transform and expand business, Microsoft also targeted the venture capital market. While serving the big customers, they do not forget to pay attention to innovative and entrepreneurial enterprises. In addition to making investment in person, they also set up incubators, which has inextricably linked to the venture capital circle. Because of the accumulation and precipitation of the past, this time CSI and China's well -known investment institutions, such as IDG Capital, Sequoia Capital, Gaoma Capital, Source Capital, Qiming Venture Capital, GGV, Gao Rong Capital, Qualcomm Venture Capital, etc. They have established close connections. These well -known institutions' Portfolio will be recommended to CSI for deep incubation. In Zhang Siyuan's view, startups are distinguished by state rather than scale. CSI supports entrepreneurial enterprises mainly through three levels: product power, brand power and industrial groups.

She believes that from 0 to 1 -the company moves users by products, which is the basis for startups. At this stage, startup companies need funds, in addition to technology and understanding of the market; from 1 to N -existing products, need to push the market. Brand influence is gradually becoming important. The company needs to let more people understand the company's business and obtain greater brand influence; from N to N or even higher, it is necessary to rely on the matrix play of industrial groups. At this stage, startup companies It has become a unit in the industrial group, and each entrepreneurial unit, in addition to the products that require 0 to 1, also increase the Group's strategic needs.

The reason why this observation is because Zhang Siyuan once had cross -industry and cross -institutional background experience in combat investment, foreign investment banks, foreign investment banks, foreign high -tech enterprises -before joining the CSI, he worked at Qualcomm's strategic investment department as the general manager of the project. It mainly focuses on high -tech fields such as AI, chip, IoT (full name: Internet of Things, the Internet of Things). He has participated in new economic and technological companies such as investors Tang Technology, Energy Artificial Intelligence, and Elephant Sounds.

As the American economist Moore said, in the organizational system that is centered on production products and services, companies to deal with the relationship between the industrial chain and find their own ecological position is to determine the "great" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "ordinary" and "normal" "One value judgment point. As an incubator, CSI's nuclear duties are to find their own positioning by helping the enterprise's ecological industry chain, docking customer resources for enterprises, obtaining customer feedback to help entrepreneurs move forward faster. For 30 years, the venture capital market with changes in the logic of fundraising management has ushered in new variables.

China's equity investment has begun to sprout in China in 1992, and has been developed and developed after landing and rooting. During the period, China's equity market fundraising and investment volume rose sharply. However, due to the influence of the internal and external economic situation, in the first half of 2022, China's private equity equity fundraising and investment amount increased. The logic of the fundraising of the entire market has also changed. Choose to open the CSI new CSI at this node, what kind of chess is Microsoft? Maybe you can find opportunities from changes in the equity market.

Data source: Qingke

As far as fundraising is concerned, the head effect is becoming more and more obvious, and there is a problem with the fundraising of the middle waist fund. With the return of the US dollar and the rise of the LP for the risk of avoidance, funds flow to the head institutions, the domestic equity market will face a wave of shuffling. For CVCs that rely on the industrial ecology like CSI, the mature industrial chain of the group and the ecology that have accumulated for many years have natural resource advantages, becoming the primary choice for the current enterprise.

Volumes of venture capital funds, the proportion of quantity (divided by scale), data source: Pitchbook

In terms of investment, it is more particular about ecological collaboration. The venture capital market is changing from model -driven entrepreneurship to technology -driven entrepreneurship. According to Qingke data, in the first half of 2022, the top three popular areas (IT, semiconductor and electronic equipment, biotechnology/medical health) of equity investment in the first half of 2022 were technology -driven. Compared with the innovation of the Internet era model, scientific and technological innovation rely more on the industry. Because CVC brings not only funds, but also the synergy effect of resources in the industrial chain. This is also consistent with CSI's investigation feedback on entrepreneurs/companies: 80%of entrepreneurs believe that the most urgent demand at this stage is to expand the market and lack customers and customers' feedback on products. In response to this pain point, on the basis of technical support, CSI focuses on investing in high -quality resources of Microsoft in different industries and global markets, helping more companies to quickly complete the development of "1 to N".

In addition, in terms of management, compared to pure financial investors, industrial investors know the industry better, and understand the financing rhythm, personnel needs and business better, and know when to expand and start financing. In addition, compared with the traditional VC investment, CVC's requirements for investing companies are developing new technologies, new products, and labor costs that can be used by the parent company. The fault tolerance mechanism is relatively good. Therefore, industrial investment, which does not take short -term returns, can actually maintain the long -term growth trend of enterprises. According to a FA, its advanced manufacturing project is the founder of CVC investors. Because in addition to funds, companies also need more than three aspects of empowerment: product verification scenarios, resource docking, management and business methods, and these are just the advantages of CVC incubators like CSI Essence

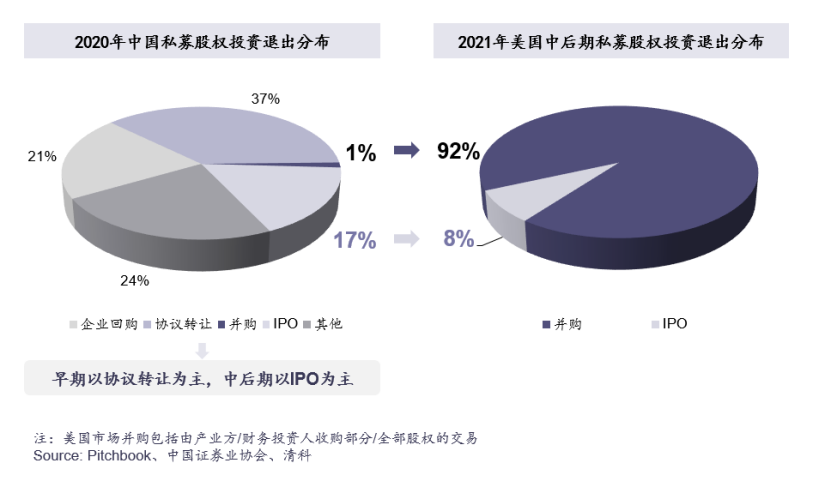

Finally, in the exit, the industry mergers and acquisitions may become one of the main ways to withdraw. Take the US withdrawal from the market as an example. Among them, the investment in the later period is mostly withdrawn from mergers and acquisitions. Among them, about six are the mergers and acquisitions of the industry. LP's requirements for DPI (Distribution Over Paid-in, Investment Capital Dividend) prompt GP to seek diversified exit channels, and mergers and acquisitions will become the mainstream exit method. In addition to mergers and acquisitions funds, large industrial investors have become one of the largest buyers because of their needs for industrial ecology. Sino -US exit method comparison

In this big background, Microsoft's significance of launching CSI is self -evident. As a global technology giant, Microsoft's accumulation of nearly half a century, coupled with its first layout of cloud computing, has brought a leading advantage to its global digital wave. On the one hand, as a gradual and perfect ecology, Microsoft CSI can provide startups not only technology, talents, but also market brands and strategic resources. On the other hand, Microsoft also needs CSI to make its business in Greater China and Microsoft Asia Pacific R & D Group and Microsoft (Asia) Internet Engineering Academy closer to support local scientific and technological companies in a targeted manner to inject global resources into Chinese technology startups. In terms of internal innovation, CSI is also the early layout of Microsoft's optimistic field, and it is also the main way to obtain human capital. In general, CSI hatching companies will bring catfish effects. In addition to the upstream and downstream industrial chain in advance, new vitality will also be injected into the ecological internal ecology of the Microsoft Group to ensure Microsoft's long -term innovation vitality.

In recent years, in the context of the penetration of the Internet and mobile Internet, the digital economy is becoming China's new economic growth momentum. As a digital transformation empower, how can Microsoft CSI empower entrepreneurial enterprises with the group's ecological advantages?

Stirring and changing, how can CSI empower Chinese start -ups

As mentioned earlier, 80%of entrepreneurs show that the most challenges are not no money. ⽽ is extremely lacking in market perception and product feedback. This is often more killed for 产品 产品 这 这 这 这 这 这 ⼒. Therefore, the starting point of CSI is cut in according to the most urgent pain points of startups. Specifically::

On the one hand, the source of the CSI project itself is more diversified. Not only does it include Xie, but also projects that have been brewed in the community, but also projects that have obtained financing. There are even entrepreneurial teams incubating within the group.

On the other hand, in the middle incubation link, CSI will start from the needs of startup companies such as technology, business, and brands to customize their crickets for each startup company. In addition to basic technology, cloud services, productivity and management software, CSI will also communicate with the founding team to collect the needs of startup companies. In addition to bridging the entrepreneurial team, it also shared the research results with the entrepreneurial team to build a possible business model in the future.

According to Qing Xuehui, general manager of Microsoft Greater China Strategic Cooperation, in the process of incubation of Xiang Yan, some rapid progress of Xiang will enter the stages, and CSI will lead Microsoft's more internal resources to start -up companies In the crickets, such as strategic partnerships, COSELL programs, etc. It is reported that, in addition to the docking of various departments within Microsoft, CSI will also introduce external investors, communities, etc., allowing more external resources to inject. "These resource investment is free of charge. We really hope that after the incubation of CSI, we will help the entrepreneurial team to enter the stages quickly."

Compared with simple financial investment, CSI provides enterprises with technical incubation, business support and market channels -such as full -stack Microsoft smart cloud resources and technical support (not only contains Azure public cloud, Microsoft 365/Office 365 cloud office, Dynamics office, Dynamics 365 Microsoft Smart Cloud "Family Barrels" of Microsoft Smart Cloud, which is smart business applications and Power Platform low -code development services, also includes Visual Studio series development tools and Microsoft Learn tutorials, hands -on laboratories, one -to -one technical support, etc.), extensive ecological resource docking ( Including recommendation investment and financing partners, docking Microsoft multinational enterprise industry alliances and global strategic customers, joining Microsoft global ecological partners networks, conversation of Microsoft global executives and industry experts, as well as access to Microsoft stores, application markets, search engines and game resources, etc.) And Microsoft's global high -quality market -oriented resources (Microsoft Global Developer Conference, Technology Conference, Partner Conference, and various regional markets, industry summits, forums, etc.). The advantages of this industrial ecological empowerment lies in the fields of game/dollar universe, Web3.0, corporate services, chips/communication, medical industry, automotive industry and other fields. In this context, the mainstream institutions of the venture capital circle are more to seek cooperation opportunities with the industry to jointly empower science and technology companies and support scientific and technological innovation. In the history of corporate financing in the above areas, cases of industry and VC/PE can always be seen.

For example, CSI's empowerment of SHOPASTRO from 0 to 1. As an extremely fast -growing e -commerce company, under the holding of CSI, the starring cross -border is more quickly landing on the overseas environment, ensuring the rapid expansion of the business under the premise of security and data compliance.

In a company from 1 to N, China Science and Technology is a typical case of CSI incubation. As the leading operating system technology listed enterprise, China Science and Technology is also working with CSI to support more startups to find new growth flywheels. Zhongke Chuangda is exploring from intelligent operating system technology to providing an advanced one -stop solution for IoT (full name: Internet of Things). So as to support more industry scenarios and applications. Conversely, this also affects the imagination of Microsoft in the field of semiconductor communication. Based on the IoT (full name: Internet of Things, the Internet of Things) accumulated with China Science and Technology Chuangda, Microsoft Headquarters is also working hard to promote it with China Cooperation of unicorn in the automotive field. In unlimited cases, Meitu is a typical one. In the impression of most users, Meitu is already a successful company, but in this successful background, Meitu is still incubating inside, investing in new entrepreneurial teams outside, looking for new increase points. In the process of CSI, CSI fully brought into full use of the dual advantages of industrial maps and entrepreneurial physical feelings. By cooperating with Meitu, the entrepreneurial team owned by Meitu Company Meitu Yidia and Meitu Overseas Products BeautyPlus, making Meitu strong images Scientific and technological capabilities are on the ground. In addition, as an excellent case of incubation cooperation, Meitu will also become a heavy DEMO of the Microsoft Technology Exhibition Center.

Prior to this conference, CSI had begun cooperation with Chinese startups, mature companies, and groups to develop in accordance with this situation. It is believed that the future CSI incubation companies will form a close form of the Ecological system built by Microsoft Group and Microsoft. Interactive collaboration, slowly weaving into a close relationship network.

Is it the best time to support entrepreneurship now?

Under the background of the Internet and mobile Internet traffic, global technology giants have been looking for the second curve. Some transitions are successful, while others are unsatisfactory. Since 2014, Satia Nadella has become the helm of Microsoft, helping Microsoft find the second growth curve -cloud computing, and successfully achieved transformation. It is said that large enterprises can turn around. Now look at large and small enterprises can achieve transformation, but the premise is to find the right direction. The search for the direction is based on the experience of Lao Dao and the understanding of the industry. This is exactly the 47 -year -old advantage of the industry.

However, due to the influence of global economic forms, the entrepreneurial boom is gradually fading. In the case of the shrinkage of the industry, why did Microsoft, which has found the second curve of cloud computing, turned to support entrepreneurial enterprises?

It is not difficult to discover the critical period of digital transformation at the moment. It is also the eve of the outbreak of some new technologies (Yuan Universe, Web3). In the early stage of the birth of new technology It is necessary to support enterprises such as Microsoft to support. For Microsoft, its new technologies have always maintained curiosity and openness, so they did not hesitate to accept and absorb new technology companies. Being able to empower the company's product and brand power through technology and group ecology is also the meaning of the micro -expanded industry and building an ecology.

In addition, just as the Chinese venture capital industry mentioned earlier, new changes are undergoing four links from the fundraising. China's venture capital industry is slowly changing -from the perspective of the funding side: from investment business models to high -tech investment, from the pursuit of high risk and high returns to stable investment, and as a leader in the technology industry, the main battlefield has come to the main battlefield. From the Microsoft territory starting from technology; from the project side: from simple financial investment to strategic ecological investment, entrepreneurs seek more than just financial support, but also pay attention to the industrial and ecological advantages of the capital. Being a perfect combination of industrial investment and financial investment, then companies will definitely get a lot of help in future development.

At present, the logic of China's capital market is that "winners are not eaten, but to prosper together." Enterprises are large and excellent, but there are very few people who really enter the micro -incubator. The main reason is that the incubator model is more suitable for dense resources or ecological perfecting enterprises. If the ecology is not perfect, it is not easy to do, and in the end, it can only be reduced to the "second landlord", which is essentially doing real estate business. This time Microsoft takes ecological strategic partners as the cornerstone, with the industry as the background, and feeds the enterprises in the incubator to provide enterprises with comprehensive services. I believe that Microsoft's "circle of friends" will definitely attract a large number of technology companies and institutions to join, and jointly build numbers together economy. The aggregation effect brought by Microsoft will continue to bring new variables to the venture capital circle.

Chinese people often say that "thirty standing". After 30 years of side with China, Microsoft has obviously settled in China and has been integrated into the development of China's digital economy. In the future, we will wait and see how to nurture innovative enterprises through CSI and expand its business ecological environment.

- END -

Chinese disruption is smooth and not lingering, as well as bird language

The following article comes from WeChat public account: Global Science, author Glo...

The imbalance of dietary dietary dietary dishes in my country began to improve the dietary structure from understanding nutritional status

The Report on the Scientific Research Report of Chinese Resident Dietary Guideline...