In the Ningde Times, the entrepreneurial project of the former employee of the former employee of the "Friend Circle" and the loss of Jinggong Technology must come to the IPO

Author:Daily Economic News Time:2022.09.29

22 years ago, a team leader of BYD left. Although BYD was not involved in electric vehicles at that time, it was already a leading battery battery. Therefore, the probability of employees at the level of group leaders did not attract much attention. It was just that no one would think that after the departure, the team leader became a supplier of BYD lithium battery equipment, and after many years, he took his company to the door of the IPO.

At the end of June this year, Shenzhen Xinyu Ren Technology Co., Ltd. (hereinafter referred to as Xinyu Ren) IPO was accepted and entered the "Inquiry" stage in late July. The company's products are mainly lithium -ion battery production equipment And key components, such as drying equipment, coating machines, roller press, sub -cutter, etc. from 2019 to 2021 are 128 million yuan, 240 million yuan, and 537 million yuan, respectively. The growth rate reached 104.78%.

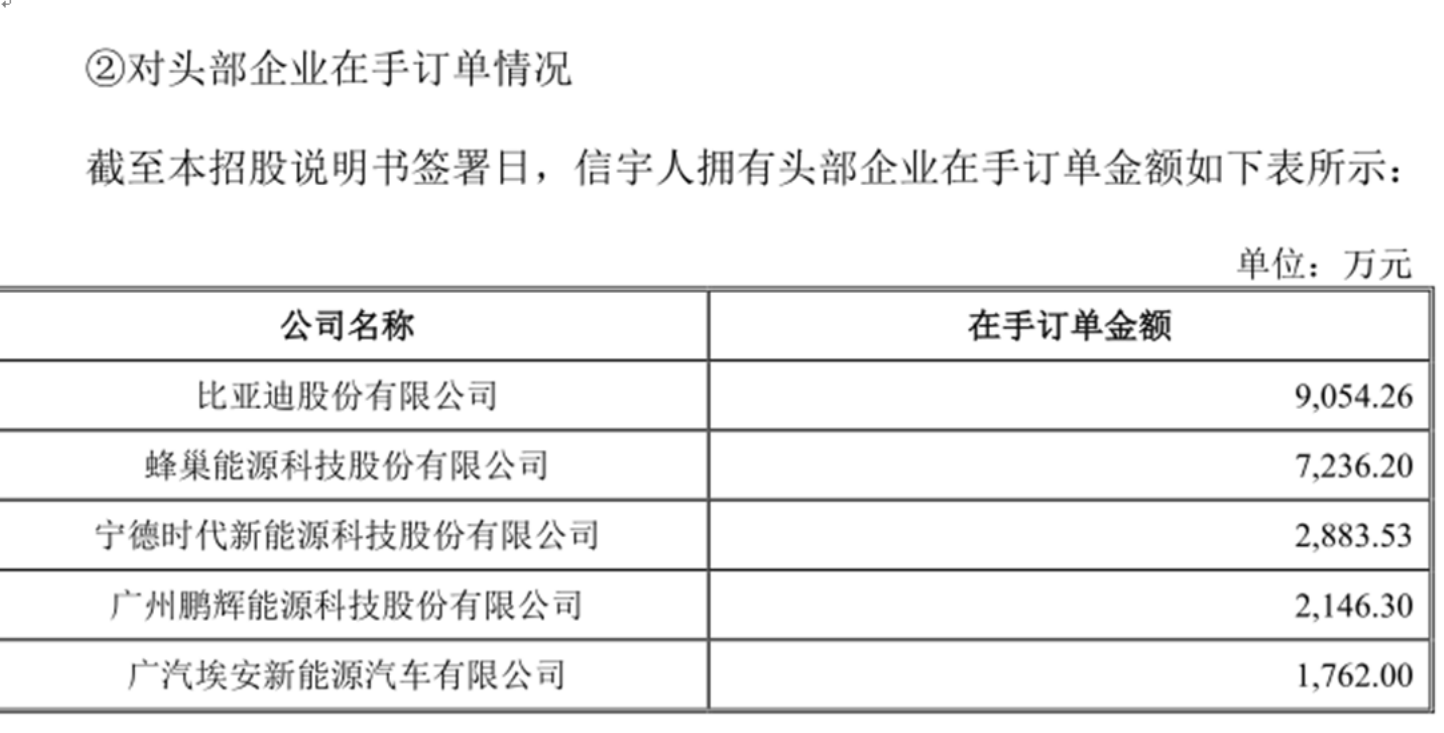

"Daily Economic News" reporter noticed that in addition to BYD, Ningde Times also incorporated Xinyu people into the "circle of friends" -theversion letters (declaration drafts, the same below) that Xinyu people have the amount of order in hand enterprises. More than 200 million yuan, of which BYD was 90.5426 million yuan, and Ningde Times was 28.8353 million yuan.

However, it should be noted that in recent years, the annual customers of Xinyu people have changed greatly. Become the first largest customer.

Real controller and core technicians come from BYD

In 1998, 24 -year -old Yang Zhiming joined the time after graduating from the undergraduate machinery design and manufacturing major, and he resigned from the position of the leader of the company's construction machinery design group in just 2 years. Prepare the establishment of Xinyu.

In August 2002, Xinyu's predecessor Shenzhen Xinyu Ren Technology Co., Ltd. was formally established. At that time, Yang Zhiming also had a partner named Hu Da Gui. The two invested 250,000 yuan each and each held 50%each. After exiting the investment, for a long time, Xinyu people are a wholly -owned enterprise of Yang Zhiming.

I learned machinery. The first job is related to the battery. Yang Zhiming naturally focused on the battery equipment. At present, Xinyu's products are also mainly used in lithium battery manufacturing full -process drying and coating, roll pressure, division, automated assembly and other processes.

In fact, there are 4 core technical personnel disclosed in the prospectus in the prospectus, and all of them have BYD's work experience. Therefore, it is not an exaggeration to say that Xinyu people are "a former employee of BYD". These four core technical staff are Yang Zhiming, chairman and general manager; Deputy General Manager and technical director Cai Lianhe; product director Cai Zhiyuan and senior electrical manager Wu Qingfang. Except for Yang Zhiming, Cai Lianhe and Wu Qingfang are former employees of BYD.

Cai Lianhe stayed in BYD for the longest time. In October 2009, the "post -85s" jumped to BYD after a year after graduating from undergraduate. By April 2018, Cai Lianhe worked in BYD for nearly 9 years and then entered Xinyu He served as the technical director and was promoted to the company's deputy general manager in February last year; Wu Qingfang entered BYD as an electrical engineer after graduating from the undergraduate in 2010. By May 2013, he changed his job to the senior manager of Xinyu.

However, it should be noted that the unit that Yang Zhiming and Wu Qingfang had worked were BYD Co., Ltd., while Cai Lianhe worked at BYD lithium battery company.

The prospectus disclosed that Yang Zhiming directly held 39.7%of Xinyu Ren, which was the controlling shareholder and actual controller of the company. Wu Qingfang indirectly held the Xinyu Ren 0.1129%of the shares, and Cai Lianhe's shares were 0.0682%. Yang Zhiming's total salary was 432,600 yuan, Cai Lianhe's salary was 59,200 yuan, and Wu Qingfang's salary was 351,800 yuan.

Picture source: Photo Network-500850476

IPO investment missed by Jinggong Technology

"Daily Economic News" reporter noticed that Xinyu people disclosed in the prospectus that they had signed an investment agreement with Jinggong Technology (SZ002006, a stock price of 25.59 yuan, and a market value of 11.65 billion yuan) on September 21, 2018, but Among them, Xinyu people are "borrowers", and Jinggong Technology is a "lender". The amount involved in the loan is 40 million yuan, and the loan period is from September 21, 2018 to April 30, 2019.

Is it an investment agreement or a loan contract? Xinyu people did not explain in the prospectus. With this question, the reporter inquired about Jinggong Technology Announcement and found out that this was an investment agreed by both parties.

On September 22, 2018, Jinggong Technology Announcement disclosed that Jinggong Technology provided a loan with an annualized interest rate of 8%and a total of 40 million yuan with its own funds. The agreed rectification conditions are fully implemented, and the borrowing into the equity investment of Xibing Technology's equity in Xinyu Ren will not be fully implemented, and there are other treatment methods.

There are three main conditions agreed on the two parties. One is that Xinyu Ren's non -net profit in 2018 reached 30 million yuan; the other is that at least five customers of the top ten customers in 2017 and 2018 are the top two in the industry ranking. Ten lithium battery manufacturers, and at least two of the top ten customers are at least two lithium battery manufacturers ranked in the top ten in the industry; Third, Xinyu Ren's 2018 account receivable turnover rate is higher than the three listed companies in the same industry designated by the investment agreement than the investment agreement. (Including the New Third Board) the average level of the same period. Judging from the agreement, Jinggong Technology is quite cautious about the investment of Xinyu people. At that time, Jinggong Technology also stated that this investment is conducive to the company's existing main business and maintaining competitive advantages, and give full play to its own equipment to give full play to its own equipment The manufacturing capacity and the integration capacity of the production line, quickly cut into the lithium power equipment industry.

Obviously, the convertible bond failed to achieve investment purposes. In July 2019, Jinggong Technology issued an announcement announced that the investment was terminated, saying that the assessment indicators such as the non -net profit of the Yusin deducted non -net profit and the account receivable turnover have failed to meet the agreed rectification conditions, and the current market environment of the lithium battery equipment industry is combined with the current market environment. , Development trend and other factors, decide to terminate investment. On August 6, Jinggong Technology received interest rates of 40 million yuan and interest of RMB 2.5775 million.

It should be noted that the termination of this investment is actually related to the financial management of Jingyu's own financial management. In the 2019 report, Jinggong Technology admitted that the controlling shareholders launched the impact of many unfavorable factors such as the reorganization of judicial bankruptcy and the continuous deterioration of the market situation. Continuously developing and stable development, the company's contraction of foreign investment in 2019 ".

What is ridiculous is that although the investment has not received more than two million yuan in interest, Jinggong Technology has also been pointed out by the Zhejiang Securities Regulatory Bureau that it has not disclosed the progress of the investment contract in time on April 30, 2019. As a result, there was no timely disclosure of major transactions, and it was determined by regulatory measures.

In 2019 and 2020, income is not comparable to the level of 2017

Jinggong Technology's investment history of Xinyu also "exposed" the past of Xinyu's performance fluctuations.

From the perspective of Xinyu's prospectus, its revenue scale increased steadily from 2019 to 2021, and the compound growth rate of revenue reached 104.78%. But the timeline has changed, and the situation has changed. In the aforementioned Investment Investment Announcement, it was disclosed that Xinyu Ren's revenue in 2017 was 257 million yuan, net profit was 89.33 million yuan (audited), and revenue from January to July 2018 was 115 million yuan, and net profit was 18.6926 million yuan (net profit (18.6926 million yuan ( Without auditing).

According to the prospectus, in 2019, Xinyu Ren's revenue was 128 million yuan, and the net profit was a loss of 25.874 million yuan. Compared with the previous two years, major changes have occurred. Can't keep up with the income scale in 2017.

During the reporting period, the letter of revenue increased significantly during the reporting scale, and there was a large fluctuation of big customers of the year. The reporter noticed that among Xinyu's first five customers in 2019, none of them entered the top five customers in 2020, and only BYD among the five major customers in 2020 became the top five customers in 2021.

From the perspective of income, there have been sharp changes before 2019; from the analysis of customer analysis, the drama of the big customer fluctuations of the year is evident. Does these mean that there are certain risks in customer stability and business sustainability? The reporter contacted Xinyu people through emails and telephones on this question, but as of press time, he had not received a reply.

Entering the "circle of friends" in the Ningde era should be one of the important reasons for Xinyu Ren's IPO. However, the Ningde Times has not yet appeared on the top five customers of Xinyu's annual customers; in addition, as of the disclosure of the prospectus, Xinyu Ren has the amount of hand in hand in Ningde Times of 28.835 million yuan. For the Ningde era, such procurement orders Not a large amount.

Xinyu Ren did not introduce too much about transactions with Ningde Times in the prospectus. It only said that at this stage, it has cooperated with many well -known domestic power lithium power manufacturers such as Ningde Times.

BYD, who entered the list of big customers of the year, is the "strength partner" of Xinyu. In 2020 and 2021, the corresponding sales were 15.547 million yuan and 25.435 million yuan, respectively.

Capacity utilization rate: calculate the work hours of employees far exceeding 100%

It is understood that the production process of lithium -ion batteries can be roughly divided into three sections: polar sheet production, battery assembly, and battery detection packaging. The lithium battery equipment can be divided into the front section of polar production equipment, the mid -range battery assembly equipment, and the rear segment Battery detection packaging equipment. In addition to the material used in the production of the battery itself, the accuracy and stability of the production equipment also directly affects the performance of lithium ion battery products.

Xinyu people introduced in the prospectus that from the perspective of value, the cost of equipment costs in the front, middle, and rear sections of lithium -ion batteries accounted for 35%, 35%, and 30%, respectively. In the previous equipment, the value of the coating machine accounts for the highest proportion. It is the core equipment of the previous section and one of the core equipment of the lithium power equipment industry. In addition, water removal is used as the root of the battery life. The process links and other crafts are involved, and it has an important position in the industrial chain.

Xinyu's core products are lithium -battery drying equipment and coating equipment. In 2019, the total proportion of these two products accounted for more than 90%. Beginning in 2020, its lithium battery roller, sub -cutting equipment, and other product revenue increased significantly. Essence In 2021, the income of these two major products accounted for nearly 60%.

Xinyu people introduced in the prospectus that the company's main products are non -standardized products and need to be customized according to customer requirements. Therefore, the production and sales of each product of each product are different.

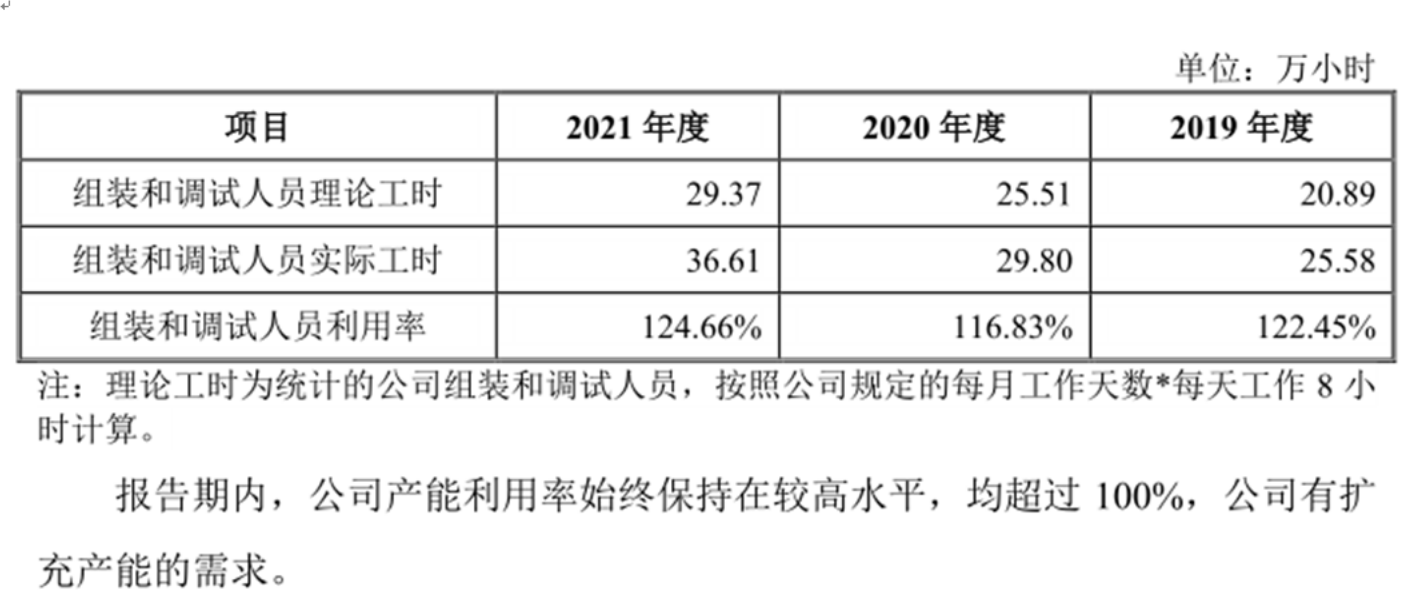

Non -standard customization also causes a certain problem to Xinyu people in production management. When introducing the company's capacity utilization rate, Xinyu people said that the volume size, technical difficulty and number of parts between different equipment are large, and the company's production capacity utilization rate cannot be measured according to the number of products of the product. The company uses working hours such as assembly and debugging to explain the utilization of capacity. Based on this, the capacity utilization rate of production capacity exceeds 100%, and the company has the need to expand production capacity.

It should be noted that the working hours of Xinyu people are based on 8 hours of work every day. Therefore, if the corresponding proportion of employees, or employees increase the corresponding proportion of work, does the company still need to expand production capacity? In other words, if you only use working hours to measure the company's capacity utilization rate, can it mean to relieve the pressure of production capacity? The reporter also consulted Xinyu people on this issue, but also failed to get a reply.

In fact, the production capacity is also closely related to factors such as the company's factory area. Perhaps may provide reference: Liyuan Heng (SZ688499, the stock price is 218 yuan, and the market value of 19.18 billion yuan) is one of the comparison companies listed by Xinyu. The company also stated that production equipment with different sizes cannot calculate standard capacity. Therefore, the enterprise uses the exchanges of the production capacity (that is, the corresponding order amount corresponding to the production and assembly products in the factory) as an alternative indicator of production capacity.

In 2021, Li Yuanheng's operating income was 2.331 billion yuan. In the first half of 2022, Li Yuanheng's shipping scale was 1.969 billion yuan, which is expected to ship 5.117 billion yuan in 2022. In the question of responding to the exchanges on the exchanges on the issue of "whether the capacity of the fundraising project can be fully digested", the order (excluding tax) of hand in hand (excluding tax) at the end of July 2022 reached 6.479 billion yuan.

Xinyu has no introduction of "shipment scale". However, the reporter inquired that as of the date of signing the prospectus, it had a leading enterprise (a total of 5) orders for only 231 million yuan, and the contract liabilities of the end of 2021 were 116 million yuan. In 2021, business revenue was 537 million yuan.

Daily Economic News

- END -

Seventeen departments issued a document: engage in car circulation to expand car consumption

Xinhua News Agency, Beijing, July 8th. The Economic Reference News published an article on July 8th Seventeen Department Published: Active Automobile Circulation and Expand Auto Consumption. The art

For each purchase of a new car with a new car of more than 10,000 yuan (inclusive), 5,000 yuan is subsidized by 5,000 yuan to promote car consumer activities in Hebei

The launching ceremony of the promotion of automobile consumption activities in He...