[Transfer] 18A Enterprise Growth troubles, how can the "Hong Kong Stock Connect" turn sharp?

Author:Yaizhi.com Time:2022.09.07

[Transfer] The growth of the 18A enterprise, how can the "Hong Kong Stock Connect" turn from good?

Source: amino observation/Fang Taozhi

One of the biggest dreams of Hong Kong stock companies must be to enter the "Hong Kong Stock Connect."

For a company, liquidity is the key to the support price (GU) value (JIA). Entering the Hong Kong Stock Connect is the most important way to attract the favor of the mainland funds and increase liquidity.

It is for this reason that entering Hong Kong Stock Connect is a compulsory course for a Hong Kong stock listed company. However, everything has two sides. It is a good thing to enter the Hong Kong Stock Connect; but if you cannot maintain the identity of the "Hong Kong Stock Connect", it may be counterproductive.

On September 5th, the Shanghai Stock Exchange issued the "Announcement on the Regulations on the Hong Kong Stock Connect Stock List of the Hong Kong Stock Connect", which was unfortunately transferred from Hong Kong Stock Connect.

This allowed the stock price of the three companies to be under pressure: As of the closing on the 6th, Yaoming Junuo, Platinum Pharmaceutical, Jiahe Biological stock prices fell 29.93%, 7.34%, and 9.74%, respectively.

It can also be understood that any unfavorable factor in the bear market may cause a fatal blow to the stock price of 18A companies.

But then again, Hong Kong stocks are just a tool to increase the liquidity of Hong Kong stocks. 18A companies can still be favored by investors regardless of whether they are concentrated on the development of their values regardless of their value.

/ 01 /

After being transferred out of the Hong Kong Stock Connect list: buying the market in the Mainland changed to sell

Why are investors so sensitive to the "Hong Kong Stock Connect" of pharmaceutical companies? Before answering this question, let's take a look at what the Hong Kong Stock Connect has.

To put it simply, the Hong Kong Stock Connect can allow mainland investors to directly participate in the Hong Kong stock market transactions and improve the liquidity of the stock of Hong Kong stocks.

For listed companies, liquidity is the key to support valuation. A shares are because of more than 100 million shareholders, and the funds are extremely abundant, and the market valuation center leads the world.

Therefore, the Hong Kong Stock Connect can greatly improve the liquidity of Hong Kong stock companies. Although the threshold of Hong Kong stocks investors is as high as "500,000" assets, there are still nearly 3 million people who meet the conditions.

In recent years, the slogan of "going south to fight for pricing" in mainland investors is not shouting.

At the same time, Hong Kong stock listed companies have been included in Hong Kong Stock Connect. In order to enter the Hong Kong Stock Connect, many requirements such as "market value, performance, liquidity" are required. The market has always existed, and entering Hong Kong Stock Connect is equal to high -quality companies.

Therefore, after the listing of Hong Kong stocks is included in Hong Kong stocks, it may usher in "Davis Double -click", and the stock price trend is strong.

Many pharmaceutical companies can also confirm the past performance. For example, on March 15, 2021, Yaoming Junuo was included in the Hong Kong Stock Connect list under the Shenzhen -Hong Kong Stock Connect. The next day, Yaoming Juuo's stock price rose 11.44%.

After understanding this logic, it is not difficult to explain why the pharmaceutical companies that have been transferred out of the Hong Kong stock list, why the stock price is under pressure.

Because as companies are transferred out of the Hong Kong Stock Connect, not only do investors in the Mainland cannot continue to contribute liquidity, they will become a pressure plate:

After a company was transferred out of the Hong Kong stocks, mainland investors could not buy operations, and they could only sell the company's stock.

If you want to buy the company's Hong Kong stocks, you need to open another Hong Kong stock account. These tedious operations will make many investors be rejected, the liquidity of the company's stock will decline, and it is also affected in the future.

To some extent, the stock price of Yaoming Juuo was affected by this factor.

Since being included in the Hong Kong Stock Connect, the proportion of the company's Hong Kong Stock Connect's shareholding has been gradually increasing. As of the closing of September 5, the shareholding of Yaoming Junuo Hong Kong Stock Connect accounted for 15.8%.

After it has been transferred out of Hong Kong stocks, nearly 16%of the shares of shares may have a certain impact on the stock price. No wonder investors voted with their feet.

/ 02 /

Maintaining the status of the Hong Kong Stock Connect, liquidity and market value are the key

So, which companies will be transferred out of the Hong Kong Stock Connect? By understanding the Rules of Hong Kong Stock Connect, let's find the answer.

There are two branches under the Hong Kong Stock Connect, one is Shanghai -Hong Kong Stock Connect, and the other is Shenzhen -Hong Kong Stock Connect. In general, the corporate standards incorporated into Hong Kong Stock Connect are consistent:

The average market value at the end of the review period is not less than 5 billion Hong Kong dollars, and it ranks among the Hang Seng Composite Index.

The Hang Seng Composite Index is adjusted regularly every half a year. Each adjustment is based on the market value and liquidity performance of the subject in the past year as the main investigation basis for entering the Hang Seng Composite Index. The adjustment results are announced in February and August each year. And officially effective in September.

Whether a company can maintain the ranks of the Hang Seng Comprehensive Index depends on 2 points: market value and liquidity.

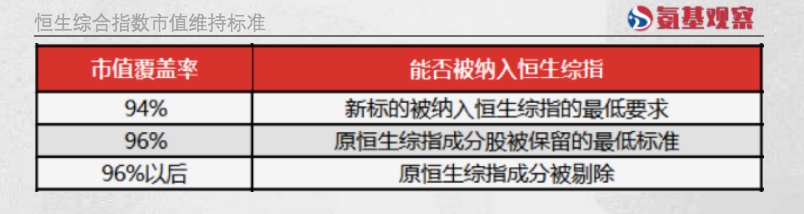

In terms of market value, the Hang Seng Composite Index Establishment Stocks implement the last elimination system. As shown in the figure below, the Hang Seng Composite Index has a large market value of 12 months from the average market value of 12 months from large to small. Calculating the cumulative market value coverage of each stock, and the ranking of companies with the conditions of the ranking 4%of the enterprises will not be able to maintain the status of the Hong Kong Stock Connect.

However, according to past experience, this standard is usually significantly higher than the minimum market value standard of HK $ 5 billion. In other words, if the 18A companies want to be kicked out of the Hong Kong Stock Connect, the market value requirements during the review period are not low.

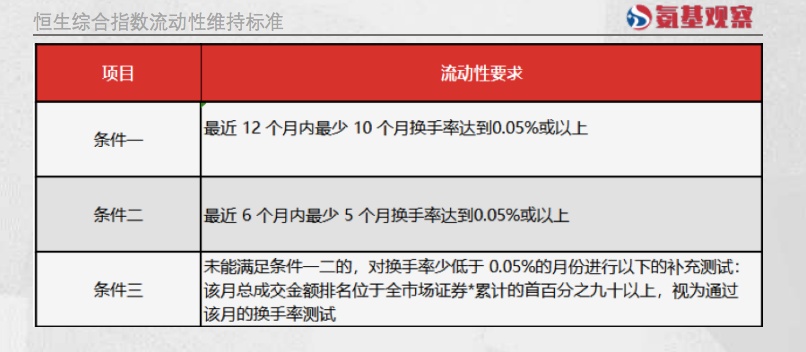

In addition to meeting the market value factors, it is also necessary to meet the liquidity requirements. The specific transaction volume requirements are shown in the figure below. Among them, the conversion rate is obtained through the median number of daily transactions in a specific month. In summary, only enterprises that meet the requirements of market value and liquidity at the same time can maintain the status of the Hong Kong Stock Connect and will not be kicked out.

Yaoming Juuo was a loss of sufficient market value. As shown in the figure below, Yao Ming Juuo can meet the liquidity requirements.

However, the company's average market value of 12 months was HK $ 4.805 billion, which has not met the corresponding requirements.

/ 03 /

In the Hong Kong Stock Connect, it does not affect the long -term value of the enterprise

It is foreseeable that the experience of Yao Mingjun in the future will be repeatedly staged in the biotechnology sector.

Because in the cold winter of biopharmaceuticals, BIOTECH, which decreases and its market value has shrunk sharply, is not a minority. In the future, there must be companies that companies are facing the transfer of Hong Kong stocks.

Of course, this is just a short -term trouble for the growth of 18A companies. As mentioned above, the Hong Kong Stock Connect is just a tool to increase liquidity.

For biotechnology companies, it is not exactly the death of the Hong Kong Stock Connect. In the end, the value of pharmaceutical companies must return to the performance level.

Although Yaoming Juuo's listing of Hong Kong Stock Connect has aroused the market's concerns and evasion of the company's risks, investors voted with their feet. But returning to rationality, Yao Ming Juuo, as a leading company in China, has been launched to achieve business.

According to the performance in the first half of the year, although there is still a certain distance from the ashore, the performance is continuing. In the first half of this year, Yaoming Juuo opened 77 Binota prescriptions to complete the return of 64 patients, bringing 66 million business income to the company.

In the future, if the company continues to prove itself at the commercialization level, it is not possible to return to Hong Kong Stock Connect.

For more Biotech, or not in the Hong Kong Stock Connect does not affect the long -term value of the company. The most important thing is to strive to build your own moat and break the development of ceiling.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform. If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

Internal and surgical experts talk about the two major esophageal cancer results of Nawuli Ulitaba, and the heavy results of the heavy esophageal cancer are approved, looking forward to the bright prospects of immunotherapy

*For medical professionals for reading referenceThe two major esophageal cancer in...

up to date!Wuhan found 2 asymptomatic infected people!37 stations in Chongqing Rail Transit will be suspended!Guangzhou: An immediate report on the subway on the subway

The National Health and Health Commission reported on August 24 that from 0:00 to ...