After the controlling shareholder reduced holdings, 18 executives increased their holdings of Fosun Pharmaceutical.

Author:Red Star News Time:2022.09.07

Red Star Capital Bureau September 7 news, the once 100 billion Big White Horse Fosun Pharmaceutical (600196.SH; 02196.HK) announced on the evening of September 6 that 18 executives voluntarily increased their holdings with their own funds. 460,000 shares (including A shares and/or H shares). This is regarded as the controlling shareholder's reduction in the stock price and the stock price has fallen sharply.

↑ The data chart is based on IC Photo

However, after the announcement of the executive's holdings, its stock price only improved slightly. As of the afternoon of September 7, Fosun Pharmaceutical A shares rose slightly by 0.59%to 35.63 yuan/share.

It is worth mentioning that in the fixed increase completed in July in Fosun Pharmaceutical, Feng Liu's Gao Yishan No. 1 Yuanwang Fund obtained 476,19047 shares at a price of 42 yuan/share, and now it has a floating loss of about 300 million Yuan.

18 executives ended "fire", shareholders: Just this?

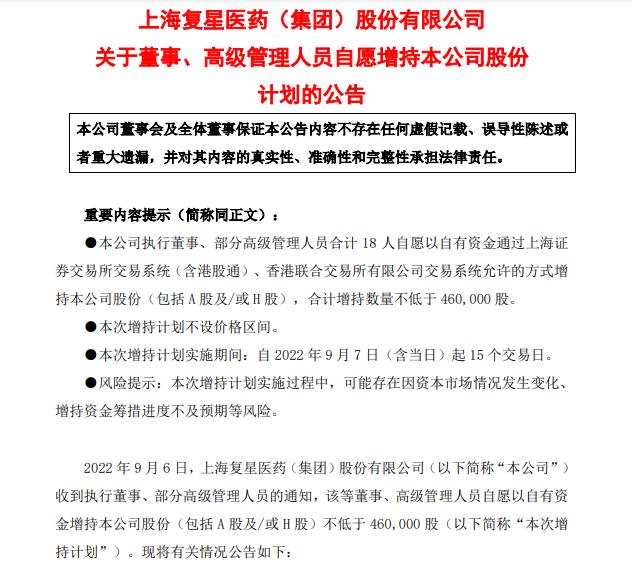

On the evening of September 6th, Fosun Pharmaceutical Announcement, 18 executives including chairman, executive director, CEO, etc. voluntarily increased their holdings of the company (including A shares and/or H shares) with their own funds. The increase in holdings is not less than 460,000 shares.

The content of the announcement shows that as of September 6, the total holding of the main body of the main body held a total of 1.6334 million shares (including 914,500 A -shares and 718,900 H shares) of Fosun Pharmaceutical Unlimited Sales conditions, which accounted for approximately the total of Japan's company as of this announcement as of this announcement. 0.0612%of the share capital. In addition, as of September 6, the holding of holders has not disclosed the holding of holdings in the past 12 months.

↑ Screenshot from Fosun Pharmaceutical Announcement

The stock price of the controlling shareholder has plummeted, and the 18 executives of Fosun Pharmaceuticals increased their holdings, which was also regarded by the market as an emergency "fire extinguishing".

On the evening of Friday (September 2), Fosun Pharmaceutical disclosed the announcement of the controlling shareholder's reduction. On the 2nd, the company's total shares calculated, that is, no more than 80.897 million A shares. It is reported that this is the first time that Fosun Pharmaceutical has been actively reduced by the controlling shareholder since the listing of A shares in 1998. The reason for reducing its holdings is the need for its own business plan.

As soon as the controlling shareholder's reduction of holdings came out, Fuxing Pharmaceutical's stock price plummeted. On September 5th, Fosun Pharmaceutical's A shares fell to the limit and closed at 36.19 yuan/share; H shares fell nearly 13%to close at 21.85 Hong Kong dollars/share. On September 6, Fosun Pharmaceutical A shares continued to fall, and H shares rose slightly by 0.92%.

However, compared with the controlling shareholder's plan to reduce its holdings of no more than 80.897 million A shares, the 180,000 A shares and H shares increased by 18 executives were large. In this regard, some shareholders said, "That's it?"

Since the beginning of this year, Guo Guangchang, the helm of the "Fosun", frequently reduced its holdings and transferred the shares of relevant listed companies to cash more than 100 billion yuan. In addition, Moody's rating agency Moody's rating reduced the corporate family rating of Fosun International (00656.HK). Or it is related to the "Fosun" its own debt pressure.

In this regard, Fosun International has responded to debt issues that Fosun International's operating situation is stable, thanks to a diversified asset portfolio, abundant book funds, stable relationships with financial institutions, and smooth diversified financing channels. Affects Fosun's debt capacity.

The controlling shareholders and executives "pull the limit", suffering from Feng Liu

It is worth mentioning that Fosun Pharmaceutical's controlling shareholder and executives once "extreme pulling", the fund manager Feng Liu, managed by Gao Yishan No. 1 Yuanwang Fund, has been floating.

On the evening of July 26, Fosun Pharmaceutical A shares were settled, and a total of 10 issues were finally issued. Among them, Feng Liu managed Gao Yishan No. 1 Yuanwang Fund's distribution of nearly 2 billion yuan, ranking first. After the issuance was completed, Gao Yi's assets jumped into the third largest shareholder of Fosun Pharmaceutical, with a shareholding ratio of 1.78%.

According to the information disclosed on the same day, Fosun Pharmaceutical's actual number of issuance this time was about 107 million shares, the issuance price was 42 yuan/share, and the net fund raised funds were 4.456 billion yuan. Among them, Gao Yi's neighboring Mountain No. 1 Yuanwang Fund received 47619047 shares.

However, after the landing landed, Fosun Pharmaceutical ushered in the planning of the controlling shareholder to reduce its holdings, and then the stock price fell. As of the afternoon of September 7, Fosun Pharmaceutical A shares rose slightly by 0.59%to 35.63 yuan/share. Based on this calculation, Gao Yi's neighboring Mountain No. 1 Yuanwang Fund has floated about 300 million yuan.

Red Star News reporter Deng Lingyao

Edit Yu Dongmei Pengjiang

- END -

Special inspection of the safety of hazardous chemicals for chemical and pharmaceutical manufacturin

With the transfer of our district to the prevention and control stage of the normalization epidemic, various types of enterprises are re -production and re -production in an orderly manner. The occurr

9 to 14 -year -old children's HPV vaccination rate Low in vaccination rate Experts: Hurry up vaccine

The Guangdong Province Cervical Cancer Prevention and Control Strategy Symposium h...