The maximum increase in a single day is 380%. Is the spring of 18A companies coming?

Author:Yaizhi.com Time:2022.09.15

The maximum increase in a single day is 380%. Is the spring of 18A companies coming?

Source of amino observation: amino observation/Cai Jiu

Beginning in July last year, the secondary market that continued to be cold allowed all pharmaceutical companies to cover a layer of overcast clouds that could not be scattered.

However, Hong Kong stocks biotechnology companies give investors a "gift". With the industry's comprehensive trend representing Hang Seng Medicine ETF, you can feel the market hot:

Recently, Hang Seng Medicine ETF has risen by 2.69%. In terms of individual stocks, nearly 20 biotechnology companies have increased by more than 5%.

Among them, the best performance of Lepu creatures directly staged a good show of the stock price 4 times a day: the maximum increase in the market reached 386%. Although the stock price then fell, the stock price increased by 283%.

Does this mean that the spring of 18A companies is back?

/ 01 /

Walkward pricing under low liquidity: 11 million % exchange leveraged 40 billion yuan in market value

On the whole, the sudden rise in Lepu creatures is not representative, and it can be said that people are "caught off guard."

Lep biological stock price began to "restless" and reached its peak at 3 o'clock. In just one hour, the company's stock price rose up to 386%, and the market value increased by 41.8 billion Hong Kong dollars.

However, from the perspective of turnover, the difficulty of lever 41.8 billion Hong Kong dollars in the secondary market does not seem to be large: within 2 to 3 hours, the turnover of Lepu biological transactions "but" 11.26 million Hong Kong dollars.

11.26 million yuan for 40 billion yuan, which is obviously a very successful "leverage." But this also shows that the "quality" of Lep biological rises is not high.

Everyone knows that the stock price and market value are essentially supported by liquidity. In terms of liquidity, to some extent, it is more important than stock prices and market value.

A mature market must first have liquidity, and then the market has a pricing function. Without liquidity, the pricing will be "willful". Just like Lepu Medical.

Although you are easy to get huge wealth in the market with lack of liquidity, it may be just rich in paper. It is not easy to settle in the bag.

Under extreme cases, thousands of shares are enough to smash a company's stock price into a large hole. For example, on August 30, the transaction volume of 6,000 shares of Beihai Kangcheng fell 13.47%.

Back to Lepu Bio. In the six months before September 8th, the total rate of Lepu Bio had only 2.42%, and the average daily turnover hovered around 600,000 Hong Kong dollars.

In the case of low liquidity, the turnover of "millions" may cause a company's stock price to rise, or it may make the stock price plummeted.

/ 02 /

The market value that lacks liquidity support is hard muscles or deficiency fat

At present, liquidity is already troubled by many 18A companies.

In this context, one thing we need to pay attention to is: the lack of liquidity support, whether it is hard muscles or deficiency.

Take Lepu Bio. Although the stock price of Lepop biological has fallen after 3 o'clock, the increase has reached 283%. After the rise, the company's market value climbed to 41.6 billion Hong Kong dollars.

This is enough to make Lep biological among the top companies in the pharmaceutical industry.

In the field of innovative drugs and weapon in Hong Kong stocks, only the market value of Baiji Shenzhou is higher than that of Lepu Bio. The market value of star companies such as Cinda Bio, Junshi Biology, and Rongchang Bio is lower than that of Lepu.

However, from the perspective of the quality of the pipeline, it is questionable whether Lep biology has the strength to stand still in the status of "the second brother of innovation medicine".

According to the company's semi-annual report, the only innovative medicine for Lepu Bio was approved to be listed is a PD-1 with fierce competition. The company's indications development and commercialization are not significant, and it must not be the key to supporting the company's valuation.

In addition to PD-1, the focus of Lepu biore pipeline is ADC. As shown in the figure below, the company has five ADCs, which targeted HER2, CD20, EGFR, TF, CLDN18.2.

From the perspective of quantity, the advantages of the ADC field of Lep biology are obvious. However, the quantity is by no means a standard for judging the quality of the management line. After all, there is still a long way to go from the real commercialization of clinical clinical. Only when the drug is successfully listed can the number be transformed into a real advantage.

Among the five ADCs, MRG002 and MRG003, which target HER 2 and EGFR targets, have made rapid progress and are already in phase II.

Among them, MRG002 is not small in competition in the field of HER 2 targets in ADC, not only facing the pressure of DS8201, but also the siege of domestic pharmaceutical companies. From the clinical point of view, the location of Lep biology is not ahead.

The competition pattern of EGFR targets is relatively better, and no ADC has been listed. And MRG003's 1B clinical trial performance is very eye -catching. According to the data released by the European Cancer Internal Science Society in 2021, its total relief rate of HNSCC (head and neck cancer) reached 40%.

Although the head -to -head test is not performed, the total relief rate of the second -line treatment of head and neck cancer is only 16%. At present, MRG003 is the most potential drug in Lepu Biological Pipeline. Of course, whether you can maintain excellent performance in the future remains to be observed.

Overall, although there are many products in the pipelines of Lep biology, most of them are still uncertain. In order to support the current market value, Lepu creatures obviously still have a long way to go.

/ 03 /

Laipu biology is accidental, but the biotechnology industry ushering in investment opportunities is inevitable that although Lepu biological skyrocketing is only "accidental", it is an inevitable event that the biotechnology industry ushered in investment opportunities.

From August to the present, nearly 7 biotechnology companies including Ruico Biology, Gacosi, and Zai Ding Medicine, with the decline in the Hong Kong stock market, have a close or more than 10%of the stock price. Among them, the most prominent Kangfang creatures rose 23%.

The reason is not difficult to understand. After the adjustment of the past year, although there are still many Biotech values that are still high, one thing that must be acknowledged is that a small part of the representative Biotech has a market value of the frozen point, and the investment value has gradually become highlighted.

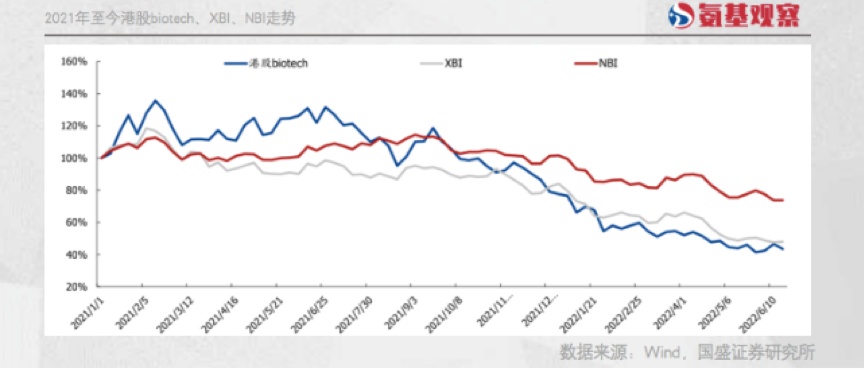

As shown in the figure below, before July, Hong Kong stocks BIOTECH declined and even surpassed the US stock biotechnology company. You must know that XBI has gone through the worst wave of callbacks since the last century.

Many investors believe that the US stock biotechnology industry has bottomed out, and the trend has also proved this. Since July, the US Biology ETF-SPDR (XBI) increase has increased by 14.21%.

Enterprises with confidence in the global biotechnology industry have begun to recover, and domestic differentiated products with superimposed commercialization capabilities are also expected to drive the stock price to recover because they expect good expectations.

As the leading biology of the increase is because the disclosed semi-annual report shows that the commercialization of PD-1 and dual anti-products meets expectations, and the stock price ushered in a strong rebound.

Regardless of the short -term trend, it is certain that with the volume of innovation varieties, the strong hardcore biotechnology companies are expected to grow and stand out.

At that time, market confidence will inevitably recover, and the industry will usher in new and new opportunities.

Disclaimer: This article is the content of Yaozhi.com, and the copyright of the pictures and text belongs to the original author. The purpose of reprinting is to pass more information, which does not represent the viewpoint of this platform. If the content, copyright and other issues are involved in the work, please leave a message on this platform, and we will delete it as soon as possible.

- END -

The first new crown vaccine approved in China has come, and how big is the market left to it

03.09.2022Number of this text: 2027, reading time for about 4 minutesIntroduction:...

A fishbone tears the entire esophagus!Eating fish quilt, doctors are most afraid of you this action

Fish thorn card throat is a common little thing in lifeFish thorns pierced the foo...