Nuggets Innovation Pharmaceuticals | Can the new crown oral medication that is not good for progress allows Ge Gift Pharmaceuticals to "counterattack"?Corning Jerry declared domestic first dual anti -ADC clinical clinical

Author:Daily Economic News Time:2022.09.15

"Nuggets Innovation Pharmaceuticals" was jointly launched by the Daily Economic News and Data Data. It aims to interpret the progress and trend of new drug research and development, analyze product competitiveness and market prospects, insight into pharmaceutical capital context, and witness the high -quality development of the pharmaceutical industry.

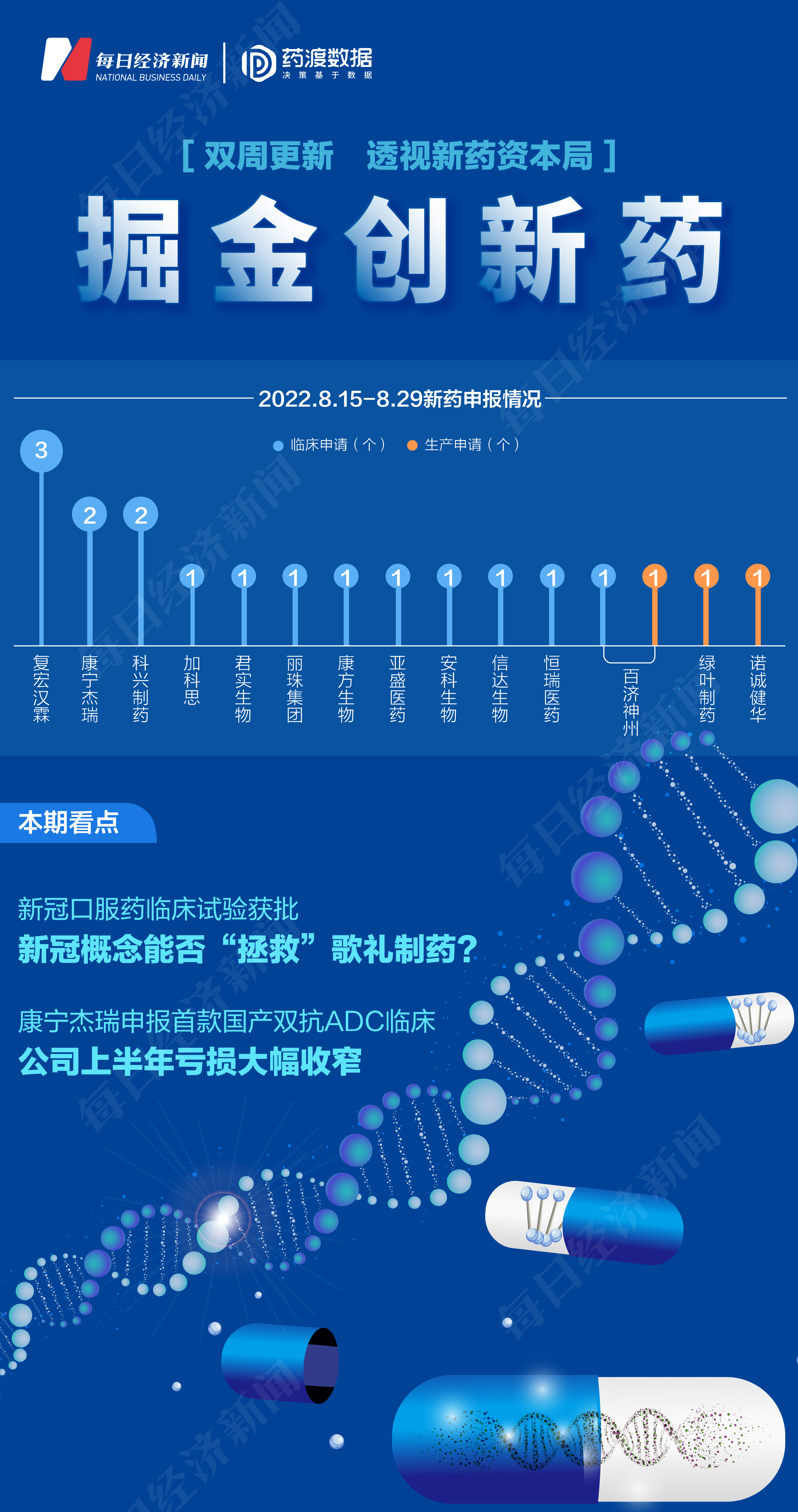

According to the pharmaceutical data, from August 15th, 2022 to August 29, 2022, the State Drug Administration of Drug Administration (CDE) received a total of 19 listed companies (including listed companies holding companies) submitted 19 submitted Application for new chemical drugs and treatment of new drugs for biological products.

New drug application

New medicine hot review

1. Ge Li Pharmaceutical New Crown Oral Candidate Candidate Candidate Pharmaceuticals' R & D Getting R & D is not dominant, and the combination of hepatitis C drugs is difficult to improve

On August 22, Ge Li Pharmaceutical (HK01672, HK $ 282, market value of HK $ 3.1 billion) announced that the China National Drug Administration has approved the new drug clinical trial (IND) Application. The drug is the first new crown oral candidate drug to be approved by the China State Drug Administration and the US Food and Drug Administration (FDA) to conduct a new drug clinical trial of an oral RDRP inhibitor.

Ge Li Pharmaceutical said in the announcement that the ASC10 is a oral dual medicine, which has a new differentiated chemical structure compared to Molnupiravir. By adopting a dual-pre-drug strategy, the permeability of ASC10 in CACO-2 cells (human colonic adenocarcinoma cells) and the exposure of active metabolites in monkeys have reached 3.2 times and 2.1 times that of Mnu Pewei, respectively.

In addition, pre-clinical studies have shown that ASC10-A has a strong cell anti-Amita variant virus (EC50 = 0.3 μm), Delta variant virus (EC50 = 0.5 μm) and wild-type virus (EC50 = 0.7 μm) Virus activity.

Industry insight:

According to incomplete statistics, there are currently more than 20 RDRP inhibitors in the global research and treatment of COVID-19, of which Mermorla's Monoderlavi is represented by Monoda. There are 5 new RDRP inhibitors on the market, and 2 are in III in III III Period clinical stage. In terms of research enterprises, Gilead, Roche, and domestic corporate songs and ritual pharmaceuticals, Koxing, Antaiwei, and China Resources Shuanghe are all actively deployed in this field.

Photo source: Kailai Yingxin

The Guilian Securities Research Report shows that Taking Pfizer's drugs as an example, if Pfizer authorized MPP to cover about 53%of people in 95 countries (estimated at the price of half of the original research), the original research covered 47%of the people ($ 530/treatment), the new crown was calculated, and the new crown was calculated. The potential market for small molecular drug treatment is 40 billion US dollars. If the toxicity of the subsequent virus strains increases, the proportion of patients with symptoms increases, or the spread is increased, and the market size may increase.

Company comment:

Ge Li Pharmaceutical is the first biomedical company to use Hong Kong stocks 18A. At the time of listing, the issue price was HK $ 14/share. However, in the past many years, Ge Li Pharmaceutical has not achieved profitability. As of the closing on September 15, the stock price of Ge Li Pharmaceutical was HK $ 2.82/share.

Ge Li Pharmaceutical ’s 2021 annual report shows that there are three self -developed drugs that have been sold in the company, namely Lavidovir, Danorifir, and AIDS Denoviri hydrochloride, which are used to treat chronic hepatitis C. However, the three listed drugs did not make Ge Li Pharmaceutical's profit. In 2021, the company's revenue increased by 119.64%year -on -year, but the net profit still lost 199 million yuan.

Ge Li Pharmaceutical has not turned losses all year round. It is related to the market structure of its main drugs. At the end of 2019, multiple hepatitis C drugs from overseas pharmaceutical companies took the lead in cutting prices into medical insurance, and Dinorifer, the Geoli Pharmaceutical, negotiated the bureau. At the end of 2020, its medical insurance negotiation failed again. In 2021, the successful enrollment Song Li Pharmaceuticals faced the situation of competitors.

Therefore, although the company's revenue increased last year, it still failed to turn losses. In the first half of this year, the company's revenue increased by 4.6%year -on -year, the profit decreased by 20.6%year -on -year, and the loss was 87.98 million yuan.

It is worth mentioning that the performance growth of Ge Li Pharmaceuticals mainly comes from the agency sales business. Data show that the total revenue of Ge Li Pharmaceuticals in 2021 was 76.88 million yuan, an increase of 120%year -on -year. Among them, more than 90%of the income came from the proxy product Roche Paro Xin.

In the context of performance and stock price performance, Ge Li Pharmaceutical turned to the development of new crown drugs. In addition to the clinical ASC10, in April this year, Ge Li Pharmaceutical also announced a 3CLPRO inhibitor ASC11 anti -new coronary virus cell experimental data, but the clinical research progress of Ge Li Pharmaceutical has not been updated for the time being.

"Nuggets Innovation Pharmaceuticals" researcher believes that at present, Azfding, the real creature, has been approved to be listed. Clinical III stage. From the perspective of progress, Ge Li Pharmaceutical is not dominant. In August of this year, Wu Yifang, chairman of Fosun Pharmaceutical, said at the performance exchange meeting that Fosun Pharmaceutical will not completely build future growth on anti -new crown products. For Songli Pharmaceuticals, it is still essential to find drugs with sustainable development of market space.

2. Corning Jerry declared domestic first double anti -ADC clinical clinical results to reduce losses in the first half of this year

On August 16, CDE's official website showed that Corning Jerry (HK09966, HK $ 7.21, a market value of HK $ 6.8 billion) JSKN-003 declared clinical clinical in China (acceptance number: CXSL2200376). JSKN-003 is an ADC drug that targets HER2 dual-table. It just started Phase I clinical in August. JSKN003 is developed based on HER2 bilateral antibody KN026, targeting different table positions of HER2. Corning Jerry said that in order to accelerate the listing of the product, priority is given to the development of the end -of -line hydraphic tumor expressed in HER2.

Industry insight:

The fastest HER2 dual -resistant ADC in the world is ZW49 of Zymeworks, which is in the clinical stage. Like Corning Jerry, the company also has a rapidly advanced HER2 dual anti -ZW25, which is in the clinical period of clinical III.

Zymeworks's domestic partner is Baiji Shenzhou (SH688235, with a stock price of 95.81 yuan, and a market value of 129.1 billion yuan). The scope of cooperation between the two includes the exclusive rights of ZW25 and ZW49 in Asia (except Japan), Australia, New Zealand. The transaction amount is $ 40 million down payment and a milestone payment of no more than 390 million US dollars.

Overall, there are not many companies that have dual -resistant ADCs. At present, more concentrated in preclinical research. The two dual -resistant ADC projects carried out by GT BiPharma and MEDLMMUNE in the early days have been terminated for development due to toxicity and other issues.

Company comment:

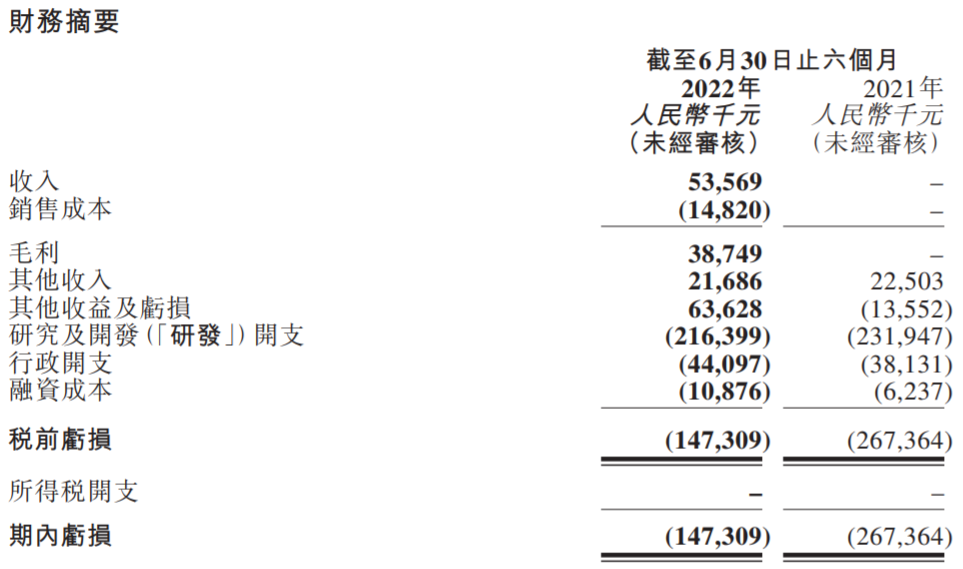

With the listing of differentiated PD-L1 products, Corning Jerry has entered the first year of commercialization. In the first half of this year, the company realized operating income of 53.569 million yuan, and gross profit was about 38.749 million yuan. During the reporting period, the company lost 147 million yuan, which narrowed a large extent, and R & D expenditure was 216 million yuan.

Photo Source: Company Semi -annual Report Screenshot

Ping An Securities said that as of now, Envolimu is applied to more than 10,000 patients. In order to further expand the indications, the company is currently carrying out the clinical trial of registered III for biliary cancer, as well as the clinical clinical of the combined Lenitinib for second-line therapy MSI-H/DMMR endometrium cancer. At the same time, the clinical clinical clinical of soft tissue sarcoma adapted by overseas and partners is also promoted in an orderly manner.

Fist product KN046 has launched 4 registered clinical clinical in China, which are the combined chemotherapy first-line treatment of advanced squamous non-small cell lung cancer phase clinical (patient admission group), and combined with Lennibinib for PD-L1 treatment of non-small cells after treatment of non-small cells. Phase III clinical (in dose exploration phase), combined chemotherapy first -line therapy for pancreatic cancer III clinical (completion of more than 50%of patients), and single -drug treatment of phase registered clinical clinical clinical. The company is expected to submit KN046 to the CDE to treat KN046 to treat two listing applications for scale non -small cell lung cancer and pancreatic cancer.

The International Research Report of Jiaotong International shows that the OS data of KN046 combined with chemotherapy to treat NSCLC's OS data can maintain its advantages.

"Nuggets Innovation Pharmaceutical" researcher believes that with Corning Jerer's first drug listing, the company has also entered the positive cycle of commercial income. However, the income of a product alone cannot support the company's long -term R & D investment. In August last year, Corning Jerry and Stone Medicine Group reached a license agreement for KN026. Corning Jerry will receive 1.5 -headed payment and milestone costs of no more than 450 million. The transaction can be said to be one of the typical cases of BIOTECH companies in advance in the context of domestic innovative drugs "inner volume". In the pipelines that are more promising and differentiated and more uncertain, enterprises also have more "bullets" response.

Daily Economic News

- END -

Medical insurance directory adjustment is about to start!Focus on rare diseases and children's

Source: CCTV News ClientThe copyright belongs to the original author, if there is any infringement, please contact it in timeOn the 13th, the State Medical Insurance Bureau issued an announcement that

Summer is coming, be careful of bacterial dysentery

The weather is hot in summer, and various pathogenic bacteria are active, and bact...