Five of the seven main subsidiaries lost money, and Huida bathroom performance changed face

Author:China News Weekly Time:2022.09.10

Huida Sanitary Smart Home Performance

More reflection and hard work need

As a ceramic sanitary company that has been established for nearly 40 years, Huida Sanitary Ware has continuously extended its business tentacles in multiple sales space, but the latest performance data shows that the development of Huida bathroom seems to be a fire and even more.

A few days ago, Huida Sanitary Ware released the 2022 semi -annual report. It achieved operating income of 1.726 billion yuan in the first half of the year, a year -on -year decrease of 1.01%; the net profit attributable to shareholders of listed companies was 068 million yuan, a year -on -year decrease of 39.21%; The net profit of non -recurring profit and loss was 0.50 million yuan, a year -on -year decrease of 44.78%.

China News Weekly recently visited three home experience stores, and found that the products of Huida Sanitary Ware basically set up areas in the area, and there were not many consumers who purchased.

The designer of a home experience store told China News Weekly that although the Huida Sanitary Ware has increased its layout in various channels in recent years, such as attracting consumers through practical display in multiple home stores, the product strength of Huida bathrooms It takes time to get greater recognition.

Multiple indicators fell sharply

Data show that the operating income and net profit of Huida Sanitary Ware in the first half of the year were declining, and the decline in net profit was far greater than the decline in operating income.

The Huida Sanitary Ware was founded in 1982 and has been in 40 years. As an old -fashioned ceramic company, Wetda Sanitary Ware has continued the momentum of increasing income from increasing income since 2020. In 2020, Huida bathroom revenue was 3.218 billion yuan, an increase of 0.2%year -on -year, and the net profit attributable to shareholders of listed companies was 307 million yuan, a year -on -year decrease of 7%; in 2020, the Huida bathroom revenue was 3.893 billion yuan, a year -on -year increase of 21% The net profit attributable to shareholders of listed companies has further declined, only 235 million yuan, a year -on -year decrease of 23%. In contrast, the momentum of its decline in operating performance this year is even more obvious.

From the perspective of revenue changes, the retail channel revenue of nearly half of the river sanitary ware business has 783 million yuan, a year -on -year decrease of 13%, and the proportion of all revenue has decreased from 52%in 2021 to 46%, thereby lowering the lowering, which lowered it, which was lowered. Its overall revenue performance.

Another ceramic bathroom listed company Emperor Oujia also ushered in a bleak semi -annual report. A few days ago, Dio Home announced that the operating income in the first half of the year was 1.999 billion yuan, a year -on -year decrease of 36.12%; of which the tile business achieved revenue of 1.606 billion yuan, a year -on -year decrease of 41.15%; the bathroom business achieved revenue of 327 million yuan, a year -on -year decrease of 1.48%.

At the same time, Emou Home Furnishing has also changed from a profit in 2021 to a loss. In the first half of 2022, the net loss of Emperor home belonging to shareholders of listed companies was 249 million yuan. The net loss belonging to the shareholders of listed companies to deduct non -recurring profit and loss was 263 million yuan.

The semi -annual report released by Dongpeng Holdings recently showed that its revenue in the first half of the year was 3.132 billion yuan, a year -on -year decrease of 13.61%; net profit was 118 million yuan, a year -on -year decrease of 69.45%.

The National Bureau of Statistics recently announced that from January to July this year, the retail sales of furniture products were 86.4 billion yuan, a year -on -year decrease of 8.6%.

Hou Wenquan, vice chairman and secretary -general of the China Ceramics Industry Association, told China News Weekly that the decline in the home industry is mainly affected by multiple factors. First, the multi -point exudation of the epidemic has caused great pressure on the multiple links of the industry, including the right right, including the right pair Production and circulation have formed a certain impact and inhibit the momentum of economic growth, leading to insufficient consumption confidence; the second is that as the real estate industry enters the downward cycle, the overall space of home consumption has declined.

The staff of Huida Sanitary Ware told China News Weekly that this year, due to the control factors of the epidemic, the factory was unable to start work, and some factories could not be produced for 2 months. The production capacity was limited and revenue declined.

Regarding the sharp decline in net profit, the above -mentioned Wetda sanitary staff said that the prices of natural gas rose sharply, and production costs rose, which led to a decline in gross profit margin.

The subsidiary has a discharge of losses

According to the Hida Sanitary Wallet, five subsidiaries among the seven main subsidiaries of Weda Sanitary Ware, in the first half of the year, they were in a loss state.

Among them, the operating income of the subsidiary Tangshan Els Sanitary Co., Ltd. was 23.586 million yuan, a loss of 1.49 million; Tangshan Huida Smart Kitchen and Households Technology Co., Ltd.'s operating income was 70.48 million yuan, with a loss of 2.632 million yuan; Beijing Huida Shiyan Network Technology Co., Ltd. The company's operating income was 64.35 million yuan, and the loss was 2.108 million yuan; the operating income of Huida Smart Home (Chongqing) Co., Ltd. was 96.23 million yuan, a loss of 6.239 million yuan; the operating income of Huida Housing Industry Equipment (Tangshan) Co., Ltd. 10,000 yuan.

The operating income of the above five subsidiaries was 320 million yuan, a total loss of 15.766 million yuan.

In addition, two other subsidiaries are in a profitable state, including Tangshan Huida (Group) Limited Company's operating income of 198 million yuan and net profit of 1.267 million yuan; The profit is 370,000 yuan.

On the whole, the total operating income of these 7 main subsidiaries was nearly 550 million yuan, and the total net profit was 14.13 million yuan.

Judging from the Huida Sweet Integration Merchants and the Mother Companies, the performance of these seven subsidiaries is the main merger data other than Huida Soning parent company.

Deng Chaoling, chief researcher of large materials research, told China News Weekly that there is a loss of the main subsidiaries of Huida Sanitary Ware, such as the operating income of Huida Smart Home (Chongqing) Co., Ltd. They all have a large loss, which affects the overall performance. However, from multiple indicators, the performance of Huida bathroom's performance has exceeded the overall performance change.

In 2021, the gross profit margin of Hardware Sanitary Ware products under the Sanitary Ware Sanitary Ware has reached 35.43%, the highest gross profit margin among all segmented products, which was 31%higher than the overall gross profit margin of Huida in 2021. As an important subsidiary of the production and sales of hardware sanitary ware, the subsidiary Tangshan Huida (Group) Limited Company was 498 million yuan in 2021, accounting for 93%of the operating income of Huida Sanitary Hardware Sanitary Ware, and its net profit It was 16.758 million yuan, and the net interest rate was 3.4%.

However, in the first half of 2022, Huida Sanitary Ware operating income was 198 million yuan, net profit was 1.267 million yuan, and the net interest rate was only sixths of thousands, and a significant decline in declined.

China News Weekly further called the Huida Sanitary Ware. The above -mentioned Huida bathroom staff said that it was mainly due to the rise in production costs such as fuel.

A senior registered accountant told China News Weekly that the above -mentioned performance changes usually means that the business environment of the subsidiary has undergone major changes. Of course, because the information involved in the subsidiary in the financial report of the listed company is not clear Know.

Smart home performance is not cheerful

In recent years, smart bathrooms have become a new consumer in the home industry. Various capitals are also investing in a lot, and Huida Sanitary Ware has also increased its layout.

In 2019, Huida Sanitary Ware Company Huida Smart Home (Chongqing) Co., Ltd. began construction. Its main business direction is to develop, produce and sell smart home supplies and accessories, smart toilet and accessories.

In 2021, Huida Smart Home (Chongqing) Co., Ltd. began to put into operation. However, in that year, its operating income was 115 million yuan, with a loss of 28.82 million yuan. In the semi -annual report of 2021, Huida Sanitary Ware said that the Smart Home (Chongqing) was put into trial production for the loss of Huida Smart Home (Chongqing) Co., Ltd., and the trial production period was high and the business loss was formed.

By 2022, Huida Smart Home (Chongqing) Co., Ltd. is still in a state of losses. Its operating income in the first half of the year was 9.623 million yuan, and a loss of 6.239 million yuan occurred, becoming a subsidiary with the most losses.

Another subsidiary, Tangshan Huida Smart Kitchen and Train Technology Co., Ltd., a subsidiary involved in smart homes, has a operating income of 70.48 million yuan in the first half of 2022 and a loss of 2.632 million yuan. In the first half of 2021, the company's operating income was 85.05 million yuan, net profit 457,000 yuan. The revenue and profits of Tangshan Huida Intelligent Kitchen and Training Technology Co., Ltd. have declined.

Tangshan Huimi Smart Home Technology Co., Ltd. is an important subsidiary of the smart home business of Huida Sanitary Ware. Its main business includes smart toilet and accessories, ceramic bathroom products, hardware products and accessories, smart home supplies and accessories. And sales, its business scale also shows a atrophic momentum.

In the first half of 2021, Tangshan Huimi Smart Home Technology Co., Ltd.'s operating income was 34.64 million yuan, net profit was 1.15 million yuan, and net interest rate was 3.3%; Yuan, the net profit margin fell sharply, only 1%.

On the whole, Huida Sanitary Smart Home has a bad performance, which is very different from the current hot sales of smart home sales.

During 618 this year, the turnover of multiple smart products on the Jingdong platform increased significantly year -on -year. Among them, the transaction turnover of smart shower increased by 200%year -on -year; the turnover of the old toilet increased by more than 5 times year -on -year; ; Antibacterial toilet and antibacterial seam transaction turnover increased by 150%year -on -year. Jiu Mu and Arrow has exceeded 100 million turnover; the turnover of multiple brands such as Hengjie, Kohler, and TOTO exceeded 10 million.

Deng Chaoming said that in the ceramic bathroom industry, there are many players, such as Hengjie, Jiu Mu, Wriggery, Kohler, TOTO, etc., the industry's competitive pressure is very high. In order to stand out from the fierce competition, the Huida bathroom has to make more efforts.

It is not advisable to miss the opportunity of industry change

A few years ago, I went to Japan to buy a "smart toilet cover". With the acceleration of domestic aging, the upgrading of consumer structure, and the change of intelligent industry technology, smart bathrooms have become more and more highlights in the domestic consumption field.

According to Ai Media Consultation data, the total expenditure of global smart homes including equipment, systems and service consumption in 2018 is close to 96 billion US dollars, and the annual compound growth rate of 10%in the next five years (2018-2023) will be 10%. The annual increase will increase to $ 155 billion.

The above data also shows that the global home market size has shown a trend of fluctuations in 2010-2025. In 2021, the global home market size was 496.2 billion US dollars, a year -on -year growth rate of 9.7%. It is expected that the market size of global home furnishings will continue to grow in the next four years, but its growth rate has remained at about 3%.

Hou Wenquan told China News Weekly that with the continuous growth of the economy and the release of second -hand housing decoration demand, consumers in the home market still have a large base. Especially with the development of smart information technology and the healthy interaction of smart home consumption demands, the smart home consumer market still has greater potential. Ai Media Consulting analysts believe that in the process of rising overall market size, with the increase of enterprises, competition among brands will inevitably increase.

In fact, in recent years, the Huida bathroom has also continued to make changes.

On the one hand, Huida Sanitary Ware has continuously expanded marketing channels, including increasing the layout of third- and fourth -tier cities and increasing its efforts to deploy foreign markets. On the other hand, Huida Sanitary Ware has also continued to increase research and development investment in recent years.

As of the first half of 2022, the total number of specialty stores in Huida Sanitary Ware was 2056, of which the total number of first- and second -tier cities was 454, and the total number of third- and fourth -tier cities was 1,602, which was 3.5 times that of the number of first- and second -tier cities.

Judging from the first half of this year, the revenue of its engineering channels was 440 million yuan, an increase of 4.38%year -on -year; foreign sales of 477 million yuan, an increase of 17.37%year -on -year.

In this regard, Huida Sanitary staff told China News Weekly that there was a certain gap in third- and fourth -tier cities and foreign markets, and the competition was not so fierce. Wetda Sanitary Ware hopes to find more footholds.

Deng Chaoming said that from the perspective of channels, after completing the layout of the outlets in third- and fourth -tier cities, the performance of Huida bathroom stores has become a key. It is necessary to use multiple marketing activities strategies to expand the scale of retail. In addition, on the basis of dealers' retail channels, we must continuously open the situation of decoration companies, e -commerce and other situations to achieve total amount.

Hou Wenquan said that high -quality development is the future direction of the home industry. Enterprises must truly implement high -quality development in terms of product quality and brand in order to truly stand.

Deng Chaoming believes that for Huida Sanitary Ware, its brand positioning needs to be further clarified, and the brand image must be renovated. It is necessary to keep up with the current trend aesthetic and demand changes. Especially to seize the tide of smart bathrooms, it is not advisable to lose this extremely critical industry change opportunity.

As a 40 -year -old ceramic bathroom company, Huida Sanitary Ware has a lot of resources, and there are many growth points. Huida bathroom needs more exploration.

Author: Liu Debing [email protected]

Edit: Li Zhiquan

Operation editor: Wang Lin

- END -

How to pass the whole house intelligence through the "Second Kan'er"

Consumers bitter chicken rib smart home products for a long time.Author/Produced/N...

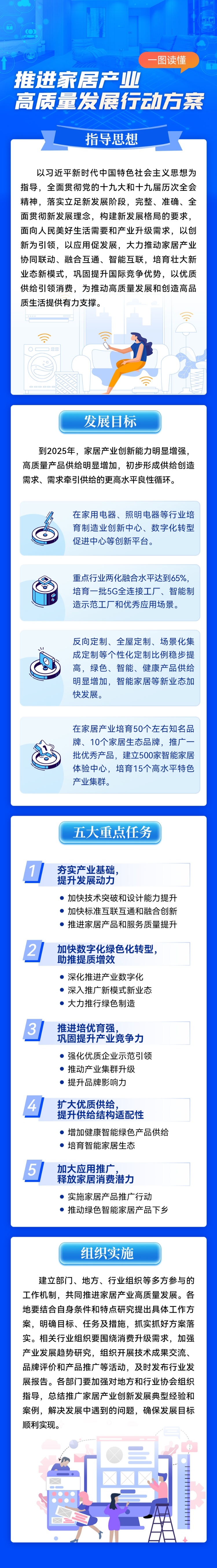

The four departments have issued the "Program for Promoting High -quality Development Action of the Home Furnishing Industry"

On the 8th, the General Office of the General Office of the General Office of the ...