The US 13 states have identified the subsidy of school assistance as "accidental wealth", and the beneficiaries may face taxation

Author:Global Times Time:2022.08.31

[Global Times Comprehensive Report] "How to tax on -school loans?" According to the US "Forbes" magazine reported on the 29th, due to different local tax systems, 13 states in the country will be identified as "unexpected wealth", related to the relevant local tax system. Benefiting people may face taxation.

It is reported that on the 24th of this month, the US President Biden announced the reduction of new measures for student loans, which provided the largest scale reduction and exemption in the country's history for low -income borrowers. For example, individuals with an annual income of less than $ 125,000 will be exempted from $ 10,000 for student loans, and those who receive Perid (winners generally come from low -income families with difficulties in economy) will be exempted from $ 20,000 loans.

Biden Data Map

The tax system in some US states will automatically follow up the federal government, eligible for reducing and exemption lenders without paying taxes. However, if 13 states do not modify the tax system urgently, they will be subsidized as the "unexpected financial" of the loan person, so a certain income tax must be paid. If the student loan bear by the public is reduced by $ 10,000, the Hawaiian government may levy $ 1100 taxpers for applicants, the highest among 13 states, the minimum Pennsylvania is 300 US dollars, and the rest are between 500 and 700 US dollars. If it is a loan of 20,000 US dollars, the tax to pay is likely to double. This incident caused controversy in public opinion, and some netizens said, "This is too ridiculous!"

- END -

American Intelligence Institution: U.S. -Chinese or monitored to communicate with Chinese relatives and relatives

Jimu News reporter Zhang YangAccording to a report from the Associated Press on Ju...

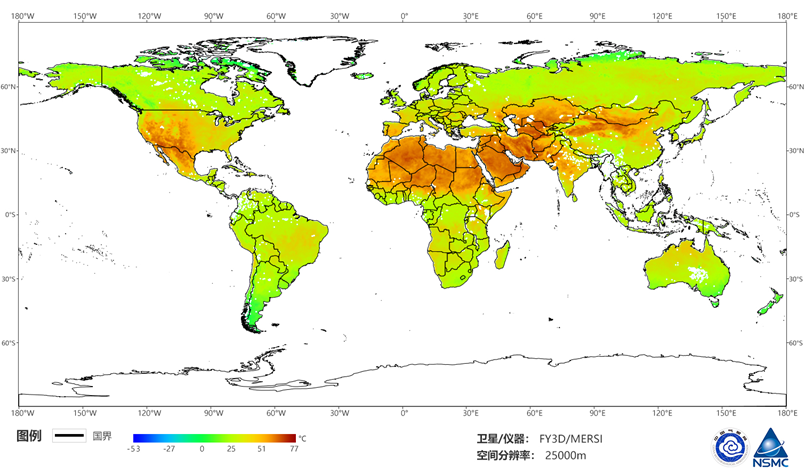

How hot is this summer?Meteorological satellite tells you!

Since June this yearFrequent high temperature events in the worldHigh -temperature...