India's richest man has a super -LV owner, ranking among the third richest people in the world, and was accused of "close" relationship with the Indian Prime Minister.

Author:Red Star News Time:2022.08.31

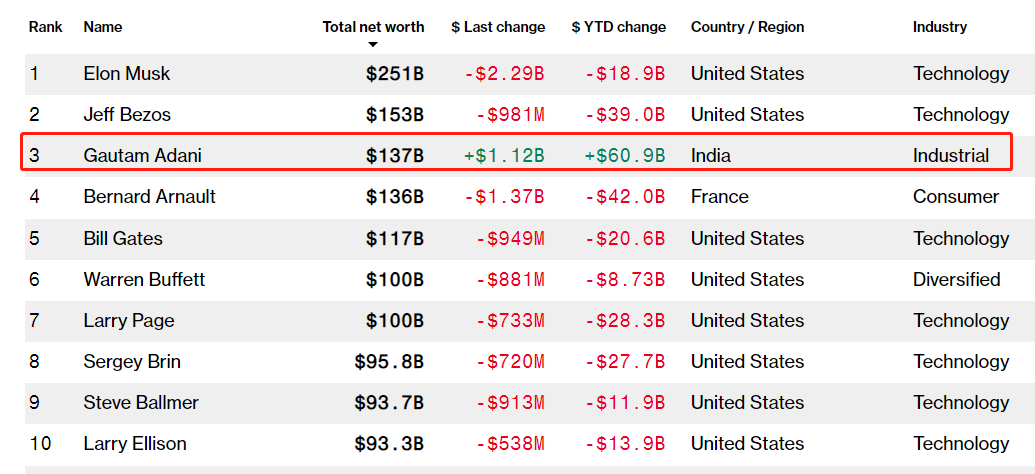

On August 30, the "Bloomberg Billionaire Index Ranking" showed that India's richest man Gutam Adoni has surpassed the French luxury giant Lu Weixuan Xuan Group (LVMH) Chairman Berned Alino, becoming the world's number one Three rich people.

↑ Gaunta Adi

According to reports, this is the first time in the history of the rich in Asia to rank among the top three in the global rich list. Ada, 60, is currently about $ 137.4 billion in net assets, second only to Tesla CEO Elon Musk and Amazon founder Jeff Bezos.

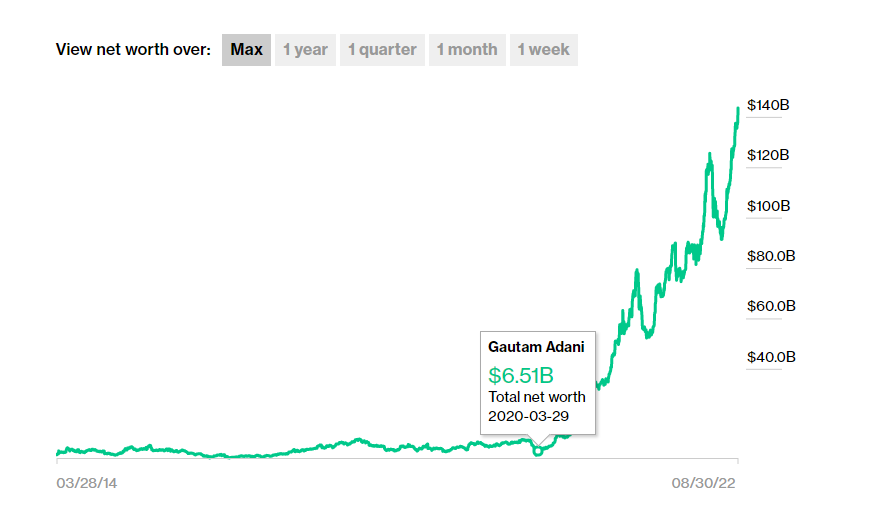

Thanks to the surge in the price of commodities in the new crown epidemic and the conflict between the Russian and Ukraine, Ada, who is only $ 6.5 billion in net worth of wealth in 2020, has now been sitting at US $ 137.4 billion, which has fallen 21 times in two years, of which 61 billion U.S. dollars have grown in growth. It was achieved in the first eight months of this year.

Started with coal mines and ports

And Indian Prime Minister is "fellow"

Gauntam Adoni was born in 1962. His father was a small local textile dealer in India. In 1988, Adiden, who studied business at the University of Gujarat, chose to drop out of school and became a diamond sorting worker in Mumbai. Soon after, he switched to a diamond trade, and earned the "first bucket of gold" in life in just one year.

Subsequently, Adi returned to his hometown of Gujarat, and established Adani Exports LTD, the predecessor of Adani Group in 1988. In 2008, Adi became a billionaire.

↑ Ada and his family

In recent years, Adi has been committed to the diversification of business. He expanded a commercial empire centered on port and coal mine mining to airports, data centers, cement and green energy fields, and its market value has increased by more than 10 times in the past three years.

Today, the proportion of Adida Group in Indian coal imports has exceeded one -third. The surge in coal demand has made it a lot of money for several months. The Group also has a market controversy, Australia's largest coal mine, which has also helped it as a representative of a global large coal company. However, this coal mine is facing a lot of criticisms on the environmental impact on the Great Barrier Reef and the use of billions of liters per year.

Last year, Adini promised to invest 70 billion US dollars in the field of green energy to become the world's largest renewable energy producer. Today, Adidan Green Energy Co., Ltd. has also become the most golden "cash cow" in the Adidani business empire. In addition, Adidan Group also has India's largest private port and airport operator.

According to reports, Ada's Group currently has a total of 7 listed companies with a total market value of about 220 billion US dollars. Adida himself is the chairman, his wife, brother, two sons, and several nephews hold different positions in the group. The Adida family has 75%of the entire group's equity.

↑ Ada and Modi are also from Gujarat, and have many years of "close relationships"

However, some critics believe that Adida benefits from his "close relationship" with Indian Prime Minister Modi. According to reports, the two also came from Gujarat, and Adiden was a supporter of Modi, then the chief minister of Gujarat in 2003. When Modi participated in the campaign in 2014, Adini lent him his private jet to him.

↑ In 2014, Modi used the Ada's private plane during the campaign

In 2018, when six Indian airports were waiting for privatization, Modi relaxed that companies with no airport operation experience were allowed to bid. The Adida Group bought all 6 airports in one breath to become India's largest airport operator.

The stock price of energy companies in the name is soaring

Value has soared 6.1 billion US dollars since this year

Like Musk and Bezos and other global billionaires, Adidan's wealth has soared during the new crown epidemic, and it showed index growth. In 2020, its personal wealth value was only $ 6.5 billion, and now it is US $ 137.4 billion, that is, the increase in two years is as high as 21 times. Among them, 61 billion US dollars have been earned in 8 months since this year.

↑ In 2020, the net value of Adida's personal wealth was $ 6.5 billion

One of the reasons for Adiden's skyrocketing value is reported to be related to the rapid expansion of its commercial empire. Since the beginning of 2020, Adani Enterprise and Adani Green Energy LTD. shares have soared by more than 1300%. Adani Total Gas LTD. has increased by about 1900%, Adani Transmission LTD. stock price rose 900%, while the BSE Sensex index increased by 42%at the same period.

As the market value of many companies under Adidin increased, his personal wealth has also skyrocketed this year by $ 61 billion. In February of this year, Adini surpassed Indian tycoon Muksh Ambani and became the richest man in Asia. Benefiting from the sharp surge in global natural gas, coal use and price, Ada's wealth has recently increased amazing.

On July 21, Adiden's value was estimated to be $ 112.5 billion. 40 days later, his value rose to $ 137.4 billion. According to reports, last month, he just surpassed Bill Gates to the fourth place in the global rich list. After the wealth surged significantly this week, he surpassed Bernard Alo, chairman of the French luxury giant Lu Weixuan Group (LVMH) for $ 137.4 billion yesterday, became the third largest rich in the world, only The second only to Tesla CEO Elon Musk and Amazon founder Jeff Bezos. ↑ According to the global rich list announced by Bloomberg, Adida has surpassed Bernard Alo, chairman of the French luxury giant Lu Weixuan Group (LVMH), becoming the third largest rich in the world

In contrast, Alo's personal wealth has evaporated $ 42 billion to $ 136 billion this year. Not only Arnold, but except for Adina, all the wealthy people in the top ten rich people in the Bloomberg billionaire index have declined this year.

Analysis agency: Group "excessive leverage"

Adida "Business Empire" may face the risk of breach of contract

As the value skyrocketed, Adi also began to "improve his popularity in other ways" in India. Last week, Adi announced a malicious acquisition of New Delhi TV (NDTV), which caused a stir.

↑ On February 23, 2012, the chairman of Adida Group Gaunt Adidanon announced the company's new global corporate brand logo and logo at a press conference.

In a statement of AMG Media Network, a subsidiary of Adi Group, saying that by acquiring the holding of a major shareholder of New Delhi TV, the company has obtained 29%of the shares of New Delhi TV, and the acquisition amount has not been disclosed. The documents submitted to the Ada Group to the Mumbai Stock Exchange showed that the company also launched an offer to NDTV shareholders to acquire another 26%of the TV station at the price of $ 61.77 million.

In this regard, the founder and sponsor of NDTV said in a statement that Adida acquired 29%of the company's shares without any "discussion, consent or notice".

However, just when the Adidin Group entered the media business, the rapid expansion of its debt -based driving force has aroused concerns from the outside world. On August 23, Creditsights, a credit research institution of Fitch, issued a warning saying that Ada's commercial empire liabilities were over -default and risks of breach of contract.

According to the report, the Ada Group's expansion in recent years has put pressure on its credit indicators and cash flows. According to the report, the Adida Group has continued to invest in existing and new businesses through debt financing. Among them, there are many "new and unrelated high capital -intensive businesses", which has led to the group in a "serious excessive leverage" situation.

In the worst case, the Adida Group may fall into a debt trap and may default. The agency wrote, "We have hardly seen signs of injecting equity capital into the group company into the group company. We believe that this is necessary for the leverage ratio on the balance sheet that reduce liabilities." In addition, the group's group The fierce competition in which the faithful industry of the former richest man, the first richest man, has made a "light financial decision" to achieve the leading position of the market.

It is also reported that "severe excessive leverage" has also limited the attractiveness of Adida Group to investors. Many of the top investment institutions in India and Wall Street choose to keep a distance from the projects under the Adidan Group, partly because the valuation is too high. " Refinitiv data shows that the historical price -earnings ratios of the four largest companies in Adi are between 260 and 725 times.

However, Creditsights analysts said that the "close relationship" of Adida Group and the bank and the Modi government made them "please". The report wrote that its founder and the Modi government were "close relationships" and benefited from the "policy direction".

Red Star News reporter Xu Hui

Editor Guan Li Guo Yu

- END -

Latest developments: The Russian Air Force hit Donetsk a zinc factory Ukraine said that the Russian army continued to attack in all directions

Xinhua News Agency, Beijing, June 25th. Comprehensive Xinhua News Agency reporters reported that the Russian Ministry of Defense spokesman Konashenkov said on the 25th that the Russian Air Force used

Extreme heat wave swept the northern hemisphere. Why is the European and American wild fire so frequently?

Jimu Journalist Sun Yan Chen XiCorrespondent Zhao HuiIntern Zeng ZhengRecently, ma...