When the balance sheet does not want to struggle anymore

Author:Positive business reference Time:2022.06.26

Reference.

BY Zhengshang Reference (WeChat's best financial reading, passing political and economic information from a professional perspective, in-depth interpretation of financial news, here you can understand more real China) WeChat: ZSNC-OK

Author: Boss Dai

Source: Yuanchuan Research Institute (ID: Caijingyanjiu)

As a reference object of "crossing the river", Japan is a stone that has been touched.

After the war, Japan is a set of exercises full of answers, which include high -scoring experience in industrial rise, cultural output, basic science, income distribution and other aspects, as well as wrong lessons related to real estate bubbles, population decline, and monetary policy. Essence For East Asian countries with high paths, the value of mirrorbook is obvious.

Everyone can find a topic on Japan -ministerial officials like to study Japanese industrial policies, wild state teachers are keen to talk about square agreement and financial defeat, science and technology observers focus on interpreting the road of semiconductor and automobiles. The number and seeds, while talking about the 20 years of losing.

But after being put under a microscope for so many years, Japan still has too many mysteries. For example, why is Japan a judgment of two countries around 1990?

WWE walked into Tokyo, 1990s

In detail, many countries will encounter a real estate collapse or financial crisis, but basically they can climb out of the deep pit through currency and fiscal means. Just like entering the time of the sage, how many times the boiling water does not work.

Before 1990, Japan was a country full of chicken blood. The "Watanabe Mrs. Watanabe" of the husband and husband could let Wall Street avoid three points; They all fiddled again, but still could not effectively stimulate the economy, and eventually made the decline over 15 years.

Not only is the economy lying flat, but entrepreneurs seem to lose their energy. Before 1990, Matsushita Xingzhizu, Sheng Tian Zhaofu and others enjoyed a fame in the world, but after that, Japan rarely gave birth to world -class brands and entrepreneurs -among the top 100 global brands in Forbes, the youngest Japanese brand is Uniqlo. In 1984.

Japan's basic science strength is strong. Since 2001, 20 Nobel Prizes have been won, but on the other hand, Japan has missed the Internet and new energy wave of the past 20 years -Japan's largest Internet company name is Rakuten The market value is only 9 billion US dollars. How many people know what it is doing?

For the mystery of Japan, Western economists, including Paul Krugman, have given many explanations, such as aging population, economic structural issues, bank zombies, fiscal stimuli, too high government debt, etc. Zheye said.

In the end, this question probably made it clear that it was a Taiwanese named Gu Chaoming.

01

Gu Chaoming

Gu Chaoming was born in 1954. He was 50 years older than him, Lin Yifu and Lang Xianping, who were also people in Taiwan. The former was 2 years younger than him, and the latter was 2 years younger than him.

However, compared with the two peers who have served in the Kinmen Army, Gu Chaoming's origin was even more prominent. His family was a Lukang Gu family, one of the five major families in Taiwan. This is a blue -green family. Guo Kuanmin, who has not only presided over the "Wang Gu's talks", but also produced the gold master of the DPP, the father of Gu Chaoming.

Gu Zhenfu and Gu Kuanmin are brothers of the same father, but the two are strangers because of their political tendencies. Gu Kuanmin fled to Taiwan because of the "228 incident". In 1949, he met Gu Chaoming's mother Cai Guoyi in Shanghai in 1949 and moved to Japan. He was allowed to return to Taiwan in the 1970s. Essence

Despite the complex history of the family, Gu Chaoming's life trajectory did not interact with Taiwan. He was born in Kobe, Japan, immigrated to the United States with his mother 13 years later, and graduated from Berkeley, California in 1976. In 1979, the captain Lian Lin Yifu hugged the basketball to Xiamen, Gu Chaoming, who was already an American, was studying for a PhD in economics in Johns Hopkins.

After graduating in 1981, Gu Chaoming entered the work of the New York Federal Reserve Bank of the Monetary Bank of New York. The starting point was quite high. In 1984, he returned to Japan. As the first foreign researcher, he joined Japan's largest securities company wild village and went up all the way. In 1997, he became the chief economist of Nomura Institute of Comprehensive Research.

Gu Chaoming was sought after in Japan. From 1995 to 1997, Gu Chaoming ranked first among the "100 Japanese Economist Rankings" organized by the Nikkei News for three consecutive years. First, provide policy suggestions to several Japanese Prime Minister.

You want to say that he is Wu Jinglian in Japan, that is overestimated him; you want to say that he is Lin Yifu, Japan, and may be comparable; but if you want to say that he is Japan's Lang Xianping, that is insulting people.

In private, Gu Chaoming's biggest hobby is to make a military aircraft model and publish a 276 -page German World War II model album. He is very fluent in Japanese and English, but he does not speak Put your call or Minnan. In 2014, the author heard Gu Chaoming's speech in Lujiazui in 2014. He opened his apology for himself. Gu Chaoming was talking, 2014

By the end of the 1990s, Japan's 10 -year decline caused widespread attention, and economists surged. You must know that the study of recession, depression and financial crisis has always been a macroeconomic "explicit learning", because any research results with policy value can bring huge public welfare and can change hundreds of millions of people's lives.

Therefore, the research on Great Depression is called "the Holy Economics Grail of Macroeconomics" like the anti -cancer in medicine.

For example, in the Great Depression in the United States in 1929, people first thought that this was caused by excessive speculation and the collapse of the stock market. The book "Book, let people only remember the greed of Wall Street and the ignorance of the crowds.

But by 1963, the Nobel Prize winner Milton Friedman gave the conclusion that "the enemy in the instinct temple": there may be many direct fuse of the collapse in 1929, but the Federal Reserve's wrong monetary policy (not in time), is the is the is the only one). The culprit for the United States into the Great Depression. This conclusion was later gradually recognized.

In 2002, the Federal Reserve President Bernanke attended Milton Friedman's 90th birthday banquet. It said directly: "You are right about Great Depression, and the Federal Reserve is wrong." This made Friedman further seal God.

Therefore, the big decline in Japan will inevitably be one of the "Holy Grails" of the Macroeconomics Session, and the situation in Japan is too charming: the government has stimulated the economy crazy, guided interest rates to zero, debt leverage is the highest in the world, but what they have received, It is zero -economic growth and austerity. Who can explain this phenomenon, who can leave the name of the history.

Gu Chaoming, who ranked first on the list of various economists in Japan, naturally would not be idle. After publishing several work papers sporadic, Gu Chaoming published the book "Asset and Liabilities Fack of Liabilities in 2003: Japan's Struggle in Economic Lost and its global influence". This concept.

This novel word may not be able to explain Japan 100%, but it does bring a set of almost completely different perspectives.

02

Great decline

The core essential of the "balance sheet decline" is not complicated at all.

To put it simply, the dying of Japanese bubbles has led to a sharp decline in asset prices, allowing a large number of companies and families to "technical bankruptcy". What is "technical bankruptcy" is that Japanese companies purchase high -priced assets when the bubble peaks are peak. If the asset -liability statement is revenue at the falling price, many companies are actually not credible.

What are the measures taken by the Japanese? It is silently earning money to pay debts. Although Japanese companies have deteriorated their balance sheets, their product competitiveness is still there, and they can still generate profit cash flow. However, these profits are not used to expand their reproduction, but to repay debts. How can the economy not shrinking under this method of engagement?

Furthermore, a fundamental change has undergone a "sea" of Japanese companies and individuals -no longer pursuing the maximum profit, but the pursuit of the minimum liability. Regardless of how much currency stimulus is, the company has no demand for reappearance at all, and the willingness to loan is seriously insufficient. This explains why monetary policy has no effect.

In 1988, 2.5%of the low interest rates could directly give birth to asset bubbles, but by 1993, the same 2.5%interest rate did not produce any stimulus, and even dropped to zero interest rates. The company was indifferent and did not borrow money. Throughout the 1990s, Japanese companies' net debts each year remained at hundreds of trillion yen.

This is completely different from the style of painting in the 1980s. A few years ago, the Japanese still wanted to buy the entire world. London and New York luxury stores were full of rich Japanese, and even ordinary working class, dare to buy a set of prices for 30 years comparable to New York. Apartments or households. After the entire national illness, everyone's expectations changed.

Haruki Murakami wrote in "Kafka by the Sea": You who escaped from the dust storm no longer you are no longer you who enter the sandstorm.

After calculating Gu Chaoming, it was found that the plunge in asset prices after 1989 caused Japan to lose 15 million yen of wealth, and the gap caused by enterprises and families for at least 15 years of net debt repayment. Then it eliminated the total demand equivalent to 20%of the total GDP, completely dragging Japan into the sludge of the depression.

Gu Chaoming wrote in the book "Big Turk": "Although for a single enterprise, debt repayment is correct and responsible, but when all companies begin to do this at the same time, they will cause serious synthesis errors ( Fallacy of composition. This panic is the so -called asset -liability statement decline. "

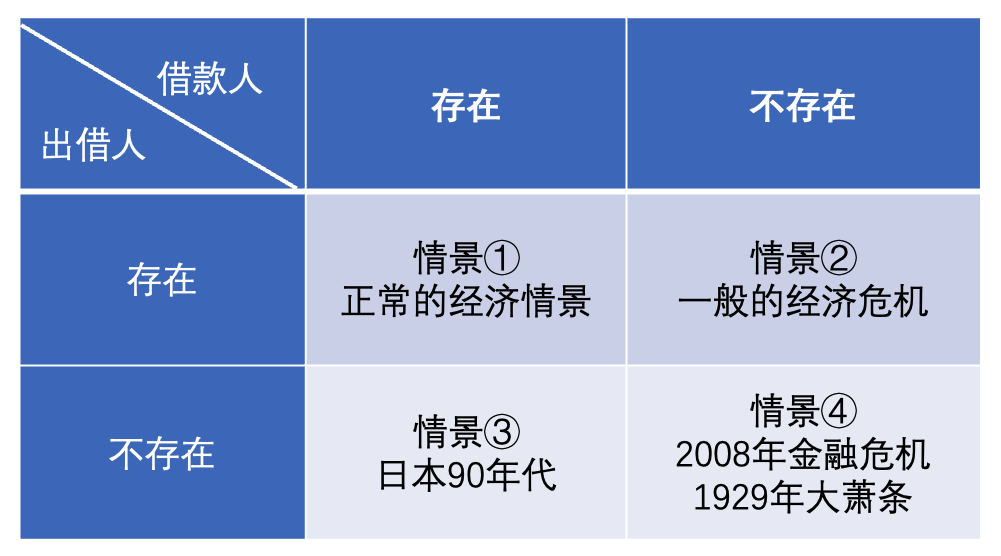

In the past, Western economists all assumed that the "demand party" of the currency exists forever (who would not want to borrow money), so only pay attention to the "supplier" of the currency, and the theory of Gu Chaoming first elaborated the "demand party" absence The scene (actually really unwilling to borrow money). Under this framework, the economy can be divided into four situations in the figure below: the scene ① and ② are the scenario existence of the "demand party". It is a world supplemented by Gu Chaoming. It is a world where the private sector is likely to lie flat and pursue the minimum debt. This world has always been ignored by mainstream.

If there is a crisis of scenario ②, the central bank becomes "the last lender", that is, the currency release; if the crisis of the scene ③ appears, the government will become the "last borrower", that is, the financial water release; For the central bank's currency to release water, and the government's finance is to release water, handed it to the right hand.

The antidote given by Gu Chaoming for the scene was actually made by the Japanese government -crazy financial stimulus.

Specifically, the Japanese government invests infrastructure through large -scale leverage and borrowed debts to invest in infrastructure to instead of inconsistent enterprises and residential departments to drive the economy. The direct result is that Japan's public debt/GDP is as high as 266%, which is almost the highest in the world. Three Chengdu with fiscal revenue is repaying the principal and interest.

The advantage of this approach is to maintain GDP and national living standards. Although economic growth cannot be stimulated, employment, benefits, foreign reserves, and low inflation can be maintained, and then the revenue re -distribution policy is used to lower the gap between the rich and the poor. Gini is Gini. The coefficient is less than 0.4 for a long time. In Gu Chaoming's view, this is a helpless choice, but it is the only correct choice.

Paste young people on the streets of Japan, 1980s

The theoretical premise of the decline of the balance sheet is that "a specific external impact will fundamentally change the behavior of the company or individual." As an economist, Gu Chaoming extracted statistics on the decline of the balance sheet, but this "specific" specific He did not analyze the impact "influence, after all, he was not a sociologist.

Therefore, the further problem is: when the "expansion desire" and "essence of qi" of enterprises and families are gone. Is it only macroeconomic data that is affected?

03

Unsolved bureau

There is a paragraph about Japan inside Apple.

In 1996, in order to expand the market, Apple tried to introduce Macintosh to the Japanese education system. Apple personally led the team from the then CEO Michael Spindler to lobby to the Ministry of Culture in Japan. After several demonstrations, the Minister of Education of Japan gave Spindler a brief answer in person: "No, thank you."

Michael Spindler was disappointed and asked Japanese colleagues, when can Apple be able to try again? The Japanese colleague pointed to the semi -circular floor pointer on the elevator, saying that you can see this floor indicator, which is used here in the 1960s. When the officials in the Ministry of Culture and the province replace it with a number, you can come again.

This paragraph may be a bit inspiring now, but back to 1996, who dares to predict that Japan will miss the software and the Internet?

Throughout the 1990s, the Japanese electronics industry was still like the sky. At that time, NHK even made a program, named "Electronics -Japan -Japan's Autobiography". It puts out Sony Panasonic and other companies, and was proud of the words. In principle, it seems difficult to extend the advantages of hardware to the software and the Internet.

However, the subsequent interpretation caused the global ICT industry observers to disappoint, and Japan's local Internet entrepreneurship and financing have always been tepid. By 2005, Ni Gloon Di, a well -known Internet investor and director of MIT, even warned Japan, "Don't be one of the unknown people in the digital age."

The reason why Japan missed the Internet is actually very simple: there are not many people who start a business, and they invest less money.

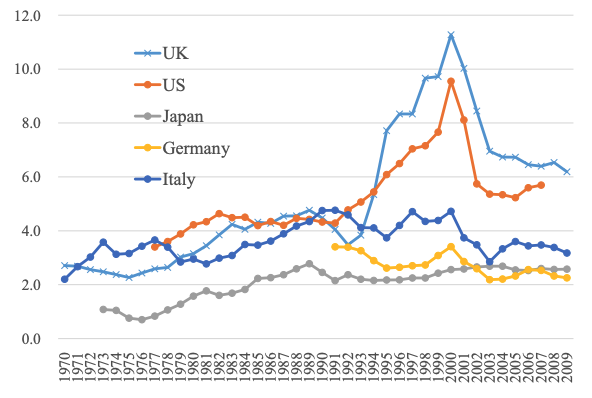

Many economists have done detailed calculations (Inklaar, Timmer, and Van ARK 2006, Fukao 2013): In the 1990s, the percentage of the US investment in ICT accounted for 4 times that of GDP, and Japan was not only lower than the United States, but also low, but also low. In the United Kingdom, Germany, Italy, basically the bottom of the G7 countries.

ICT investment accounts for GDP ratio, gray is Japan

And the only Internet company Rakuten (known as Amazon in Japan), the founder of Mika Hao Histo shared two secrets: one is a large number of foreign people, "the reason why Rakuten grows rapidly is that we hire foreign engineers"; The company must speak English on all occasions in 2012.

The case of the Internet industry is an example of the "balance sheet decline" that affects the industry: when companies do not want to expand their reproduction, how can they expect them to kill the blood in the new wave?

Human Resources Service Company RANDSTAD conducted a survey in 33 countries and regions. The results showed that 66.9%of the Japanese said that they did not have entrepreneurial willingness, ranking the penultimate ranking in 33 countries and regions; in addition, only 32%of Japan in Japan People say that "work in emerging enterprises" is also the first.

From 1991 to 2005, Japanese companies spent 15 years and finally repaired the balance sheet. But just after breathing, Japan suddenly found that its population was seriously aging, and globalization has shaped a group of young and rapidly rising opponents. In the words of Gu Chaoming: "Only out of the oil pan and entering the sea of fire again." In the end, Japanese society became a large -scale site with a "balance sheet decline" spread from enterprises to families, from families to individuals. The company uses reports to reflect the recession, while young people use mortgage, marriage, fertility and entrepreneurial passion -these their only assets -to respond to the "balance sheet decline".

The Japanese managers wrote in the book "Low Desire Society": "Japanese -especially those young people who have encountered economic downturn when they are sensible and now under 35 There is uneasy, I do not want to bear the loan heavy load. They have no response to interest rates and are nationals who are against Kanes' economic theory. "

The sub -standard title of the book "Low Desire Society" is called: the era of losing great ambitions.

For Japan, the last time window that can reorganize it is 1990-2000. The level of aging at that time is not too serious. The old industry advantages are still there. The new industry has not yet begun. The expansion willingness of enterprises and families can be saved by structured in -depth reforms. But in the end, Japan wasted for 10 years.

A "Water Margin", fortunately to surrender. Fortunately, it failed to give the antidote to save Japan, but it used a brand new perspective to show people the micro (enterprise and family) of the society lost energy. After that, what its macroeconomic and mid -view industry will worsen.

Every ethnic group that is getting old has a time window to save itself. Once missed, it can no longer be recovered.

04

Revelation

Luo Xiang once talked about a mouse experiment:

"Put a mouse in a cage, open a door on the left and right of the cage, put an electric electrode on the left, and put a piece of cake on the right. Drive the mouse with a stick. You can eat the cake on the right. After training a few times, the mouse ran to the right when he saw the stick, forming a conditional reflection.

As soon as the mice were formed, we tuned the cake on the left and put the electrode on the right. As a result, the mouse saw the stick running to the right, was electric, and then stunned. But the mice were very smart. After adapting, I ran to the left and could eat cake again. Then we changed the rules and repeatedly tuned several times. What do you find a mouse?

As a result, the mouse did not run, you poked it, and it did not run. This is the same, what if it is human? "

Gu Chaoming's research tells us: The expansion willingness and aggressive determination of an economy, just like a bottle containing water, the initial state is full, and every time it is shaken, it will be sprinkled with a lot, and the severe shock will be even more. Fall the water to empty. To cherish the water in the bottle and reduce the number of shocks is the hope of preserving growth.

The Japanese survey company's Empire Data Bank does a statistics every year -the average age of Japanese entrepreneurs. The data of their data in 2021 showed that the president of about 1.47 million companies across Japan was 60.3 years. Even if the asset -liability statement is struggling again, I am afraid that the time window has been missed.

In contrast, the structural advantages of China's current economic structure are still obvious, the old industrial advantages are still there, and the new industrial tickets are in hand; although the catch -ups are approaching, they have not yet produced a systemic threat. Although there are frustrations, people's pursuit of a better life is continuing and strong.

- END -

Putin just had a meeting

Putin held economic conferences to give Russian industry production data, asking ...

"I want to win China and plan a big heel!" Japan fell into the "Indian high -speed rail dilemma"

Regarding the latest progress of the India's first high-speed rail project, the fi...