There is no need to make money to settle down the mortgage. This first -tier city has pushed the "transfer of transfer"!The stock price of real estate agencies rose sharply

Author:Daily Economic News Time:2022.09.21

Guangzhou second -hand housing market will usher in major changes!

According to the Guangzhou Daily, on September 21, the Guangzhou Branch of the People's Bank of China recently issued a notice on encouraging the promotion of the promotion of second -hand housing "transferred transfer" model to the central branch and banking agencies within its jurisdiction. It is reported that this is currently the first official document that clearly encourages the promotion of "transfer".

According to the official website of the Guangzhou Branch, the Guangzhou Branch of the People's Bank of China is a dispatch agency of the People's Bank of China. According to the authorization of the three provinces (districts) of the three provinces (districts) of the three provinces (districts) of Guangdong Province, Hainan Province, and Guangxi Zhuang Autonomous Region. The Guangzhou Branch (including the Branch's Business Management Department) has 40 departments (including the Office of the Department), 1 business management department in the branch of the branch, 2 provincial capital center branches (Nanning and Haikou), and 1 provincial urban center branch 1 (Shenzhen), 34 city central branches, and 154 county (city) branch.

The core of the "transit" is to avoid the "bridge" link that cancels the mortgage registration in advance to achieve the registration of loan funds and the registration of mortgage rights, the registration of mortgage rights, and the establishment of registration. Trading costs, enhancing transaction convenience.

In short, the so -called "transferred transfer" refers to a mortgaged property. You can complete transactions, transfer, and issue new loans without repayment of loans in advance.

What are the benefits of "Taking the Trummers"?

It is understood that in the original trading model, if there is a loan in the second -hand housing, the loan is not paid off, and the loan will be settled first. In this way, the buyer should apply for a second -hand housing transaction. After the buyer and the buyer signed the contract, the buyer must first submit a loan application to the bank. After the loan approval is approved, the seller must first clear the original bank loan, apply for mortgage cancellation registration before applying for second -hand second -hand application for second -hand The transfer registration of the house and the mortgage registration of the buyer's loan. The buyers and sellers must not only travel between the registration agency and the bank many times, but also the required time cycle will also be long. Before all the transactions and registration procedures are completed, the seller will settle the fee of the original bank loan. Many of them need to use bridge funds. High cost of house transfer.

Compared with the previous model, the second -hand housing "transferred transfer" model does not need to pay the funds and the pledge of advance. After the buyer and the bank reached an agreement, the buyer and the new loan bank will pay the housing funds to the fund supervision account. After the "three -in -one" registration procedures for transfer, regulatory funds will be directly called to the original mortgage bank and seller.

According to the Ocean.com, relevant personnel of the Guangzhou Branch said that the core of the second -hand housing "transferred transfer" model is to avoid the "bridge" link of cancellation of mortgage registration in advance to achieve the registration of loan funds and transfer of property rights. Power injection and establishment registration simultaneously.

Compared with the original trading model, the second -hand housing "transferred transfer" can greatly shorten the transaction time, reduce transaction costs, improve transaction efficiency and convenience, and help stimulate the vitality of the second -hand housing market transaction. Promoting the "transfer transfer" model of second -hand housing can indirectly accelerate the exfoliating of new houses while revitalizing second -hand housing transactions, forming mutual promotion between the new commercial housing market and the second -hand housing market, and better meet the rigid and improved housing needs. Promote the healthy development of the real estate market.

However, it also involves some risks.

The Guangzhou Branch of the People's Bank of China pointed out that after the "transferring transfer" of second -hand housing for cross -bank may generate property rights, the risk of the bank mortgage and the final risk of the transaction can be introduced. Business risk.

According to the Ocean.com, a house intermediary who is unwilling to disclose the name also believes that the promotion of second -hand housing "transferred transfer" model will help the house trading and seller procedures to handle faster and more convenient. Once there is a "transferred transfer", it can be traded without removal, which will make more homeowners willing to be listed. For buyers, there is no need to entangle whether it should be linked to the seller for the seller, and the safety is guaranteed.

"Bringing the transfer" has been launched in many places

According to the 21st Century Business Herald, in fact, in addition to Guangzhou, second -hand houses have been launched in many regions in China. As of now, Qingdao, Hefei, Zhuhai, Kunming, Jinhua, Shenzhen, Jinan, Xi'an, Nanjing, Fuzhou, Wuxi and other cities have implemented the "transfer" model of second -hand housing.

In mid -September, the official website of the Hainan Provincial Government issued the "Notice on Printing and Distributing the" Plan for the Prevention and Control and Economic Restoration of Economic Refesting and Economic Restoration "and" Special Measures for the Development of Enterprises in Hainan Province (Special Measures for the Development of Enterprises (2.0) ". It mentioned that the new policy of the down payment of the second home to four % and the pilot pilot of the second -hand housing "bringing the transfer" and other new property market has aroused widespread attention from the outside world.

Image source: Photo Network -id: 501248392

The Fuzhou Real Estate Registration Center has also announced recently that it has completed the first batch of government -bank cooperation "withdrawal" projects on September 15 through the coordinated cooperation with the Real Estate Registration and Trading Center and the Construction Bank and Industrial and Commercial Bank of China.

On the evening of September 16, the Nanjing Real Estate Registration Center announced that it has completed the registration of 158 houses in the city through cooperation with Construction Bank and Nanjing Bank, including more than 50 banks including Construction Bank and Nanjing Bank, and has completed the registration of 158 houses in the city. The transaction value exceeds 500 million yuan Essence

Suzhou Zhangjiagang successfully handled the city's first "mortgage transfer" registration and mortgage loan business at the Suzhou Branch of Construction Bank in early September. Earlier August, Jinan Real Estate Registration Center stated that the city's "transferred transfer" has been successfully piloted in many banks such as CCB, ICBC, and Bank of Beijing, and will be fully implemented in the second -hand housing market in the city.

According to First Finance, from the first eight months of this year's real estate transactions and residents' medium and long -term loan data, the current demand for the property market is still sluggish. Many market participants believe that, as high -quality assets with high yields and low -risk, the current bank loan business pressure is relatively high, so the willingness to participate in cooperation is strong. It is expected that more cities will follow up with the "transfer of transfer" model, and the corresponding effects of some cities are worth looking forward to.

Strong agency stocks

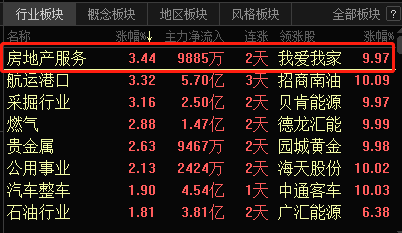

"Bringing the transfer" directly stimulate second -hand housing transactions. The first benefit is undoubtedly the real estate intermediary company. Recently, the A -share market has been adjusted. The real estate service sector has become the "most shiny star in the night sky".

On September 21, the real estate service sector rose 3.44%, and the industrial sector of the two cities rose first. Earlier, the sector also rose sharply by 3.15%. In terms of individual stocks, I love my house and Zhongtian's services in the past two days. Middle -heaven has continued to daily limit. The impression of Shibei High -tech, Guochuang High -tech, and Sanxiang also received a daily limit.

On September 21, I loved my family's announcement of the stock price change announcement, saying that the company's business operation was normal in the near future. Recently, the policy and market environment of the company's industry have improved. Many policies and measures that are conducive to market confidence and enhancement of housing consumption are conducive to the restoration and recovery of the company's market.

In addition to real estate services, the real estate development sector also increased on Wednesday. In fact, the entire real estate developers, especially the leading central enterprises and local leaders, are eye -catching. For example, Binjiang Group, Huafa, and Jianfa have increased by more than 20%this month. Poly Real Estate and China Merchants Shekou have also performed.

According to recent data from the National Bureau of Statistics, from January to August, the sales area of commercial housing nationwide was 87.89 million square meters, a year -on -year decrease of 23%, and the residential sales area fell by 26.8%. The sales of commercial houses were 8587 billion yuan, a decrease of 27.9%, of which residential sales fell by 30.3%. At the end of August, the area of commercial housing to be sold was 54.605 million square meters, an increase of 8.0%year -on -year. Among them, the area of residential sale increased by 15.1%.

The current sales recovery rhythm is slow, and the fundamentals are obvious. Since August, core cities such as Changsha, Xi'an, Shanghai, Ningbo, Suzhou, Jinan, Qingdao have introduced to varying degrees of relaxation. , To strengthen the supervision of pre -sale funds in many places, all of which are consolidating the confidence of the "guarantee of the property".

Guoxin Securities believes that under the current policy entrustment, there is no need to have concerns about real estate sales that exceeds the overall economy. On this basis, it is expected that the effect of the demand side will be more powerful. The policy is favorable, and real estate will eventually return to normal track.

(This article does not constitute investment suggestions, the risk of operation according to this)

Edit | Sun Zhicheng Du Hengfeng

School pair | Lu Xiangyong

Daily Economic News Comprehensive Guangzhou Daily, First Finance, Public Information, Public Information,

Daily Economic News

- END -

Easily buy a house like "buying socks"

Picture source Visual ChinaComprehensive compilation Zhao TingtingI want to have a...

Entering the site of urban renewal urban construction project | Qingdao low -efficiency area accelerate industrial transition

Systematic promotion upgrade and transformation, focus on optimizing industrial fa...