Luoyang Luanchuan County: If you purchase new houses from 2014 to the end of this year, you can enjoy 20 % subsidy

Author:Dahe Cai Cube Time:2022.09.22

[Dahecai Cube News] On September 22, according to the website of Luanchuan County People's Government of Luoyang, Luanchuan County Finance Bureau, the State Taxation Bureau Luanchuan County Taxation Bureau, Luanchuan County Government Service Center, Luanchuan County Housing and Urban -Rural Development Bureau , Luanchuan County Natural Resources Bureau and other five departments jointly issued the "Measures for the Luanchuan County Commodity Housing Deeds Tax Payment of Government Subsidy". It is clearly stated that from January 1, 2014 to December 31, 2022, buyers who purchase new commercial houses in Luanchuan County but have not yet paid deed tax have been approved by the review, and subsidies will be given at a ratio of 20%of the total tax tax.

Specifically:

Scope of application: From January 1, 2014 to December 31, 2022, purchase a new commercial house in Luanchuan County (subject to the date of signing a housing contract, excluding second -hand housing), obtain a network signing contract in the housing management department, But buyers who have not paid deed tax. And from September 20th to December 31st, 2022, the deed tax (the specific time is subject to the dated the deed tax payment voucher), which can be identified as the object that meets the scope of the application this time.

After the deed tax is paid after January 1, 2023 (including this date), the deed tax (the specific time is subject to the dates of the deed tax payment voucher), and this subsidy policy will no longer be enjoyed.

Subsidy standards: For objects that meet the scope of the application, subsidies will be given according to the ratio of 20%of the total amount of deed tax.

Subsidies: The tax subsidy is "first -time, then replenish", and each house can only enjoy once. Subsidy funds are issued to the bank account submitted by the applicant (house owner) through bank transfer.

Attachment: The process and process of deed tax payment

(1)

Taxpayers can pay real estate deed taxes through centralized agency and on -site processing. The centralized agency is based on the real estate development company to conduct a tax helper office for buyers, and go to the county's government service center window for centralized handling; the on -site processing is handled by the taxpayer to the county government service center window.

(2) Information preparation

1. Information required for incremental housing (buying new houses): commodity housing buying and selling contract, full invoice of house purchase, household registration book (husband and wife and minor children), ID card (husband and wife), marriage certificate or divorce certificate (single does not need to provide provided by individuals, no need ),Bank card.

2. Increased housing non -residential (purchasing new commercial housing) and the information required for new commercial housing for enterprises and units: commodity housing buying and selling contracts, full invoices of house purchase, ID card (buyer on the contract) or unit unified social credit code Certificate, bank card.

Note: Taxpayer widowed -if the hukou book shows the relationship between husband and wife and has been stamped with the sales seal, it will not provide a marriage certificate and death certificate.

All the above information needs to be reviewed, please bring the original.

(3) Address of address and processing time on site

Application Address: County Town, Funiu North Road and Gengzhen Road, Southeast Phoenix Plaza Luanchuan County Government Service Center

Application time: working days (Monday to Friday) from 9:00 am to 12: 00 am; 13: 00-17: 00 pm

Consultation Tel: 0379-66873993

Tax subsidy processing method: on -site handling

2022年9月20日至2023年1月20日(含)之间,在政务服务中心契税补贴申请窗口,按照契税补贴申请要求,提供相关资料的原件和复印件:商品房买卖合同、身份证( The buyer on the contract) or the unit unified social credit code certificate, deed tax payment certificate, bank card or unit bank account, and accurately fill in the "Application Form for Deedy Tax Subsidies". One -stop service service.

Responsible editor: Shi Jian | Audit: Li Zhen | Director: Wan Junwei

- END -

The adjustment of the entrance threshold for the right house and the limited price of Xi'an

Recently, the office of the Xi'an Housing Security Work Leading Group issued a not...

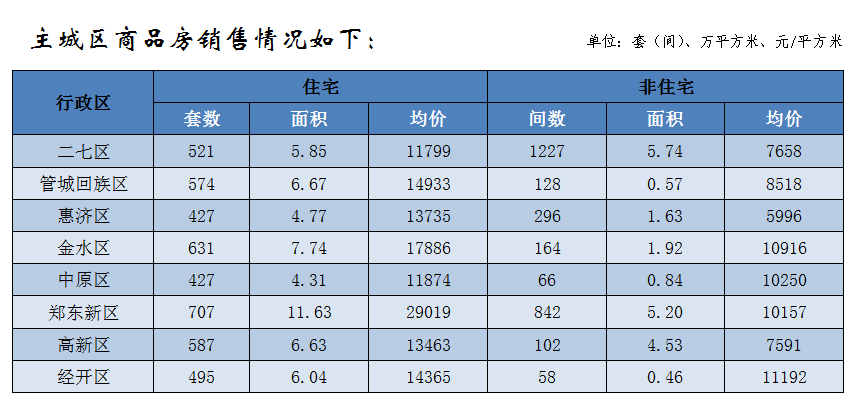

Zhengzhou July July commercial residential sales 7,668 units, with an average price of 13234 yuan/square meter

In July, Zhengzhou's commercial housing approved the pre -sale area of 797,100 squ...