The lower limit of the first home loan interest rate is relaxed?At least 23 cities meet the conditions, but not north, Shanghai, Guangshen

Author:Zhongxin Jingwei Time:2022.09.29

Zhongxin Jingwei, September 29th (Xue Yufei) On the evening of the 29th, the People's Bank of China and the Bank of China Insurance Supervision and Administration issued the "Notice on Staging Differential Housing Credit Policy" to determine the phased adjustment of differentiated housing credit policies. Eligible urban governments can decide to maintain, lower or cancel the lower limit of the first set of housing loan interest rates in the first place in the first time of the end of 2022.

The notice stated that the introduction of this policy and measures is conducive to supporting the urban government's "policy of urban policies" to make good use of policy tool boxes to promote the steady and healthy development of the real estate market. Within the scope of the local policy, banks and customers can negotiate to determine the specific newly issued first set of housing loan interest rates, which will help reduce residential interest expenses and better support the demand for rigid housing.

The notice also stated that for cities with the month-on-month and year-on-year decline in the sales prices of newly-built commercial housing in June-August 2022, before the end of 2022, the interest rate of the first house of commercial personal housing loans was relaxed at the end of 2022. The lower limit of the two -sets of commercial personal housing loan interest rate policy is implemented in accordance with the current regulations.

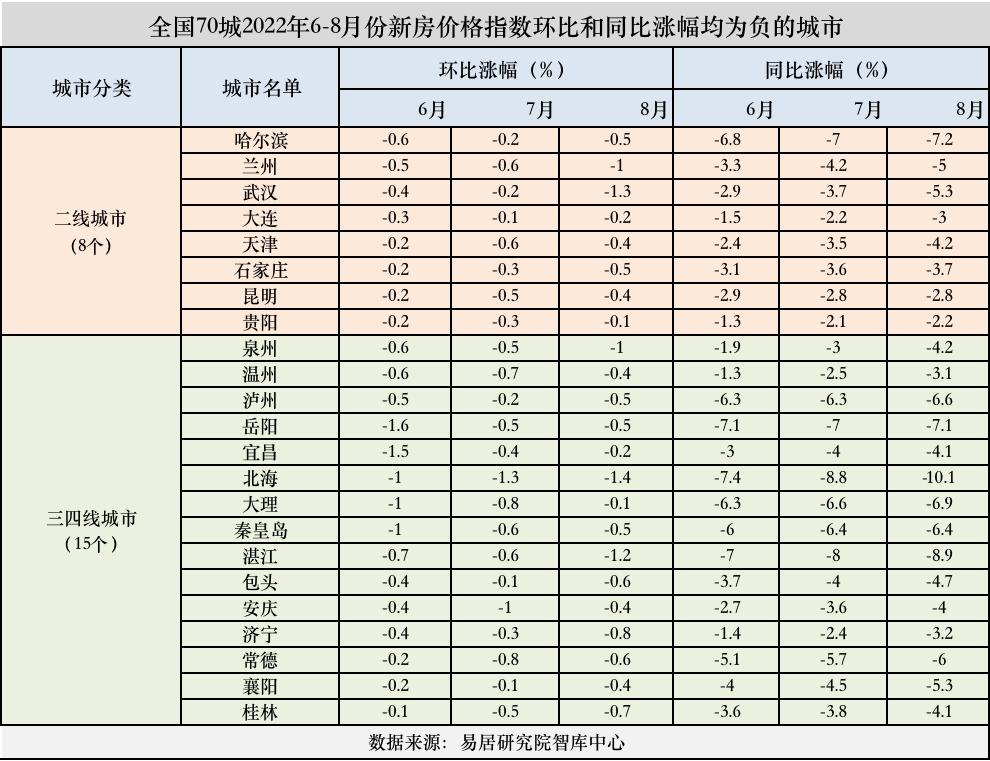

According to the data provided by the E-House Research Institute, in the 70 large and medium-sized cities' commercial housing sales prices announced by the National Bureau of Statistics, the sales prices of new commercial housing sales in June-August 2022 were declining year-on-year and year-on-year. There are 23, including 8 second -tier cities and 15 third -tier cities. Four first -tier cities do not meet the above conditions.

Among these 23 cities are Harbin, Lanzhou, Wuhan, Dalian, Tianjin, Shijiazhuang, Kunming, Guiyang, Quanzhou, Wenzhou, Luzhou, Yueyang, Yichang, Beihai, Dali, Qinhuangdao, Zhanjiang, Baotou, Jining, Changde, Changde, Xiangyang, Guilin.

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, said to China Singapore Jingwei that the above 23 cities generally belong to cities with weak real estate transactions, excessive housing prices, or excessive duration. The policy of the Central Bank and the Banking Insurance Regulatory Commission mainly refers to the relaxation of the lower limit of the interest rate of the first house's commercial personal housing loan. In other words, the policy is based on the lower limit of the real estate interest rate. That is, it is allowed to be further reduced on the basis of 4.1%interest rate.

Dong Ximiao, chief researcher at Zhailian Financial, told Zhongxin Jingwei that this is the third time that the financial management department has adjusted the lower limit of the first set of housing loan interest rates for the third time in three years. In the case of small consumption demand for residential housing and weakening the real estate market, adjusting the lower limit of the first home loan interest rate is important and urgent, or it will produce three functions: First, stable The expectations of residential housing consumption stimulate new housing consumption demand; the second is to convey signals of stable confidence and stable markets to promote the stable and healthy development of the real estate market; the third is to reduce housing consumption expenditure and boost residents' willingness and ability to expand consumption.

"Of course, this is just the adjustment of the lower limit of the interest rate of the first set of mortgages. The interest rates of different regions and different banks may be different. From the region, some second- and third -tier cities may meet the conditions and adjust it, but it is difficult to adjust the first -tier cities and some provincial capital cities. From the perspective of the bank, it is expected that most banks will have a lower limit on the actual interest rate on the first home loan. "Dong Ximiao said.

Dong Ximiao also suggested that it should be accelerated and optimized and optimized real estate financial policies, and the relevant requirements of the concentration management of real estate loan concentration should be relaxed; measures and other measures through special borrowings of policy banks to leverage the credit funds of commercial banks and provide special support for the "insured property" project; For personal housing loans, the implementation of differentiated housing credit policies should be further increased, and measures such as down payment ratio, cancellation of "recognition of housing and recognition", and reducing loan interest rates are optimized to accelerate measures. At present, the adjustment of housing credit policies is mainly concentrated in supporting the demand for rigid housing. In the next step, there is still much room for optimization in how to better support the improvement of housing demand. The lower limit of the interest rate of the two sets of housing loans should also be adjusted appropriately.

It should be pointed out that the coverage of the above-mentioned policies of the Central Bank and the Banking Insurance Regulatory Commission is not only 70 large and medium cities, but "cities where the sales prices of newly-built commercial housing in June-August 2022 have continued to decrease year-on-year. There are more cities with conditions. (For more report clues, please contact the author [email protected]) (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Editor in charge: Li Zhongyuan

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Strengthening the support for grassroots teachers to support Sichuan for 92,000 young teachers and rural teachers to provide housing security

Cover Journalist Yang LanSeptember 10th is Teacher's Day. Cover reporters learned that in order to strengthen the support of grass -roots teachers, the Sichuan Provincial Department of Housing and Urb...

Yi Xianrong: The liberalization of the city has little effect on house prices

Yixian Rong, a professor at the School of Economics, Qingdao UniversityRecently, Z...