Liu Yongqiang of the Securities and Futures Commission Inspection Bureau: Resolutely investigate illegal acts that maliciously speculate in the form of pseudo -market value management

Author:Dahe Cai Cube Time:2022.09.09

"Strengthen the punishment of the major cases, and improve the" zero tolerance 'law enforcement "deterrence." Liu Yongqiang, deputy director of the Securities and Futures Commission and Vice Director Liu Yongqiang on September 9th in the Supreme Prosecutor's Supreme Law, the Ministry of Public Security, and the China Securities Regulatory Commission, "strictly crack down on securities illegal crimes in accordance with the law At the press conference of creating a good environment for the rule of law for the capital market, the key areas of the next audit and law enforcement were revealed.

He said that he will focus on key areas and severely affect the quality illegal behavior of listed companies. Insist on a case, seriously investigating many intermediary agencies who have not diligently responsible for legal responsibilities, and further compact the duties of "seeing the door". Adhere to the full chain accountability, resolutely investigate and handle inside of the listed company with the manipulating gang to collude, maliciously specify in the form of pseudo -market value management, and continue to increase the key links of the M & A and reorganization of the merger Behavioral investigation.

When talking about recent cases of violations of cases, Liu Yongqiang added that the characteristics of manipulating markets, chainization, and circles were prominent. Among them, the large shareholders pledged the stocks of listed companies at a high proportion, breeding bad motivations for "pseudo -market value management". They also form a gray and black interest chain of funding intermediaries, marketing customers, "black mouths", and asset management institutions. The "cloud division warehouse" funding technology, procedural transactions, high -frequency transactions and other informationization and intelligent tools have been upgraded rapidly, becoming a new challenge for abnormal trading monitoring and administrative investigation and evidence collection.

Another feature is that the disclosure of financial fraud violations occurs. New models and new models such as supply chain finance and commercial factoring have gradually become "vests" to cover up fraud, and individual cases present a series of development trends. Mass shareholders' funds occupation and illegal guarantee, such as various sets of company funds, seriously damage the interests of listed companies. Enterprises engage in hidden dangers such as securities illegal acts and bond defaults, major illegal forced delisting and other risks.

In addition, the field of mergers and acquisitions and reorganizations is still the "heavy disaster area" of insider trading. The insider of the actual controller and the "insiders of listed companies" in the "listed company" of the "insiders of the listed company" was issued. The case of the target company and the opponent's executives of the mergers and acquisitions and reorganizations also showed a high incidence, and the inside information management and control were defective. The number of nests and string cases has increased, and the phenomenon of insider transactions in borrowing accounts is more common, and inside trading of damage type occurs.

On March 5, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council issued the "Opinions on Stringing Strict Securities' Securities Illegal Activities in accordance with the law". Trusting good capital market ecology.

For more than a year, it has achieved positive results in cracking down on the capital market illegal activities. According to Liu Yongqiang, in the first half of this year, the Securities Regulatory Commission's inspection system handled more than 400 cases, and the frequent high incidence of illegal acts in the securities market was effectively curbed. Essence

However, at the same time, with the continuous breakthrough of key system innovation in the capital market with the reform of the registration system, the illegal activities of the capital market are still outstanding, and illegal activities such as financial fraud, illegal disclosure, insider trading, manipulation of the market, and the damage to the interests of listed companies are serious. Destroying the order of the capital market, harming the interests of investors, and the development of the reform and development of the capital market must be severely cracked down.

In terms of audit and law, in addition to strengthening the punishment of major cases, the CSRC will also strengthen it from three aspects.

"Strengthen the construction of mechanisms and improve the ability and level of audit and law enforcement." Liu Yongqiang said that he will optimize clues to the analysis and processing mechanism, and strengthen the coordination and coordination of information disclosure supervision and abnormal transactions. Strengthen the management of case investigation work, concentrate their efforts to quickly break through major cases, respond to market concerns in a timely manner, and lay a solid foundation for criminal legal responsibilities for the transfer of the case to the public security judicial organs. Accelerate the scientific and technological construction of law enforcement, actively overcome the adverse effects of epidemic conditions on audit handling, and strengthen non -on -site research and judgment capabilities.

At the same time, strengthen work coordination and promote the joint effort of building securities crimes. On September 9 last year, the Procuratorate of the Supreme Procuratorate was established.

Liu Yongqiang said that it will give full play to the advantages of the Supreme Procuratorate and the Ministry of Public Security's office in the office, continue to deepen the work of the securities regulatory authorities and public security judicial organs, strengthen the efficient connection of administrative and criminal law enforcement judicial judicially, and promote the improving the implementation of criminal cases. "In the first half of this year, I would transfer more than 60 cases of suspected securities and futures crimes to the public security organs in accordance with the law and more than 200 criminal suspects, and copied the highest prosecution simultaneously." He introduced.

In addition, the CSRC will also promote the issuance of criminal claims for securities and futures crimes, accelerate the revision of criminal judicial cooperation documents for administrative law enforcement, increase the supervision of joint special law enforcement actions, and vigorously support the construction of public prosecution laws and the professional construction of trial bases. Strengthen the unified enforcement of the bond market, strengthen the discipline of the providers with the People's Bank of China, the Development and Reform Commission and other departments, increase the law enforcement efforts of the bond market, and maintain a good ecological and credit environment in the market. Strictly implement the internal reporting system of major illegal cases in the capital market, and promote cross -departmental information interoperability and law enforcement collaboration.

Responsible editor: Wang Shidan | Audit: Li Zhen | Director: Wan Junwei

- END -

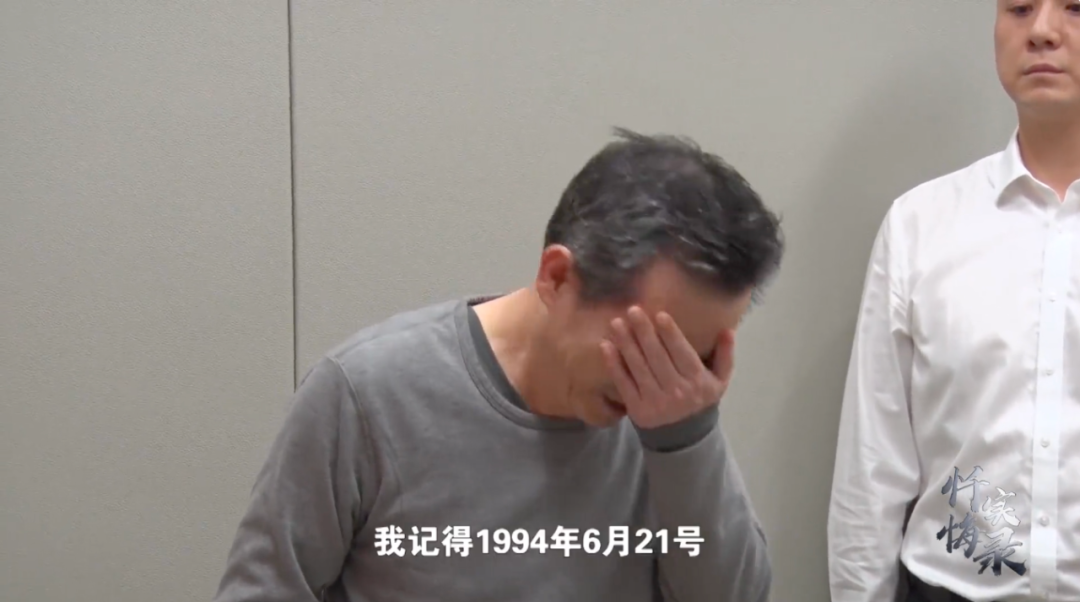

Facing the party flag, Deputy Mayor Luo Ma cried and louder

Woohoohooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo...

The Changde Intermediate People's Court helped the business environment of the rule of law and was praised by the enterprise

Huasheng Online News (Correspondent Zhang Leilei Fan Jinyu) Recently, the judge of the Executive Bureau of the Changde Intermediate People's Court received a call from the person in charge of a concre...