The second "Tiger" who had been in the horse this year was arrested, and the new crime was first disclosed!

Author:Look at the news Time:2022.09.13

According to Supreme Procuratorate, Wang Bin, former party secretary and chairman of China Life Insurance (Group), was arrested. Wang Bin is the second "tiger" who has fallen off this year and has worked in the financial system for more than 30 years. The official disclosed for the first time that Wang Bin was suspected of concealing the crime of overseas deposits.

Added such a crime

Wang Bin, the former party secretary and chairman of China Life Insurance (Group), was suspected of accepting bribes and concealing an overseas deposit case. A few days ago, the Supreme People's Procuratorate made a decision to arrest Wang Bin in accordance with the law and conceal the crime of concealment of overseas deposits. The case is being handled further.

According to the news disclosed by the Supreme Procuratorate, Wang Bin was suspected of two crimes -the crime of bribery and concealing overseas deposits. Compared with the notification of being investigated, this is the first time that the official disclosed Wang Bin's suspected crime of concealing overseas deposits.

The criminal law stipulates that the deposit of national staff should be declared in accordance with national regulations. If the amount is large and concealed, it will be imprisoned or detained for less than two years; if the circumstances are relatively light, the unit or higher authority shall give administrative sanctions as appropriate.

Before Wang Bin, there were other "tigers" suspected of or committed the crime of concealing overseas deposits.

He Xingxiang, who was just tried last month, was suspected of concealing overseas deposits. On August 23, He Xingxiang, the former vice president of the National Development Bank. According to the charges of prosecutors, he was suspected of bribery, crime of issuing financial tickets in violation of regulations, crimes of lending loans illegal, and concealing overseas deposits. Prosecutors accused that from 2010 to 2021, He Xingxiang knew that the state staff's deposits should be declared in accordance with national regulations, and the actual control of its relative accounts was equivalent to more than RMB 33.69 million and concealed it.

In February 2019, Zhou Chunyu, the former deputy governor of Anhui Province, was crime, concealing the crime of concealment of overseas deposits, the crime of abuse of power, and insider trading. The court trial found that Zhou Chunyu violated national regulations during his tenure as the secretary of the Bengbu Municipal Party Committee of the Communist Party of China, and concealed more than 4.12 million yuan in the US dollar stored in overseas banks.

Manufacturing and amplifying financial risks to make financial corruption

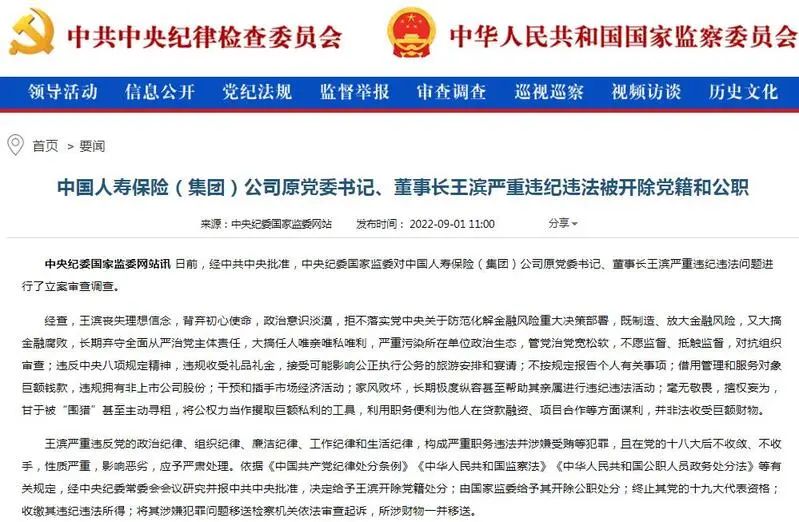

On January 8 this year, the Central Commission for Discipline Inspection issued news that Wang Bin, Secretary of the Party Committee and Chairman of China Life Insurance (Group) Company, was reviewed and investigated.

Wang Bin was born in November 1958. Since 1975, he has worked in the educated youth farm, the Three Companies of the Pipeline Pipeline Bureau of the Ministry of Petroleum, the Heilongjiang Provincial Commercial Department, the Anthine Reform Commission, and the Provincial Government General Office of the Heilongjiang Nanchali Hydraulic Plant. In 1990, he entered the Minnan Rongjiang Branch of the People's Bank of China as the deputy director of the office and started his financial career. Since then, Wang Bin has served as the central bank, Rural Distribution, Bank of Communications and other units. In 2012, he served as chairman of China Taiping Insurance Group and transferred to chairman of China Life in six years until he was investigated.

Wang Bin's multiple violations of discipline and laws are related to his financial system.

On September 1, the Central Commission for Discipline Inspection reported that Wang Bin, former party secretary and chairman of China Life Insurance Company, was "double -opened". The "Double Open" report mentioned that after investigation, Wang Bin refused to implement the Party Central Committee's major decision -making and deployment of financial risks to prevent and resolve financial risks. , To make a big person, only the privileges, the political ecology of the unit where the units are located, the party and the party are loose and soft, unwilling to supervise, conflict supervision, and fight against organizational review ... Family style is corrupt, long -term extreme indulgence and even helping their relatives perform for a long time Violations of discipline and law; no fear, good at all, be willing to be "hunting" or even actively renting, regarding public power as a tool to seize huge private interests, and use job convenience to make benefits for others in loan financing and project cooperation. Receive huge amounts of property.

It is worth noting that the "manufacturing and enlargement of financial risks", "big financial corruption", "active rent -seeking" in the report, and "the party and the party are loose and soft", "unwilling to supervise, and the supervision", etc. Officials have never appeared.

Family style corrupted long -term "extreme indulgence" and even helped relatives violate discipline and law

Wang Bin's "double opening" report mentioned that "the family style is corrupted, the long -term extreme indulgence and even helping their relatives conduct violations of discipline and illegal activities" "use job convenience to make benefits for loan financing and project cooperation." It is worth noting that Wang Bin and his brother Wang Qiang have served as a large state -owned enterprise executive at the same time. The company managed by the two has provided financing to the same company. Wang Qiang's company also provides financing for Wang Bin's associated company.

According to media reports, Wang Bin was investigated and related to his time as the chairman of China Taiping Insurance Group. Wang Bin and the former chairman of Huarong Group Lai Xiaomin have been very close, so that Taiping Group and Huarong Group are mostly crossed in terms of personnel and business. Wang Bin's younger brother Wang Qiang even "two in two outs and two out" in Huarong. It is reported that Wang Qiang was the general manager of Huarong International Holdings and later left Huarong. In June 2016, he returned to Huarong again and served as the president of Huarong Financial Holdings. In February 2017, he served as an executive director and chief executive officer, and the chairman of the board of directors in April 2017. In April 2018, Lai Xiaomin's case was issued; November, Wang Qiang left Huarong. In January this year, after Wang Bin was checked, his brother Wang Qiang was also lost.

According to relevant insiders, many customers introduced by Wang Qiang after Huarong Financial Holdings successively "exploded" one after another, causing continuous losses to the company. Some funds flowed to places where they should not flow, which led to the loss of large state -owned funds. Some customers have a scale of hundreds of millions of dollars from Huarong Financial Control financing and China Taiping financing under Wang Bin. After this round of financial system inspection

In September 2021, the eighth round of the 19th Central Committee inspected the People's Bank of China, the CBRC, the CSRC, and the State Administration of Foreign Exchange conducted regular inspections.

In October of the same year, the Eleventh Inspection Team of the Central Committee inspected China Life Insurance (Group) Company's Party Committee Work Mobilization Meeting, and the inspection time for inspection was about two months.

At the mobilization meeting, Wang Bin, then "first leader", presided over the meeting and spoke. Wang Bin said that it is necessary to strengthen political responsibilities, take inspection as an opportunity to promote the company's high -quality development, better meet the demand for high -quality financial insurance services for the people and the real economy, and promote the party's route policies and party central decision -making. The landing is effective.

After the inspection was launched last year, a group of financial system executives were investigated one after another. Wang Bin was the first former provincial and ministerial cadre to investigate after the inspection.

Just two days ago (September 11), Chinese Life reported the progress of inspection and rectification, and Wang Bin was "named". The report mentioned that the Chinese Life Party Committee "deeply learned the lessons of the Wang Bin case, resolutely carried out the responsibility of comprehensively and strictly governing the party," thoroughly eliminated Wang Binliu poison, and carried out in -depth cases to promote reforms, promote the construction, and promote treatment by the case. Work and further form a strict atmosphere.

In many parts of the rectification report, China Life has rectified the problems of the exposure of the Wang Bin case. For example, Wang Bin was accused of "managing the party and governing the party's looseness and softness" and "unwilling to supervise and conflict with supervision". In the rectification notification, the party committee of the group "resolutely carrying the main responsibility, the pressure on layers of conduction, and the comprehensive and strict thoughts of the system are even more rigid. Unity, more determined attitude, implementing gradually and deeper implementation "," take the lead in strengthening the supervision of the leaders at all levels and leadership teams "," the negative mentality of breaking the unwilling supervision '"and so on.

In addition to Wang Bin, the names of Lai Xiaomin, Hu Huaibang, Cai Esheng, and Yang Jiacai have also appeared in the contents of the inspection team feedback.

For example, the inspection team pointed out at the Great Wall Company that "there is a gap between the lessons of Lai Xiaomin's case", and at Huarong Company pointed out that "the reflection of the Lai Xiaomin case is not deep enough, the impact of clearing is not thorough, and the accountability is not in place." Lai Xiaomin, who had previously served in the Central Bank and the CBRC, was in the chairman of Huarong Company in April 2018. In January last year, he was sentenced to death for nearly 1.8 billion bribes for bribery, corruption, and great marriage.

For another example, the inspection team demanded that it "deeply eliminates the bad influence of Hu Huaibang and fully repair the political ecology." Hu Huaibang has been cultivating in the financial system for many years. In April 2013, he worked in the country. In September 2018, Hu Huaibang no longer served as the party secretary and chairman of the National Development Bank, but after retiring, he did not land safely. In July 2019, Hu Huaibang was officially released. In January last year, Hu Huaibang was sentenced to life imprisonment for bribery.

Jiefang Daily · Shangguan News Comprehensive Report

Source: Supreme Prosecutor's website, the website of the Central Commission for Discipline Inspection, China News Network, Beijing Youth Daily, China Economic Weekly, First Financial, etc.

Author: Shangguanhe WeChat Editor: Miss Pi

- END -

100 -day operation | Chief of theft!Fushayi company employees sneaked in partnership, result ...

Since the launch of the Hundred Days of Actions in the summer public security crac...

Illegally add western medicine to herbal tea?Procuratorate filed a criminal attachment to civil publ

A few days ago, the case of herbal tea adding western medicine with criminal public interest lawsuits by the Huidong County Procuratorate of Guangdong Province was tried in the county court. The court