[Hundred Days Action] Stealing Tax Falunning Invoicing Classification Copy End Failure Network

Author:Ping An Jingmen Time:2022.09.20

Source: Ping An Zhongxiang

Invoices are not only a certificate of personal payment, but also a voucher for enterprise operations.

We often hear that someone uses fake invoices to the company to reimburse and collect state or corporate property; some companies use fake VAT invoices to deduct taxes.

There are both real fake invoices and fake real invoices.

What's going on?

Generally speaking, general invoices and special VAT invoices are two common invoices now. General invoices are issued by taxpayers to ordinary consumers. VAT invoices are issued by general taxpayers. It can be simply understood as an invoice issued between enterprises and enterprises. Invoices can deduct a certain amount of taxes.

Recently, Zhongxiang police successfully captured an online fugitive on a foreign online online with a false VAT invoice.

"You just buy an invoice at the 6%tax point of the ticket value ..."

In 2018, Ju (have arrived in the case) and fired a shoe factory with others. Occasionally I met President Pan by chance. After several cooperation, President Pan asked. Click to buy.

After discussing with the partner, Ju and partner gave the invoicing information to President Pan. In this way, from 2018 to 2022, Ju Mou purchased 31 special invoices for VAT through Pan, with a total tax amount of more than 410,000 yuan. More than 10,000 yuan, and all of the tax bureau of the Zhongxiang Municipal City were deducted, and Pan's behavior was suspected of a dedicated invoice for VAT.

On August 11, 2022, Zhong Xiang police listed Pan as an online fleeing person. On August 29, the police of the Economic Investigation Brigade successfully arrested Pan and returned to justice with the assistance of the police in Qingyuan County, Guangdong.

At present, the criminal suspect Pan has been adopted criminal compulsory measures, and the case is undergoing further treatment.

Police reminder

VAT invoices are the voucher for deductible tax deductions, which are the basis for levying VAT. If a special VAT invoice is used, the purchaser can be deducted by the deduction to apply for the deduction of input tax in accordance with the law, and ordinary invoices cannot. In other words, special invoices for selling and virtual VAT can make criminal suspects illegally profit.

Article 205 of the Criminal Law of the People's Republic of China, Article 205 of the Victoring VAT invoices, used to deceive export tax refund, deduct tax invoices; virtual invoices for virtual VAT invoices or fictional tax refund If other invoices deducted taxes, they will be imprisoned or detained for less than three years, and shall be fined more than 20,000 yuan or less; if the amount of tax is large or other serious circumstances, it will be in three years. The above ten years will be imprisoned and shall be fined more than 50,000 yuan to 500,000 yuan. The above 500,000 yuan is fined or the property is confiscated.

If the crime stipulated in this Article of the unit shall be punished by the unit, and the person in charge and other directly responsible persons who are directly responsible for them shall be sentenced to three years in prison or detention. In the case of imprisonment for more than three years or less; if the amount of tax opens is huge or other particularly serious cases, it will be sentenced to more than ten years in prison or life imprisonment.

Dedicated VAT invoices or other invoices that are used to deceive export tax refund and deduct taxes of taxes refer to one of the behaviors for others, opening up for themselves, let others open for themselves, and introduce others to others. of.

One of the 205th Article 205 is crime of virtual invoicing. This law is invoice other than Article 205. If the circumstances are serious, it will be sentenced to imprisonment, detention or control, and fines for less than two years. In order to be imprisoned for two years and seven years, and fined. If the unit offend the previous crime, the unit will be punished and the person in charge and other responsible persons who are directly responsible for will be punished in accordance with the provisions of the previous paragraph.

Source: Economic Investigation Brigade

Photo: Wang Xingxing

Editor: Wang Xingxing

Review: Chen Long

- END -

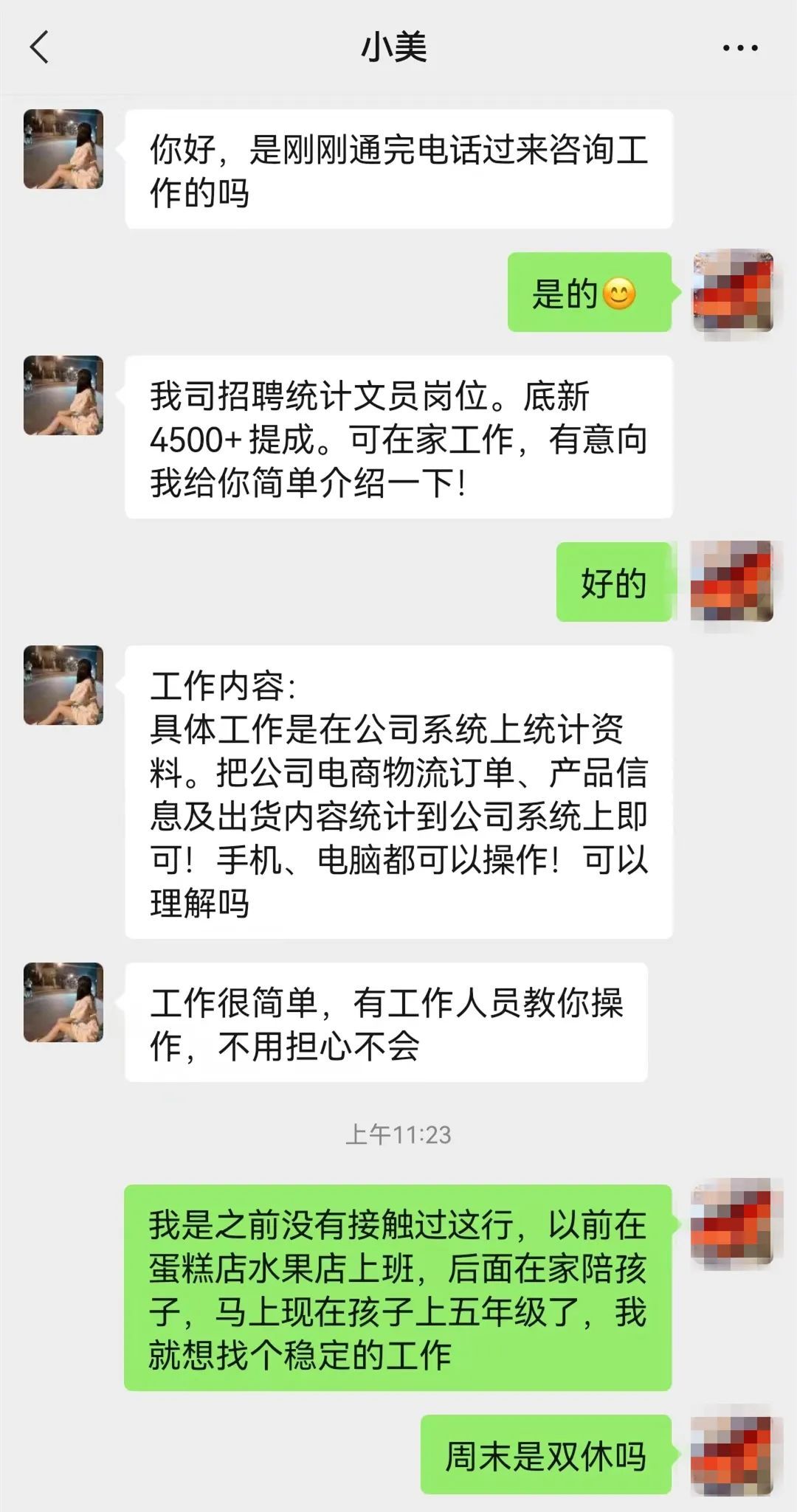

The women's online job search encountered "beauty", and suddenly remembered the words on the wall of the house.

If there is a high salary, easy work, no interview, and the inauguration offer wit...

Let the appropriate court trial appropriate case -see the first anniversary of the reform of the 4 -level court trial function positioning

Xinhua News Agency, Beijing, September 2 (Reporter Li Fang) Where should my case g...