Note these three categories of fraud!Haikou Police notified the anti -fraud police situation last week

Author:International Tourism Island B Time:2022.09.25

Commercial Daily All -Media (Coconut Network/Altitude journalist Chen Yonghe) On September 24, the International Tourism Island Business Daily reporters learned from Haikou Anti -Telecom Network Fraud Center that from September 12 to September 18, Haikou Telecom Network Fraud Police trends have generally risen. The types of high incidence of cases are mainly based on three categories: rebate, eliminating bad records, and false loan fraud. The loan category accounted for 15.9%, accounting for 62.3%of the police conditions this week. The fraudulent group is a company staff, migrant workers, and retirees, and the age group is between 25-60 years old.

Classic Case

1. Pretend to be a business service fraud

On September 14th, Xiaoli (pseudonym, 26 years old, company staff), the masses of Meilan District, Haikou City, said: On September 13, he logged in to the idle fish app at Wuxi Road, Haidian Island, Meilan District, Haikou City. In the clothes, there was a user who wanted to buy, and Xiaoli sent the Alipay receipt code to the other party. Later, I received the information and payment screenshots of another user on Alipay, and said that Xiaoli's shop was not upgraded, and the store needs to be upgraded within a certain period of time. Otherwise, the official will freeze the Alipay account between the two parties and attach a QR code picture.

Xiaoli scanned the QR code in the picture to contact customer service. The customer service said that upgrading the store needs to generate an exclusive bank card account to allow him to perform fund transfer authorization certification. And "ID". Xiaoli transferred to the account designated by the customer service. After the transfer, the customer service continued to transfer the transfer on the grounds that the quota was insufficient. After Xiaoli transferred the customer service again, the customer service still could not activate the account upgraded store, which caused the funds to be temporarily returned. Xiaoli chose to believe in customer service because of the rush of money. After repeatedly transferred the account to the customer service, the customer service also said that the application of various types of online loan platform software to apply for registration before the funds will be returned. After downloading as required, she still did not see the return of funds and could no longer contact the customer service. She was deceived and was deceived by more than 20,000 yuan.

Easy to be deceived group: company staff, individual households.

Case: scammers passing the second -hand trading platform to impersonate buyers to contact the seller, and at the same time send false pictures to the victims to guide the victims to scan the QR code in the false pictures to further contact fake customer service. The fake customer service will be transferred to the designated account on the grounds of upgrading the store, so as to achieve cheating the victim's money.

Police reminded that you must be careful when buying items online or selling idle items. The transaction method outside the platform is not guaranteed, and the two -dimensional code of unknown origin can not be scanned at will. The idle fish platform transaction is an individual who does not need to pay a deposit. Do not trust fraudulent words such as "margin", "certification fee", "buyer guarantee". If you encounter problems, please contact the official customer service of the platform.

Second, false loan fraud

On September 15, the small army (pseudonym, 49 years old, and company staff) reported that on September 15, he reported that on September 15, he received a strange call from the zone of 0898 at No. 2 Sanfeng Road, Haikou City. "Jingdong Financial Customer Service" is said that due to the adjustment of national loan interest rates, it is necessary to verify the operation to reduce the previous loan interest rate.

The other party asked Xiaojun to download an app named "Cloud Vision", and Xiaojun joined the meeting through the conference code. Then the other party sent a false link at the meeting. After the small army opened the link, the "China Banking Regulatory Management Committee" page was displayed. Click the online service function of the page to guide the customer service and transfer to the designated account. After the transfer of the transfer, he noticed that it was inappropriate. After consulting the 96110 (national anti -fraud hotline), he was deceived and was deceived for a total of 10,000 yuan.

Easy to be deceived group: company staff and migrant workers.

Case: scammers pretend to be financial customer service, lied to respond to the national loan interest rate adjustment policy, and send false links to the victims. After obtaining the trust of the victim, guide him to contact the customer service in the false link to verify whether the victim's funds meet the reducing loan interest rate and let it transfer to the designated account to achieve the purpose of cheating the victim's money.

Police reminded: receiving a call from the customer service of self -proclaimed financial platforms, you must verify the identity of the other party. You can verify it through the official platform or website, and do not believe in strange calls. Anyone who takes the initiative to call for interest rates requires downloading software and making money to the bank account.

Third, brush order rebate fraud

On September 15th, Xiaoqiang (pseudonym, 27 years old, company staff) reported that on September 11, it was reported by a strange QQ on September 11. Earnation is fast, Xiaoqiang said he could understand, so the other party pulled it into a QQ group to chat.

Xiaoqiang downloaded an app called "Mao He" through the QR code sent by this group. After contacting the APP customer service, he was pulled into an app group to chat. When Xiaoqiang saw many people in the group sending a "profit screenshot", he asked the instructor in the group how to receive orders to make money. The other party first distributed a task to Xiaoqiang, and asked Xiaoqiang to transfer the account to the other party to recharge, and log in to a false website for operation. After the first order is over, the other party claims that it is connected to the company, and the order needs to be continued. After the order is over, it will be returned. Xiaoqiang believed to be true, and once again transferred to the designated account. After several operations, the other party claimed that his operation was wrong and could not be repaid. Let him transfer it to a fix as a fix. Xiaoqiang couldn't withdraw after transferring the money. The other party asked him to transfer another funds as a return order, and he was deceived and was deceived by more than 40,000 yuan.

Easy to be deceived group: company staff and students. Case: Liar adds a lot of victims through social platforms and send false profit screenshots. If the victim can't stand the temptation or is lucky, it is easy to fall into the scammer's trap. After sending a false website to the victim, the scammer sends a false website to order, and then use its operation error to guide them to transfer multiple transfers to the designated account to implement fraud.

Police reminded that the online ordering is illegal. Do not scan or click the QR code or URL sent by a stranger to beware of being deceived. Don't be greedy for small and cheap, don't have a fluke, part -time order, first recharge and transfer to the task, and then rebate.

The Anti -fraud Center of Haikou Public Security Bureau reminded that unknown links do not click on, strange calls are not credible, personal information is not disclosed, and the transfer remittances are more verified.

[Editor in charge: Long Yansing]

[Content review: Xie Qingpei]

Copyright Statement: Copyright works such as the International Tourism Island Business Daily Commercial Daily, pictures, videos, audio and other copyright works. Welcome to repost, but the consent of the written authorization of this newspaper is strictly forbidden to include but not limited to reprinting or adaptation, citations, etc. responsibility.

- END -

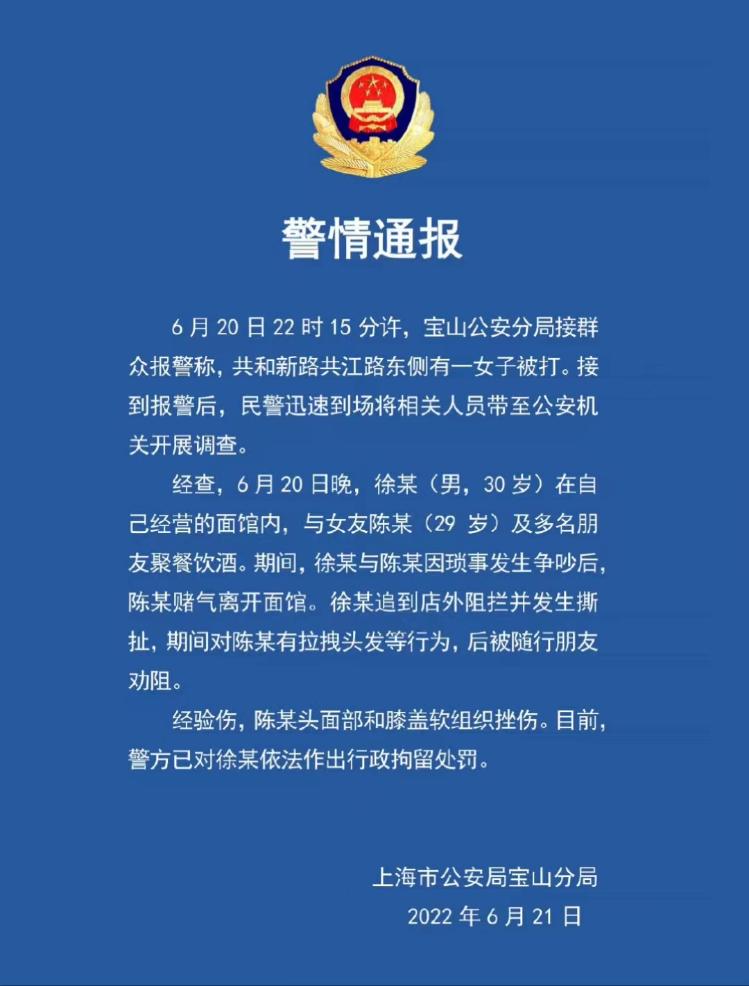

Shanghai men's streets dragging and pulling women police: couple dispute men have been detained

Poster reporter Zhuang Binbin Shanghai reportOn June 21, a media reported that on ...

Violations of Epidemic Prevention Regulations, a property company in Lizhou was fined and the person in charge was detained

Commercial Daily All -Media (Coconut Network/Altitude journalist Huang Guifeng) Re...