He hung up the police's phone "wit" ... | 100 -day operation • Anti -fraud

Author:Harbin Net Police Inspection L Time:2022.09.26

When "online loan"

Receive the fraud warning call from the police

Mr. Zhang is full of be full of heart

Note that you have encountered the "fake police"

Hang the phone immediately

Upload your ID card and bank card "online loan platform"

However

I encountered big trouble when withdrawing

Native

Affectionate

Recently, the Ningjin County Public Security Bureau of Shandong Province received a warning from the National Anti -Fraud APP: Mr. Zhang, a resident of the area under the jurisdiction, may be suffering from telecommunications network fraud, and the police immediately called Mr. Zhang to understand the situation.

"I know, some policemen promoted me, I understand, how could I be deceived?" Mr. Zhang said that he needed a sum of money for the roll of business funds, but he would go to a regular institution loan.

"Sir, you talk about your specific address. Our police officers come to check with you ..." Hearing Mr. Zhang's disapproval, the police proposed to verify the situation, but Mr. Zhang was reluctant to disclose the address and immediately hang up Telephone.

Feeling the perfunctory tone in the phone, worried that the masses would be deceived, and after the police called without fruit, he sent a text message to Mr. Zhang, reminding him of the idea.

▲ The police send a text message to Mr. Zhang

"Hello, it is fraud, what should I do?" I didn't expect that half an hour later, Mr. Zhang called the police's phone call, saying that he had encountered telecommunications fraud.

It turned out that when Mr. Zhang browsed online on the same day, he found a loan advertisement, saying that the loan was fast, the procedures were simple, the interest rate was low, and the business was not smooth. Loan app.

When the information was registered, he received the warning call of the police. Mr. Zhang didn't care about it and hung up quickly.

Subsequently, Mr. Zhang applied for a loan of 20,000 yuan online on the APP, and uploaded his ID card and bank card number according to the system prompts.

After some operations, the system showed that the loan was successful. However, the loan from the account was out, and the interface was popped up -the withdrawal of the withdrawal funds was frozen.

Subsequently, the app popped up the customer service information and informed Mr. Zhang's loan that he had arrived, but because the card number he entered was wrong, Mr. Zhang must first remit 6,000 yuan to the company's account and open a member permissions to withdraw this loan. Otherwise It is necessary to repay, and it will be deemed to be fraudulent, which will be "handled" by the public security organs!

He doubted that he called the loan platform customer service phone and found that he couldn't contact him. He suspected that he was deceived.

Mr. Zhang, who was anxious, remembered the police phone he had just received, immediately called back, and rushed to the Public Security Bureau for consultation.

"I have uploaded my ID card and bank card, what should I do!"

"Don't worry, you call the police in time, and now the money is still safe." The police said.

▲ Police promoted anti -fraud knowledge to Mr. Zhang

"You have encountered online loan fraud. The scammers use fraud software to steal the personal information of the victim, loan in the name of the victim, and then use excuses such as paid fees and thawing fees to trick the victims to transfer money ..." The police turned to Zhang to Zhang The gentleman explained the scammer's fraud in detail, instructed him to deal with the loan matters in a timely manner, and deleted the relevant software and text messages, and the contact information of the scammer was black.

"Before we called you to remind you, why would you still be on it?" After the processing, the police asked Mr. Zhang why he hung up his phone.

"I have received anti -fraud propaganda. Everyone said that many scammers pretended to be a public prosecution law for fraud. When you said it was a police officer, I felt that you were a liar ..." Mr. Zhang said embarrassed.

"Your awareness of prevention is worth advocating, but it is necessary to improve the ability to distinguish."

Network loan fraud characteristics

Online loan fraud refers to the suspect of criminal suspects to imitate a regular loan platform and establish a false online loan platform. When the victim applies for a loan, he promises that there is no mortgage, low interest, and fast loan, and then let the victims enter the designated bank card on the grounds of viewing the bank's flow or charging a deposit or a fee, thereby cheating the money.

Scam

Contact online loans through WeChat, QQ, and telephone. When the victim agrees to the loan, the victim is required to download the loan app registration information, and then lead to "handling fees", "margin", "bank flow", "account freezing" People remit money to the designated account until they are discovered.

Police reminder

If you apply for a loan, you must go to a regular financial institution. Remember: regular financial institutions such as banks will not require borrowers to pay various fees such as handling fees, insurance premiums, and thawing fees before lending. Once they are discovered, pay attention to collecting evidence such as relevant transfer records, chat records, and call 110 or go to the police station to call the police as soon as possible.

- END -

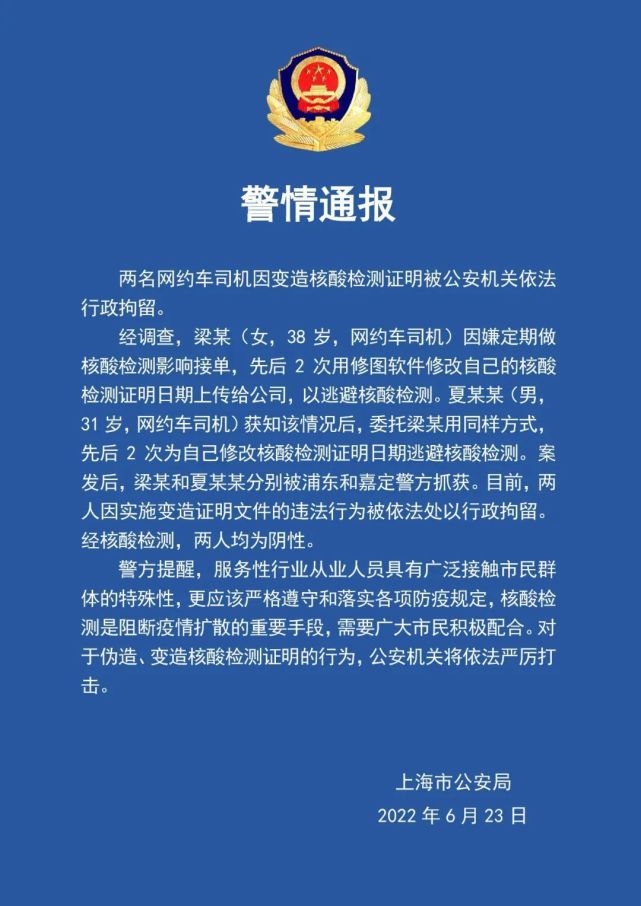

Due to a regular nucleic acid affect the order, the two online car drivers in Shanghai have transformed nucleic acid proof of being detained

Two online car drivers were administrative detention by public security organs due...

Three men's online shopping luggage to transfer the stolen goods, the police caught a rush

Jimu News reporter Wang JunVideo editing Wang JunCorrespondent Yang Bing Tujing