Haitong Strategy: The upward trend of the medium and long term will not change. Continue to be optimistic about the growth of high prosperity and take into account the necessary consumer goods

Author:Broker China Time:2022.07.24

Source: Stock Market Xunye ID: xunyugen

Core conclusions: ① The market adjustment has stemmed from the fundamental aspect since early July. It has not kept up with the market. During the history, it often vomits half of the increase in the early stage and the transaction volume has shrunk by half. ② Adjusting the inducement is the high domestic CPI phase, poor interim report, and overseas fluctuations. The adjustment of the adjustment is the cold of spring, and the mid -term trend of the reversal is not changed. ③ Keep patients, and the growth of high prosperity such as new energy is still upward, and it is necessary to consume medicines such as medicine.

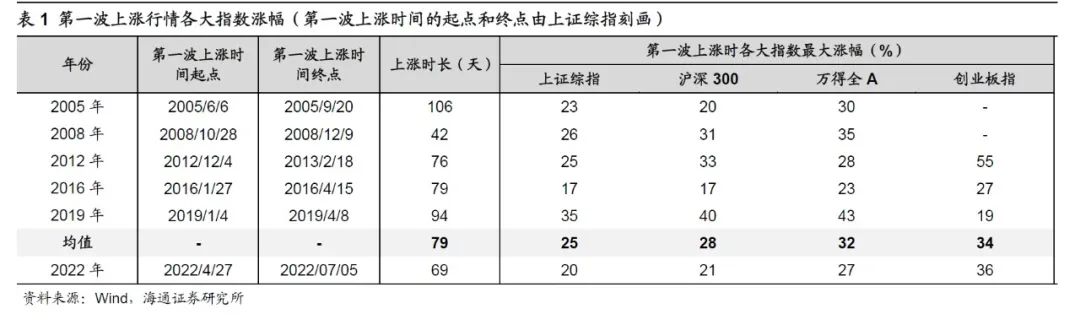

In the past week, the market trend has continued the adjustment since July 5th. As of July 22, the largest decline in the Shanghai Stock Exchange Index has reached 5.8%in July, 300 CSI 300 was 7.1%, and the GEM index was 7.4%. Since July, we have continued to emphasize that in the short term, we need to be alert to the cold spring cold after the market reverses from the bottom, and clearly states that the market may usher in a staged rest of the two retreats. For details Nature: Chunchun cold -20220717 ". However, this round of rest is a health adjustment. The low in April is the reversal bottom of 3-4 years.

1. The logic of the cold spring cold

The market experience adjustment has been adjusted since July 5. In essence, we believe that the market cannot keep up after the market has obvious restoration. In the rise of this round, the major index highs in the A-share index have been close to the level before the early epidemic, but from the perspective of fundamental recovery, the industrial added value rose to 3.9%year-on-year in June, which is still lower than February to March this year. s level. We believe that the low point in April is the bottom of the reversal. Since April, the rise is like the end of winter and the spring is coming. Spring often has a cold spring. It is inevitable that there is a retracement during the rise. The rise of the surface is slow, and we will analyze the risk factors in China and overseas below.

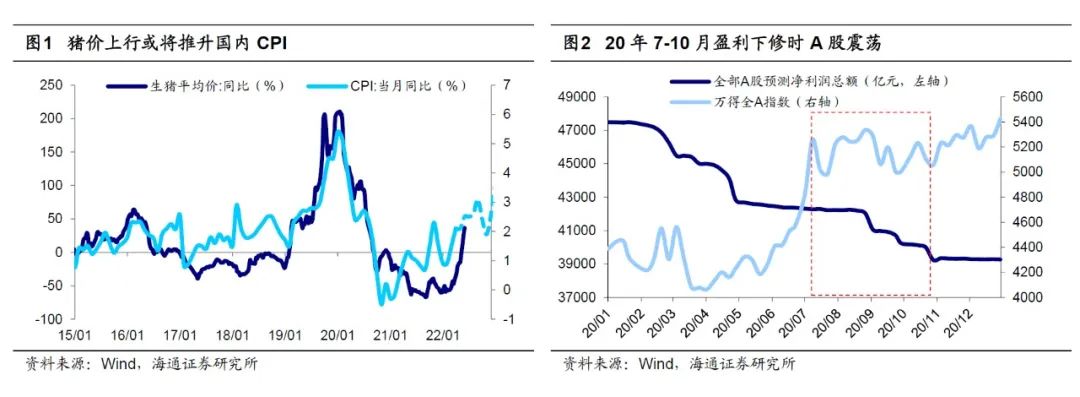

Internal concerns: CPI surges to form disturbances of monetary policy, and the poor interim data is triggered by profit forecasts. First of all, from our own situation, in history, the price of CPI in my country is highly related to pork prices, and as of 2022/07/21, the average daily price of pigs has increased by 43%year -on -year. Looking back, in the context of capacity exfoliation and rising feed costs, pig prices may still have room for upward in the future. In June, the CPI in my country has reached 2.5%year -on -year. According to Wind unanimous expectations, the CPI in July may be higher than June, and it may exceed 3%in the next 3 months. The continuous upward upwardness of inflation may be constrained by monetary policy. In addition, due to the recent suspension of some real estate projects, the owners of many places across the country issued a statement to force the suspension of repayment of loans, which has affected market risk preferences to a certain extent. At present, the risks brought by the "stop loan" storm to the financial system are still controllable. Earlier, many banks have announced that the business scale involved in the incident is small.

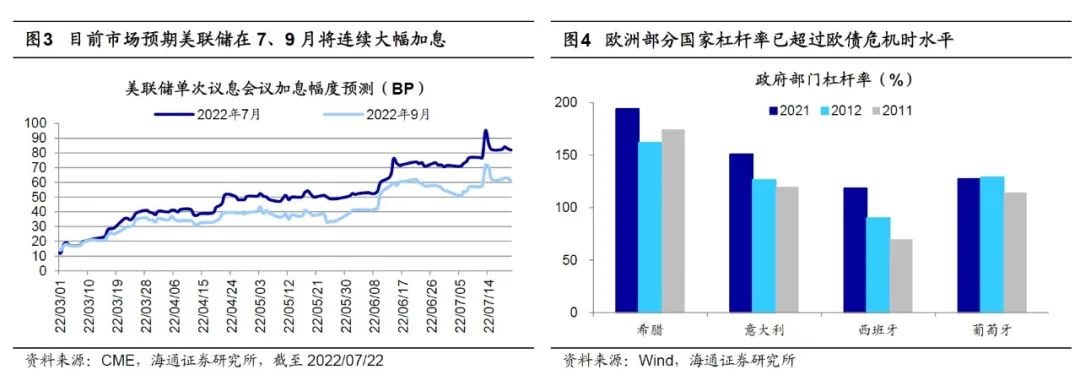

At the micro level, the current investor's attention to the central report is high. We have analyzed in the "20 years of reference and the impact of the reporting of profitability under the reporting of the newspaper". Profit forecasts have been greatly repaired. After the market experience rose, the valuation rose to the high level, and the market entered the stage of shock adjustment. For this year, we calculated that 22Q2 A shares removed the net profit growth rate of the mother-in-law in a single quarter was about -10%, and the growth rate of all A shares after considering finance was about 0%. The prediction may be repaired again, but the amplitude may be smaller.

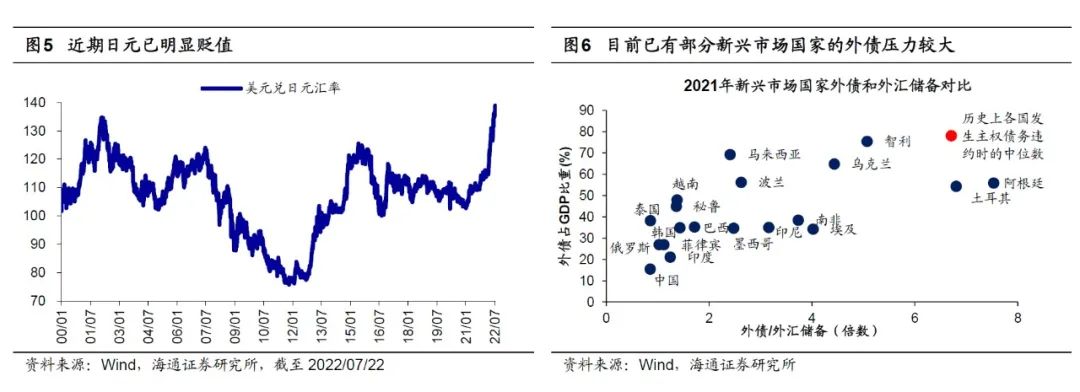

External risks: The risk of "hard landing" in the US economy in the context of high inflation and fast interest rate hikes has increased, and other overseas economies also have hidden concerns. On the overseas side, the current potential impact and the most concerned about the market are the Federal Reserve raising interest rates and the US economy. We have analyzed in many reports such as "Self-winner-the impact of US stocks on A shares -20220615" and other reports. Eat, and this will increase the risk of "hard landing" in the US economy. On July 27th of next week, the Fed will hold a new round of interest rate interest conferences. The current market expectation is that the Fed will choose to raise interest rates by 75-100bp at the July meeting and raise interest rates by 50-75bp at the meeting on September 21. Under the expectation of a sharp interest rate hike, the market's concerns about the "hard landing" of the US economy are still difficult to alleviate.

Except for the United States, what "ash rhinos" in "overseas" is worthy of vigilance? -20220719 also sorted out three potential risks under the global perspective: ① The possibility of re -acting in the European debt crisis. Europe is currently in a macro background of economic stagflation and policy tightening. At the same time, the leverage and deficit rates of countries such as Greece, Italy, Spain, Portugal and other countries are even higher than the European debt crisis in 2011-12. Looking back, the debt risks of these countries may continue to amplify in the process of interest rate hikes in the European Central Bank. ② The yen and daily debt may become a new unstable factor. The current Japanese central bank chooses currency looseness under the global interest rate hike to stimulate the economy. Uncertainty. ③ Emerging markets may reproduce the sovereign debt crisis. With reference to history, with the Federal Reserve's interest rate hikes and the US dollar appreciation, emerging markets will often face the pressure of increasing capital outflow and foreign debt burden. Compared with historical sovereign debt default incidents, we calculated that the risk of sovereign debt in Chile, Ukraine, Argentina, and Turkey is relatively obvious. 2. Falling spring cold disk

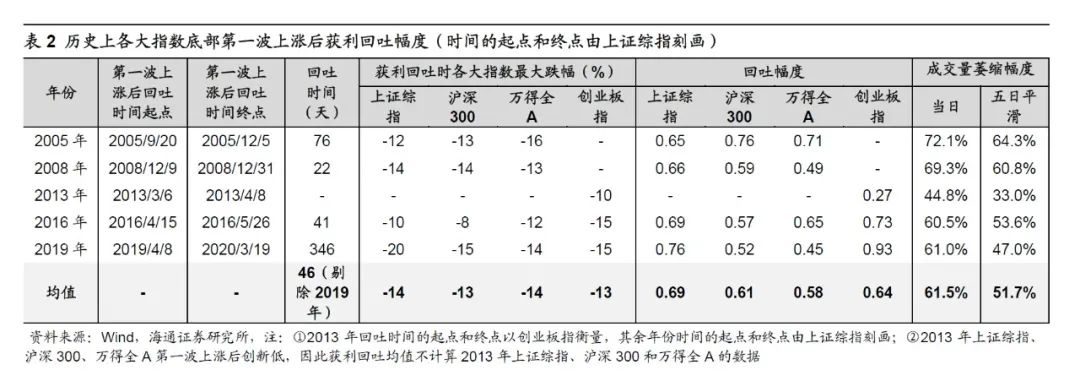

With reference to history, after the first wave of rising, it was 0.5-0.7 of the early increase, and the transaction volume shrunk by half. Since the high point on July 5 (as of 2022/7/22, the same below), the Shanghai Stock Exchange Index has a maximum decline of 5.8%, the Shanghai and Shenzhen 300 is 7.1%, and the GEM index is 7.4%. The median number is 9.3%. We analyzed in the "Revailors of the first wave at the bottom of the five times -20220712". After the end of the bear market, the first wave of rising markets was finished, and the market often made a profit. Not solid enough. In the past, the Shanghai Stock Exchange Index fell 46 days on average (excluded 2019). Essence In addition, during the historical profit, the average contracted volume of the entire A transaction was 62%(52%smooth on the 5th). See Table 2 for details. As of 22/07/22, the total A transaction volume was 76.5 billion, which was reduced by 31%compared with the June high, and 17%was reduced under the smooth caliber on the 5th.

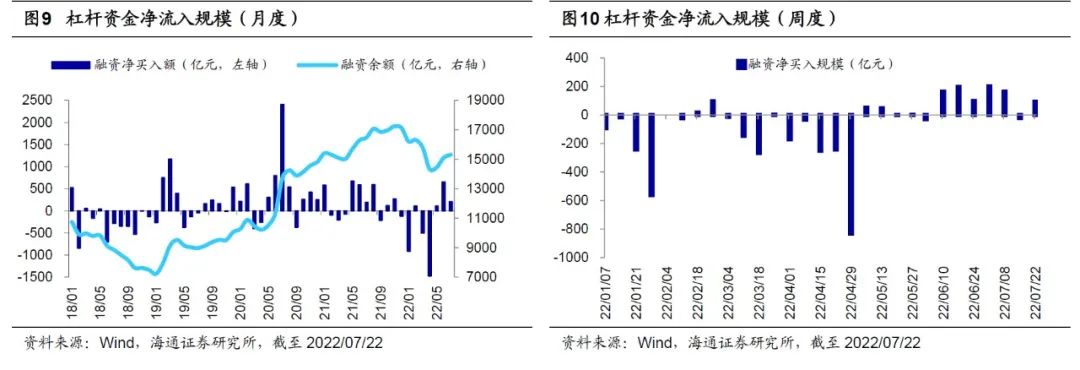

When the market rose in the early stage, the north and leverage funds were significantly inflow. Since July, the steering flow of funds in the north has slowed down, and the inflow of leveraged funds has slowed down. From the perspective of funds, the most obvious incremental funds from the end of April to the beginning of July from the end of this round of April to the beginning of July. 5. In June, net inflows were 12.9 billion yuan and 73 billion yuan, respectively, and after the market began to adjust in early July (as of 2022/7/22, the same below), the funds on the north have accumulated a total of 25.4 billion yuan, especially 7/11-7 /15 records a single week of net outflow of 22 billion yuan, which is 26.1 billion yuan from 36.3 billion yuan and 1/24-1/28 that flows out of 3/7-3/11 this year. In addition to north funds, leverage funds also inflows in the early rise. In May of this year, the net financing balance increased by 10.8 billion yuan, which was significantly increased by 65.2 billion yuan in June. Since the market adjustment in July, it has only increased by 11.9 billion yuan. During July 11-7/15, lever funds have been net outflows of 2.2 billion yuan. It is the first weekly net outflow of leverage funds since June. The inflow rate of medium leverage has slowed down significantly compared to June.

3. Keep patience and firm confidence

The cold trend since the end of April does not change. In the previous two weeks of the weekly report "Rest and wait for the fundamentals -20220710", "The Nature of Adjustment: Infalling Spring Cold -20220717", the adjustment and qualitative adjustment of the market experience since July is the cold spring, that is, the winter has ended, the spring has arrived, but there will still be there still some Chunchun cold. Some investors are worried that this adjustment will return to the lowest point in the early April? We think not, the low point in April is the reversal bottom. From the perspective of the investment clock and the cycle of the bull, the market in April is the bottom of the 3-4 years. At that time The position of the position is at the bottom, three of the five fundamental leading indicators, and the other two gradually stabilize. For details, please refer to "What are the conditions for rebound to reversal?" -20220504 "," Compared with history, this time it may be a shallow V base -20220605 "," The dawn first-20122 mid-term capital market outlook-201220618 "and other reports. The trend must be patient and firm.

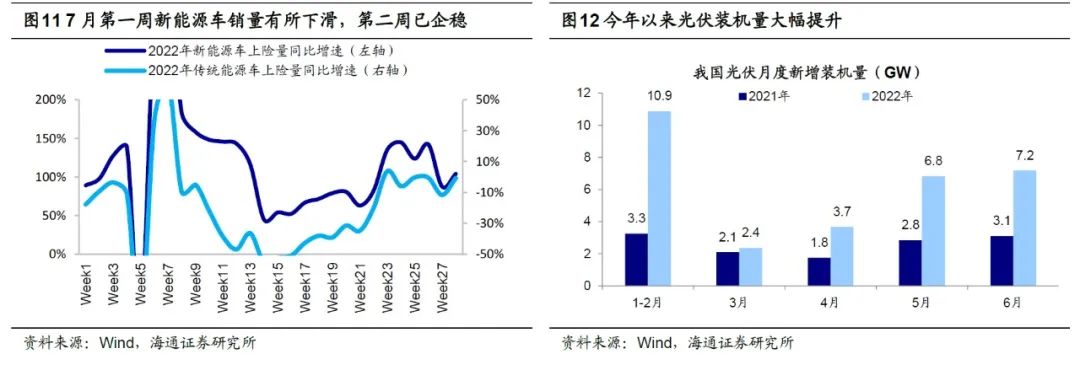

The mid -term continues to be optimistic about the growth of high boom, taking into account the necessary consumer goods. After the first four months of this year, after the bank real estate, since the end of April, we have been optimistic about the growth of the new energy representative. Under the catalysis of incidents and policies, photovoltaic demand has risen at home and abroad. From January to June this year, my country ’s new photovoltaic installation machines were 30.9GW, an increase of 137%over the same period last year. Among them, the number of new photovoltaic installations in June was 7.2GW, a year-on-year+131%. The cumulative sales of new energy vehicles in the first 6 months of the first 6 months, a cumulative year -on -year growth rate of 116%, of which 596,000 units were sold in June, a year -on -year of 133%. At the end of the year, 19%rose to 24%in June this year. After the rapid rise since the end of April, as the market has entered a period of rest of spring cold, it is normal for new energy -related fields to take advantage of the opportunity to rest and digest. In the first week of July, the year -on -year growth rate of sales of new energy vehicles (the insurance caliber on the CBRC) fell from 140%in the last week of June to 90%, causing investors to worry about the sustainability of new energy vehicles, but in fact July and August are the off -season of traditional sales, and the year -on -year growth rate of the second week of July has risen to 100%. The data has stabilized. In the future, new energy vehicle related industries continue to rise. At present, the market is expected to sell for 22 years of new energy vehicles at about 6 million vehicles (optimistic assumptions of 6.5 million vehicles). Performance. In terms of photovoltaic, the National Energy Administration is expected to increase by 95.9%year -on -year in photovoltaic power generation. If the production capacity of silicon materials in 22 years and the price of silicon materials have fallen, domestic and foreign support policies have brought super -expected marginal changes to the installation volume, and the light volume will also be further processed. For details, see "How about the new energy and cars?" -20220704.

In addition, consumer consumer goods, especially medicine. With the control of the domestic epidemic, residents' travel and consumption activities were significantly repaired. The latest data showed that the domestic agency zero in June increased from -6.7%in May to 3.1%year-on-year, higher than the market expectations -0.5%. In addition, the price of domestic agricultural products and pigs has risen sharply since this year. The year -on -year year -on -year growth rate of CPIs exceeded the expected increase to 2.5%. The CPI may further rise in the second half of the year. Historically, CPI consumption must often be better due to the increase in price increases. Essence It focuses on pharmaceuticals. From the Fund 2nd quarter report, the proportion of public funds to the pharmaceutical industry (relative to CSI 300) has fallen to a new low of 13 years, and the pharmaceutical industry is relatively needed for consumer goods and higher barriers.

Risk reminder: The deterioration of domestic epidemic affects the domestic economy; hard landing in the US economy affects the global economy.

Editor -in -chief: Wang Lulu

- END -

Converted the van into a refueling car to sell gasoline Suining's first crime of dangerous operations

Recently, Suining's first crime of dangerous operations was publicly pronounced in the Daying County Court.From May to August 2021, the defendant Zhu Moumou converted the three second -hand vans he pu...

Young people who adhere to the Gobi Electric Farm

Pomegranate/Xinjiang Daily reporter Wei Yonggui Zhang RuilinThe sun is empty, and ...