Yi'an Property Insurance has become the first bankruptcy insurance company in China!What about consumer policies?

Author:China Consumer News Time:2022.07.29

On July 15th, the CBRC issued the "Approval on the Bankruptcy and Reorganization of Yi'an Property Insurance Co., Ltd.", saying that principles agreed that Yi'an Property Insurance Co., Ltd. (hereinafter referred to as Yi'an Property Insurance) entered the bankruptcy reorganization procedure. Yi'an Property Insurance became the first domestic insurance company in China.

Insurance company bankruptcy

What about consumers?

How to guarantee the insurance policy?

What should I pay attention to when buying insurance in the future?

01

Enter the bankruptcy reorganization procedure

On July 15, the Beijing Financial Court also disclosed a civil ruling and ruled that the application for the reorganization of Yi'an Casualty Insurance was ruled.

"The court accepted the application for bankruptcy and reorganization, which is different from the bankruptcy liquidation." Li Bin, a lawyer Li Bin, a lawyer in Beijing, explained that the purpose of bankruptcy and reorganization is to reorganize and strive for enterprises to be able to be able to be able to reorganize. Survive. The bankruptcy liquidation is to settle claims and debts to achieve the end of corporate life.

Yi'an Property & Casualty Insurance is one of the four domestic Internet insurance companies. It was approved and opened on February 16, 2016 with a registered capital of 1 billion yuan. Since 2018, the operating conditions of Yi'an's financial insurance have begun to deteriorate and have lost money for two consecutive years. The asset-liability report issued by the International Accounting Firm of Tiangdo shows that as of March 31, 2022, the total assets of Yi'an Property & Casualty Insurance were 334 million yuan, the total liabilities were 462 million yuan, and the shareholders (or owner) equity was 127 million yuan.

The Beijing Financial Court stated in a civil ruling that Yi'an Property Insurance has the advantages of flat management structure and light asset operations. At the same time, Yi'an Property & Casualty Insurance's own assets and liabilities are not large, and they are expected to improve their solvency through limited investment. In summary, Yi'an Property Insurance has the possibility of reorganization and saving.

02

The stock policy continues to be fulfilled

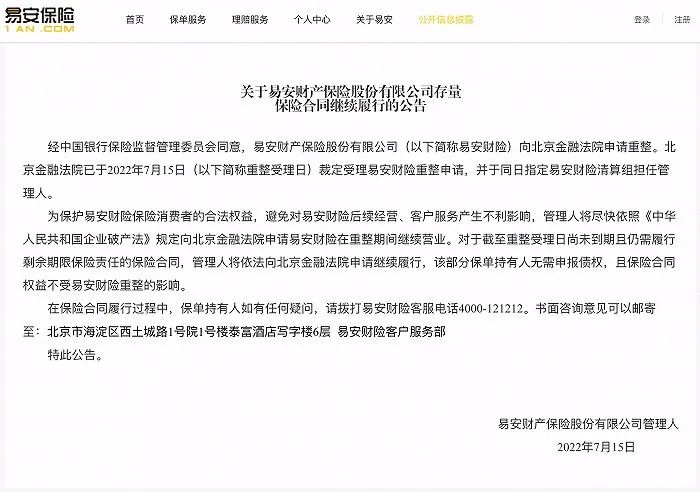

After entering the bankruptcy and reorganization procedure, the issue of the rights and interests of the Yian Property and Casualty Insurance policy has received widespread attention. On July 15, the official website of Yian Cai Insurance issued a number of announcements, involving the rights and interests of the policy creditors, and the existing insurance contract continued to be fulfilled.

The Yi'an Property & Casualty Insurance Manager issued an announcement saying that in order to protect the legitimate rights and interests of the insurance consumers who Yi'an Casualty Insurance, the manager will apply to the Beijing Financial Court for the Yi'an Price Insurance to continue its business during the reorganization period. For insurance contracts that have not yet expired as of the reorganization acceptance date and still need to fulfill the remaining period of insurance liability, the manager will apply to the Beijing Financial Court to continue to perform in accordance with the law. The influence of the reorganization of the security insurance.

The fundamental announcement was the announcement of the China Insurance Security Fund Co., Ltd. that with the insurance contract of Yi'an Property Insurance as an insurance contract, there are three types of situations that need to declare claims to the manager:

The first is the policy that has expired before the reorganization, and the insurance accident has occurred but the insurer has not yet completed the compensation;

The second is to reorganize the policy that has not been expired a few days ago. Insurance accidents have occurred and the insurer has ended after completing the insurance liability after this compensation;

The third is that the insured applied for a surrender before the reorganization and the reorganization period, and the insurer had not refunded the insurance premium.

The announcement also pointed out that in order to simplify the procedures for the declaration of claims and fully guarantee the legitimate rights and interests of the creditor's creditors, the above policy holder authorizes the China Insurance Security Fund Co., Ltd.

"For the holder of the policy, just wait for the announcement of the manager. If there is a surrender or an insurance accident has occurred but has not yet been claimed, it is necessary to authorize the China Insurance Security Fund to declare the claims." Li Bin said.

03

The corresponding mechanism guarantees the rights and interests of the policy holder

During the insurance process, many consumers are worried that the insurance company is running and the policy is not managed. It is believed that the policy of large companies is more guaranteed. Is this idea correct?

In Li Bin's view, this worry is completely unnecessary. He analyzed that insurance is divided into life insurance and property insurance.

property insurance

Generally, one -year insurance, that is, the two -year receiving period expires. Many insurance insurance policies have already expired, and bankruptcy and reorganization have no effect on the previously expired policies. Even though the policyholder chose the renewal during the two -year reception period, the Yi'an Property & Casualty Insurance Manager and China Insurance Security Fund Company also made proper arrangements for the relevant creditor's rights in the announcement.

life insurance

"Although Life Insurance is often long -term insurance, there is also a complete set of mechanisms to protect consumers' rights." Mr. Wang, a senior insurance agent, told the China Consumer News that the insurance company has many security guarantee mechanisms to ensure the holding of insurance policies to hold the policy holding. Human rights.

For example, a real -registered capital of more than 200 million yuan, 20%of which are used as a deposit, which is only used to repay debts when the company is liquidated. At the same time, the insurance industry has also established a responsible reserve system, provident fund system, re -insurance system, and insurance security fund system. The regulatory authorities will disclose the solvency of the insurance company every quarter. When the solvency is insufficient, the corresponding regulatory measures such as restricting the new business will be taken.

It is understood that in 2006, Xinhua's life solvency was seriously insufficient. After being taken over by the former Insurance Regulatory Commission, the Insurance Security Fund acquired its shares and successfully rescued it. In 2018, after Anbang Insurance was taken over, the Insurance Security Fund jointly established "everyone insurance group" and SAIC Group and other "everyone insurance groups" to undertake Anbang's compliance business and assets.

"Therefore, the bankruptcy of insurance companies will not affect the rights and interests of the original policy. The insured does not need to choose the product of the big company because of the concern of the insurance company's bankruptcy." Mr. Wang said.

Correlation

Article 19 of the Administrative Measures for the Insurance Security Fund stipulates that if the insurance company is revoked in accordance with the law or implemented bankruptcy according to law, the liquidation property is not enough to pay the benefit of the insurance policy, the insurance guarantee fund shall provide the policy holder of the non -life insurance contract in accordance with the following rules in accordance with the following rules. Rescue: (1) The loss of the policy holder is within the part of RMB 50,000, and the insurance security fund is fully rescued; The amount of rescue funds of the guarantee fund is 90 % of the amount of more than part of the amount; if the policy holder is the person as an institution, the insurance guarantee fund's rescue amount will be more than 80 % of the amount of the insurance guarantee fund. Article 92 of the Insurance Law stipulates that if an insurance company operating a life insurance business is revoked or declared bankrupt in accordance with the law in accordance with the law, the life insurance contract and liability reserve they hold must be transferred to other people's life insurance business Insurance companies; those who cannot reach a transfer agreement with other insurance companies shall be transferred by the State Council's insurance supervision and administration agency that operates a living insurance business. The insurance company that accepts the transfer shall safeguard the legitimate rights and interests of the insured and the beneficiary.

Produced by Chinese Consumer Newspaper New Media Editorial Department

Source/China Consumer News · China Consumer Network

Reporter/Nie Guochun

Edit/Pei Ying

- END -

Old party member Du Shu'e: keep in mind the party membership of the party members to practice the party constitution with action

The continuous high temperature steamed to the city. On the morning of June 28, th...

Dali Railway Dali to Baoshan section opened on July 22

Hulk passed the bridge No. 2. Photo by Yao Wei of China NetChina Net July 21 (Repo...