In order to focus on the main business, it is planned to transfer 6.545%of Mianyang Commercial Bank's 6.545%equity in the past five years. In the past five years, the investment income of "falling" exceeded 276 million yuan

Author:Daily Economic News Time:2022.07.31

On the evening of July 29, Fu Linyun (SZ002357, a stock price of 5.97 yuan, and a market value of 1.872 billion yuan) issued an announcement stating that it is a focus on the company's main business and is planning to transfer the transfer of Mianyang Commercial Bank Co., Ltd. (hereinafter referred to as "" Mianyang Commercial Bank ") 6.545%equity.

The announcement shows that according to relevant regulations, the transaction will constitute a major asset reorganization. In the next month, Fulin Transport will publicly solicit the intention of the transferee, and the two parties will negotiate the price based on the asset evaluation results.

"Daily Economic News" reporter noticed that since the acquisition of Mianyang Commercial Bank's equity in 2016, Fu Linyun has received a generous return from this high -quality asset. According to statistics, from 2017 to 2021, Fulin's investment income confirmed by Mianyang Commercial Bank exceeded 276 million yuan.

"After all, this is some of the income of financial investment. Our positioning still hopes to focus on the main business." On July 30, the relevant staff of Fu Linyun said to each reporter on the phone that the company hopes that there will be some in the industry that can have some in the industry. In order to support the company's business development and in order to meet the strategic development plan, the company has carefully made the decision to transfer the equity of Mianyang Commercial Bank.

Public solicitation intention to transfer

On the evening of July 29, Fu Linyun issued a prompt announcement on planning major asset sales and public solicitation intentions.

The announcement shows that 6.545%of the Mianyang Commercial Bank held by the Fulin Transportation Plan for the transfer industry, and this transaction will constitute a major asset reorganization stipulated in the "Administrative Measures for the Reorganization of major assets of listed companies".

In the announcement, Fu Linyun said that the other party of the transaction is not yet sure that the company will publicly solicit the intention of the transferee. The solicitation period is from July 29 to August 31, 2022, and the transaction party needs to meet certain qualifications. In terms of transaction price, the two parties use the results of the asset evaluation report issued by the evaluation agency as the result of reference to negotiating pricing and buy them in cash.

Fu Linyun industry reminds that this transaction is in the planning stage, and it is necessary to fulfill the necessary internal and external related decision -making and approval procedures. There are still uncertainties in this transaction -related matters.

Public information shows that Fulin's transportation industry is a national first -level road passenger transportation enterprise engaged in road passenger transport. It ranks first in the Sichuan road transportation industry in terms of scale and strength.

In recent years, Fulin's transportation industry has used investment and mergers and acquisitions in the financial field as an important direction for the diversified development of the company. Following the subscription of 9.5%of the equity of the Rural Credit Cooperative Cooperative in Sanshi County in 2014, it cost 336 million yuan in 2016, with The price of 6.25 yuan per share acquired 53.8 million shares of Mianyang Commercial Bank, accounting for 8.65%of Mianyang Commercial Bank's total share capital.

With this shareholding ratio, Fulin Transport has lived in the second largest shareholder of Mianyang Commercial Bank all year round. However, in December 2021, Mianyang Commercial Bank recently increased its capital and shareholding, and Fu Linyun gave up the priority subscription rights based on its own business development plan. Therefore, at the end of 2021, the shareholding ratio of Fulin's transportation industry on Mianyang Commercial Bank fell from 8.65%to 6.545%to the fourth largest shareholder.

It can be seen from the shareholding ratio that Fulin's transportation industry has transferred all the equity of Mianyang Commercial Bank under its name. Combined with Mianyang Commercial Bank's equity structure at the end of 2021 and the total share capital of 1.644 billion shares, the number of equity involved in this transfer was 107.6 million shares.

Regarding the reasons for the transfer of "clearing", Fulin's transportation industry stated in the announcement that it is to focus on the company's main business to promote the "Internet+" convenient transportation development. Fulin transportation industry pointed out that if this transaction can be completed smoothly, it will promote the adjustment of the company's industrial structure, improve the layout of the road passenger transport industry, enhance the company's core competitiveness, and enhance the company's sustainable operation capabilities and profitability.

On July 30, each reporter called Fu Linyun's industry on the transfer of equity. The company's staff said on the phone that the equity of the transfer of Mianyang Commercial Bank was because the company wanted to focus on the main business. There are some breakthroughs or attempts in the industry. In order to support the company's business development and in order to meet the strategic development plan, this decision is very carefully made. "

The staff of Fulinyun industry said that the intention of the intention of the intention is concentrating, and the solicitation period is one month. If there are related progress in the future, the company will issue a progress announcement in a timely manner.

Mianyang Commercial Bank made a profit of 721 million yuan in the first half of the year

According to the announcement of Fu Linyun, after preliminary estimates, the proposed assets planned to sell assets to the recent accounting assets accounted for more than 50%of the total assets of consolidated financial statements that were audited during the same period, and this transaction would constitute a major asset reorganization.

According to public information, Mianyang Commercial Bank was established in September 2000. It is a state -owned capital holding bank directly led by the CCP Mianyang Municipal Party Committee and the Mianyang Municipal People's Government and the strategic holding of China Minmetals Group. Corporate Bank.

As of the end of 2021, Mianyang Commercial Bank registered capital 1.644 billion yuan, with a total of 81 licensed institutions (including the head office), and established branches such as Chengdu, Guangyuan, Ziyang, Nanchong, Suining, Deyang and other branches. Just a few days ago, the bank also obtained the opening approval of the Sichuan Banking Insurance Bureau on its Meishan Branch.

Every reporter noticed that as of the end of 2021, the total assets of Fulin's transportation industry were 2.605 billion yuan, while the assets of Mianyang Commercial Bank had exceeded 150 billion yuan. Judging from the performance of Fu Linyun ’s industry in recent years, the equity of Mianyang Commercial Bank can indeed be regarded as a high -quality asset, which brings a generous return on investment for Fulin Transport. According to the financial data disclosed by Fu Linyun, in 2021, the company confirmed that the investment income of Mianyang Commercial Bank was 57.688 million yuan, accounting for 83.34%of the net profit of shareholders of listed companies. The reporter sorted out and found that from the reporting period from 2017 to 2021, Fulin's transportation industry confirmed the investment income of Mianyang Commercial Bank 54.8739 million yuan, 54.802 million yuan, 57.625 million yuan, 51.376 million yuan, and 57.638 million yuan. 276 million yuan. As of the end of 2021, Fu Linyun's book value has exceeded 585 million yuan in the book value of investment in Mianyang Commercial Bank.

The financial report shows that in recent years, the scale of Mianyang Commercial Bank's assets has increased steadily, and at the end of 2021, it has reached 150 billion steps, reaching 150.404 billion yuan. In 2021, the bank's revenue and net profit achieved double -digit growth. The annual operating income was 3.866 billion yuan and net profit was 783 million yuan, a year -on -year increase of 22.80%and 31.81%, respectively.

According to the information disclosure report of Mianyang Commercial Bank in the second quarter of 2022, in January to June 2022, the net profit of Mianyang Commercial Bank continued to increase doubled from January to June 2022. Among them, operating income was 2.268 billion yuan, a year -on -year increase of 25.82%; net profit was 721 million yuan, a year -on -year increase of 4.53%.

As of the end of June this year, the total assets of Mianyang Commercial Bank had exceeded 160 billion yuan, reaching 164.542 billion yuan, an increase of over 14 billion yuan from the beginning of the year, an increase of 9.4%.

Daily Economic News

- END -

Drop gathers and frugality, Jinan Border Inspection Station focuses on promoting the creation of conservation agencies

New Yellow River Reporter: Chai YingyingDo not buy new ones when you can use the o...

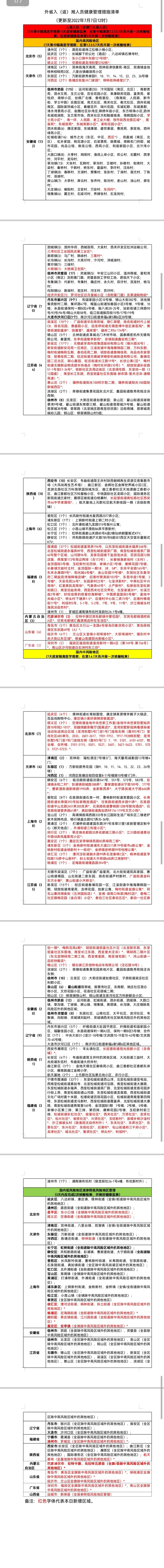

focus on!The latest list of the health management measures of Hunan personnel in the province is here

Hunan Daily, July 7 (All media reporter Zhang Chunxiang Correspondent Zhang Hengji...