Adverse the trend!Northbound funding to bottom out the "two kings" this week, and new energy is expected to return to the "high -speed track"

Author:Federation Time:2022.09.04

This week, the A -share market continued to adjust the situation. The main indexes fell to varying degrees, and the GEM index fell 4.06%, leading the decline. The overall energy track was downturn, and the "two kings" Ningde era and BYD weekly declines in the track also reached 8%and 10.68%, respectively.

It is worth noting that, when the index is tangled and the growth style is cold, the north -directional funds frequently "show operations", quietly opened the "bottom copy mode".

The northbound capital is fast -moving, and the signs of the short -term "show operation" are obvious

Data show that the cumulative net purchase of funds in the north this week was 441 million yuan. Three days on Tuesday, Thursday, and Friday were recorded in three days, and the net inflows were on Monday and Wednesday. Among them, Wednesday was significantly inflow of 7.9 billion yuan. The reason behind it was the concentrated configuration of MSCI's quarterly adjustment and passive funds.

From the sharp inflow of the northern direction of funds on Wednesday, to the accelerated outflow of the end of Friday, the attitude of "smart money" is not difficult to see that before the market has not made a direction choice, foreign emotions are still cautious, and the short -term "shows the short -term" show. The signs of operation are obvious.

From the perspective of the industry increase, photovoltaic equipment for five trading days this week was bought the most by the northbound capital, reaching 2.184 billion yuan. In addition, batteries and home appliances are ranked second and third to buy nets in the north this week.

From the perspective of reducing holdings, the brewing industry has the largest amount, with a net sales amount of 2.907 billion yuan, followed by the banking industry, which sells 1.231 billion yuan.

The new energy track was turned off, but King Ning and Di Wang were still popular

From the aspect of increasing individual stocks this week, the north -wing funds bought Gree Electric, Ningde Times, Longji Green Energy, TCL Central, and BYD. Gree Electric was purchased 2.22 billion yuan in nets, Ningde Times was bought 1.287 billion yuan, Longji Green was purchased 1.191 billion yuan, TCL Central was purchased 571 million yuan, and BYD was bought 532 million yuan.

The most surprising thing on the list is undoubtedly Ningde era and BYD. On the new energy track, the "two kings" standing on the cusp of the wind are still sought after by funds. Now that "new energy seeing the top" may still be early.

"Ning Wang" and "Di Wang" have been affected by the recovery of the new energy track this week, and have fallen sharply. On the news, the "two kings" have not stopped, "being replaced by public opinion", "abandoned by the stock god" and so on. The news, always holding the hearts of investors.

The market enters "going to Ningde Times"? "Ning Wang" made a strong response

In recent times, with the upstream raw material price increase, Great Wall, Volkswagen and other car companies, such as the upstream raw material price increase, the public, etc., more and more car companies have begun to develop their own batteries. Some social media interpret it for the sake of eyeballs. " "Going to Ningde Time" frequently sounded in the public opinion field.

In the Ningde era, there was no response statement on this, but an alternative response. King Ning signed a five -year long -term strategic cooperation agreement with Jili and Selis, respectively. According to the agreement, Ji Yan has become the global production launch brand of Kirin batteries. Jiguan 009 is the first model of the Kirin battery, and Ji Yan 001 will become the world's first model equipped with a Kirin 1000 km battery. At the same time, the Kirin battery will land the new model of the AITO in the AITO, and the AITO question world will be equipped with Ningde Times power batteries.

Backed from the public opinion, the market choice was originally mutual and dynamic. When some car companies build a new supply chain, new car companies also include Ningde Times into their own supply chain to achieve the industrial chain and value chain improvement. The latest data released by the Korean market institution SNE Research shows that in the first half of this year, the battery installed volume of the Ningde Times was 70.9GWh (Giva Time), an increase of 115.6%year -on -year. To 34.8%.

The stock god re -reduced its holdings, BYD's latest response

This week, the news that the stock god Buffett sold the BYD H -shares twice, which aroused great attention in the market.

Buffett, who has not moved in BYD for 14 years, has recently reduced its holdings frequently. The latest documents of the Hong Kong Stock Exchange show that Buffett's Berkshire Hathaway reduced BYD 1.716 million H shares, which has reduced its holdings of 17.86 million shares, and the shareholding ratio has fallen to 18.87%.

In response to Buffett's re -reduction of BYD H shares, the relevant staff said that BYD also learned about the relevant situation from the Hong Kong Stock Exchange. Shareholders 'reduction of holdings is shareholders' investment decisions. The company's sales volume has reached record highs.

Judging from the recent disclosure of the financial report data in the first half of the year, BYD's performance is undoubtedly hot: driven by the rapid growth of new energy vehicle business, BYD included 150.6 billion in the first half of the year, an increase of 65.71%year -on -year. In the first half of the year, the net profit attributable to listed shareholders was nearly 3.6 billion, which was over 2021, a year -on -year increase of 206%. At the same time, BYD's continuous expanding electric vehicle manufacturing market accounts for nearly 30%.

"Smart Money" is going against the trend, and new energy is expected to return to the "high -speed track"

In addition, it should be noted that since the news of Buffett's selling news, not only the BYD A/H shares have fallen, but the entire new energy track has also been treated sharply.

As for the adjustment of the track, the industry said that the previous market was mainly due to the expectations of intelligent and new energy, which gave the vehicle enterprise a higher valuation, which has already broke through the original valuation range. Once the market, the market once the market is once There was a message of disturbance, and some adjustments appeared under panic. However, a number of investors still said that the new energy track is one of the most determined tracks at present. This growth is particularly precious under the background of global inflation. If you care too much about short -term fluctuations, you may miss it. To embrace long -term opportunities, it is recommended to continue to pay attention to the leaders in the field of competitive landscapes in the new energy track.

The new energy track collectively recovered this week, but the "two kings" as the leader was copied by the north -north capital. Behind the market's response, or it is related to the current part of the market investors in some links in the new energy industry chain. When encountering the news, it will cause some funds to panic.

The north -facing funds often seize the opportunity to go against the trend and pick up these "blood chips with blood." Whether the "smart money" bottom can drive new energy to return to the "high -speed track", let us wait and see.

Click "watching

"Stocks make a lot of money

- END -

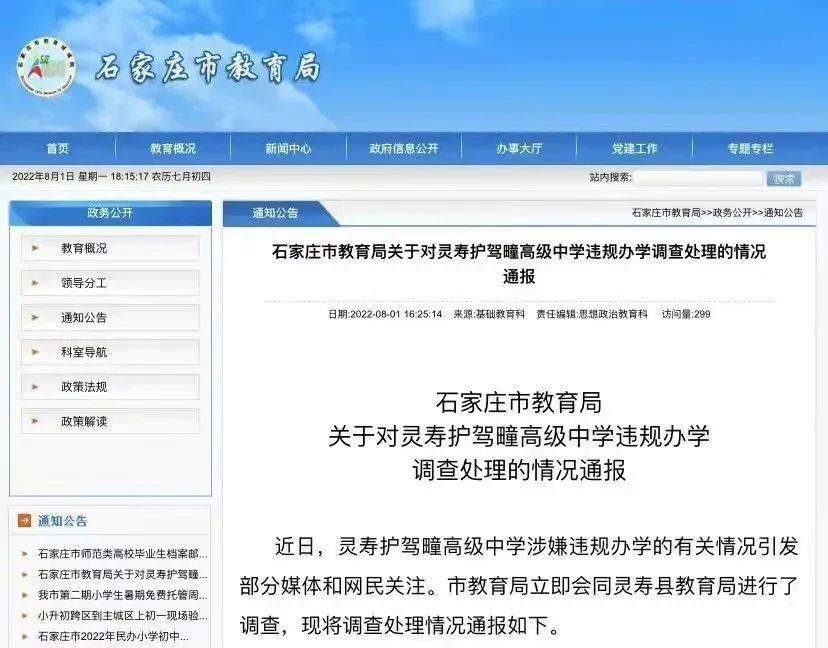

200 students attended a fake middle school?The official report is here

Recently, Lingshou Lingshou Lingshou High School in Shijiazhuang, Hebei, has attra...

Rail traffic, fast roads, new schools ... Xuzhou runs "acceleration"!

New landmarks in the city are constantly emergingUrban appearance is constantly ch...