Policies for the continuation of a combination tax support policy -deduction of key group entrepreneurship taxes and fees

Author:SME public service platform Time:2022.09.05

In order to facilitate the timely understanding of the applicable tax support policies in time, the State Administration of Taxation has sorted out the newly introduced and continued implementation policies, and forms a new combined combination in accordance with the compilation of the subject, the preferential content, the conditions, and the policy basis for the policy basis. Tax and fees support policy guidelines will continue to be updated in accordance with the new tax policy situation. Today, I will take you to understand: Continuing the implementation of tax support policies — the tax deduction policy of key group entrepreneurship.

Key group entrepreneurial tax deduction policy

【Enjoy the subject】

The poverty -stricken population and the "Employment and Entrepreneurship Certificate" (indicating "independent entrepreneurial tax policy" or "independent entrepreneurial tax policy within the graduation year") or "Employment and unemployment registration certificate" (indicating the "independent entrepreneurial tax policy") Personnel, including:

1. Incorporate the poverty -stricken people in the national poverty alleviation and development information system.

2. Personnel who register for public employment service agencies in the Human Resources and Social Security Department for more than half a year.

3. Zero -employment families and registering unemployed people at the minimum living security family of urban residents.

4. College graduates within the graduation year. College graduates refer to ordinary colleges and universities and adult colleges who have implemented higher education education.

【Promotion】

From January 1, 2019 to December 31, 2025, if the above -mentioned personnel are engaged in individual management, from the month of the registration of individual industrial and commercial households, in 3 years (36 months), 12,000 yuan per household will be deducted in order. Reduce the value -added tax, urban maintenance and construction tax, educational additional, local education additional and personal income tax paid by its actual affordable, and personal income tax. The limit standard can float up to 20%, and the people's governments of all provinces, autonomous regions, and municipalities may determine the specific limit standards within this extent according to the actual situation of the region.

【Enjoy conditions】

If the taxpayer's actual value -added tax, urban maintenance construction tax, educational surcharge, local education additional, and personal income tax are less than the amount of tax reduction, the value -added tax, urban maintenance construction tax, educational costs, and local education additional additional payables paid The amount of personal income tax is limited; the actual value -added tax, urban maintenance and construction tax, educational surcharge, local education additional and personal income tax are greater than the reduction of tax and exemption, and the limit of tax exemption is limited.

- END -

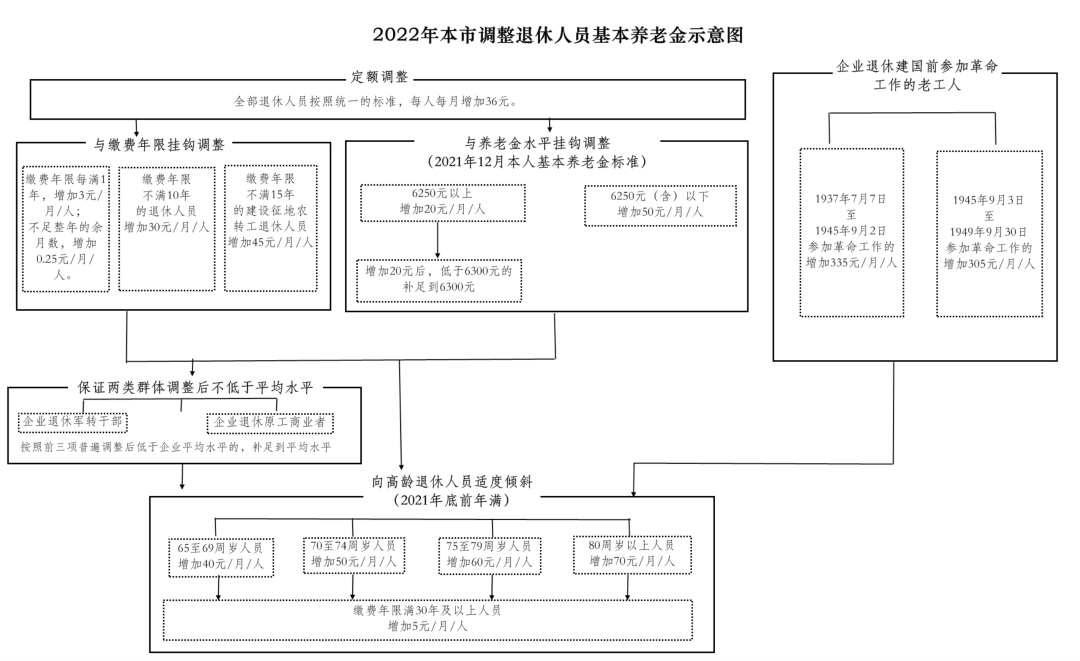

Beijing raises pensions for retirees!Publish in place

On July 14, the Beijing Municipal Bureau of Human Resources and Social Security re...

Houqi Fire Development Gas Fire Specialist Special Inspection Examination

In order to deeply learn the lessons of the gas accidents in the near future, furt...