When the elderly began to retire and recreate, young people couldn't sit still ...

Author:Uncle blanket money Time:2022.09.10

Recently, a website has been online, which has aroused my focus.

Why do you say that?

This is not an ordinary website. It can be seen from the name -called "China Elderly Talent Network", which specializes in helping the elderly retired people to find a job.

Picture source: China Elderly Talent Network

As soon as the news came out, the elderly hadn't stated, and many young netizens "fried hair" first:

"I thought that the elderly life was drinking tea to see a newspaper and jumping square dance. I did not expect to find a job after retirement ..."

But in fact, if you look closely, the help of the elderly here is not just to find a job. There are more than 40 large and small columns, covering the talent policy, recruitment information, literary talents, volunteer public welfare, elderly education that the elderly cares about Waiting for multiple aspects, it is a website that enriches the lives of the elderly.

It is said that as soon as this website opened, it attracted more than 5,000 people to register. Many elderly people say that they want to work again, they are not all for money, and they also want to adjust their boring retirement life.

You know, the life expectancy of our country's per capita now has risen a lot from the age of 74.8 10 years ago. By the age of 78.2, how to live a good "elderly life" has become a major proposition of the Chinese.

Photo source: Financial Association

Of course, I can also understand the concerns of young people.

In the final analysis, everyone is worried that the bombing of "China Elderly Talent Network" is still worried that their lives after retirement are unsatisfactory.

For us ordinary people, it is not terrible to get older, after all, no one will be young forever.

What is terrible?

It's "I haven't got rich yet, it's old!"

This is the same for a person, which is the same for a economy.

In recent years, the aging phenomenon of our country has become more and more serious. According to the survey data of the "State Council's Report on Strengthening and Promoting the Progress of Aging Work", in 2021, the elderly population over 60 years old in my country reached 267 million, accounting for 18.9%of the total population; For the first time, the elderly population over 65 exceeded 200 million, accounting for 14.2%.

According to the United Nations standards, more than 7%of the population over 65 years old is "aging society", more than 14%is "aging society", and more than 20%is "super -aged society".

From this point of view, we are no longer a "aging society", but we have officially entered the "aging society". Maybe soon, you will enter the "super -aged society".

But that's the reason, aging is not terrible. This is an unacceptable natural law. Any developed countries have experienced this process.

What is terrible?

It is "there is no enough ability to establish a social security system, and aging comes."

my country's population aging is not only large, fast, but also not wealthy. Most ordinary people in our country have not been fully prepared at the material level and spiritual level.

On the other hand, my country's development in the past few decades depends on the endowment of human resources. The pension system and retirement system have not yet fully cope with the current aging trend. Economic burden.

These two points are far more terrible than "aging" itself.

What should I do?

There is only one method to continue the current pension system.

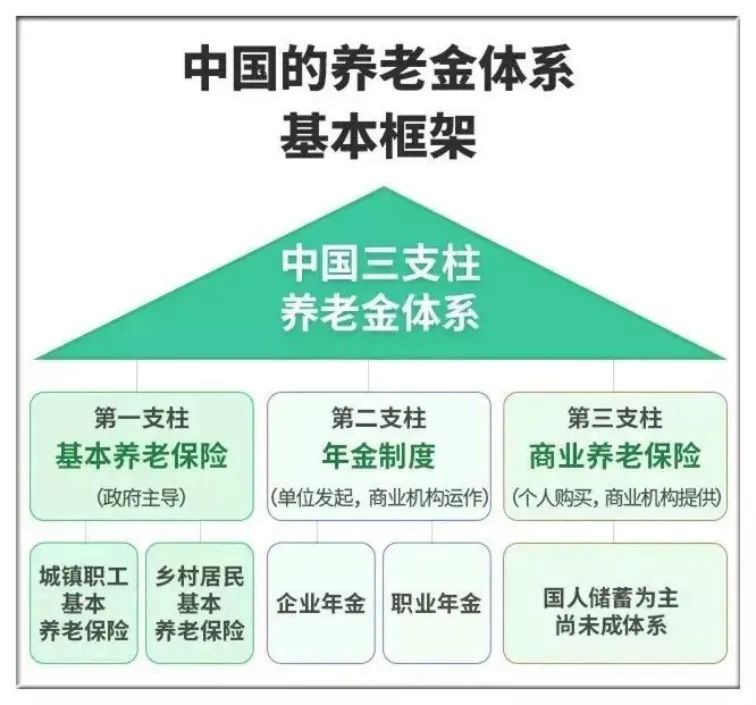

The country is now aware of the problem. Last year's government work report was proposed to "regulate the development of the third pillar pension insurance."

What is the "third pillar"?

In simple terms, the first pillar is basic pension insurance, which is often referred to as pensions; the second pillar is corporate annuity and occupational annuity; and the third pillar includes personal savings pension insurance and commercial pension insurance.

In order to cope with the aging of the population, we must vigorously develop a second and third -pillar private pension system.

There are two benefits in this way, which can not only provide a steady stream of long -term funds for my country's capital market, but also provide family responsibility supplements for social security.

Similarly, for individuals, what exactly does the elderly say?

Anyway -money.

Under the circumstances, all three pillars are enjoyed, which is obviously the most favorable choice for individuals.

If you want to pursue the ideal retirement life, travel with old friends, jump with old sisters, or live in a senior nursing home to enjoy his old age, you must not rely on the basic social maintenance pension. Instead, you need to be more early in advance. And reasonable wealth planning.

And layout pension investment in advance, especially the third pillar pension, is a good way.

However, I have observed that in investment, many young people are still in the stage of "short speculation and making fast money", and they have a mentality of rushing and profitable and getting rich overnight.

But pension investment requires a longer -term, more rational and calm financial management view. To put it plainly, it is to be "stable and stable and stable."

Is there any pension product that is suitable for long money and long money on the market?

I found one.

As a pension for public offering institutions, I have always been concerned about the ICBC Credit Suisse Fund, and I have always been committed to the positive layout and deep cultivation of pension products.

Especially in the layout of the third -pillar pillar public -funded pension product, ICBC Credit Credit has precisely noticed the pension needs of mainstream people from post -70s to 00, and comprehensively deployed the target retirement date from 2035 to 2060.

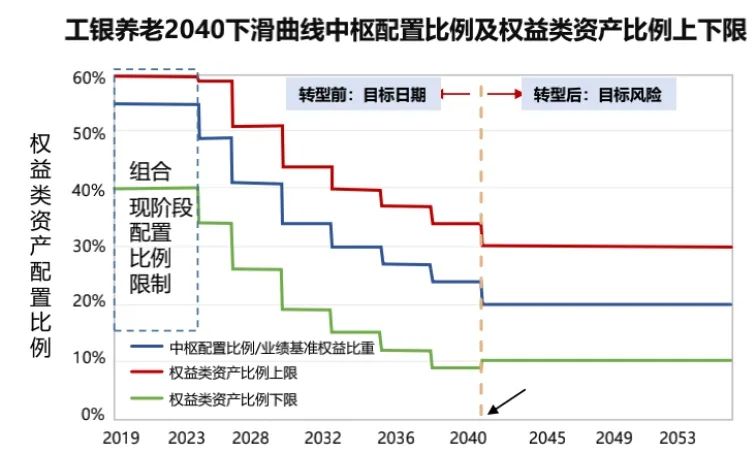

Take the ICBC Pension 2040, for example, this fund is designed for a crowd accumulated by retirement or completing the pension wealth around 2040. In a word, it summarizes its characteristics: it will combine the life trajectory of the holder, dynamically adjust the allocation of large categories of assets, and tailor -made one -stop pension investment solutions for investors.

Why do you say that?

First, it is a FOF fund.

What is FOF?

It is Fund of Funds, and more than 80%of the investment targets are fund products on the market.

You can understand that FOF is a buyer by a professional fund manager to allocate high -quality assets in the market. The type is rich enough and the investment risk is relatively low.

Because the pension investment period is long and the ability to control risks is high, more than ten or decades will experience the rotation of different sectors and multiple cycles in the market. Comprehensive investment management. Therefore, FOF may be more suitable as an old -age investment than other funds.

Moreover, ICBC Pension 2040 is very special, that is, it will allocate different assets with the different trajectories of investors.

According to the theory of life cycle, in general, as investors grow, risk preferences are gradually declining with their age.

ICBC Pension 2040 designed a decline curve in accordance with this law. As the retirement date is close, the weight of equity assets gradually decreases, so that investors no longer need to worry about when they are regulated, which is more convenient and worry -free. Some.

In addition, we often say a word: "Buying a fund is a fund manager."

Who is the fund manager of the ICBC Pension 2040?

Jiang Hua'an, general manager of the FOF Investment Department of the ICBC Credit Fund, has 14 years of investment management experience.

And it is very interesting that Jiang Hua'an once served as the deputy director of the asset allocation department of the Social Security Fund Council, and is a witness of the Social Security Fund from 100 billion yuan. In the management of pension assets, Jiang Hua'an can be said to be a veritable "big guy".

Of course, no matter how much you say, he has to speak by performance. Jiang Huaan's historical performance has outstanding historical performance. The performance of the three public offering FOFs that have been established for 2 years has exceeded the performance of the performance comparison during the same period.

Among them, ICBC Pension 2035 Since its establishment on October 31, 2018, 49.32%of investment returns have been achieved, and the performance comparative benchmark is 33.22%. Since the establishment of ICBC Pension 2040, since its establishment on September 17, 2019, the net value growth rate has reached 27.99. %, The performance comparison benchmark is 15.31%; since the establishment of the ICBC Pension 2045 Since its establishment on January 21, 2020, the net value growth rate has reached 21.75%, and the performance comparative benchmark is 10.73%. (Data comes from the mid -2022 report, as of June 30, 2022)

Of course, in addition to excellent fund managers, an excellent fund is inseparable from the support of a strong investment and research team.

Now, ICBC Pension 2040 has a total of 9 members of the investment and research team. These 9 members have different research and working backgrounds. The team is investing in three -dimensional investment in multiple levels of multi -level from asset allocation, fund investment, and research support. The effect of sewing to achieve 1+1 & 2 effect.

And don't forget that behind the fund manager and investment research team, there is also the vanguard in the field of pension management -ICBC Credit.

ICBC Credit Suisse Fund has been committed to the active layout of pension products over the years. According to the data of the "Fund Management Company Pension Management scale rankings" released by the China Fund Industry Association, as of the end of the first quarter of 2022, the scale of pension management of ICBC Creditkin Fund has been 16 consecutive consecutive consecutive In the quarter, maintaining the first industry in the fund industry.

Behind the excellent performance and long -term steady returns, it is actually the long -term support and forging of the ICBC Credit Fund to help investors achieve long -term excellent performance. In turn, it has prompted ICBC to obtain more customers in pension investment management capabilities in pension investment management capabilities. Acknowledge.

As the saying goes, long -term investment yields are the best advertisements for financial products to attract investors.

So let me summarize it, if you do n’t want to retire and re -employ and hope that you have a more decent retirement life, you may wish to plan it in advance to carry out scientific wealth management for long -term pensions. Essence

Of course, investors who want to have a diversified and balanced allocation of assets can also start.

※ Risk reminder: The content of this article does not constitute any investment advice or reference. Readers are requested to make independent decisions based on personal investment goals, financial status and needs. ICBC Pension 2040 The shortest holding period for each fund share setting is 3 years, and the shortest holding period does not handle redemption and conversion transfer business. The name of the "pension" does not represent income guarantee or any other form of income commitment. The product does not keep the capital and may lose money. The fund is risky, and investment must be cautious.

*All the contents of the carpet's money are all personal views. The purpose of exchanging personal ideas and sharing of knowledge does not constitute any investment advice or reference. The market is risky, and investment needs to be cautious. Readers are requested to make independent decisions based on personal financial conditions.

- END -

127 newly added local infections in Henan

At 0-24 on July 19, 127 new natives of infection were added in the province (127 cases in Zhumadian City), and there were no new local diagnosis cases and suspected cases.Two new overseas input inputs

Celebrate the Song of the August to praise the people's army

Video/Snapshot, T_100, F_JPG, M_fast Controls = Controls data-version/ueditor/vide...