"9 · 5" Luding 6.8 magnitude 6.8 earthquake resume reconstruction tax support policy understands that the card is coming

Author:Kangba Media Time:2022.09.13

At 12:52 on September 5th, a magnitude 6.8 earthquake occurred in Luding County, our state, causing mountains, roads, house collapses and casualties. The taxpayers in the earthquake area were affected to varying degrees. After the earthquake, in order to help the affected taxpayers accurately grasped and enjoyed the preferential tax and fees in a timely manner, the Ganzi Taxation Bureau sorted out the current relevant tax support policies to form a clear card to facilitate the taxpayer's payment.

Due to the rushing time of the compilation, there is inevitable omissions in the policy sorting, which understands that the card is for reference only. For further details, please call 0836-12366, 0836-6612366 or consult with the competent tax authorities. In the process of handling the tax -related business, the taxpayer encounters the specific situation and issues encountered directly with the competent tax authorities. It is subject to the explanation of the current effective laws and regulations, tax standard documents, and the competent tax authority.

Preferential policies I. Corporate income tax (1) The actual property loss caused by an enterprise due to earthquake disasters is allowed to deduct the taxable income amount. (2) The public welfare donation expenditure incurred by the enterprise shall be deducted when the taxable income is calculated in accordance with the provisions of the corporate income tax law and the implementation regulations. 2. Personal income tax (1) Individuals who have caused major losses due to earthquake disasters can reduce personal income tax. The specific reduction and period of time are determined by the people's governments of the provinces, autonomous regions, and municipalities in the affected areas. (2) For the pension and relief of individuals obtained by individuals in the affected area, it is exempted from personal income tax. (3) Donation of their income to the earthquake -stricken area shall be deducted from taxable income in accordance with the relevant provisions of the personal income tax law. 3. Value -added tax does not need to be transferred normally for the amount of input tax corresponding to the purchase of goods caused by earthquake disasters, which can be deducted normally. 4. Real Estate Tax (1) After identification of the relevant departments, the real estate tax can be exempted from the use of unimpractive and useful houses and dangerous houses. (2) For more than half a year, the house is exempted from the real estate tax during the overhaul. 5. Taxpayers in urban land use have serious losses due to earthquake disasters. If they are difficult to pay, they can apply for regular reduction in urban land use tax in accordance with the law. 6. In the process of mining or production taxable products of resource tax taxpayers, if a major loss suffers from the earthquake, the resource tax is exempted. The specific amount of exemption shall not exceed the taxable taxable tax payable for the year before the taxpayer. 7. Vehicle and boat tax (1) If the taxable vehicles have been scrapped or lost during the earthquake, the taxpayer may apply for tax rebate of the taxi tax. (2) Vehicles and vessels that need to be reduced to the difficulty of taxation on the earthquake and other special reasons can be reduced or exempt from the taxi and ship tax within a certain period of time. 8. For the loss of housing due to earthquakes and re -bear the ownership of housing, deed tax is exempted. Zhengzai Service I. Extend the tax declaration period in Luding County, Ganzi Prefecture, extended the tax declaration period in September 2022 to October 31, 2022; the tax declaration period for extended in October 2022 to October 31, 2022. 2. Extension of taxpayers and deductible obligations due to earthquake disasters cannot apply for tax declaration or submitted taxes on time or submitted taxes on behalf of the deduction and payment of taxes. 3. If the taxpayer is extended, the taxpayer cannot pay taxes on time due to the earthquake, and the taxation of the tax payment can be extended by the tax authorities of the province, the autonomous region, and the municipality directly under the Central Government, but the longest must not exceed three months. 4. The Tax Services State Administration of Taxation's Luding County Mosixi Taxation Branch has set up a temporary consultation window. It can be "accommodated" for matters that need to be urgently required. The "non -contact tax" method such as the platform mobile phone side is handled.

Source: Ganzi Tax

Edit: Guo Fan

School pair: Yue Shirui

Editor -in -chief: White Horse

Review: Yang Jie

Kangba Media condenses Kangba's positive energy and spreads the good voice of Ganzi! (Internet news information service license number: 5120190010) 127 original content public account

- END -

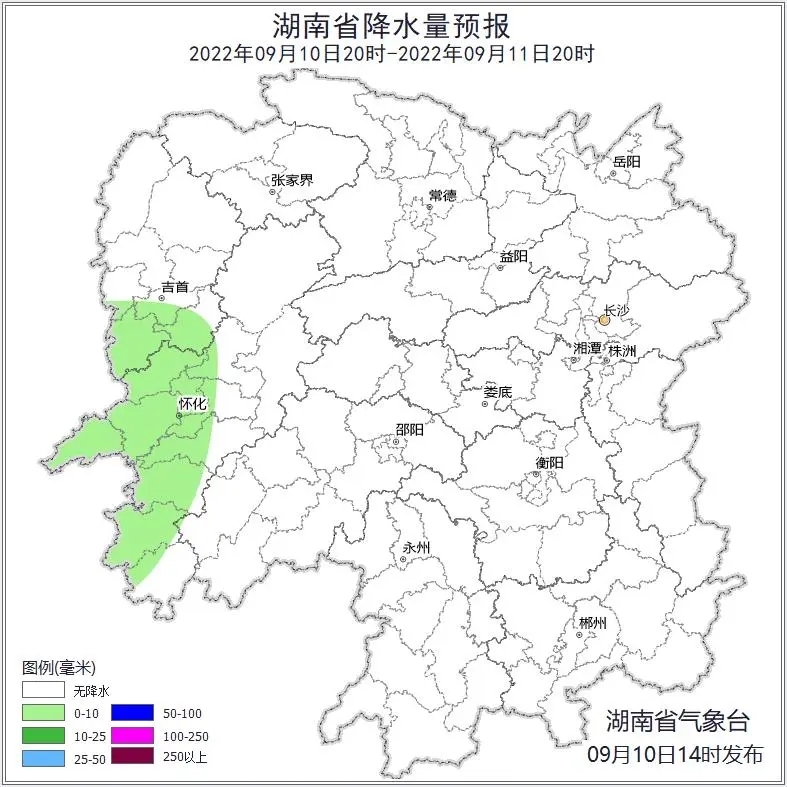

The weather in Hunan during the Mid -Autumn Festival is sunny and conducive to the moonlight

Hunan Daily, September 10 (All Media Reporter Hu Panpan) The Provincial Meteorolog...

Floating bridges were broken, hundreds of tourists were trapped by the Internet celebrities, and hundreds of tourists were trapped

On August 15th, Dalian City, Liaoning Province, rushed to the sea Golden Stone Bea...