The person in charge of the relevant departments of the China Banking and Insurance Regulatory Commission answered the reporter asked about the "Administrative Measures for the Internal Control of Financial Company"

Author:Bank of China Insurance Superv Time:2022.09.14

In order to implement the important deployment of the Party Central Committee and the State Council on strengthening the construction of financial rule of law, to promote the management of wealth management companies to operate in accordance with laws and regulations, and continue to perform their duties in accordance with the principles of honesty and diligence, the China Banking Regulatory Commission has formulated the "internal control of the wealth management company internal control Administrative Measures (hereinafter referred to as the "Measures"). The person in charge of the relevant departments of the CBRC answered questions from reporters on related issues.

1. How is the "Measures" publicly soliciting opinions?

From April 29th to May 29th, 2022, the China Banking Regulatory Commission publicly solicited opinions from the "Measures" and carefully studied the feedback one by one, and further improved the "Measures".

The "Measures" fully absorb and adopt reasonable suggestions, mainly include: First, in accordance with the principle of the consistency of the supervision of similar asset management products, combine the rules of financial management business, and refine relevant regulations. The second is to further improve the management regulations and specific operation requirements of related related transactions, risk reserves. The third is to adjust and improve some expressions.

2. What is the background of the "Measures"?

Since the implementation of the "Administrative Measures for Commercial Bank Financial Subsidians" (hereinafter referred to as financial management companies) in December 2018, a total of 30 wealth management companies have been approved for construction, of which 28 are approved for opening. As of the end of June 2022, the total balance of wealth management products of banks and wealth management companies was 291 trillion yuan. Among them, the balance of wealth management companies was 1.91 trillion yuan. As a new type of asset management institution with independent legal person qualifications, wealth management companies need to build a comprehensive and effective internal control management system as soon as possible.

First, the new regulations such as asset management regulations have proposed the principles of internal control. The formulation of the "Measures" is related to the "Guiding Opinions on Regulating the Asset Management Business of Financial Institutions" (hereinafter referred to as the new rules of asset management), the "Measures for the Supervision and Management of Commercial Bank of Wealth Management Business" (hereinafter referred to as the new financial management regulations), and the method of wealth management companies The refinement and supplement of the system will help to promote the establishment of a sound internal control standard for wealth management companies. The second is to give full play to the role of the internal control line of wealth management companies. The wealth management company is in the critical period of "clean start" and urgently needs to build a internal control compliance management system that is compatible with its own business scale, characteristics and risks, and provides solid guarantees for compliance and stable operations in accordance with laws. The third is to continue to strengthen risk isolation. Wealth management companies also need to build risk isolation walls in terms of personnel, funds, investment management, information, systems and other aspects to improve their independent business capabilities.

3. What are the principles and significance of formulating the "Measures"?

The formulation of the "Measures" mainly follows four principles: First, adhere to the problem orientation, and put forward specific requirements for weak links and lack of internal control management in the wealth management company to improve the executive and operability of the rules. The second is to adhere to the industry's benchmark, fully draw on the practice of domestic and foreign financial industry, and promote the consistency of similar business rules. The third is to adhere to the bottom line of risk, strengthen the prudent business concept of wealth management companies, effectively enhance the ability to prevent and resolve hidden dangers of various types of risks, and ensure stable and sustainable development. The fourth is to adhere to protecting the legitimate rights and interests of investors, give full play to the role of internal control management mechanisms, and implement the protection requirements of investors.

The "Measures" is an important institutional guarantee for wealth management companies to better fulfill the duties of trustees management and the obligation of faith and justice. It is the inherent requirements of the high -quality development of wealth management business. It is an important way to achieve effective supervision. The implementation of the implementation of the implementation of the "Measures" in the new period and new stage of the transformation and development of wealth management companies is conducive to promoting the unified standards of similar asset management business supervision, enhancing the concept and compliance awareness of the rule of law of the wealth management company, establishing and improving the internal control compliance management system, promoting the formation of the wealth management industry formation Good development of ecology.

4. What is the overall structure of the Measures?

"Measures" 46 chapters. Chapter 1 "General Principles", clarify the legislative basis, scope, definition, overall requirements, supervision and management, etc. Chapter 2 "Responsibilities of internal Control" stipulates that the organizational structure of the wealth management company, the division of responsibilities and positioning of directors such as directors and supervisors, internal control functional departments, and internal audit departments. Chapter III "Internal Control Activities", refine the internal control system, product design and duration management, account and sales management, investment and transaction systems, key personnel management, risk reserves, related transaction management, and and with Mother risk isolation and investor rights protection requirements. Chapter 4 "Internal Control Guarantee", clarify the regulatory requirements of wealth management companies in terms of information system management, network and information security management, data quality, accounting and valuation, internal control evaluation, internal control training, and other regulatory requirements. Chapter 5 "Internal Control Supervision", clarify the obligation of internal audit and annual reporting of wealth management companies, and the responsibility for continuous supervision of the regulatory authorities. Chapter 6 is "Affiliated".

5. What are the provisions of the "Measures" on strengthening the management responsibilities of wealth management companies?

The "Measures" require wealth management companies to formulate comprehensive, systematic and standardized internal control systems for various business activities and management activities, and conduct a comprehensive evaluation at least once a year. The first is to strengthen product design and duration management. Before the issuance of wealth management products, the internal approval procedures are strictly implemented, the changes in each product risk monitoring indicator continuously track the stress testing and take effective measures in time. The second is to strengthen the management of wealth management business accounts. It is required to complete the identity information of investor complete and accurately, and open a wealth management account for investors. All processes such as the collection of wealth management funds, collection and payment, and transfer through bank accounts and bank liquidation and settlement channels. The sales information and data exchange of wealth management products pass through the banking industry The CBRC's CIRC's approval platform such as the Central Data Exchange Platform of the Financial Registration Center is carried out. Each wealth management product has set up investment accounts to better track the capital direction and implement the "three orders management". The third is to improve the investment and transaction system. Requires reasonable division of investment decision -making authority, and establish a continuous evaluation and feedback mechanism for investment decision -making authorization. Clarify different types of asset investment review standards, decision -making processes, risk control measures and post -investment management requirements. Improve the full -process management system of transaction, effectively identify and control the risks of related related risks. The fourth is to implement comprehensive management of key personnel in important positions. Implement the job responsibility system and the separation measures of incompatible positions, and emphasize that the development of a unified management of communication tools should be used and monitored and reserved marks should be used. Fifth, strengthen the risk isolation from the mother. Wealth management companies are required to conduct independent approval and investment decisions for each investment. Comprehensively and accurately identify the related parties, standardize the management of related related transactions, and reasonably set up major affiliated transaction standards. 6. What are the main provisions of the "Measures" in the consistency of similar business rules?

The "Measures" fully standardized the good supervision and practice of the domestic and foreign management industry, and refined relevant requirements in combination with the characteristics of wealth management companies. The first is to set up chief compliance officers. Responsible for reviewing, supervising and inspecting internal control construction and implementation, and can report directly to the board of directors and regulatory authorities to better play its role of supervision and balance. The second is to further strengthen information disclosure. Establish a system of personnel information registration and publicity, and clarify the list of investors and trading personnel. Public information on the official website of wealth management companies or China Financial Network and other industries to publicize information, related transaction information, and custody agency information. The third is to strengthen trading monitoring, early warning and feedback. Implement a fair transaction and abnormal transaction monitoring system, forward -looking and prevent risks. Implement a centralized transaction and transaction record system to ensure the separation of investment and transactions, and trading information back trading and inspection. The fourth is to improve personal information protection. Establish an information isolation system, strengthen information isolation, and prevent improper dissemination and use of sensitive information. Handle personal information of investor in accordance with the law to protect the security of investors' personal information.

7. What are the provisions of the "Measures" to strengthen the supervision of internal and external supervision of wealth management companies?

The "Measures" adhere to the combination of internal supervision and external supervision, and jointly promote wealth management companies to improve the internal control long -term mechanism. The first is to require the internal control functional departments of the wealth management company to organize internal control evaluation at least each year, and the evaluation results are included in the performance assessment index system. The second is to request the internal audit department of the wealth management company to conduct internal control audit assessments at least each year to play a role in supervising and checks balance. Third, the regulatory authorities have strengthened continuous supervision, gradually established a financial management company evaluation system to improve the effectiveness of supervision.

8. What are the arrangements for the transition period?

The transition period of the Measures is six months from the date of implementation. If it does not meet the "Measures", rectification shall be completed during the transition period. The wealth management company shall submit the internal control self -assessment report to the relevant regulatory departments of the CBRC before the end of the transition period, and ensure that the provisions of the Measures are internalized into their own system and operation practice.

Nine, the relationship between the Measures and the current relevant institutional rules?

The "Measures" and the system rules such as new rules of asset management, new financial management regulations, and financial management companies jointly constitute the fundamental follow of the internal control management of wealth management companies. If the above -mentioned system rules have stipulated, such as sales management, internal and external audits, etc., the Measures are fully connected. For banks that are still conducting financial management business through internal departments, their internal control management mainly follows the "Guidelines for the Internal Control of Commercial Banks"; if the guidance is not clear, it shall be implemented with reference to the Measures.

- END -

The production workshop full power is full of production Chengdu enterprise recovered power consumption full effort

Red Star News Network (Reporter Li Huiying) On August 30, Is there special electri...

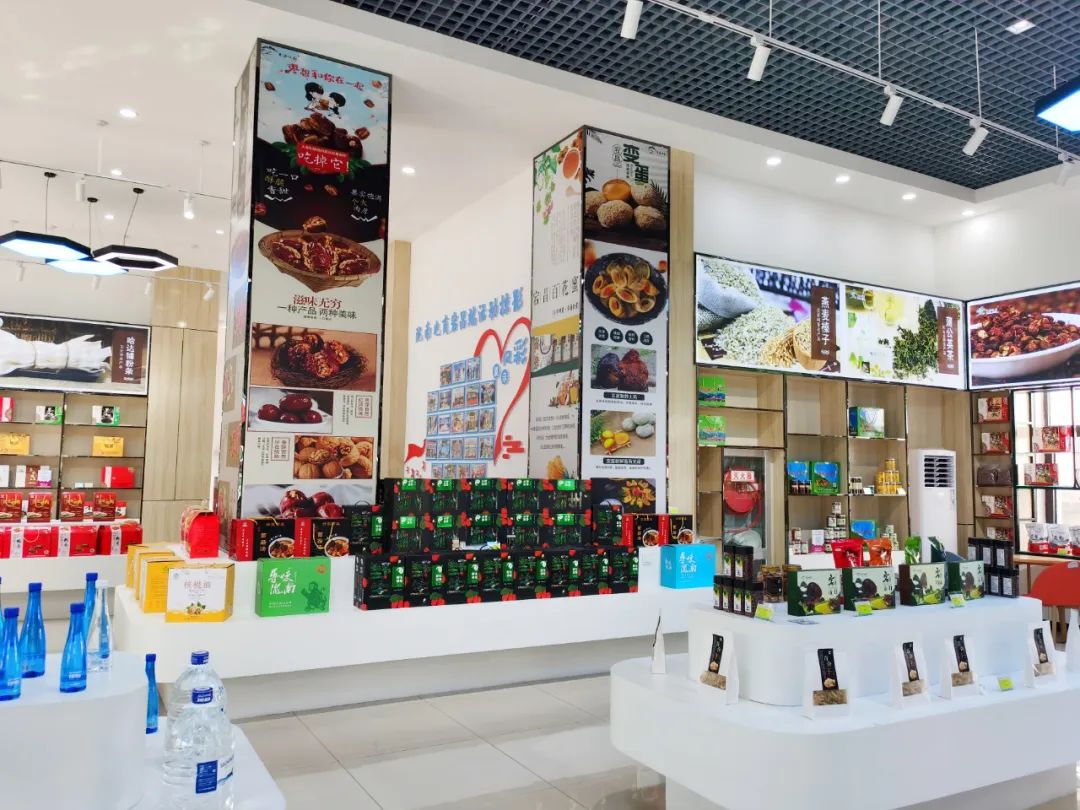

[Welcome to the 15th Provincial Games • Dangchangmei] Dangchangtu specialty originated from the deliciousness of nature ~

The climate of Dangchang County is mild and humidThe difference between north and ...