Notice on the centralized payment of social insurance premiums on social insurance premiums of flexible employment personnel in 2022

Author:Changyi Rong Media Time:2022.09.18

According to the "Notice of the Shandong Provincial Department of Human Resources and Social Security, the Shandong Provincial Medical Security Bureau on the announcement of the issues related to the average salary of employment staff in the province's full -caliber urban units in 2021" (Lu Renxian Zi [2022] No. 89), as a notice, to in order Individual industrial and commercial households and various flexible employees (hereinafter referred to as "flexible employees") who participated in corporate employees' social insurance as their personal employees (hereinafter referred to as "flexible employees") will now enjoy social insurance benefits. The announcement is as follows:

1. Concentrated and payment time

August 29 to September 16, 2022

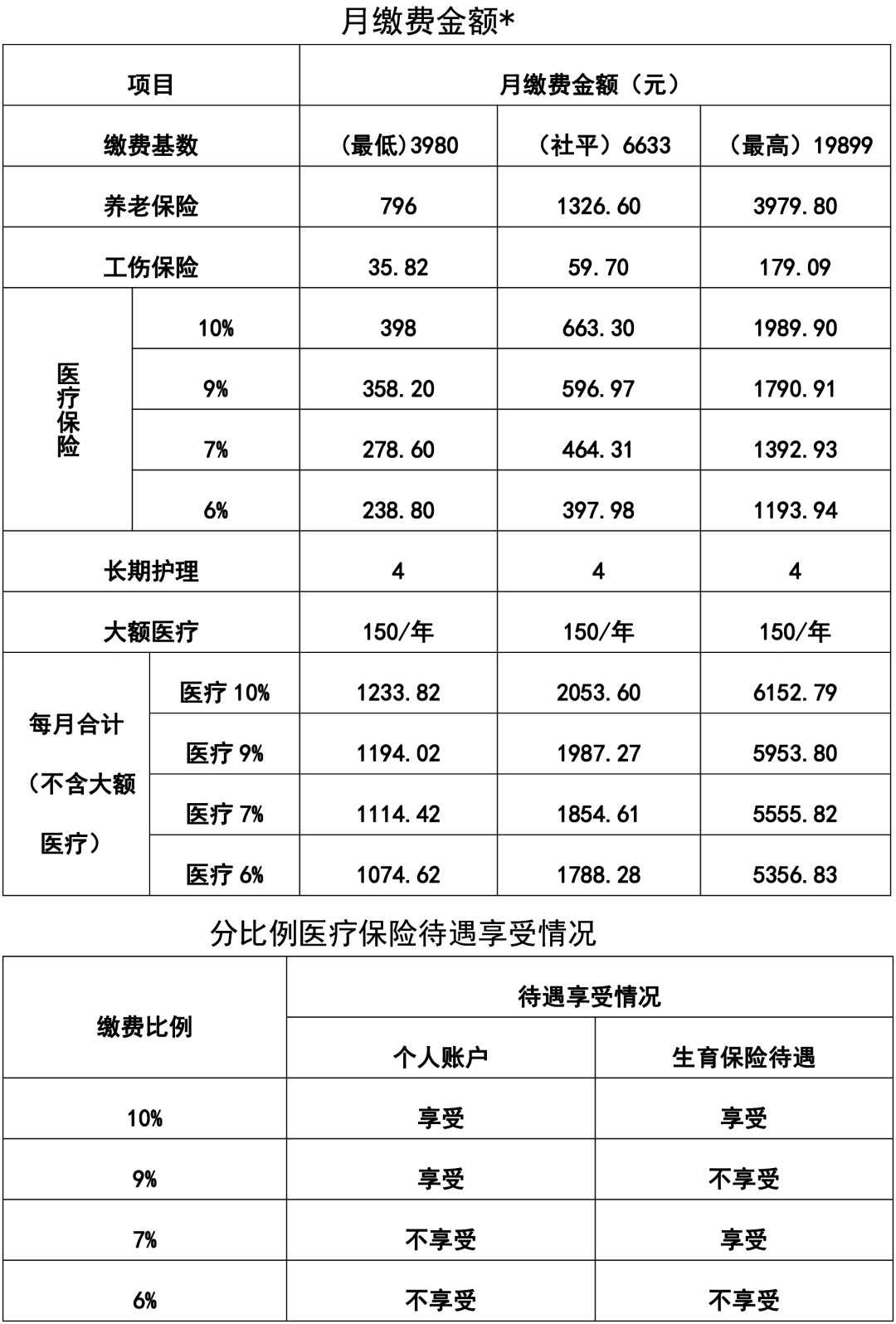

2. Payment standards and sub -payment ratio of medical insurance treatment enjoyment situation

*Special attention: The standard announced this year is the monthly payment amount. It takes several months to pay for the monthly number. Large medical treatment is charged at 150 yuan/year. The payment base can be selected between 3980 yuan and 19899 yuan, and the amount of payment is subject to the amount of ticket issuing.

3. Payment method

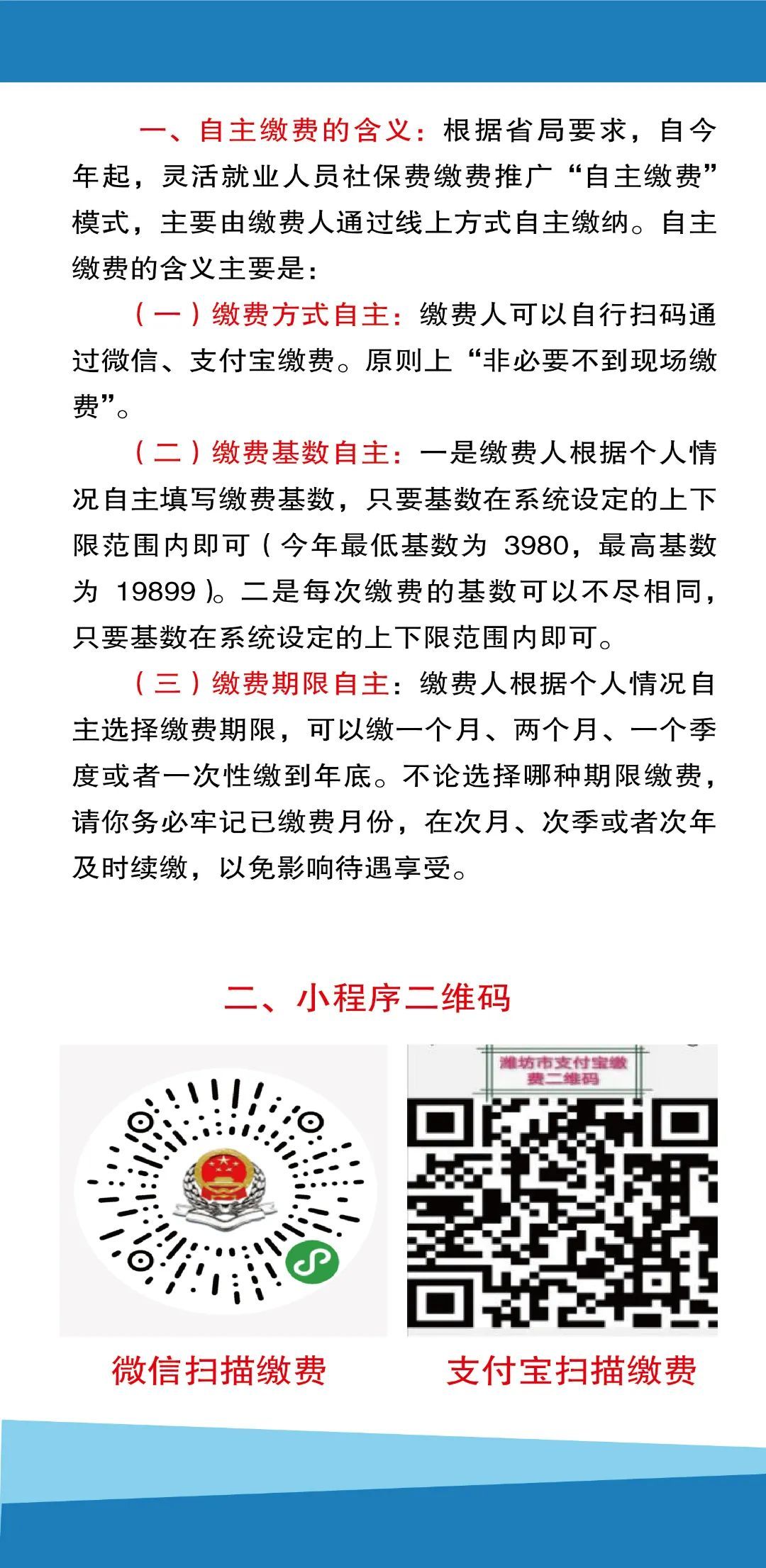

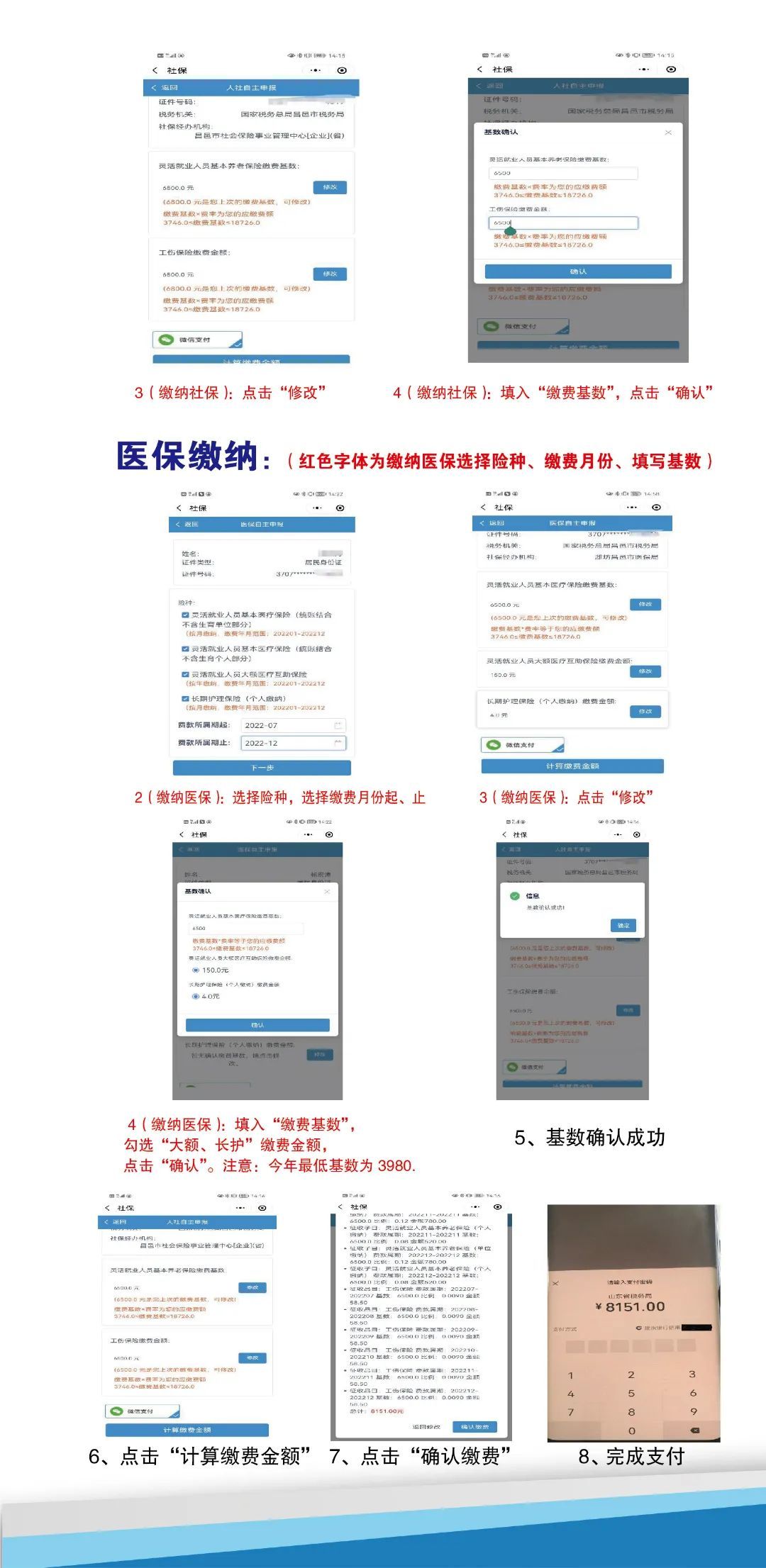

(1) Code online payment. According to the work deployment of the Provincial Taxation Bureau, in order to reduce the burden on the payment of the payment, the "payment of the payment" has been promoted since this year. Therefore, it is recommended to choose to scan code. For the specific operation process, please refer to the "Flexible Employee WeChat (Alipay) Application Payment Operation Guide".

WeChat payment QR code

Alipay payment QR code

(2) On -site payment. Payeers bring resident ID cards, bank cards, etc. to pay the front desk of taxation.

Special attention: This year's payment can be selected in the tax mini -proceedings to choose month, quarterly, and half a year. There are special circumstances (for example, if you are preparing to adjust the unit to pay, and you will retire after a few months. Try not to pay more monthly numbers, so as not to apply for a long period of time and affect treatment enjoyment. When the tax front desk window is paid, there are special circumstances, you must explain to the staff in advance.

Fourth, on -site payment location

(1) New insured personnel and interrupted insured personnel renewed the insurance personnel again: the public's home social security, medical insurance, and tax joint payment window.

(2) Normal renewal personnel. The main hall of the first floor of the Kuiju Road Office of the Changyi City Taxation Bureau (location: Sanxiang Building, the southeast corner of the intersection at the intersection of traffic street and Kuiju Road).

5. Business processing process

(1) New insured person: First apply for employment registration at the employment service window of the citizen's home. After the social security and medical insurance windows are registered, the tax channel (scanning or tax front desk) will be paid.

(2) After interrupting the insured, the renewal is re -enrolled in the flexible employment: After handling the archives custody and personnel agency at the personnel file service window of the citizen's family, then pay through the tax channel (scan or tax front desk).

(3) Normal renewal personnel: Pay the code directly through the WeChat (Alipay) applet, or swipe the card through the tax front desk.

6. Precautions

(1) New participation in changing insurance issues. New insured person (first payment personnel) must go to the employment service window of the Human Resources and Social Affairs Bureau of the Citizens and Social Security and Social Security Window to complete the registration of flexible employment and insurance. For the medical insurance window, you need to go to the medical insurance window before passing the tax channel.

(2) During the payment period. After the social security premium declaration model of flexible employment personnel is adjusted to the independent declaration of the tax department, the period of the fee can only be freely selected for the month of the year (the system limited to the longest in December of the year), and the annual payment cannot be paid. The payment of the payment in June 2022 in 2021 will start from July 2022 from January to June 2022. Start in August. Otherwise, the refund of the refund and the long refund time may affect your rights and interests.

(3) Renewal of renewal. The tax system pays for natural annual annual payment, and the maximum month of the system limited payment is December of that year, that is, December 2022. Therefore, please keep in mind your payment month and renew the fee in a timely manner after expiration to avoid affecting your rights and interests. Especially after entering January 2023, please be sure to scan the code in time.

Special reminder: Please learn to use the "WeChat or Alipay Mini Program" to scan the code to pay for it to facilitate the renewal of the later period. This is the only way to reduce the payment of the payment of the payment.

(4) Make -up problem. If you have paid various social insurance premiums in 2022, the 2022 annual social insurance premiums have been paid according to the 2021 payment base (minimum base number 3746), and the difference should be made in accordance with the 2022 base (minimum base 3980).

(5) Slowly paying the issue of social security. According to the documents, if the flexible employee is difficult to pay the pension insurance premiums from May 2022 to December 2022, the payment can be relieved voluntarily. In 2023, the local personal payment base is selected within the upper and lower limit range of the local personal payment, and the accumulated calculation of the payment period. Slow -payment can only be paid for pension insurance, and medical insurance cannot be paid slowly. Those who do not choose to pay the pension insurance, click "I know" when the applet pops up.

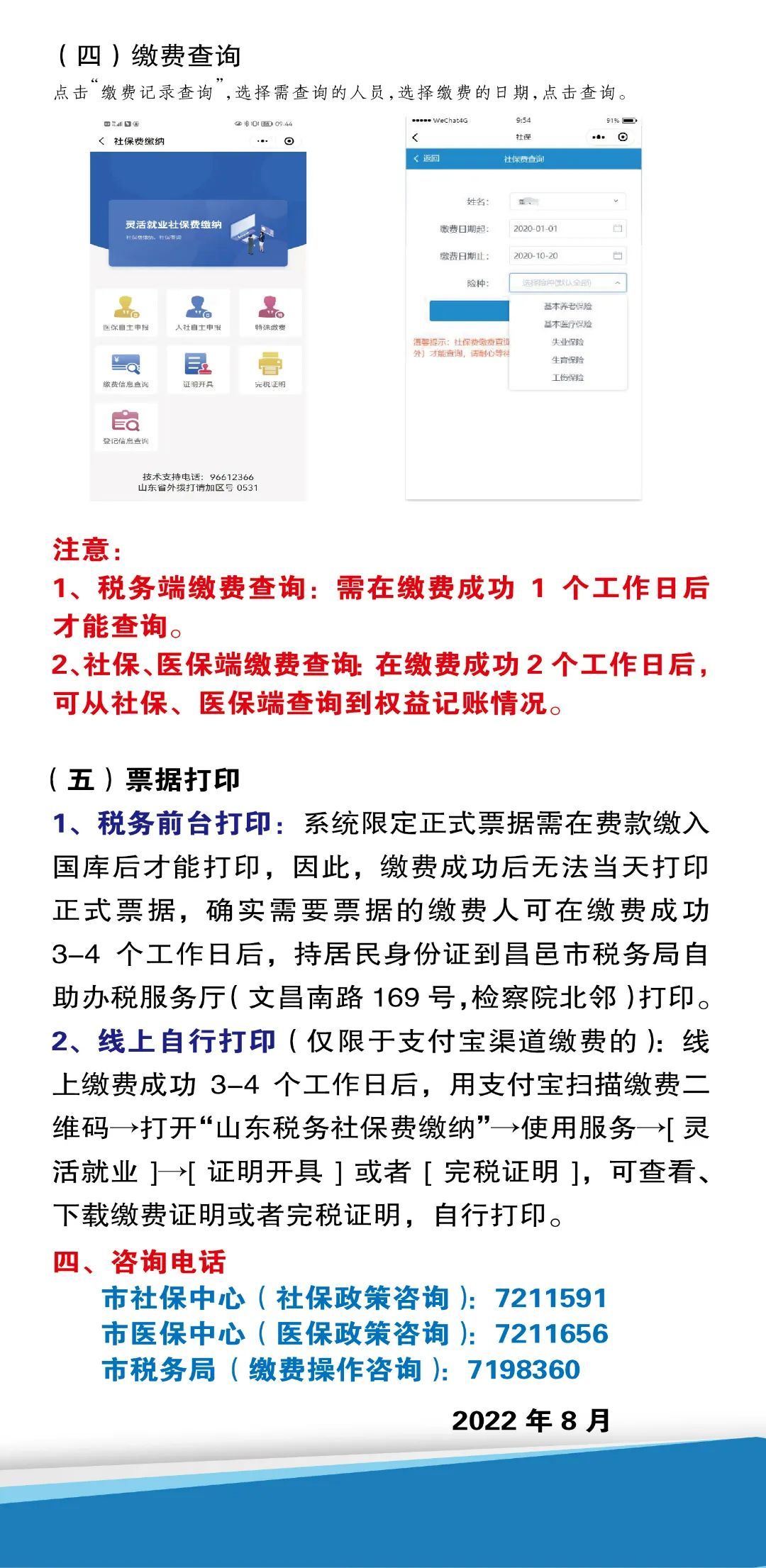

(6) The issue of birth and working hours and years is determined by retirees. The flexible employee is close to retirement. You need to go to the Personnel Archives Service Window of the West Hall of the Citizens first to confirm the retirement year, the working hours, and the payment period before you go to the tax window or pass through the tax mini program Retirement procedures. (7) Bill printing. After the payment is successful, the payment person who needs the bill can be printed on the Self-service Taxation Service Office of the Changyi City Taxation Bureau (169 Wenchang South Road, and the north of the Municipal Procuratorate) of the resident ID card after 3-4 working days.

(8) The issue of epidemic prevention and control. Please go to the on -site window to pay for the epidemic prevention and control. There must be 48 hours of kernel acid test records, wearing a mask, showing the health code as required, and maintaining a safe distance with others with more than 1 meter; Any suspected situation such as fatigue or history and contact history in high -risk areas within 14 days shall not enter the venue; during the payment process, if you have fever or physical discomfort, please contact the on -site staff in time.

(9) Reminder of vehicle parking. Due to the limited parking spaces on the site, it is advocated to take public transportation to the payment. If you really need to drive yourself, park your vehicle on the parking lot south of the "House of Citizens".

7. Consultation telephone

Changyi City Taxation Bureau (Consultation of Payment Operation): 7198360

Changyi City Social Security Center (Social Security Policy Consultation): 7211591

Changyi Medical Insurance Center (Medical Insurance Policy Consultation): 7211656

Changyi City Taxation Bureau, State Taxation Administration

Changyi City Human Resources and Social Security Bureau

Changyi City Medical Security Bureau

August 2022

- END -

Real -name system management implements "one place access, universal province"

Recently, the cloud platform issued the Notice on the Implementation of the Real -name System for the Urban Project in the Autonomous Region's Housing and Municipal Engineering Project.In order to i...

The number of applicants and the number of admission in Xi'an in 2022 in Xi'an

July 27thXi'an announced the primary school and junior high school in 2022The numb...