Crazy!Holding the super "money printing machine", India's richest man earns 1.75 billion yuan daily, becoming the second richest man in the world!The British giant suddenly stopped production, and the food crisis alert sounded again

Author:Broker China Time:2022.09.19

The global wealth pattern has changed dramatically.

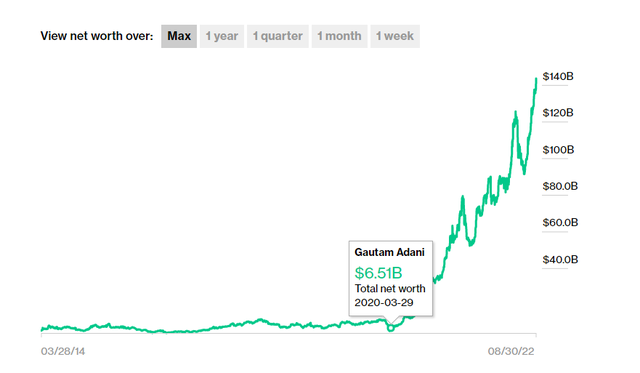

After the U.S. technology giant suffered a sharp plunge, many scientific and technological guys plummeted, and the global coal boss and petroleum tycoon counterattack became the biggest winner in 2022. According to the latest data from Bloomberg Billionaires, the net assets of GAUTAM Adani, the most bullish "coal owner" in India, reached US $ 146.8 billion (about RMB 1 trillion), surpassing Amazon founder Jeff · Bezos, ranked second in the global billionaire list, second only to Tesla CEO Elon Musk ($ 263.9 billion). In the first eight months of this year, its net worth of more than 610 billion US dollars (about RMB 420 billion) has become the fastest -growing billionaire this year.

Such amazing wealth growth has attracted the attention of the global capital circle, and Adi also became the focus of the capital market. The Adida Group, which was founded, controls India's largest private port, urban gas company and coal mines. Among them, the coal business is one of the core businesses of the Adida Group. At present, the Adida Group has almost monopolized the import trade of Indian coal, with a market share of more than one -third. At present, Adida Group has 7 listed companies, and some companies have increased by more than 1,000%since 2020.

At present, the energy crisis in Europe is still one of the focus of market attention, and the food supply chain also comes with alarm. Due to the tight supply of natural gas and the continued soaring prices, recently, the British fertilizer giant CF industry suddenly announced that a large factory in England has suspended production, which further reduces the local carbon dioxide supply, or causes a new round of impact on the local food supply chain.

The best "coal boss" has a net worth of more than 1 trillion

Although the new energy track was "lively and extraordinary" in 2022, the world's most profitable "money printing machine" is still traditional energy such as coal, natural gas, and oil.

Among them, India's most bullish "coal boss" Gaunt Adani can be described as a lot of money, and its value has soared all the way. It is the second place in the global billionaire list.

According to the latest data from Bloomberg Billionaires, Tam Atani's net assets reached 146.8 billion US dollars (about RMB 1 trillion), which continued to surpass luxury godfather, LV President Berner Alino, Amazon founder Jay Fu Bezos, second only to Tesla CEO Elon Musk ($ 263.9 billion), became the first Asian to break into the list.

In early 2022, Adini ranked only 14th in the Bloomberg billionaire index. At present, the top three competition for the global wealth list is still very fierce. Bezos's net worth is only 19 million US dollars behind Adiden. The main variable may be Amazon's stock price. Its stock price has a cumulative decline of 27.4%during the year.

According to Bloomberg's data, Ada's wealth has continued to soar since the global new crown epidemic outbreak, which has shown almost exponential growth. In early 2020, its personal wealth net value was only $ 6.5 billion, and it has now risen to $ 146.8 billion, a cumulative increase of 21 times in just 2 years. In the first eight months of this year, it earned up to $ 61 billion (about RMB 420 billion), roughly calculated. In the year, Adidan earned 1.75 billion yuan.

It is with such rapid wealth growth that Adidan has surpassed a lot of global super rich. In February this year, it surpassed Indian tycoon Mukish Ambani for the first time, and became the richest man in India and Asia; then in April this year, his net worth exceeded 100 billion US dollars and surpassed Microsoft's founder Bill Gates in July, Become the fourth largest richest man in the world; at present, its value ranking has risen to the second place in the world.

Such amazing wealth growth has attracted the attention of the global capital circle, and Adi also became the focus of the capital market.

Adidan's super "money printing machine"

According to official information, 60 -year -old Adini founded Adani Exports LTD in 1988, and later gradually developed into Adidon Group. At present, Ada Group's business spans energy, mining and resources, natural gas, ports and logistics, national defense and aerospace and other fields.

Adida Group has 7 listed companies, and some companies have increased by more than 1,000%since 2020. As of August 30, the total market value exceeded 251.51 billion US dollars (about 1.75 trillion yuan).

At the same time, the group controlled India's largest private port, airport operators, urban gas distributors and coal mines. Among them, the coal business is one of the core businesses of the Adida Group. At present, the Adida Group has almost monopolized the import trade of Indian coal, with a market share of more than one -third.

Since 2022, India has encountered extreme high temperature and drought climate, and the increase in electricity consumption has led to a significant increase in domestic coal demand. Earn a lot of money. Bloomberg said in the report that from January to August 2022, Adidan's wealth rose rapidly, mainly benefiting from the rise in corporate coal sales and prices.

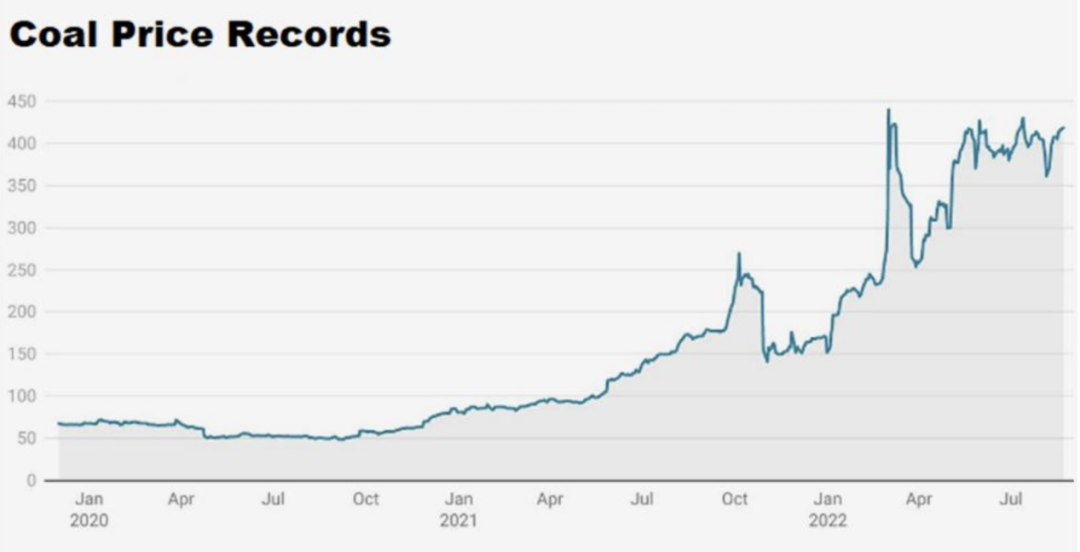

At the same time, the international situation is turbulent, the Russian -Ukraine conflict has intensified, and the international energy market pattern has changed dramatically, which has caused the price of international coal, oil and natural gas to continue to soar. Among them, the coal soared from $ 50/ton a year ago to $ 400/ton, with a maximum increase of more than 700%. Facing the background of natural gas supply in Europe, the current rising international coal price continues. According to the data of Ice Futures EUROPE, in 2022, the price of the three major power coal in 2022 continued to impact the historical high, and Newcastle's power coal spot once broke through the $ 460 mark, setting the highest level since January 2016.

At the same time, many European countries have announced that restarting the coal power plan, Germany has resumed 10 gigresses to idle coal -fired power plants, or it will further exacerbate the global coal market for supply and demand. The highest record.

As the world's second largest coal consumer, the supply and demand of the coal market in India has become increasingly tense. Since mid -August this year, the fossil fuel inventory of the Indian power plant has fallen by about 11%. It means that the average coal inventory of Indian power plants is only 10 days, which is far lower than the requirements of more than three weeks.

Faced with the pressure of stress, India may further increase the import of coal, and the Adidan Group is still in a better money -making window period, and Adiden's net worth will grow further.

It is worth mentioning that the Adida Group also has Australia's largest coal mine Carmichael. It is the first coal mine in the Galilee Basin, Queensland, Australia. It covers an area of about 250,000 square kilometers. Mining and exports will further contribute to the Adida Group.

British giant announced the suspension of production

At present, the energy crisis in Europe is still one of the focus of market attention, and even has begun to impact the food chain.

Due to the tight supply of natural gas and the continued soaring prices, recently, the British fertilizer giant CF industry suddenly announced that a large factory in England has suspended production, which further reduces the local carbon dioxide supply, or causes a new round of impact on the local food supply chain.

It should be pointed out that carbon dioxide is a by -product in the process of production of fertilizer fertilizers. It is widely used in the food industry. A large amount of carbon dioxide must be used in important food production processes such as slaughtering animals, food packaging, dry ice, beer and carbonated beverages.

According to public information, CF industry is the largest carbon dioxide supplier in the UK, and its production of carbon dioxide accounts for 42%of the UK. In 2021, the CF industry shut down two factories due to the surge in natural gas prices, which once triggered a chaotic food chain in the British market.

In August of this year, CF industry issued a warning of suspension of production and blamed the cause of production suspension on natural gas prices soaring.

Natural gas is an important raw material for nitrogen fertilizer and carbon dioxide production. Due to the soaring price of natural gas, more than 70%of the chemical production capacity in Europe has been cut. At the beginning of September this year, Ensus LTD., the second largest carbon dioxide supplier in the UK, also temporarily suspended production.

Kate Halliwell, chief science officer of Food and Drink Federation, said British food companies will face huge pressure this fall. At present, it has faced multiple pressures such as soaring energy prices, fluctuations in exchange rates, rising raw materials costs, and stubborn labor shortages. The British government needs to take emergency actions to solve these problems.

The Everbright Securities Research Report believes that the Russian-Ukraine conflict continues, the supply of Russia has declined sharply, and the shortage of natural gas in Europe may last for 2-3 years. In the long run, European natural gas reserves have continued to decrease, and the potential for increasing the production of self -production gas is insufficient. Only Norway has a small potential to increase production; in terms of LNG -In 2024 new production capacity is mainly the United States. It is estimated that from 2023 to 2025, the liquefied capacity of new LNG exports in Europe is 8.2, 34.6, 78.0BCM/year, and the increase in Russia with a natural gas of Russia with a 140BCM/year of 2023-2024 is not enough. continued.

Responsible editor: tactics

School pair: Gaoyuan

- END -

Fangshan Public Security Joint Financial System to carry out anti -fraud publicity

Huanghe News Network Luliang News (Zhang Lifeng Zhang Huiqian) Recently, the Fangs...

The Ministry of Public Security deployed to promote the "100 -day action" of summer public security and strikes

The National Public Security Organs' Summer Public Security Campaign Hundred Days Action promotion meeting was held on the 15th. Chen Siyuan, a member of the Party Committee and Deputy Minister of t...