Central Bank and China Banking Regulatory Commission: relaxation of the first set of housing loan interest rates in some cities in stages | Express

Author:Huaxia Times Time:2022.09.29

Text/Lu Mengxue

Housing loans will welcome new policies.

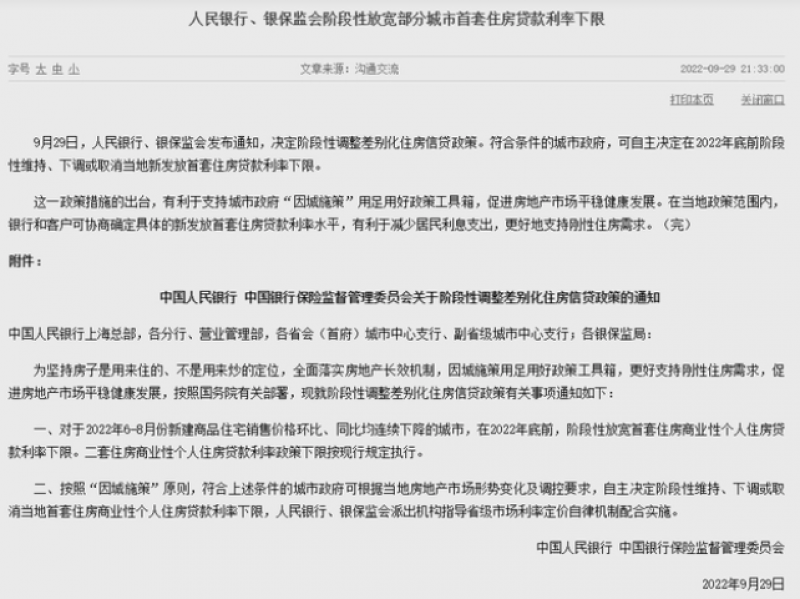

On September 29, the People's Bank of China and the CBRC issued a notice to decide to adjust differentiated housing credit policies in stages. Eligible urban governments can decide to maintain, lower or cancel the lower limit of the first set of housing payment on the lower limit of local housing payment at the end of 2022.

On August 22 last month, the latest 5 -year LPR offer was 4.3%, which was reduced by 15 BP. The lower limit of the interest rate of commercial personal housing loans has also been reduced. The minimum can be executed by 4.1%, and the minimum of the two sets can be executed by 4.9%. The monitoring period released by Rong 360 Digital Science and Technology Research Institute at that time was from July 20, 2022 to August 18, 2022. In August 2022, 33 cities in the 42 cities monitored could perform the minimum national mortgage national loan. In interest rates, the interest rate of mainstream mortgages in 30 cities is the national lower limit.

On May 15, 2022, the People's Bank of China and the Banking Insurance Regulatory Commission issued relevant notices to adjust differentiated housing credit policies. For residents who buy ordinary home houses for loans, the lower limit of the interest rate of the first set of housing commercial personal housing loans is adjusted to not lower than the corresponding period of loan market quotation interest rates at 20 basis points. implement. The notice also proposes that on the basis of the national unified loan interest rate limit, the People's Bank of China and the Banking Regulatory Commission's dispatched institutions in accordance with the principles of "urban policies" guide the provincial market interest rate pricing and self -discipline mechanism, according to the changes in the real estate market situation in various cities in the area under their jurisdictions As for regulatory requirements for urban government, the first set of urban first and two -sets of commercial personal housing loan interest rates were independently determined to independently determine the lower limit.

The introduction of differentiated housing credit policies and measures at this stage is conducive to supporting the urban government's "policy of urban policies" to make good use of policy toolboxes to promote the steady and healthy development of the real estate market. Within the scope of the local policy, banks and customers can negotiate to determine the specific newly issued first set of housing loan interest rates, which will help reduce residential interest expenses and better support the demand for rigid housing.

Edit: Meng Junlian

- END -

Dongguan Natural Resources Bureau conscientiously implemented the deployment of flood prevention and typhoon prevention work

Text/Yangcheng Evening News all -media reporter Wang MoAccording to the news relea...

Stone frog hugging the group "jump" to get rich -Suichangpu City Construction of the Zhejiang Fujian Border Party Construction Alliance

China Well -off Network, June 18th. Reporter Zhou Chuanren Correspondent Lei Xiaoy...