Oil prices have fallen continuously!

Author:Hubei Daily Time:2022.07.15

At present, the global economy is facing the risk of recession. The international market is not optimistic about the prospects of oil demand. In addition, the United States is facing huge pressure on inflation, which has led to the continued strengthening of the Federal Reserve's increase in interest rates. (Reported before)

On July 12, international oil prices fell sharply and fell below $ 100 for the first time since mid -April. Two days later, the international oil price fell again, and he had risen since the outbreak of the Russian and Ukraine conflict.

Why does international oil prices have fallen in the near future? What is the future? How does it affect China?

01

International oil price

Fall

Recently, international oil prices have continued to decline sharply, and it has fallen below the $ 100 mark twice a week.

On July 12, the WTI crude oil futures delivered by the New York Commodity Futures Exchange in August was US $ 95.84/barrel, a decrease of $ 8.25 in the day, a heavy drop of 7.93%, the lowest closing price since April 12; The crude oil futures contracts delivered in September were closed at $ 99.49/barrel, down 7.61 US dollars in daily, down 7.11%to a new low since April 11.

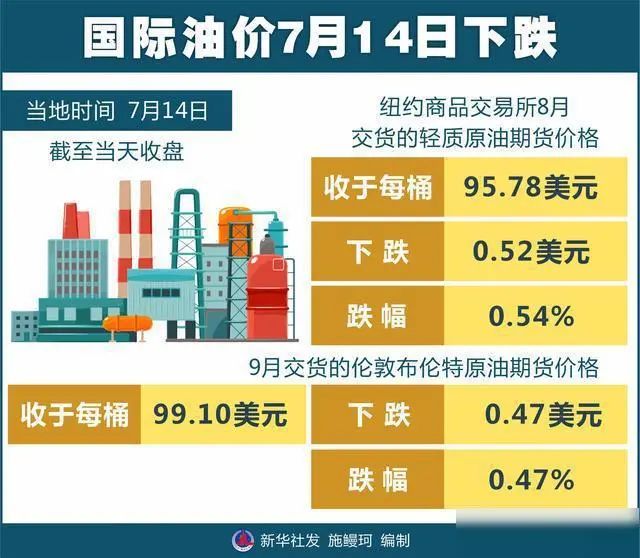

On July 14, the price of light crude oil futures delivered in August of the New York Commodity Exchange fell 0.52 US dollars to close at $ 95.78 per barrel, a decrease of 0.54%. The price price of Buret crude oil in London, which was delivered in September, fell 0.47 US dollars, closed at $ 99.10 per barrel, down 0.47%.

In the session, the price of lightweight crude oil and Brent crude oil fell by more than 5%, the lowest level since the outbreak of the Russian -Ukraine conflict in February this year, and vomited all the gains.

According to expert analysis, the core factors of this round of international oil prices are the global economy, especially the European and American economic situation is not optimistic.

Experts say that economic development is positively related to oil prices, and the demand for oil consumption in economic growth will be greater. Conversely, when the economy declines, the demand for oil consumption will weaken.

At present, countries' continuous interest rate hikes to fight inflation have exacerbated the risk of economic recession and directly facing the demand for oil.

It is worth mentioning that the US inflation climbed a new high. On July 13, the US Department of Labor announced data showing that the US CPI (consumer price index) in June increased by 9.1%year -on -year, refreshing the record of 41 years.

In this regard, the market is expected to take more aggressive interest rate hike measures. Once the interest rate hike is successful, the US dollar will also rise again, allowing oil prices to take pressure.

It is understood that the US dollar and oil prices are a reverse relationship. The depreciation of the US dollar will usually lead to an increase in oil prices, and the appreciation of the US dollar will lead to a decline in oil prices.

In addition, political and financial factors such as European and Russia's sanctions and anti -tanks, the exchange rate of the euro to the US dollar to the US dollar has fallen in nearly 20 years, and has also exacerbated the trend of decline in oil prices.

02

International crude oil market

Multi -short differences

Is the international oil price rising or falling, and the analysis of many international institutions is very different.

The main reason for some institutions is that the Federal Reserve ’s interest rate hikes have caused the market to intensify the economic recession; the main reason for some institutions is that the tightening of the Russian crude oil supply side under multiple rounds of sanctions in the European Union has led , And the remaining production capacity of other oil -producing countries is difficult to make up.

On July 6th, Citi Group stated that if the economic recession seriously affected demand, crude oil prices may fall to $ 65 per barrel at the end of this year, and by the end of 2023, it may fall to $ 45 per barrel.

Goldman Sachs said on July 14, "It is expected that oil prices will rise sharply under the circumstance where global oil supply and demand is unfavorable."

Berlaide, the world's largest asset management company, also said that as Western countries try to reduce their energy dependence on Russia and fail to keep up with the growing energy demand, oil prices will still be high.

Some experts believe that in the long run, insufficient global oil and gas capital expenditures have caused long -term tightening crude oil supply, coupled with factors such as geopolitics and global industrial chain supply chains are still reorganizing, international oil prices still have fundamental support.

03

International oil prices high

How does it affect China?

At present, international oil prices are still at a high level. How does it affect China?

Lin Boqiang, dean of the China Energy Policy Research Institute of Xiamen University, said that high oil prices have little impact on China. This is because China's energy sources mainly rely on coal. As long as the price of coal is not wrong, the impact of high oil prices on the Chinese economy will be relatively weak. "In terms of the proportion of oil and gas, Europe is about 60 %, and the United States exceeds 70 %, so the inflation rate abroad is very high."

According to data from the National Bureau of Statistics of China, the National Resident Consumer Price Index (CPI) in June increased by 2.5%year -on -year.

As for the oil stocks in my country's A -share market, they are affected by high oil prices and the level of profit is quite considerable.

Among the 21 companies in the oil and gas mining and service sector, a total of 13 companies in the first quarter of this year have achieved a year -on -year increase in net profit, accounting for more than 60 %.

Among them, 7 companies including ST continent, Zhongman Petroleum, Quasi -Oil shares, Blue Flame Holdings, Guanghui Energy, China Sea Oil, and Xinchao Energy achieved a net profit of the first quarter of this year.

As of July 14, four companies including Zhongman Petroleum, Lan Flame Holdings, Guanghui Energy, and Xinchao Energy have disclosed the preview of the performance of the first half of 2022, all of which have achieved pre -joy.

Is the recent decline in international oil prices, is it good for domestic consumers?It is understood that the statistics of the new round of oil price cycle in my country have begun. The third working day of the adjustment cycle is predicted that the retail price of domestic refined oil products will be reduced by 515 yuan/ton, and it is converted to 0.39 yuan/liter-0.44 yuan/liter. The box (50 liters) oil is 19.5 yuan cheap.From 24:00 on July 12, the prices of gasoline and diesel in my country will be reduced by 360 yuan and 345 yuan per ton, respectively.

(Tip: This article does not constitute investment suggestions, and the risk of operation according to this)

Source: Hubei Daily Integrity from Xinhua News Agency, Global Network, 21st Century Economic Herald, Securities Daily, China News Network, Interface News, Overseas Network, Surging News, Beijing Youth Daily, etc.

- END -

26307 people were killed throughout the year!How to catch safety production?Hunan is clear

At present, safety production is still in the difficult stage of climbing, and var...

The new urbanization construction has ushered in the latest construction map!

In recent years, Liangping District of Chongqing City has actively promoted the ur...