Performance pressure domestic hotel group switch to mid -to -high -end market

Author:China Tourism News Time:2022.09.15

A few days ago, the company's listed hotel companies in mainland China all released the half -annual report in 2022. According to the financial report data, only Huazhu, Jinjiang Hotel, and the first brigade's operating income exceeded 1 billion yuan. There are only 8 hotel groups with a revenue of over 100 million yuan, including "old names" such as Jinling Hotel and Huatian Hotel. Facing the continuous pressure of performance, hotel people have continued to explore innovation, for survival, breakout, and the arrival of the next stop.

Tuwa Creative Photo Conferry

"Three Giants" Bao Bao Middle and High -end

In the first half of this year, the "three giants" of domestic hotel groups could be described as difficult, and there was a significant loss without exception.

The fastest decline in net profit is Jinjiang Hotel. During the reporting period, Jinjiang Hotel achieved a consolidated operating income of 50.043 billion yuan, a decrease of 4.18%over the same period last year. The net profit loss attributable to shareholders of listed companies was 118 million yuan, a decrease of 2637.79%over the same period last year.

The Jinjiang Hotel said that the cause of revenue and net profit decline is mainly because the epidemic of domestic limited service -oriented hotel operations under the company is greatly affected. In particular, affected by the Shanghai spring epidemic, in April, the overall REVPAR (average tax income) of hotels in the group in the group fell to 54.35%in the same period of 2019.

The first brigade also had a "double drop" situation. According to financial reports, the first brigade Rulai realized operating income of 2.331 billion yuan, a year -on -year decrease of 25.88%; net loss attributable to shareholders of listed companies was 384 million yuan.

Although Hua lived in the first half of the year, it achieved operating income growth, but it failed to avoid losses. Data show that in the first half of 2022, Huazhu's revenue was 6.1 billion yuan, an increase of 2.5%year -on -year; net loss belonging to Huaju Group was 980 million yuan, while the net profit of the same period in 2021 was 130 million yuan.

It is worth noting that after the domestic epidemic fluctuations weakened, the performance of the "three giants" rebounded. For example, Huazhu's REVPAR resumed 86%in June to the level of 2019, and further increased to 90%in July 2022.

In the short term, the performance of the "Three Giants" is under great pressure, but at the same time, each family is in the market layout in the fast horse and whip, and puts its attention to the mid -to -high -end market.

The financial report shows that the first half of the year's first brigade to concentrate on the development of high -end hotels. As of the end of the reporting period, the proportion of mid -to -high -end hotels in the first travel hotel increased to 24.44%, which benefited from the continuous increase in the proportion of mid -to -high -end products. During the reporting period, the mid -to -high -end products of the first travel hotel accounted for 50.70%of the hotel revenue, which was compared to the whole year of 2021. Increase 3.82%.

Some operators said that leisure tourism has become one of the lifestyle of new generations of consumers, and accelerating the new format of leisure tourism has also become one of the competitive methods for head hotels. The market for the middle and high -end hotels of Baobao is a good breakthrough.

Huaju's high -quality holiday hotel brand Huajiantang and its Huajian series brands with humanistic characteristics as the core are focusing on broadening the development path of the high -end leisure resort market. The designer brand has recently ushered in the 100th store. The Meilun brand aiming at the stock market is also actively tapping more opportunities for flippacks.

"Sinking cities contain more business opportunities than first -tier cities." This has become the consensus of the three giants. Expanding the mid -to -high -end market also follows this rule.

For example, at the end of the second quarter of this year, Jinjiang Hotel (China) opened the theme of investor activities with the theme "Old Friends Gathering and Drama" in Nanning, Guangxi. Market competitiveness and development potential. Some industry analysts have analyzed that in the past two years, Nanning Hotel Industry has ushered in a new climax. The mid -to -high -end brand owned by Jinjiang Hotel also wants to sink the market to become a bright color of the Nanning Hotel market.

"Old name" also has new ideas

In fact, the days of the mid -to -high -end market are not good. For the hotel groups, which are mainly on the battlefield, such as Jinling Hotel, Huatian Hotel, Junting Hotel, etc., they also have their own difficulties in the first half of this year.

In the first half of the year, Jinling Hotel achieved a small growth in operating income, and became the highest operating income among these three hotel groups for 658 million yuan. However, the Jinling Hotel is also the most declined in profit. The net profit attributable to the owner of the parent company was 30.672 million yuan, a year -on -year decrease of 81.65%. Regarding the main reasons for the decline in profits, Jinling Hotel explained in the financial report. In addition to the repeated impact of the epidemic, the company's decline in the source of the customer, in the first half of the year, the company gave it The three -month rental reduction has led to a decline in lease income from the same period last year.

In April this year, Junting Hotel, which acquired Junlan Hotel and Jinglan Hotel brand, achieved operating income of 140 million yuan in semi -annual this year, a decrease of 4.08%from the same period last year. The same period last year fell 43.77%. Junting Hotel explained in the financial report that in the first quarter, the comprehensive operating indicators of the group's hotels were better recovered than the same period last year. In the second quarter, due to the influence of the Shanghai epidemic, the business travel travel in the Yangtze River Delta was restricted. 42.77%.

Huatian Hotel achieved a operating income of about 224 million yuan in the first half of this year, a decrease of 26.62%year-on-year, and the net profit attributable to the mother was -123 million yuan. Compared with the same period of the previous year, the loss narrowed. For Huatian Hotel, the biggest crisis is that its main business has been in a loss in recent years. Although, in 2021, Huatian Hotel's total operating income was 594 million yuan, and the business scale was not a profit. However, from the perspective of financial report information, the key to achieving losses is that the investment income contributed by Huatian Hotel's equity transfer is 404 million yuan, which has nothing to do with the operation of the main business. Despite the poor performance, these hotel groups still did not stop the pace of opening up the country in the mid -to -high -end market. However, compared with the three giants, it can be described as "steady development in scale". At the same time, the reporter noticed that the digital transformation was mentioned during the reporting period of the Jinling Hotel and the Junting Hotel during the reporting period. Junting Hotel said that in the first half of the year, the company officially launched the implementation of the group's digital transformation to complete the system switching preparation work of the group's hotel PMS and the member system integration plan of Jun Ting, Junlan, and Jinglan. Fusion. Jinling Hotel focuses on e -commerce, direct sales and collection, and promotes online sales with special customized products, and promotes digital platform functions to benefit. In the first half of the year, the company's self -built online sales platform "Enjoy Jinling" total sales of nearly 50 million yuan, Jinling VIP membership room reservations have continued to increase, and the purchase volume of membership hotel collection platforms exceeded 48 million yuan in the first half of the year.

From the horizontal point of view, these three hotel groups are based on hotel operations and management, but relatively speaking, the business of Jinling Hotel and Huatian Hotel is more diverse, so that they can have them in multiple parties. More opportunities to find business growth points. For example, Huatian Hotel vigorously develops hotel business and washing, housekeeping, property, security and other living services industries. In 2021, operating income was 24.698 million yuan. As of the end of June this year, the company's living service industry revenue accounted for less than 5%to 8.44%at the end of 2021.

More test core competitiveness

Strengthen product innovation research and development and open up new business growth space ... Some industry people say that in order to cope with the complex and changeable market environment in the epidemic, the hotel industry has almost made eighteen martial arts in the past three years.

Not long ago, the Junting Hotel released a planned increase in 2022, and the total amount of funds raised from specific objects should not exceed 517 million yuan (including the number). After deducting the funds, it is intended to invest in the newly -operated hotel investment and development project and the existing hotel decoration and upgrade projects. It is reported that the company plans to build 15 hotels in three batches of major core cities across the country in the next three years, all of which are direct -operated mid -to -high -end selection service hotels in the company.

Huaju has also announced recently that at the brand development level, it will focus on high -quality expansion routes. In the future, soft brands that will no longer develop economy sectors will not be developed. Improve the quality of the overall hotel in the hotel network.

From the above information, it can be clearly felt that the layout of the mid -to -high -end market is the strategy of listed companies in various hotels, but the way of each family is different. Some attract franchisees through decoration and transformation of brand flagship stores, increase the income of franchise fees, and achieve large -scale large -scale output. But in the crowded track, some players have begun to question how many winners can be?

For the increasingly concentrated attention of mid -to -high -end hotels, Gu Huimin, a professor at the School of Tourism Science, School of Tourism Science, Institute of Foreign Languages in Beijing, explained that before, the return on investment in economical hotels is relatively fast, but now with the changes in the market, the energy cost of economy hotels is now And the advantages of labor costs are weakened. Relatively speaking, the income of mid -to -high -end hotels will be higher. According to STR's sample data, GOPPAR (single -room -available guest room operating profit) of high -end and mid -range in 2021 reached 112%of the same period in 2019. In addition, from the perspective of financing, mid -to -high -end hotels have higher value in the capital market than economical hotels.

In fact, the chain rate of the mid -to -high -end market is still at a low level. In the eyes of many industry players, there is indeed a lot of room for development. Of course, this is also related to the rapid expansion of consumption upgrades and the rapid expansion of middle -class consumer groups, as well as consumption transfer of economic hotels and luxury hotels. Now how do you explore the high -end hotel brand in front of the hotel group? This requires deep thinking and carefully operating. "The hotel should select the ideal location, select the advantages of segmentation, and ensure that there is a continuous core competitiveness in order to obtain a continuous dividend and ensure the yield." Zhao Huanhuan, chief knowledge officer of Huamei Consulting agency and senior economist, analyzed.

Whether the mid -to -high -end market is the Red Sea or the Blue Ocean. How big can these listed hotel companies set off, the financial report of the new season may be performed.

- END -

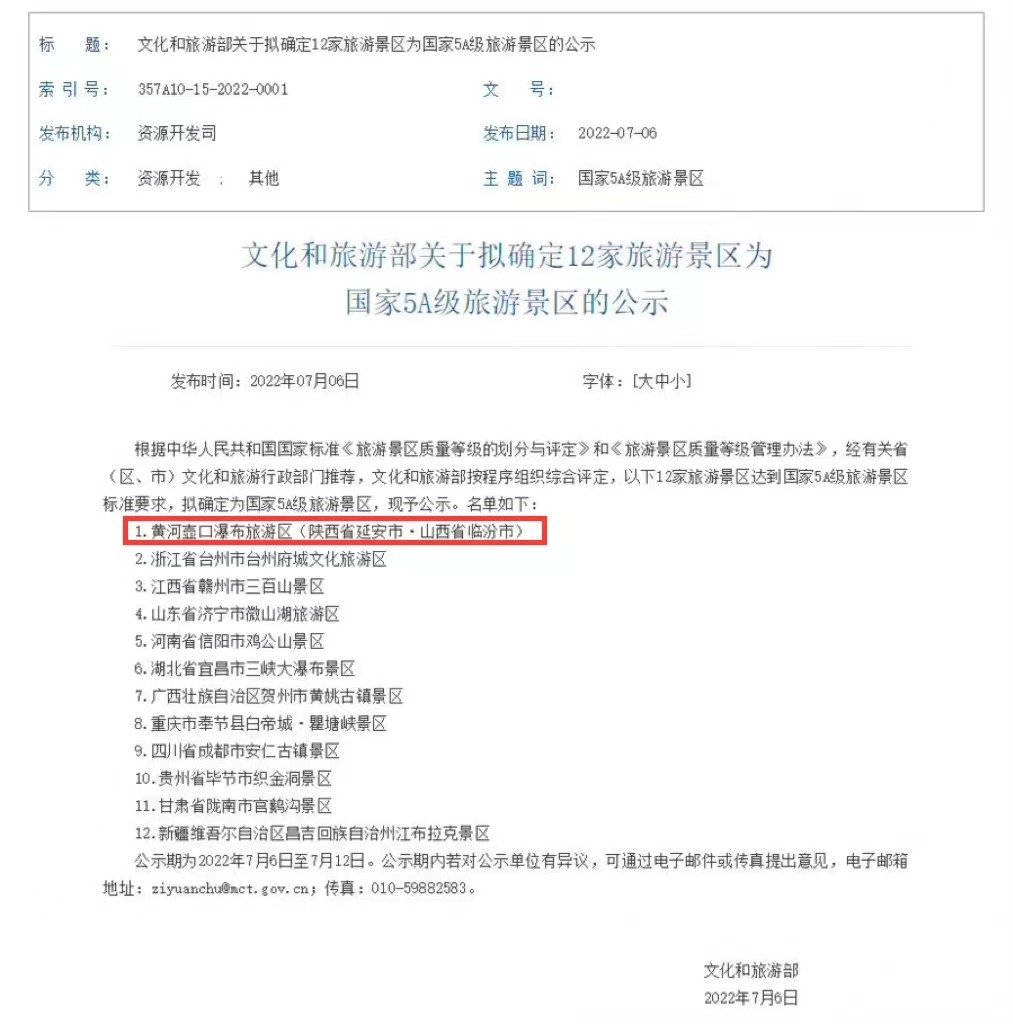

Ministry of Cultural Tourism: It is planned to determine the 5A scenic spots of 12 countries!Shanxi here selected

On July 6, the official website of the Ministry of Culture and Tourism announced t...

Xinjiang: Discover the rich tourism format for ancient road resources

The ancient road of the Silk Road, also known as the Silk Road Ancient Road. Recently, the Xinjiang Uygur Autonomous Region Culture and Tourism Department focused on the theme of discovering ancient