4825 listed companies disclosed the 2022 interim report.

Author:Dahe Cai Cube Time:2022.08.31

[Dahe Daily · Dahecai Cube] (Reporter Zhang Keyao) As of August 31, 4,825 listed companies in Shanghai, Shenzhen and North Stock Exchange disclosed the semi -annual report in 2022. According to the data collected and organized by the China Listed Companies Association (hereinafter referred to as the China -Shanghai Association) Listed Companies Regional Research and Service Alliance Office (Note: The following data sources are the same), the total operating income of listed companies achieves 3.454 trillion yuan, an increase of 9.24%year -on -year.

The Chinese and Shanghai Association believes that under the impact of repeated epidemic, increasing international conflict, and external inflation, the overall operating performance of listed companies has maintained a growth trend, the "basic market" background of my country's economy is highly promoted, the quality of listed companies has steadily improved, the structure is further optimized Essence

Data show that the proportion of total operating income in the first half of the year has further expanded, and the growth rate is much higher than the GDP of the same period. It was 5.49%and 1.16%; non -financial companies realized total operating income and net profit of 2.923 trillion yuan and 1.95 trillion yuan, an increase of 10.89%and 4.55%year -on -year.

According to the Central and Shanghai Association, the performance in the second quarter is generally better than market pessimistic expectations, which fully reflects the strong competitiveness and development toughness of listed companies as leaders in various industries. Since the first quarter of 2021, the growth rate of physical companies' revenue continues to higher than financial categories than financial categories The company shows the good development trend of my country's economic deficiency and reality. Looking at the branch industry, there are obvious differences between the industry, and the performance of coal oil and gas, basic chemicals, power battery raw materials, and photovoltaic new energy industry companies have increased rapidly. Influence, companies such as aviation, catering, tourism, and tourism are still in trouble.

Benefiting from the State Council's policy and measures to stabilize the economy, the listed company received taxes and fees in the first half of the year, with a tax return of 468.9 billion yuan, an increase of 162%year -on -year. Under the active policy and measures, the cash flow of listed companies improved. A positive impact.

Data show that with the steady progress of the comprehensive registration system, the total number of new companies in the GEM, science and technology board, and Bei Stock Exchange accounted for 82%of the number of newly listed companies in the first half of the year.

The average research and development expenditure revenue of listed companies accounted for 1.69%, of which the R & D intensity of science and technology boards, GEM and Bei Stock Exchange was 8.62%, 4.82%, and 4.58%, respectively. , Up to 10.29%, 10.10%, and 6.84%, respectively, the market "containing science content" and "new content" increased significantly.

The China and Senior Association stated that the revenue and cash flow of listed companies in the main board rose steadily, building the foundation for the performance of listed companies, and the profit quality was further improved. Revenue and net profit ranks 72%and 85%of the top 200 companies, respectively, showing the effect of head geese. As of now, 102 companies have released a mid -term cash dividend plan, with cash dividends exceeding 170 billion yuan, and actively returned investors to become a market consensus.

In addition, the number of delisting companies has reached a record high, and the ecological ecology with an orderly and retreat is formed. The number of companies with equity incentives, employees holding, and shares repurchase has increased significantly; the good securities market ecosystem that is trustworthy, standardized, and open and inclusive is further formed.

Attachment: Data Description

1. The data caliber of this article is a listed company listed on June 30, 2022;

2. Statistical timing is 8 am on August 31, 2022;

3. The data is collected and sorted out by the "Office of the Regional Research and Service Alliance of the China Listed Companies Association", all from the listed company interim reported from Wind Financial Terminal and Flush Financial Terminal statistics. Analysis of opinions does not constitute the authenticity, accuracy, integrity and timely confirmation, commitment or guarantee of the central report data.

Responsible editor: Gao Shuai | Review: Li Zhen | Director: Wan Junwei

- END -

Recently, a new trend has appeared in the fund distribution market

Recently, some fund companies have reported a hybrid fund with a closed operation ...

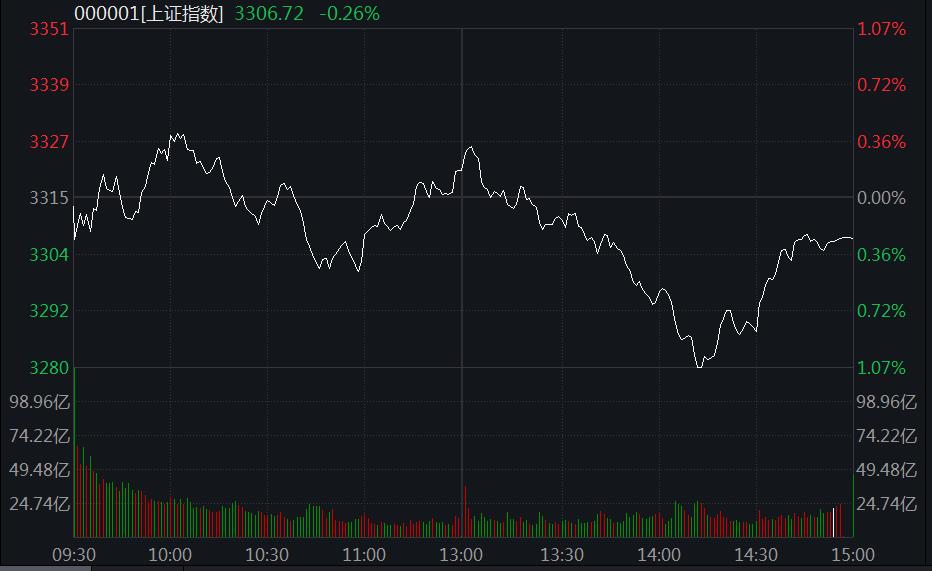

A -share collective income: Education stocks fall, robotic concept stocks are active in the market

Zhongxin Jingwei, June 21st. On the 21st, the three major A -share indexes were we...