Cloud service track: In addition to Amazon and Microsoft giants, who else gains this market?

Author:Sword finger Time:2022.09.08

Text/Yang Jianyong

Since Amazon released the world's first cloud computing service in 2006, human beings officially ushered in the era of cloud computing, and traditional IT structures have gradually transformed to clouds. Now, cloud computing has become an important infrastructure in the world. The pattern drives the global cloud computing industry to show a booming trend. According to the latest data of the authoritative research institution Synergy Research, the expenditure on cloud infrastructure services included in cloud infrastructure services included in cloud infrastructure services in 2021 reached 178 billion US dollars, an increase of 37%year -on -year.

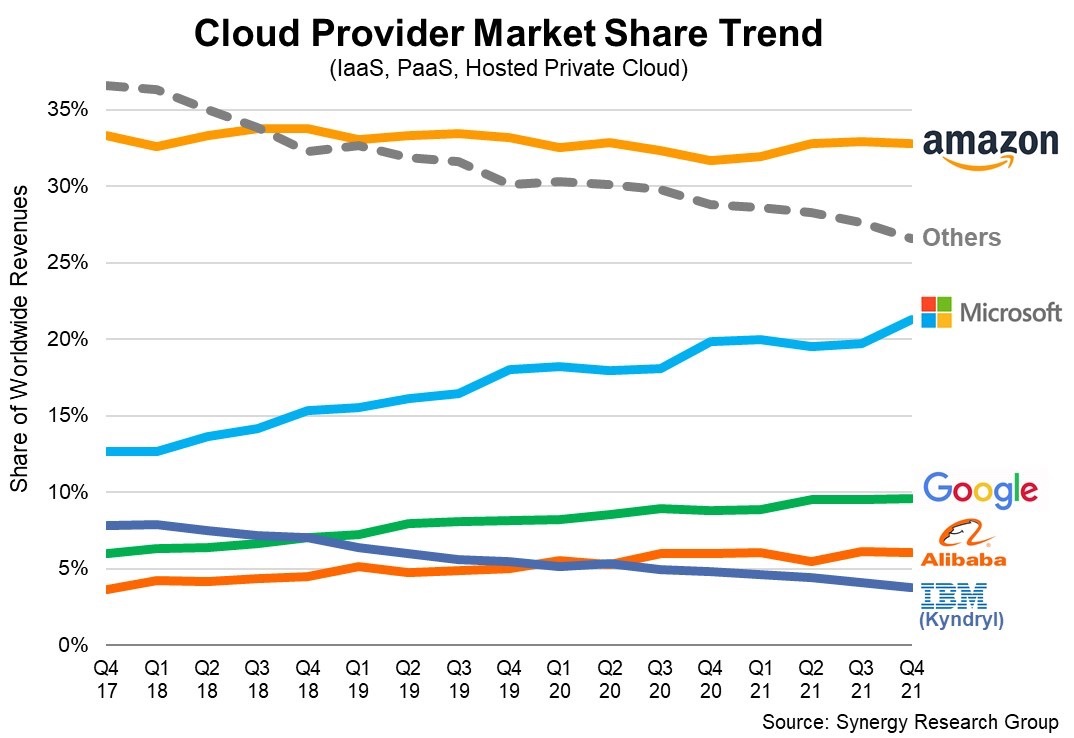

In the huge cloud service market, many heavyweight players have influx. However, the manufacturers are mainly crowded on the public cloud IaaS track, but the market that performs well is Amazon Cloud, Microsoft, Google, Alibaba and other technology giants. The top five manufacturers control nearly 80 % of the world's market share.

Among them, Amazon is undoubtedly the biggest winner of the world's public cloud, not only controlling one -third of the world's market share, but also maintaining a strong growth trend. In the second quarter of 2022, Amazon AWS revenue reached 19.739 billion US dollars, an increase of 33%year -on -year, and revenue in the past 12 months reached $ 72.1 billion.

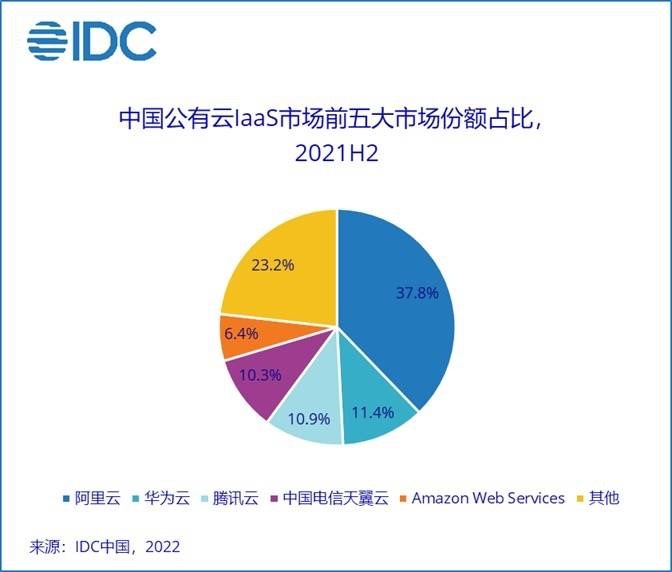

Obviously, other cloud manufacturers want to snatch the public cloud market in the hands of the giants. Judging from the domestic public cloud market, it presents a large and strong pattern. One super -referring to Alibaba Cloud is the first cloud manufacturer in China to exceed the 100 billion levels. Later, there were Huawei Cloud, Tencent Cloud, Tianyi Cloud and Amazon Cloud Technology.

The IDC report shows that five major cloud manufacturers occupy nearly 80 % of the domestic public cloud IaaS market share. It should be pointed out that the public cloud IaaS market is increasingly fierce, and the giants seize the market through prices, and then the small and medium -sized cloud players on the track are obviously difficult to survive in the giant seams. Under the pressure of giants, such as Jinshan Cloud and Youjie Youjin, such as Jinshan Cloud and Youjie, and other small and medium -sized public cloud manufacturers showed a sharp decline in revenue. In the second quarter of 2022, Jinshan Yungong had a cloud revenue of 1.29 billion yuan, a year -on -year decrease of 16.9%.

In the first half of 2022, Qingyun Technology's revenue decreased by 14.84%year -on -year, of which cloud product revenue decreased by 24.48%year -on -year. At the same time, it is pointed out that the competition in the cloud computing industry is very fierce. Especially in the field of public clouds, due to the addition of giant competitors, the use price of resources in the industry is downward, and the company's cloud service business is under pressure to reduce prices. You must know that the Matthew effect of the public cloud industry is outstanding, the company's cloud service business is in a disadvantage in market competition, and there is a large gap between the industry's leading companies in terms of scale and brand, and the competitive pressure is large.

The core depends on the excellent carving of the public cloud. In the first half of 2022, revenue fell by 30%to 1.046 billion yuan. In the market competitive risk prompts, the carving indicates that the main product price has shown a decline in the overall decline since 2018, and the price reduction is large. It also pointed out that the competition in the future cloud computing market may still be fierce. The possibility of competitive price reduction is to achieve a short -term market share. In the face of fierce market competition, there may be a situation of continuous price reduction of products in the next few years.

In fact, the core competition is the price in the crowded public cloud IaaS market, but the small and medium -sized cloud manufacturers and market competition are weak, which leads to the slowdown in revenue speed and decline. However, in the huge cloud computing market, SaaS (software is service) market size, followed by PaaS (platform as service).

In the cloud computing industry, Microsoft has taken a different approach to transform various application services to the cloud. This is also after Nadella's helm, and then the cloud priority development strategy is promoted, and now it has become a leading cloud computing company. At present, Microsoft Cloud covers IaaS, PaaS, SaaS services, and has become the largest business sector. The latest quarter revenue was US $ 25 billion, an increase of 28%year -on -year.

Microsoft Smart Cloud consists of Azure Public Cloud Platform, Microsoft 365 Productivity Cloud Platform, Microsoft Dynamics 365 commercial intelligent application platform, Power Platform development platform, and Microsoft development tools and services. In terms of, Dynamics 365 is a comprehensive, efficient, and intelligent SaaS -level platform that integrates CRM and ERP functions. This platform is seamlessly integrated with Azure and Power Apps, providing enterprises with end -to -end digital transformation tools. Because more and more companies use Microsoft Smart Cloud to innovate, smart clouds have become Microsoft's largest business sectors.

In the domestic cloud service market, Kingdee is a domestic power manufacturer covering PaaS and SaaS. It benefits from cloud computing dividends. Although the revenue still maintains a steady growth under the repeated influence of the new crown epidemic. In the first half of 2022, cloud service revenue reached 1.238 billion yuan, an increase of 35.5%year -on -year, and cloud service revenue accounted for 76.4%. Thanks to the strong growth of cloud services, the overall revenue increased by 17.3%year -on -year.

Similar to Microsoft, in the context of global cloud computing, Kingdee actively transforms the cloud transformation, cloudization of various CRMs, ERP and other enterprises, and creating the Dalmon Cloud Sky Platform. Eventually evolved from ERP to EBC (Enterprise Business Capability) to realize the transformation from informatization to digital and intelligent. As of now, digital management solutions have been provided for more than 7.4 million companies and organizations. In the past two years, the sky and Xinghan have helped 122 companies to complete domestic alternatives, helping Huawei, Vanke, China Merchants, Merchants, China University of China, Hesteel Group, and Shagang Group for digital management reconstruction. For example, Wen's use of the sky PaaS low code to build the Wen's modern agricultural industry Internet platform, and the "Internet+" technology is fully applied to unit management efficiency, cadre management efficiency, per capita production efficiency, and improvement of home farm main breeding efficiency. Based on the assembled enterprise -level PaaS Paas platform, Golden Die Cloud · Sky and large enterprise EBC Kingdee Cloud · Xinghan, through data empowerment and through business, jointly build a unified management and control platform for the group, and strive to build a main system, including Hunan's color "one base and seven, seven, seven, seven, The business scenario of various business covers various business lines of "people, wealth, goods, property, production, supply, and sales", covering various management levels and various subsidiaries, and helping Hunan's high -quality development.

Since its establishment 30 years, Kingdee's first -mover advantage and technical precipitation are being implemented through more and more corporate practice. It has been recognized by well -known research institutions at home and abroad. It is the only Chinese enterprise -level Chinese enterprise level in the world's top ten in Gartner's 2021 high productive forces APAAS platform. SaaS manufacturer won the first in China; won the IDC APAAS China Public Cloud Market ("China ERP Application Platform Platform Insight"); selected into the GARTNER Chinese Enterprise Low Code Application Platform competition pattern, becoming a report in the report in the report Representative manufacturers.

And Baidu, compared with the increasingly competitive LaaS infrastructure market, it has taken a differentiated competition road with the "integrated Yunzhi", which has also opened the space business growth space. In the second quarter of 2022, Baidu's non -online marketing revenue reached 6.1 billion yuan, an increase of 22%year -on -year, mainly to promote the promotion of beneficiary clouds and other AI driving businesses. Among them, Baidu's smart cloud revenue was 4.3 billion yuan, a year -on -year increase of 31%. It is an important engine that drives Baidu's growth, showing that the Yunzhi integrated strategy has entered the harvest period.

Compared with other cloud giants, Baidu's core competitiveness lies in artificial intelligence landing capabilities. Combined with the AI public cloud service market data released by IDC, Baidu Smart Cloud ranks first. Its series of solutions have penetrated into many fields such as finance and manufacturing. For example, on the industrial track, Baidu Smart Cloud Industrial Internet Platform is characterized by "AI+Industrial Internet" to help enterprises achieve quality improvement and efficiency. The field performance is dazzling. According to the IDC report, Baidu Smart Cloud ranked first in the field of industrial quality inspection in the field of quality inspection. While promoting the intelligent transformation of the industry, it also harvested the intelligent dividend of the industry.

Today, Baidu Intelligent Cloud has entered the 3.0 era based on the new strategic cloud and wisdom, especially under the strong support of flying paddle deep learning framework and the large model of the Wenxin industry. PaaS has evolved into a "AI engine", which can make full use of the AI computing power, reduce the use threshold, and accelerate the model iteration.

In the end, Yunzheng is increasingly dominated by the IT pattern. The intelligent and digital speed of Yun's core is accelerating, driving Yunzheng's increasingly dominated IT pattern, and PaaS and SaaS service capabilities are the core driving force for enterprises to implement digital transformation. At this point, companies around the cloud ecosystem will benefit, while helping enterprises to conduct digital transformation and innovation faster, its cloud service sector will further grow.

Yang Jianyong, a Forbes Chinese writer, is committed to in -depth interpretation of cutting -edge technologies such as the Internet of Things, cloud services and artificial intelligence.

- END -

Turn from "Selling" to "Professional and interesting people to buy you" live e -commerce to enter a new stage

In the past year, Taobao live broadcast has continued to grow steadily. The live b...

Recommended reference for reference for different positioning configurations for different positioning configurations in the opening season

The beginning of school is about to start, and the freshmen will also enter the ca...