When will the pharmaceutical stock pick up?Zhu Guoguang: Soochow Securities may have a big counterattack at any time in the fourth quarter, focusing on the four major sectors of the layout

Author:Broker China Time:2022.09.19

Is it time to copy pharmaceutical stocks?

"The current pharmaceutical sector configuration value is high and has the conditions for stabilizing and recovering. It is expected to be one of the sectors of the annual growth." Zhu Guoguang, co -director of the Soochow Securities Institute and chief analyst of pharmaceuticals In the second quarter performance of some companies in the pharmaceutical sector was affected by the epidemic, he was still optimistic about the resonance market that could bring in the third quarter report and the valuation switching.

In Zhu Guoguang's view, with the gradual relaxation of the innovative pharmaceutical policy in the pharmaceutical sector, the influence of the epidemic on pharmaceutical production and consumer medical treatment has gradually recovered. The current valuation of the pharmaceutical sector at the bottom of the historical bottom may reverse. In the fourth quarter, the pharmaceutical sector is expected to counterattack at any time. Among them, it is particularly optimistic about scientific research services, consumer medical care, innovative drugs, and CXO with valuation switching spaces.

When will pharmaceutical stocks bottom out?

A reporter from securities firms: Since this year, the medical index has fallen by more than 20%, and the valuation of the pharmaceutical sector has continued to hover at low. Do you think the current pharmaceutical sector has the conditions to stabilize and recover?

Zhu Guoguang: We believe that the current pharmaceutical sector configuration value is high. It is very optimistic about investment opportunities in the pharmaceutical sector in the fourth quarter. It is recommended to actively allocate.

First of all, the valuation of the pharmaceutical sector is low. Although it has rebounded, it is still in a lower position for nearly ten years. From the perspective of valuation, from early 2010, the PE of the pharmaceutical industry has a maximum of 73 times, a minimum of 23 times, and an average value of 37 times. At present, the PE of the pharmaceutical industry is about 24 times, which is far lower than the historical average valuation; Medical services have also fallen significantly.

Secondly, from the perspective of the fund configuration ratio, the pharmaceutical standard is about 8%, and the full -based configuration ratio is less than 4%. It shows that the pharmaceutical sector has been greatly lowered by public funds. Essence

Third, the innovative pharmaceutical policy has recovered, and the impact of the epidemic on pharmaceutical production and consumer medical care is fading, and its performance is expected to gradually recover. A series of policies such as innovative medicines, innovative drugs encouraging some single -arm clinical trials, and DRS exemptions of innovative drugs to help domestic innovative drugs increase their status on the international pharmaceutical stage. Although the epidemic is still this one after another, the rapid recovery of the outpatient clinic and the amount of surgery in the second quarter is conducive to prescription medicine.

Fourth, the annual expenditure of medical insurance funds increased by more than 12%, and the pharmaceutical industry continued to grow. Although there are policies such as generic drugs and consumables, it is only adjusting the structure. The support of medical insurance for innovative drugs and equipment has continued to increase.

A reporter from securities firms: Recently, the collection of pharmaceutical collection has once again aroused heated discussions in the industry. How do you think of the market's concerns about the pharmaceutical sector? What marginal changes did you see the recovery of the pharmaceutical sector?

Zhu Guoguang: At present, Ji Cai mainly focuses on some products with high proportion of medical insurance such as generic drugs and some consumables. Dental implants include cases, and there are not many medical insurance funds. It is expected that it is unlikely to expand to other fields. The Guangdong Alliance has gathered growth hormone, which has little impact on the market from the results. Zhejiang Ji Cai may not include growth hormones. Even if including growth hormones, referring to the situation of the Guangdong Alliance, judging the impact on growth hormones is relatively limited.

At present, the marginal changes of the recovery of the medical sector are mainly reflected in three aspects: from the perspective of the medical insurance payment side, most of the approximately 15%subsequent will be reduced by the two years of medical insurance. "Notice" Practice the support of the National Medical Insurance Bureau for innovation; from the perspective of the drug review center, innovative drugs that have no classic treatment plan encourage single -arm clinical trials, reduce the cost of innovative drug development and improve the characteristics of medicine; The average price reduction of seven batches of collecting mining was 48%, and the decline was narrowed.

Layout the four main lines in advance, so that the medical sector is at any time to counterattack at any time

China reporter: What is the performance of the medical sector interim report? What kind of company's stock price is more tough?

Zhu Guoguang: Affected by factors such as the epidemic, the second quarter performance of some medical targets did face pressure. Next, we must focus on focusing on the target of strong growth in the third quarter. It is expected that in the fourth quarter, it is expected to usher in the third quarter report and valuation switching resonance.

From the perspective of market performance, large market value companies with large declines and institutions are relatively strong in the early stage; from the perspective of sectors, scientific research services and consumer medical care are the continuous main line, because their growth and policy immunization; effectively controlling the epidemic situation, and effectively controlling the epidemic. The trend of consumption and economic recovery is obvious.

China reporter: Overall, you are more optimistic about which segments in the medical sector and why? Which medical tracks are more interested in institutional investors?

Zhu Guoguang: At present, the high -profile tracks include scientific research services, consumer medical care, innovative drugs, and CXO.

Among them, the scientific research service sector is related to the rapid market expansion and the continued rising prosperity. Without considering the laboratory equipment (very low domestic rate), it is estimated that the overall market size of 2020 exceeds 60 billion yuan, and the CAGR of 2020-2024 is about 20%. And high growth of R & D expenditure in life science.

The consumer medical sector is no longer restricted after the epidemic is retreated, and market demand has been quickly released. Although the performance growth of related companies in the second quarter was affected by varying degrees, it has recovered better growth momentum, and the stock price of the sector has also recovered.

The innovative pharmaceutical sector has undergone a long and large callback since the second half of 2021. The valuation of many high -quality innovative drug standards has been in the bottom range, and the current innovative pharmaceutical sector has the layout value. At the 2022 ASCO Annual Conference, domestic innovative drugs were excellent in data. The certainty of multiple core varieties of patent medicine gradually obtained confirmation, and the innovative drug sector also ushered in a round of rebound. In addition, in the long run, the commercial ceiling of innovative medicines is high enough, the domestic high -quality innovative drugs are authorized to go to sea, the amount has repeatedly reached high, and the global competitiveness of Chinese pharmaceutical companies and domestic innovative drugs have gradually been recognized by overseas markets. Chinese native innovation models Enterprises are also improving the development efficiency of new drugs and embracing the global market.

China reporter: How do you think of the global competition route of Chinese pharmaceutical companies? Can you talk about the way to open a new policy of two -way opening of GDR and other financial two -way financial companies?

Zhu Guoguang: There are two main ways to go out to sea in China. One is to fully develop independently, do clinical trials of multi -centered global centers, and promote a commercial team overseas for promotion. Second, overseas authorization is performed at the right time. For subsequent R & D and commercial promotion, we will charge a certain authorization fee and sales sharing from it.

At this stage, the first route is very difficult and requires a lot of money; for most domestic pharmaceutical companies, the second method of overseas authorization is easier and more mainstream. According to our statistics, from 2020 to the first half of 2022, there are nearly 70 domestic innovative drugs, which are out of sea in the form of external authorization. Among them, there are billions of dollars of heavy transactions. The amount is as high as $ 2.6 billion.

Behind overseas authorization is not only the development strength of Chinese pharmaceutical companies and the global competitiveness of domestic innovative drugs has gradually been recognized by overseas markets. It can also be seen that Chinese local innovation enterprises have already won the top spot in the field of segmentation, improving the development efficiency of new drug development and hugging Global Market.

The main thing to note is that the new drug research and development cycle is very long. A successful listing of innovative drugs generally takes more than 5 years and the consumption of billions of funds. Financing is critical to the continuous research and development investment of pharmaceutical companies. Since 2022, more and more A -share companies have planned to issue GDR (global deposit vouchers business), which has further broaden financing channels and has brought convenience to the financing development of local companies. With the GDR business, domestic companies are also expected to enhance brand awareness, which is expected to help in future authorization and cooperation.

Risk reminder: The information in this article or the opinions expressed in this article does not constitute investment suggestions for anyone. Investors are requested to make investment decisions and bear their own investment risks.

Editor -in -chief: Wang Lulu

School pair: Zhao Yan

- END -

Some areas of Sanya central urban area to relieve temporary static management

According to a report on the press conference of the Sanya New Guan Guan Pneumonia...

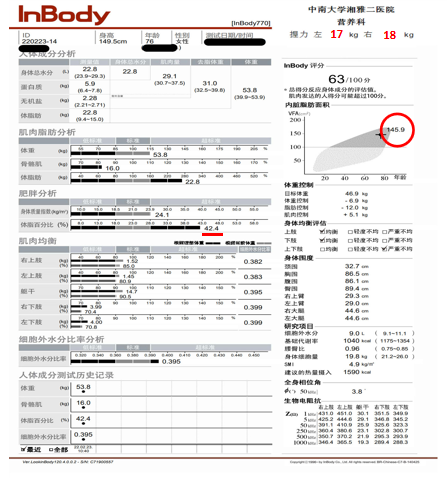

How to perform effective intervention measures for elderly young muscle obesity?

Generally, the normal range of normal adult BMI is 1.5-23.9kg/m2, while the normal...