The property market 丨 September housing loan interest rate continued to decline, and some real estate mortgage interest rates in Changsha fell to 4.1% to 4.1%

Author:Sanxiang Metropolis Daily Time:2022.09.27

Recently, the Shell Research Institute issued data data on mainstream mortgages in key cities. Data show that the interest rate of the 103 key cities monitored by the 103 key cities was 4.15%and the two sets of interest rates were 4.91%. Among them, Changsha's first mortgage interest rate was reduced by 35 basis points. Today, the reporter visited a number of real estate and banks found that some of the first home loans in Changsha had dropped to 4.1%, and the interest rate of two sets of mortgages dropped to 4.9%.

Changsha's first set of mortgage interest rates reduced 35 basis points

The data shows that due to the influence of LPR bearing more than 5 years on August 22, the interest rate of Hundreds of Hall's mortgage in September has been reduced. As of September 19, the mainstream interest rate of 86 urban mortgage loans was as low as 4.10%of the first set, two sets of two sets, and two sets of sets of two sets. 4.90%of the lower limit.

The average bank loan period is 25 days, which is basically the same as last month. Among them, the average loan cycle of first -tier cities is 31 days, and the average loan cycle of second -tier and third -tier cities is 24 days. From the perspective of interest rate changes, Xiamen's first home loan mainstream interest rate was reduced the largest, reaching 45bp (base point), and the mainstream interest rates of the first house in Dongguan and Changsha all lowered 35 basis points. From the perspective of Changsha, the reporter visited and found that the interest rate of the first home loan earlier this year was generally 5.64%, fell to 5.0%-5.2%in May, and in August to 4.25%-5.05%. As the mortgage interest rate enters the downward channel, the interest rate has further declined.

"The average price of our project is 15,000-18,000 yuan/square meter. At present, the main cooperation is China Merchants Bank, Construction Bank, Everbright Bank, etc. More than a month ago, the interest rate of the first home loan was 4.25%, and the interest rate of the second set of mortgages was 5.05%. Now that the interest rate of the first home loan has dropped to 4.1%, the second house is 4.9%, and the loan cycle has basically not changed. "

Mr. Li, the person in charge of the relevant business of the Cai Yongbei Sub -branch of the ICBC, said that this year's loan interest rate is the lowest value since 2016, and some real estate loan interest rates are 4.1%. The mortgage loan cycle is generally 1-2 months. "Last year's mortgage interest rate was between 5.5%-6.3%. Can save a lot of money. "

"Now the loan interest rate of our first house is 4.3%, and the interest rate of the second house is 4.9%." The customer manager of Huarong Xiangchun Road Sub -branch of Xiangjiang Bank of Huarong said that because the loan needs to look at the real estate first, the banks cooperated with specific real estate are all banks. Different, but the overall mortgage interest rate is in the range of 4.3%-4.9%.

Interest rate reduction promotes the phased restoration of the market

The decline of the mortgage interest rate has undoubtedly reduced the loan cost for buyers.

Based on a home buyer's loan of 1 million, calculated the principal and interest of 30 years of equivalent, and performed 5.0%of the first home interest rate, the buyer provided 5368.22 yuan a month, and the total interest was 932,600 yuan. The interest is 771,100 yuan; if it gets a 4.1%preferential interest rate, the monthly supply is 4831.98 yuan, and the cumulative interest is 739,500 yuan. The interest difference between this middle is 193,000 yuan.

Zhang Dawei, the chief analyst of Zhongyuan Real Estate, believes that the property market policy has been exhausted and the market has gradually stabilized. For buyers, housing is still a policy direction, but some cities, especially first- and second -tier cities, are gradually bottoming out, and the rapid stability of the market will be a trend. However, in the actual process, the interest adjustment of the existing mortgage users or buyers who have already been repaid by the loan repayment can not be lowered until the New Year's Day next year.

"The repair of the later market requires the support of the loose credit environment. Low interest rates and fast loans can help reduce the cost of buying houses and accelerate the purchase process. To a certain extent, it promotes the phased restoration of the early market to a certain extent. "Industry insiders pointed out that the current mortgage interest rate level of key first -tier and second -tier key cities is still higher than the lower limit, and there is still room for lowering in the future.

Text/Figure All Media Reporter Bu Lan Intern Long Siyan Video Trainee Reporter Wang Pu

(First instance: Zhu Rong II Trial: Huang Jing III: Zhang Jun)

- END -

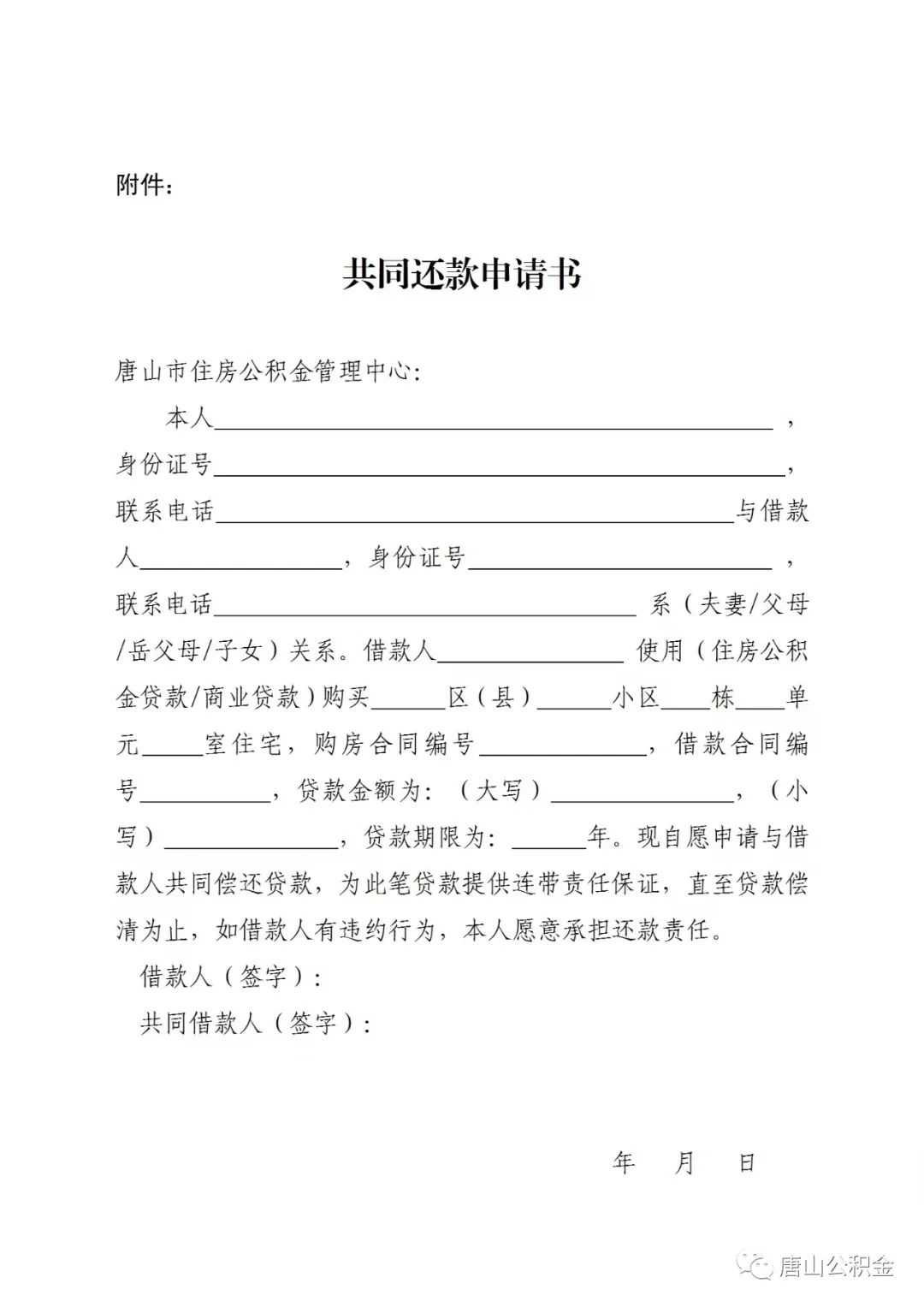

Tangshan: Buying a house and repayment, do not worry about the provident fund to launch the "one person to buy the whole family gang"

Beginning on July 15, 2022, Tangshan Housing Provident Fund Management Center purc...

In 2021, 6611 million people from the country withdraws more than 2 trillion yuan in housing provident fund

Xinhua News Agency, Beijing, June 24th (Reporter Wang Youling) In 2021, the nation...